UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

(Rule 14-101)

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No.

)

|

|

|

|

|

|

|

Check the appropriate box:

|

|

¨

|

|

Preliminary information statement.

|

|

¨

|

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2)).

|

|

x

|

|

Definitive information statement.

|

|

|

|

STAKTEK HOLDINGS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

NOTICE OF ACTION TAKEN PURSUANT TO

WRITTEN CONSENT OF STOCKHOLDERS

8900 Shoal Creek Blvd.

Austin, Texas 78757

DATE FIRST

MAILED TO STOCKHOLDERS: FEBRUARY 26, 2008

To the Stockholders of Staktek Holdings, Inc.:

This Notice and the accompanying Information Statement are being furnished to the stockholders of Staktek Holdings, Inc., a Delaware corporation (the

“Company”), in connection with action taken by the holders of a majority of the issued and outstanding voting securities of the Company, approving, by written consent dated August 30, 2007, an increase in the number of shares of the

Company’s authorized common stock reserved for issuance under the Company’s 2003 Stock Option Plan (the “2003 Plan”) by 500,000 shares from 11,030,000 shares to 11,530,000 shares (the “Plan Increase”), as reflected in

the Amended and Restated 2003 Stock Option Plan (the “2003 Plan”). A copy of the 2003 Plan is attached to this Information Statement as

Exhibit A

.

Our Board of Directors approved the Plan Increase in connection with the Company’s acquisition of Southland Micro Systems, Inc. (“Southland”), a leading provider of memory products and services. As part

of the acquisition, which closed on August 31, 2007, we granted certain Southland employees employment inducement stock options under the 2003 Plan to purchase a total of 500,000 shares of our common stock. The Plan Increase provided for the

issuance of these options. All of the options issued to the Southland employees have a per share exercise price $2.84, the closing sales price per share of the Company’s common stock on August 31, 2007, and will vest over a four-year

period.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Your vote or consent is not requested or required to approve these matters. The accompanying Information Statement is provided solely for your

information. The accompanying Information Statement also serves as the notice required by Section 228 of the Delaware General Corporation Law of the taking of a corporate action without a meeting by less than unanimous written consent of the

Company’s stockholders.

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Wayne R. Lieberman

|

|

President and Chief Executive Officer

|

Austin, Texas

February 26, 2008

2

INFORMATION STATEMENT

OF

STAKTEK HOLDINGS, INC.

8900 Shoal Creek Blvd.

Austin, Texas 78757

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The actions described in this Information Statement have already been approved by our majority stockholders.

A vote of the remaining stockholders is not necessary.

General

This Information Statement is being furnished by Staktek Holdings, Inc., a Delaware corporation (“we,” “our,” “us,”

“Staktek” or the “Company”), in connection with action taken by the holders of a majority of the Company’s issued and outstanding voting securities, approving, by written consent dated August 30, 2007, an increase in

the number of shares of the Company’s authorized common stock reserved for issuance under the Company’s 2003 Stock Option Plan (the “2003 Plan”) by 500,000 shares from 11,030,000 shares to 11,530,000 shares (the “Plan

Increase”), as reflected in the Amended and Restated 2003 Stock Option Plan (the “2003 Plan”). Other than the Plan Increase, there were no changes to the terms or conditions of the 2003 Plan. A copy of the 2003 Plan is attached to

this Information Statement as

Exhibit A

.

Our Board of Directors approved the Plan Increase in connection with the Company’s

acquisition of Southland Micro Systems, Inc. (“Southland”), a leading provider of memory products and services. As part of the acquisition, which closed on August 31, 2007, certain Southland employees were granted employment

inducement stock options to purchase a total of 500,000 shares of our common stock. The Plan Increase provided for the issuance of these options. All of the options issued to the Southland employees have a per share exercise price $2.84, the closing

sales price per share of our common stock on August 31, 2007, and will vest over a four-year period.

This Information Statement is

being provided pursuant to the requirements of Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to holders of our common stock entitled to vote or give an authorization or consent in regard to the matters

acted upon by written consent. This Information Statement is for informational purposes only, and you need not take any further action in connection with this Information Statement.

This Information Statement is being mailed on or about February 29, 2008 to our stockholders of record as of August 30, 2007 (the “Record

Date”). Under federal law governing the taking of stockholder action by written consent, stockholder approval of the Plan Increase will be deemed effective 20 days after the mailing of this Information Statement to our stockholders.

Our principal executive offices are located at 8900 Shoal Creek Blvd., Austin, Texas 78757, and our telephone number is (512) 454-9531.

The Action by Written Consent

On

August 30, 2007, Austin Ventures VII, L.P. and Austin Ventures VIII, L.P. (together, “Austin Ventures”), which, as of August 30, 2007, beneficially owned an aggregate of approximately 78% of our common stock delivered to us an

executed written consent of stockholders ratifying the Plan Increase (the “Written Consent”). No payment was made to any person or entity in consideration of their executing the Written Consent.

Voting and Vote Required

We are not seeking consent,

authorizations or proxies from you. Section 228 of the Delaware General Corporation Law (“Section 228”) provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum

number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for a meeting. Approval of at least a majority of the outstanding voting

power of the shares of our common stock present and voting on the matter at a meeting would be required to approve the Plan Increase.

3

As of the close of business of the Record Date, we had 46,981,466 shares of common stock outstanding and

entitled to vote on the matters acted upon in the Written Consent. Each share of common stock outstanding as of the close of business on the Record Date is entitled to one vote. On the Record Date, Austin Ventures, together with its affiliates,

beneficially owned, directly and indirectly, 36,481,999 shares, or approximately 78%, of our common stock.

Accordingly, the action by Written Consent executed by Austin Ventures on the Record Date pursuant to Section 228 is sufficient to

approve the Plan Increase and requires no further stockholder action

.

Notice Pursuant to Section 228

Pursuant to Section 228, we are required to provide notice of taking a corporate action by written consent to the Company’s stockholders who

have not consented in writing to such action. This Information Statement serves as the notice required by Section 228.

Interest of Certain Persons

in or Opposition to Matters to be Acted Upon

Each of our officers and directors is eligible to receive awards under the 2003 Plan,

although none is receiving any of the 500,000 shares pursuant to this Plan Increase.

Dissenters’ Rights of Appraisal

The Delaware General Corporation Law does not provide dissenters’ rights of appraisal to the Company’s stockholders in connection with the

matters approved by the Written Consent.

Householding of Stockholder Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” stockholder materials, such as proxy

statements, information statements and annual reports. This means that only one copy of this Information Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of this Information Statement

to you if you write or call the Company at the following addresses or telephone numbers: General Counsel, Staktek Holdings, Inc., 8900 Shoal Creek Blvd., Austin, Texas 78757, (512) 454-9531, or Shelton Investor Relations at (972) 385-0286

and

www.investors@staktek.com

. If you want to receive separate copies of stockholder materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank,

broker, or other nominee record holder, or you may contact Staktek or Shelton Investor Relations at the respective addresses and telephone numbers set forth above.

APPROVAL OF AMENDMENT TO THE

2003 STOCK OPTION PLAN

On August 17, 2007, our Board of Directors adopted and approved the Plan Increase increasing the number of shares of the Company’s common stock

reserved for issuance under the 2003 Plan from 11,030,000 shares to 11,530,000 shares. On August 30, 2007, a majority of consenting stockholders adopted and approved the Plan Increase pursuant to the Written Consent. After giving effect to the

Plan Increase, there were 500,000 shares available for issuance as awards under the 2003 Plan, all of which shares were subsequently allocated to stock options granted on August 31, 2007 to employees of Southland in connection with our

acquisition of Southland.

Reason for Amendment

Our Board of Directors approved the Plan Increase in connection with the Company’s acquisition of Southland, a leading provider of memory products and services. As part of the acquisition, which closed on August 31, 2007, certain

Southland employees were granted employment inducement stock options to purchase a total of 500,000 shares of our common stock. All of the options have a per share exercise price $2.84, the closing price per share of our common stock on

August 31, 2007, and vest over a four-year period.

4

AMENDED AND RESTATED STOCK OPTION PLAN

The benefits or amounts that will be received by or allocated to any executive officers or employees under the Plan Increase are as set forth

below.

|

|

|

|

|

|

|

Name and Position

|

|

Dollar Value ($)

|

|

Number of Shares

|

|

Wayne R. Lieberman

President and Chief Executive Officer

|

|

|

|

0

|

|

|

|

|

|

W. Kirk Patterson

Senior Vice President and Chief Financial Officer

|

|

|

|

0

|

|

|

|

|

|

Stephanie A. Lucie

Senior Vice President, General Counsel and Corporate Secretary

|

|

|

|

0

|

|

|

|

|

|

Executive Group

|

|

|

|

0

|

|

Non-Executive Director Group

|

|

|

|

0

|

|

Non-Executive Officer Employee Group

|

|

|

|

500,000

|

Other awards pursuant to the 2003 Plan may be made to our executive officers, directors and other members of the

executive group in the future. Other than the awards set forth in the table above, no awards pursuant to the 2003 Plan have been specifically designated to members of the executive group as of the date of this Information Statement.

Description of the 2003 Plan

The purpose of the 2003

Plan is to advance the interests of our Company by providing an incentive to attract, retain and motivate highly qualified and competent persons who are important to us and upon whose efforts and judgment the success of our Company is largely

dependent, including our employees and directors.

Eligibility

. Awards under the 2003 Plan may be granted to persons selected by the

Board of Directors for participation in the 2003 Plan who are directors, officers or other employees of the Company or a parent or subsidiary company of the Company, as well as consultants of the Company, provided that no award will be granted to

any otherwise eligible person at a time when the individual would prohibited from participating in the 2003 Plan under applicable law. Approximately 100 individuals are eligible for awards under the 2003 Plan, including our six non-employee

directors and three executive officers.

Administration

. The 2003 Plan is administered by our Board of Directors. The Board of

Directors determines, from time to time, those of our employees and directors to whom Plan options will be granted, the terms and provisions of the 2003 Plan options, the dates such 2003 Plan options will become exercisable, the number of shares

subject to each 2003 Plan option, the purchase price of these shares and the form of payment of the purchase price. All other questions relating to the administration of the 2003 Plan, and the interpretation of the provisions thereof, are to be

resolved at the sole discretion of the Board of Directors.

Shares Subject to the 2003 Plan

. Pursuant to the Plan Increase, a

maximum of 11,530,000 shares of our common stock will be available for awards under the 2003 Plan, subject to adjustment as described below. No more than 11,530,000 shares of our common stock may be made subject to options granted under the 2003

Plan that are intended to be “incentive stock options’ within the meaning of Section 422 of the United States Internal Revenue Code of 1986, as amended (the “Code”). If any shares subject to an award granted under the 2003

Plan are forfeited, cancelled, exchanged or surrendered or if an award terminates or expires without a distribution of shares, or if shares of stock are surrendered or withheld as payment of either the exercise price of an award and/or withholding

taxes in respect of an award, those shares will again be available for awards under the 2003 Plan. Upon the exercise of any award granted under the 2003 Plan in tandem with any other award, the related award will be cancelled to the extent of the

number of shares as to which the award is exercised and such shares will not again be available for awards under the 2003 Plan. In the event that the Board of Directors determines that any corporate event, such as a dividend or other distribution,

recapitalization, stock

5

split, reorganization, merger, spin-off or the like, affects our common stock such that an adjustment is appropriate in order to prevent dilution or

enlargement of the rights of plan participants, then the Board of Directors will make those adjustments as it deems necessary or appropriate to any or all of (i) the number and kind of shares or other property that may thereafter be issued in

connection with future awards, (ii) the number and kind of shares or other property that may be issued under outstanding awards, (iii) the exercise price or purchase price of any outstanding award and (iv) the individual share

limitations applicable to awards granted under the 2003 Plan.

Terms of Awards

. Plan options granted under the 2003 Plan may either

be options qualifying as incentive stock options under Section 422 of the Code, or options that do not so qualify. Any incentive option granted under the 2003 Plan must provide for an exercise price of not less than 100% of the fair market

value of the underlying shares on the date of such grant, but the exercise price of any incentive option granted to an eligible employee owning more than 10% of our common stock must be at least 110% of such fair market value as determined on the

date of the grant.

The term of each option and the manner in which it may be exercised is determined by the Board of Directors, provided

that no option may be exercisable more than ten years after the date of its grant and, in the case of an incentive option granted to an eligible employee owning more than 10% of our common stock, no more than five years after the date of the grant.

The per share purchase price of shares subject to options granted under the 2003 Plan may be adjusted in the event of certain changes in

our capitalization, but any such adjustment will not change the total purchase price payable upon the exercise in full of options granted under the 2003 Plan. All options are nonassignable and nontransferable, except by will or by the laws of

descent and distribution and, during the lifetime of the optionee, may be exercised only by such optionee. Previously granted options are subject to early termination in the event of the death or disability of the option holder, or in the instance

of options granted to employees, the termination of that employee’s employment with our company.

Amendment; Termination

. The

Board of Directors may amend, suspend or terminate the 2003 Plan at any time, except that, without the consent of the Company’s stockholders, no amendment shall be made which:

|

|

•

|

|

increases the total number of shares subject to the 2003 Plan (except in either case in the event of adjustments due to changes in our capitalization);

|

|

|

•

|

|

changes the class of persons eligible to receive incentive stock options; or

|

|

|

•

|

|

requires the approval of the Company’s stockholders under any applicable law, rule or regulation.

|

No termination or amendment of the 2003 Plan shall affect any then-outstanding stock option unless expressly provided by the Board. In any event, no

termination or amendment of the 2003 Plan may adversely affect any then-outstanding stock option without the consent of the optionee, unless such termination or amendment is required to enable an option designated as an incentive stock option to

qualify as an incentive stock option or is necessary to comply with any applicable law, regulation or rule.

Unless the 2003 Plan is

earlier suspended or terminated by the Board of Directors, the 2003 Plan terminates ten years from the date of the 2003 Plan’s adoption. Any termination of the 2003 Plan does not affect the validity of any options previously granted thereunder.

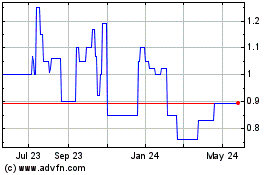

The potential benefit to be received from a Plan option is dependent on increases in the market price of the common stock. The ultimate

dollar value of the 2003 Plan options that have been or may be granted under the 2003 Plan is not currently ascertainable. On January 31, 2008, the closing price of our common stock as reported on the Nasdaq Global Market was $1.78. The above

description of the 2003 Plan is qualified in its entirety by reference to the full text of the 2003 Plan, a copy of which is attached to this Information Statement as

Exhibit A

, as well as the terms and conditions of any agreement governing

the grant of an award under the 2003 Plan.

T

AX

A

SPECTS

The following discussion applies to the 2003 Plan and is based on federal income tax laws and regulations in effect. It does not purport to be a complete

description of the federal income tax consequences of the 2003 Plan, nor does it describe the consequences of applicable state, local or foreign tax laws. Accordingly, any person receiving a grant under the 2003 Plan should consult with his or her

own tax adviser.

6

The 2003 Plan is not subject to the provisions of the Employee Retirement Income Security Act of 1974 and

is not qualified under Section 401(a) of the Code. An employee granted an incentive option does not recognize taxable income either at the date of grant or at the date of its timely exercise. However, the excess of the fair market value of

common stock received upon exercise of the incentive option over the 2003 Plan option exercise price is an item of tax preference under Section 57(a)(3) of the Code and may be subject to the alternative minimum tax imposed by Section 55 of

the Code.

Upon disposition of stock acquired on exercise of an incentive option, long-term capital gain or loss is recognized in an amount

equal to the difference between the sales price and the incentive option exercise price, provided that the option holder has not disposed of the stock within two years from the date of grant and within one year from the date of exercise. If the

incentive option holder disposes of the acquired stock (including the transfer of acquired stock in payment of the exercise price of an incentive option) without complying with both of these holding period requirements (“Disqualifying

Disposition”), the option holder will recognize ordinary income at the time of such Disqualifying Disposition to the extent of the difference between the exercise price and the lesser of the fair market value of the stock on the date the

incentive option is exercised (the value six months after the date of exercise may govern in the case of an employee whose sale of stock at a profit could subject him or her to suit under Section 16(b) of the Securities Exchange Act of 1934) or

the amount realized on such Disqualifying Disposition. Any remaining gain or loss is treated as a short-term or long-term capital gain or loss, depending on how long the shares are held. In the event of a Disqualifying Disposition, the incentive

option tax preference described above may not apply (although, where the Disqualifying Disposition occurs subsequent to the year the incentive option is exercised, it may be necessary for the employee to amend his or her return to eliminate the tax

preference item previously reported).

We are not entitled to a tax deduction upon either exercise of an incentive option or disposition of

stock acquired pursuant to such an exercise, except to the extent that the option holder recognized ordinary income in a Disqualifying Disposition. If the holder of an incentive option pays the exercise price, in full or in part, with shares of

previously acquired common stock, the exchange should not affect the incentive option tax treatment of the exercise. No gain or loss should be recognized on the exchange, and the shares received by the employee, equal in number to the previously

acquired shares exchanged therefor, will have the same basis and holding period for long-term capital gain purposes as the previously acquired shares. The employee will not, however, be able to utilize the old holding period for the purpose of

satisfying the incentive option statutory holding period requirements. Shares received in excess of the number of previously acquired shares will have a basis of zero and a holding period which commences as of the date the common stock is issued to

the employee upon exercise of the incentive option. If an exercise is effected using shares previously acquired through the exercise of an incentive option, the exchange of the previously acquired shares will be considered a disposition of such

shares for the purpose of determining whether a Disqualifying Disposition has occurred.

With respect to the holder of non-qualified

options, the option holder does not recognize taxable income on the date of the grant of the non-qualified option, but recognizes ordinary income generally at the date of exercise in the amount of the difference between the option exercise price and

the fair market value of the common stock on the date of exercise. However, if the holder of non-qualified options is subject to the restrictions on resale of common stock under Section 16 of the Securities Exchange Act of 1934, such person

generally recognizes ordinary income at the end of the six-month period following the date of exercise in the amount of the difference between the option exercise price and the fair market value of the common stock at the end of the six-month

period. Nevertheless, such holder may elect within 30 days after the date of exercise to recognize ordinary income as of the date of exercise. The amount of ordinary income recognized by the option holder is deductible by us in the year that income

is recognized.

EQUITY COMPENSATION PLAN INFORMATION AS OF DECEMBER 31, 2007

We currently maintain two equity compensation plans: the Amended and Restated Staktek Holdings, Inc. 2003 Stock Option Plan and the Company’s 2006

Equity-Based Compensation Plan, which provides for the issuance of restricted stock, restricted stock units, stock appreciation rights, bonus stock and other types of equity to our employees, directors and consultants. The following table provides

information about the Company’s common stock that may be issued upon the exercise of options under the 2003 Plan, upon the issuance of restricted stock units pursuant to the 2006 Equity-Based Compensation Plan, and the shares of stock issued

pursuant to the 2005 Employee Stock Purchase Plan, which purchase plan we terminated, in each case as of December 31, 2007.

7

|

|

|

|

|

|

|

|

|

|

|

|

A

|

|

B

|

|

C

|

|

Plan category

|

|

Number of securities to

be issued upon exercise

of outstanding options,

warrants and

rights

|

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

(1)

|

|

Number of securities

remaining available for

future issuance

under

equity compensation plans

(excluding securities

reflected in column A)

|

|

Equity compensation plans approved by security holders

|

|

5,839,255

|

|

$

|

3.31

|

|

229,111

|

|

Equity compensation plans not approved by security holders

|

|

0

|

|

|

N/A

|

|

N/A

|

|

Total

|

|

5,839,255

|

|

$

|

3.31

|

|

229,111

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company regarding the beneficial ownership of

the Company’s common stock as of February 1, 2008 by (i) each person known to the Company to be a beneficial owner of more than 5% of the Company’s common stock; (ii) each director and nominee for director; (iii) each

of the Named Officers in the Summary Compensation Table of the Executive Compensation section of this Proxy Statement; and (iv) all executive officers and directors of the Company as a group. Unless otherwise indicated in the footnotes, the

beneficial owner has sole voting and investment power with respect to the securities beneficially owned, subject only to community property laws, if applicable.

|

|

|

|

|

|

|

|

Beneficial Owner

|

|

Number of

Shares Owned(1)

|

|

Percent(2)

|

|

|

Austin Ventures (3)

|

|

36,481,999

|

|

78

|

%

|

|

Joseph C. Aragona (4)

|

|

36,481,999

|

|

78

|

|

|

Wayne R. Lieberman(5)

|

|

766,218

|

|

1.6

|

|

|

W. Kirk Patterson (6)

|

|

415,092

|

|

*

|

|

|

Stephanie A. Lucie (7)

|

|

364,386

|

|

*

|

|

|

Harvey B. Cash (8)

|

|

215,000

|

|

*

|

|

|

A. Travis White (9)

|

|

215,000

|

|

*

|

|

|

Kevin P. Hegarty (10)

|

|

54,166

|

|

*

|

|

|

Clark W. Jernigan (11)

|

|

34,000

|

|

*

|

|

|

Joseph A. Marengi

|

|

0

|

|

0

|

|

|

All current executive officers and directors as a group (9 persons)

|

|

38,545,861

|

|

82.5

|

%

|

|

*

|

Less than 1% of the outstanding common stock

|

|

1)

|

Under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of shares that can be acquired by such person within 60 days upon the

exercise of options. Except as otherwise noted, options granted under the Staktek Holdings, Inc. 2003 Stock Option Plan are immediately exercisable, subject to our right to repurchase unvested shares at their initial purchase price, which repurchase

rights lapse over a four-year period in most cases.

|

8

|

2)

|

Percentage ownership is based on 46,703,794 shares of common stock issued and outstanding on January 31, 2008. Shares of common stock, which are currently exercisable or will

become exercisable within 60 days after January 31, 2008, are deemed outstanding for computing the percentage of the person or group holding such options, but are not deemed outstanding for computing the percentage of any other person or group.

|

|

3)

|

Includes 18,186,278 shares of our common stock held by Austin Ventures VII, L.P. and 18,295,721 shares of our common stock held by Austin Ventures VIII, L.P. The sole general

partner of Austin Ventures VII, L.P. is AV Partners VII, L.P. The general partners of AV Partners VII, L.P. are Mr. Aragona, Kenneth P. DeAngelis, John D. Thornton and Blaine F. Wesner. The sole general partner of Austin Ventures VIII, L.P. is

AV Partners VIII, L.P. The general partners of AV Partners VIII, L.P. are Mr. Aragona, Kenneth P. DeAngelis, Christopher A. Pacitti, John D. Thornton and Blaine F. Wesner. Each of Messrs. Aragona, DeAngelis, Pacitti, Thornton and Wesner

disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address of both of these funds is 300 West 6th Street, Suite 2300, Austin, Texas 78701.

|

|

4)

|

Includes 18,186,278 shares of our common stock held by Austin Ventures VII, L.P. and 18,295,721 shares of our common stock held by Austin Ventures VIII, L.P. Mr. Aragona is a

general partner of each of the sole general partners of Austin Ventures VII, L.P. and Austin Ventures VIII, L.P. and may be deemed to share voting and investment power with respect to all shares held by Austin Ventures VII, L.P. and Austin Ventures

VIII, L.P. Mr. Aragona disclaims beneficial ownership of shares held by these funds except to the extent of his pecuniary interest therein.

|

|

5)

|

Includes 28,131 shares of common stock owned, 734,640 vested options and options that vest within the next 60 days and 3,447 shares of stock that will vest in the next 60 days

pursuant to his 2006 and 2007 RSU grants.

|

|

6)

|

Includes 5,986 shares of common stock owned, 408,049 vested options and options that vest within the next 60 days and 1,057 shares of stock that will vest in the next 60 days

pursuant to his 2006 and 2007 RSU grants.

|

|

7)

|

Includes 15,504 shares of common stock owned, 347,825 vested options and options that vest within the next 60 days and 1,057 shares of stock that will vest in the next 60 days

pursuant to her 2006 and 2007 RSU grants.

|

|

10)

|

Includes 54,166 vested options and options that vest within the next 60 days.

|

|

11)

|

Includes 12,810 shares of our common stock that are held by Mr. Jernigan as custodian for his three minor children under the Uniform Gifts to Minors Act. Mr. Jernigan

disclaims beneficial ownership of these shares.

|

9

ADDITIONAL INFORMATION ABOUT STAKTEK

Executive Compensation

The following discussion of executive compensation contains descriptions of

various employee benefit plans and employment-related agreements. These descriptions are qualified in their entirety by reference to the full text or detailed descriptions of the 2003 Plan, a copy of which is attached hereto as

Exhibit A

, and

the agreements, which are filed as exhibits to our 2006 Annual Report on Form 10-K.

SUMMARY COMPENSATION TABLE

The following table sets forth certain information with respect to compensation earned by our named executive officers in the fiscal years ending

December 31, 2007 and December 31, 2006:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position (a)

|

|

Year

(b)

|

|

Salary ($)

(c)(1)

|

|

Bonus ($)

(d)(2)

|

|

Stock

Awards ($)

(e)(3)

|

|

Option

Awards ($)

(f)(4)

|

|

Non-Equity

Incentive Plan

Compensation ($)

(g)(5)

|

|

All Other

Compensation ($)

(i)

|

|

|

Total ($)

(j)

|

|

|

Wayne R. Lieberman

President and Chief Executive Officer

|

|

2007

2006

|

|

$

$

|

338,017

309,808

|

|

$

$

|

132,375

90,951

|

|

$

$

|

124,383

86,321

|

|

$

|

23,035

0

|

|

$

$

|

0

275,089

|

|

$

$

|

20,297

21,504

|

(6)

(6)

|

|

$

$

|

638,107

783,673

|

(7)

(7)

|

|

W. Kirk Patterson

Senior Vice President and Chief Financial Officer

|

|

2007

2006

|

|

$

$

|

246,529

225,179

|

|

$

$

|

61,460

38,069

|

|

$

$

|

56,053

26,472

|

|

$

|

22,335

0

|

|

$

$

|

0

116,779

|

|

$

$

|

13,500

13,200

|

(8)

(8)

|

|

$

$

|

399,877

419,699

|

(7)

(7)

|

|

Stephanie A. Lucie

Senior Vice President, General Counsel and Corporate Secretary

|

|

2007

2006

|

|

$

$

|

230,486

214,119

|

|

$

$

|

52,950

35,996

|

|

$

$

|

56,053

26,472

|

|

$

$

|

39,085

2,841

|

|

$

$

|

0

105,923

|

|

$

$

|

13,500

12,847

|

(8)

(8)

|

|

$

$

|

392,074

398,198

|

(7)

(7)

|

|

(1)

|

The current base salary for Mr. Lieberman is $350,000, for Mr. Patterson it is $260,000 and for Ms. Lucie it is $240,000.

|

|

(2)

|

In the third and fourth quarters of 2007, the Board of Directors authorized a payment to all eligible employees based on the Company’s work in acquiring and integrating

Southland. In 2006, the Company met 98% of its targeted annual adjusted operating income established by the Board of Directors at the beginning of 2006. As a result of this accomplishment, the Board authorized a payment to all employees of the

Company based on the ratio of the 2006 full-year adjusted operating income to the 2006 adjusted operating income annual target.

|

|

(3)

|

Restricted stock unit grants made in 2006 and 2007, subject to four-year vesting. The executives will forfeit these grants upon termination of employment prior to the vesting date.

The amounts shown set forth the FAS 123R expense recognized by the Company.

|

|

(4)

|

Grants of options to purchase common stock, which are subject to four-year vesting. The executives will forfeit these grants upon termination of employment prior to the vesting

date. The total shown includes the FAS 123R expense recognized by the Company for unvested equity awards.

|

|

(5)

|

No bonuses were paid pursuant to the Company’s 2007 Bonus Incentive Plan.

|

10

|

(6)

|

For 2007, includes $13,500 in matched contributions under our 401(k) Plan and $6,798 for reimbursement of life insurance as set forth in Mr. Lieberman’s employment

agreement. For 2006, includes $13,200 in matched contributions under our 401(k) plan and $8,304 for reimbursement of life insurance as set forth in Mr. Lieberman’s employment agreement.

|

|

(7)

|

The total shown includes the FAS 123R expense recognized by the Company for unvested equity awards.

|

|

(8)

|

Matched contributions under our 401(k) plan.

|

Non-Equity Incentive Plan Compensation.

Included in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table are variable-performance awards that have typically been paid in quarterly cash

payments based on the preceding quarterly results in accordance with the Company’s bonus incentive plans, one of which has been adopted at the beginning of each year to apply for that year. These payments, when the criteria are satisfied,

generally have been paid out within 40 days after the end of a quarterly period. In 2006, the Compensation Committee adopted the 2006 Bonus Incentive Plan (“2006 Bonus Plan”).

There were two parts of the 2006 Bonus Plan. The first part covered employees who were at or below the manager level. Bonuses paid to these employees

were based on the Company meeting certain corporate goals as determined by the Chief Executive Officer at the beginning of each calendar quarter. As long as Adjusted Operating Income, which was defined as pro forma operating income plus the expense

of the Bonus Plan, was positive for the quarter, employees in this group were paid up to 18% of their quarterly base salary based on the goal achievement set forth above. The second part of the Bonus Plan covered director-level employees, vice

presidents and the President/Chief Executive Officer, with each named executive officer eligible to receive up to the percentage of his or her base salary as set forth below.

The bonuses paid were based on Adjusted Operating Income, with the quarterly targets set by the Board of Directors on a quarterly basis. The Company must

have achieved at least 75% of a quarterly target in order for any bonus to be paid for that quarter, although the Board could waive this 75% threshold in a quarter, as it deemed appropriate. The payments were scaled from a 75% payout for achieving

75% of the Adjusted Operating Income target, to a 100% payout for achieving 100% or more of the quarterly target. If the Adjusted Operating Income for the year was between 75%—100% of the annual target, the fourth quarter bonus was calculated

to achieve the greater of: 1) the amount as determined under the same process as the first three quarters, or 2) the amount required to achieve a full-year payout equal to the ratio of the full-year Adjusted Operating Income to the Adjusted

Operating Income annual target. If Adjusted Operating Income for the year was between 100%—120% of the annual target, a pool of 5% of the incremental amount (from 100% to 120%) was established and paid as an additional part of the fourth

quarter bonus. For Adjusted Operating Income greater than 120% of the annual target, a pool of 10% of the incremental amount (over 120%) would established and paid as an additional part of the fourth quarter bonus.

The Board of Directors adopted the 2007 Bonus Incentive Plan (the “2007 Bonus Plan”), in large part based on the 2006 Bonus Plan. The 2007

Bonus Plan was the same as the 2006 Bonus Plan, until November 1, 2007, when the Board amended it to provide that bonuses would be paid to all employees were based on the same criteria. Following the amendment, bonuses were based on Adjusted

Operating Income, which was defined as Pro Forma Operating Income, excluding (i) bonus expense for the fourth quarter; (ii) earn-out expenses associated with the Southland acquisition; and (iii) Southland integration costs. Pro forma

Operating Income was defined as operating income as reported under generally accepted accounting principles (GAAP), less amortization of acquisition intangibles and stock option compensation expense. The Company must have achieved the quarterly

threshold in order for any bonus to be paid for that quarter, although the Board could waive this threshold in a quarter, as it deemed appropriate. The payment was scaled from a 75% payout for achieving the quarterly threshold, to a 100% payout for

achieving 100% or more of the quarterly target. The Board of Directors determined the quarterly threshold and quarterly target for the fourth quarter. No payments were made under this plan for 2007.

Other Payments

. For 2006, the Company met 98% of its targeted annual adjusted operating income established by the Board of Directors at the

beginning of 2006. As a result of this accomplishment, the Board authorized a payment to all employees of the Company based on the ratio of the 2006 full-year adjusted operating income to the 2006 adjusted operating income annual target.

On November 1, 2007, the Board of Directors approved a payment for the third quarter of 2007 based on the Company’s acquisition of

Southland, its ongoing integration efforts, as well as its performance in a time of transitioning the Company’s business model. The Board approved a payout of 100% based on the payout percentages of each eligible employee as set forth in our

2007 Bonus Plan. On February 1, 2008, the Board of Directors approved a payment for the fourth quarter of 2007 based on the Company’s acquisition and integration activities, as well as other factors. The Board approved a payout of

approximately 25% based on the payout percentages of each eligible employee as set forth in the Company’s 2007 Bonus Plan.

11

The bonus targets for our executive officers are as follows:

|

|

|

|

|

|

Name

|

|

Percentage of

Base Salary

|

|

|

Wayne R. Lieberman

|

|

120

|

%

|

|

W. Kirk Patterson

|

|

75

|

%

|

|

Stephanie A. Lucie

|

|

70

|

%

|

In 2007, we paid out the following bonuses to our executive officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Q1

|

|

Q2

|

|

Q3

|

|

Q4

|

|

Total

|

|

Mr. Lieberman

|

|

0

|

|

0

|

|

$

|

105,000

|

|

$

|

27,375

|

|

$

|

132,375

|

|

Mr. Patterson

|

|

0

|

|

0

|

|

$

|

48,750

|

|

$

|

12,710

|

|

$

|

61,460

|

|

Ms. Lucie

|

|

0

|

|

0

|

|

$

|

42,000

|

|

$

|

10,950

|

|

$

|

52,950

|

We do not provide perquisites to our executive officers.

Outstanding Equity Awards at Year-End Table

The

following table sets forth certain information with respect to outstanding equity awards at December 31, 2007 with respect to the named executive officers.

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2007

|

|

|

|

|

|

|

|

Option Awards(1)

|

|

Stock Awards(2)

|

|

Name (a)

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

(b)

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

(c)

|

|

Equity

Incentive

Plan Awards:

Number

of

Securities

Underlying

Unexercised

Unearned

Options (#)

(d)

|

|

Option

Exercise

Price ($)

(e)

|

|

Option

Expiration Date

(f)

|

|

Number of

Shares or

Units of

Stock That

Have

Not

Vested (#)

(g)

|

|

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($)

(h)

|

|

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units or

Other Rights

That Have Not

Vested (#)

(i)

|

|

Equity

Incentive

Plan Awards:

Market

or

Payout Value of

Unearned

Shares, Units or

Other Rights

that Have Not

Vested ($)

(j)(3)

|

|

Wayne R. Lieberman

|

|

650,682

0

|

|

356,825

80,000

|

|

356,825

80,000

|

|

$

$

|

2.70

2.73

|

|

5/16/2015

5/11/2017

|

|

—

—

|

|

—

—

|

|

42,188

75,000

|

|

$

$

|

82,688

147,000

|

|

W. Kirk Patterson

|

|

302,835

27,072

37,517

50,000

0

|

|

0

0

0

0

80,000

|

|

0

0

0

13,542

80,000

|

|

$

$

$

$

$

|

0.67

0.67

1.97

4.02

2.73

|

|

11/17/2013

11/19/2013

11/19/2013

1/12/2015

5/11/2017

|

|

—

—

|

|

—

—

|

|

12,938

23,000

|

|

$

$

|

25,358

45,080

|

|

Stephanie A. Lucie

|

|

268,750

93,735

2,333

0

|

|

0

0

4,667

140,000

|

|

0

25,387

4,667

140,000

|

|

$

$

$

$

|

8.37

4.02

6.09

2.73

|

|

12/18/2013

1/12/2015

8/3/2016

5/11/2017

|

|

—

—

|

|

—

—

|

|

12,938

23,000

|

|

$

$

|

23,358

45,080

|

|

1.

|

All options vest over four years, with a one-year cliff and monthly vesting thereafter.

|

|

2.

|

All restricted stock units vest over four years, with a one-year cliff and quarterly vesting thereafter.

|

|

3.

|

Based on the closing price of the Company’s common stock on December 31, 2007 of $1.96. This market value represents the aggregate value of the award, which vests over

four years.

|

13

Amended and Restated 2003 Stock Option Plan

A description of the 2003 Plan is provided under the caption “Amended and Restated Stock Option Plan” above.

2006 Equity-Based Compensation Plan

In 2006, our

Board of Directors and stockholders adopted our 2006 Equity-Based Compensation Plan (the “Equity Plan”). Our Board of Directors has appointed the Compensation Committee to administer this plan pursuant to its terms and all applicable

state, federal, or other rules or laws, except in the event the Board chooses to take action. Any individual who provides services to the Company or its subsidiaries, including independent directors of and consultants for the Company and who is

designated by the Committee to receive an award is eligible to participate.

A participant under this plan is eligible to receive an award

pursuant to its terms and subject to any limitations imposed by appropriate action of the Compensation Committee. No Award may be granted if the award relates to a number of shares of common stock that exceeds the number of shares that remain

available under this plan minus the number of shares issuable in settlement of or relating to outstanding awards. In addition, in any 12-month period established by the Compensation Committee, no award may be granted for purposes of

Section 162(m) of the Code for more than 100,000 shares (subject to any adjustment due to recapitalization or reorganization permitted) and no payment may be made in excess of $700,000 with respect to awards that are not related to common

stock. As of January 31, 2008, we had remaining 145,187 shares of common stock available for issuance under this plan.

We may issue

stock appreciation rights, restricted stock, restricted stock units, bonus stock, dividend equivalents and other stock-based awards pursuant to this plan. Upon a change in control of the Company (as this term is defined in the Equity Plan),

outstanding awards will vest and become fully exercisable.

Retirement Benefits

We do not maintain a defined benefit pension plan that covers members of senior management. We do offer a 401(k) plan and a retiree medical policy, both

of which are described in more detail below.

Staktek 401(k) Plan.

Retirement benefits to our senior management, including the named

executive officers, are the same as provided to all employees and are provided through the Staktek Group L.P. 401(k) Plan and Trust. This plan is a tax-qualified profit-sharing and 401(k) plan. This plan has one primary component, which is a

Company match of $1 up to the first 6% of the employees’ pre-tax deferrals under this plan. The amount matched by the Company for each executive officer in 2007 is as set forth below:

|

|

|

|

|

|

Name

|

|

Company

Matching

|

|

Wayne R. Lieberman

|

|

$

|

13,500

|

|

W. Kirk Patterson

|

|

$

|

13,500

|

|

Stephanie A. Lucie

|

|

$

|

13,500

|

Southland 401(k) Plan

. We also maintain the Southland 401(k) Employees Savings Plan, which

we acquired with the Southland acquisition (the “Southland Plan”). Under the provisions of the Southland Plan, we made a contribution for 2007 in the amount of $28,000. We are planning to merge the Southland Plan into our Staktek

Plan effective March 1, 2008.

Retiree Medical Policy.

We offer a Retiree Medical Policy to each employee who is at least 60

years of age when retiring from the Company, has had at least five years of active service with us, is an active employee at the time of retirement, and is a department director or member of senior management. In connection with this policy, we

provide specified medical, dental and vision coverage to each employee who retires and his or her dependents. We pay the same amount per month towards the cost of this coverage as the monthly amount we paid for him or her in the last month prior to

retirement. The retiree is responsible for paying the remaining cost of the coverage, which terminates at age 65.

Pension Benefits

We do not have any plan that provides for payments or other benefits at, following, or in connection with, retirement.

Non-Qualified Deferred Compensation

We do not have

any plan that provides for the deferral of compensation on a basis that is not tax-qualified.

14

Potential Payments Upon Termination or Change in Control and Employment Contracts

We have entered into executive employment agreements with Mr. Lieberman, Mr. Patterson and Ms. Lucie.

In May 2005, we entered into an executive employment agreement with Mr. Lieberman, which we amended in October 2005 upon Mr. Lieberman’s

appointment to the position of Chief Executive Officer. His original executive employment agreement in May 2005 provided for an initial employment term of two years, subject to successive one-year renewal periods following the expiration of the

initial term, but the agreement could be terminated by either party, with or without cause, upon 30 days’ prior written notice, subject to certain severance and non-competition obligations. The agreement also provided that in the event his

employment was terminated without cause, as defined in the employment agreement, Mr. Lieberman was entitled to 12 months of base salary (following a six-month waiting period if required by Section 409A of the Internal Revenue Code) and 12

months’ accelerated vesting of his stock options. This employment agreement included an agreement by Mr. Lieberman not to compete with us for a period of 12 months following the termination of employment. In October 2005, we amended this

agreement to reflect Mr. Lieberman’s promotion to Chief Executive Officer. The term was extended to three years from the amendment date; the definition of “cause” was revised; his base salary was increased to $325,000; his bonus

percentage was increased to 120%; his relocation allowance was increased to $120,000; the terms of his stock options were amended so that all of his outstanding options to purchase common stock would vest upon a change of control of the Company; and

we included certain language to address Section 409A of the Code.

In November 2003, we entered into an executive employment agreement

with Mr. Patterson for the position of Vice President and Chief Financial Officer, and in December 2003 we entered into an executive employment agreement with Ms. Lucie for the position of Vice President, General Counsel and Secretary.

These agreements provided for an initial employment term of two years, subject to successive one-year renewal periods following the expiration of the initial term, but each agreement could be terminated by either party, with or without cause, upon

30 days’ prior written notice, subject to certain severance and non-competition obligations. The agreements also provided that in the event their employment was terminated without cause, as defined in each employment agreement,

Mr. Patterson and Ms. Lucie were entitled to 12 months of base salary and 12 months’ accelerated vesting of their initial stock option grants. These employment agreements included an agreement by each executive not to compete with us

for a period of 12 months following the termination of employment. In October 2005, we amended these agreements to reflect the promotion of each of Mr. Patterson and Ms. Lucie to Senior Vice President, to reflect an increase in their base

compensation, and to extend the term of each agreement for two years from the amendment date. In May 2007, we amended these agreements to provide for the vesting of certain stock options in the event of a change of control; to include the definition

of ‘good reason’ in the event of a termination without cause; to allow for an additional three month to exercise options following termination; as well as to include certain language to address Section 409A of the Code.

Director Compensation

Compensation for certain

directors is a combination of cash and equity-based compensation. Joe Aragona, a general partner of Austin Ventures, and Clark Jernigan, a venture partner with Austin Ventures, do not receive any compensation for their Board activities. Directors

who receive compensation for their Board positions may not receive consulting, advisory or other compensatory fees from the Company in addition to their Board compensation. The following table sets forth the cash compensation currently payable to

directors, other than Staktek employees, Mr. Aragona and Mr. Jernigan:

|

|

|

|

|

|

Annual Director Retainer

|

|

$

|

20,000

|

|

Audit Chairperson Annual Retainer

|

|

$

|

15,000

|

|

Board Meeting Attendance Fees per meeting (in person)

|

|

$

|

1,000

|

|

Committee Meeting Attendance Fees per meeting (in person)

|

|

$

|

750

|

|

Board and Committee Meeting Telephonic Attendance Fees per meeting

|

|

$

|

500

|

In addition, certain directors receives an option to purchase 100,000 shares of Staktek common

stock upon becoming a director, with 25% vesting after one year and the reminder vesting equally over the following 36 months. Upon re-election, independent directors do not receive additional options to purchase common stock.

The table below sets forth the compensation paid to our directors in 2007.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (a)

|

|

Fees Earned

or Paid in Cash

($)(b)

|

|

Stock

Awards

($)(c)

|

|

Option

Awards

($)(d)

|

|

All Other

Compensation

($)(g)

|

|

Total

($)(h)

|

|

Joseph Aragona

|

|

$

|

0

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

0

|

|

Berry Cash(1)

|

|

$

|

29,750

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

29,750

|

|

Kevin Hegarty(2)

|

|

$

|

30,500

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

30,500

|

|

Clark Jernigan

|

|

$

|

0

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

0

|

|

Wayne Lieberman(3)

|

|

$

|

—

|

|

—

|

|

$

|

—

|

|

—

|

|

$

|

—

|

|

Joseph Marengi(4)

|

|

$

|

6,000

|

|

0

|

|

$

|

11,646

|

|

0

|

|

$

|

17,646

|

|

Travis White(5)

|

|

$

|

45,750

|

|

0

|

|

$

|

0

|

|

0

|

|

$

|

45,750

|

|

1.

|

On November 11, 2003, Mr. Cash received a stock option grant to purchase 100,000 shares of common stock of the Company when he joined the Board of Directors, which was

granted at $1.44 per share. This grant became 215,000 shares to purchase common stock when the Company effected a 2.15-to-1 stock split in 2004. This grant has a one-year cliff and monthly vesting thereafter. Mr. Cash has not received any other

equity grants from the Company.

|

15

|

2.

|

On February 21, 2006, Mr. Hegarty received a stock option grant to purchase 100,000 shares of common stock of the Company when he joined the Board of Directors, which was

granted at $6.09 per share. This grant has a one-year cliff and monthly vesting thereafter. Mr. Hegarty has not received any other equity grants from the Company.

|

|

3.

|

See the Summary Compensation Table for Mr. Lieberman, who is an executive officer of the Company.

|

|

4.

|

On October 15, 2007, Mr. Marengi received a stock option grant to purchase 100,000 shares of common stock of the Company when he joined the Board of Directors, which was

granted at $3.41 per share. This grant has a one-year cliff and monthly vesting thereafter. Mr. Marengi has not received any other equity grants from the Company.

|

|

5.

|

On November 19, 2003, Mr. White received a stock option grant to purchase 100,000 shares of common stock of the Company when he joined the Board of Directors, which was

granted at $1.44 per share. This grant became 215,000 shares to purchase common stock when the Company effected a 2.15-to-1 stock split in 2004. This grant has a one-year cliff and monthly vesting thereafter. The fair market value of the

Company’s common stock on the date of grant was determined to be $4.24 per share. As a result and in accordance with Section 409A of the Internal Revenue Code, in December 2006, the Company and Mr. White entered into an amendment of

this grant, postponing the exercise of the portion of the option that was unvested on December 31, 2004 until the earlier of (i) the termination of Mr. White’s service for any reason other than for cause; (ii) ten days prior

to a change in control; and (iii) January 1, 2013. Mr. White has not received any other equity grants from the Company.

|

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Exchange Act and

in accordance with the Exchange Act, we file periodic reports, documents and other information with the SEC relating to our business, financial statements and other matters. These reports and other information may be inspected and are available for

copying at the offices of the SEC, 450 Fifth Street, NW, Washington, DC 20549 or may be accessed on the SEC website at

www.sec.gov.

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

Wayne R. Lieberman

|

|

President and Chief Executive Officer

|

Austin, Texas

February 26, 2008

16

Exhibit A

STAKTEK HOLDINGS, INC.

AMENDED AND RESTATED

2003 STOCK OPTION PLAN

As amended

on November 10, 2003, August 8, 2005 and August 30, 2007

(and split adjusted on January 16, 2004)

1.

Establishment, Purpose and Term of Plan

.

1.1

Establishment

.

The Staktek Holdings, Inc. 2003 Stock Option Plan (the

“

Plan

”

) is hereby established effective as of July 7, 2003 and is

amended effective as of November 10, 2003, August 8, 2005 and August 30, 2007.

1.2

Purpose

.

The purpose of the Plan is to advance the interests of the Participating Company Group and its stockholders by providing an incentive to attract and retain persons performing services for the Participating Company Group

and by motivating such persons to contribute to the growth and profitability of the Participating Company Group.

1.3

Term of

Plan.

The Plan shall continue in effect until the earlier of its termination by the Board or the date on which all of the shares of Stock available for issuance under the Plan have been issued and all restrictions on such shares under the terms

of the Plan and the agreements evidencing Options granted under the Plan have lapsed. However, all Options shall be granted, if at all, within ten (10) years from the earlier of the date the Plan is adopted by the Board or the date the Plan is

duly approved by the stockholders of the Company.

2.

Definitions and Construction

.

2.1

Definitions.

Whenever used herein, the following terms shall have their respective meanings set forth below:

(a)

“

Board

”

means the Board of Directors of the Company. If one or more Committees have been appointed by the

Board to administer the Plan,

“

Board

”

also means such Committee(s).

(b)

“

Cause

”

shall mean any of the following: (i) the Optionee’s theft of Company property or falsification of any Participating Company documents or records; (ii) the Optionee’s improper use or

disclosure of a Participating Company’s confidential or proprietary information; (iii) any action by the Optionee which has a detrimental effect on a Participating Company’s reputation or business; (iv) the Optionee’s

failure or inability to perform any reasonable assigned duties or the breach by Optionee of any duties to the Company or its stocholders; (v) any breach by the Optionee of any employment or service agreement between the Optionee and a

Participating Company; or (vi) the Optionee’s conviction (including any plea of guilty or no contest) of any felony, criminal fraud, theft or crime of moral turpitude.

(c)

“

Code

”

means the Internal Revenue Code of 1986, as amended, and any applicable regulations promulgated

thereunder.

(d)

“

Committee

”

means the Compensation Committee or other committee of the Board

duly appointed to administer the Plan and having such powers as shall be specified by the Board. Unless the powers of the Committee have been specifically limited, the Committee shall have all of the powers of the Board granted herein, including,

without limitation, the power to amend or terminate the Plan at any time, subject to the terms of the Plan and any applicable limitations imposed by law.

1

(e)

“

Company

”

means Staktek Holdings, Inc., a Delaware

corporation, or any successor corporation thereto.

(f)

“

Consultant

”

means a person engaged to

provide consulting or advisory services (other than as an Employee or a Director) to a Participating Company, provided that the identity of such person, the nature of such services or the entity to which such services are provided would not preclude

the Company from offering or selling securities to such person pursuant to the Plan in reliance on either the exemption from registration provided by Rule 701 under the Securities Act or, if the Company is required to file reports pursuant to

Section 13 or 15(d) of the Exchange Act, registration on a Form S-8 Registration Statement under the Securities Act.

(g)

“

Director

”

means a member of the Board or of the board of directors of any other Participating Company.

(h)

“

Disability

”

means the permanent and total disability of the Optionee within the meaning of Section 22(e)(3) of the Code.

(i)

“

Employee

”

means any person treated as an employee (including an officer or a Director who is also

treated as an employee) in the records of a Participating Company and, with respect to any Incentive Stock Option granted to such person, who is an employee for purposes of Section 422 of the Code; provided, however, that neither service as a

Director nor payment of a director’s fee shall be sufficient to constitute employment for purposes of the Plan.

(j)

“

Exchange Act

”

means the Securities Exchange Act of 1934, as amended.

(k)

“

Fair Market Value

”

means, as of any date, the value of a share of Stock or other property as determined by the Board, in its discretion, or by the Company, in its discretion, if such determination is expressly

allocated to the Company herein, subject to the following:

(i)

If, on such date, the Stock is listed on a national or regional

securities exchange or market system, the Fair Market Value of a share of Stock shall be the closing price of a share of Stock (or the mean of the closing bid and asked prices of a share of Stock if the Stock is so quoted instead) as quoted on the

Nasdaq National Market, The Nasdaq SmallCap Market or such other national or regional securities exchange or market system constituting the primary market for the Stock, as reported in

The Wall Street Journal

or such other source as the

Company deems reliable. If the relevant date does not fall on a day on which the Stock has traded on such securities exchange or market system, the date on which the Fair Market Value shall be established shall be the last day on which the Stock was

so traded prior to the relevant date, or such other appropriate day as shall be determined by the Board, in its discretion.

(ii)

If, on such date, the Stock is not listed on a national or regional securities exchange or market system, the Fair Market Value of a share of Stock shall be as determined by the Board in good faith without regard to any restriction other than a

restriction which, by its terms, will never lapse.

(l)

“

Incentive Stock Option

”

means an

Option intended to be (as set forth in the Option Agreement) and which qualifies as an incentive stock option within the meaning of Section 422(b) of the Code.

(m)

“

Insider

”

means an officer or a Director of the Company or any other person whose transactions in Stock are subject to Section 16 of the Exchange Act.

2

(n)

“

Nonstatutory Stock Option

”

means an Option not intended

to be (as set forth in the Option Agreement) or which does not qualify as an Incentive Stock Option.

(o)

“

Option

”

means a right to purchase Stock (subject to adjustment as provided in

Section 4.2

) pursuant to the terms and conditions of the Plan. An Option may be either an Incentive Stock Option or a

Nonstatutory Stock Option.

(p)

“

Option Agreement

”

means a written agreement between the

Company and an Optionee setting forth the terms, conditions and restrictions of the Option granted to the Optionee and any shares acquired upon the exercise thereof. An Option Agreement may consist of a form of “Notice of Grant of Stock

Option” and a form of “Stock Option Agreement” incorporated therein by reference, or such other form or forms as the Board may approve from time to time.

(q)

“

Optionee

”

means a person who has been granted one or more Options.

(r)

“

Parent Corporation

”

means any present or future “parent corporation” of the Company, as defined in Section 424(e) of the Code.

(s)

“

Participating Company

”

means the Company or any Parent Corporation or Subsidiary Corporation.

(t)

“

Participating Company Group

”

means, at any point in time, all corporations collectively

which are then Participating Companies.

(u)

“

Rule 16b-3

”

means Rule 16b-3 under the

Exchange Act, as amended from time to time, or any successor rule or regulation.

(v)

“

Securities

Act

”

means the Securities Act of 1933, as amended.

(w)

“

Service

”

means an

Optionee’s employment or service with the Participating Company Group, whether in the capacity of an Employee, a Director or a Consultant. An Optionee’s Service shall not be deemed to have terminated merely because of a change in the

capacity in which the Optionee renders Service to the Participating Company Group or a change in the Participating Company for which the Optionee renders such Service, provided that there is no interruption or termination of the Optionee’s

Service. Furthermore, an Optionee’s Service with the Participating Company Group shall not be deemed to have terminated if the Optionee takes any military leave, sick leave, or other bona fide leave of absence approved by the Company; provided,

however, that if any such leave exceeds ninety (90) days, on the ninety-first (91st) day of such leave the Optionee’s Service shall be deemed to have terminated unless the Optionee’s right to return to Service with the

Participating Company Group is guaranteed by statute or contract. Notwithstanding the foregoing, unless otherwise designated by the Company or required by law, a leave of absence shall not be treated as Service for purposes of determining vesting

under the Optionee’s Option Agreement. The Optionee’s Service shall be deemed to have terminated either upon an actual termination of Service or upon the corporation for which the Optionee performs Service ceasing to be a Participating