Country's beer makers keep a grip on their home market, while

branching out abroad

By Atsuko Fukase and Megumi Fujikawa

TOKYO -- In an era when Budweiser is sold by a Belgium-based

company and California's Lagunitas IPA is partly Dutch-owned,

Japanese beer has remained in Japan's hands, away from the global

consolidation party.

The head of the biggest-selling Japanese beer maker says he

wants to keep it that way.

"The subtle taste and quality of beer that the Japanese favor

can be created only under Japanese management," said Akiyoshi Koji,

president of Asahi Group Holdings Ltd., in an interview. "If a

foreign company takes control of a Japanese maker, there is a risk

of the brand's credibility being harmed."

The planned merger of the world's two biggest beer makers,

Anheuser-Busch InBev NV and SABMiller, has brought renewed

attention to global consolidation. Japan is something of an anomaly

because its top players have been the same for decades. Tokyo-based

Asahi and its leading rival in Japan, Kirin Holdings Co., are

minnows globally but big fish in their own pond.

That pond is getting smaller. Japan's population is shrinking

and younger consumers are heading toward wine or cocktails instead

of beer. Shipments of beer and related brews including low-malt

beer came to about 425 million cases in 2015, compared with a peak

of 573 million cases in 1994, according to the Brewers Association

of Japan.

The answer, say Asahi and its main Japanese rivals, is to branch

out into other drinks and try to build a global business focused on

premium brands.

However difficult it may be for foreigners to re-create the

taste of Japanese beer, Mr. Koji is betting billions of dollars

that his company can do so with Italian and Dutch beer. Asahi plans

to acquire European brands Peroni and Grolsch for $2.9 billion from

SABMiller, divestitures that SABMiller is making to get regulatory

clearance for the Anheuser-Busch InBev deal.

"We aren't planning to engage in a head-on fight with products

in a similar price range" to those from AB InBev, Mr. Koji said.

"We would like to challenge our global competitors with value-added

products."

Mr. Koji said Asahi had room to make further acquisitions,

although he declined to say whether he was interested in Eastern

European assets of SABMiller that are also up for sale. An Asahi

spokesman said the company could spend roughly $3 billion to $4

billion for further acquisitions and still stay within its debt

target.

The Anheuser-Busch InBev-SABMiller combination would create a

giant brewer with around 30% global market share by volume. That

compares with 1.2% for Asahi, putting it in 10th place, according

to Euromonitor.

The megamerger could pose "immense competition to the Japanese

beer companies," said Ranjan Kumar Singh, an analyst at Allied

Market Research. "The big players are using these strategic moves

to boost profitability by cutting costs."

Asahi is still growing, despite slower sales of its flagship

Super Dry brand. The company has recently posted steadily rising

revenue and profit, with sales of Yen1.86 trillion ($18.2 billion)

in 2015. Its market capitalization of Yen1.6 trillion slightly

exceeds Kirin's.

It has kept growing partly by diversifying into products such as

wine and baby food, and by adding beer alternatives that cost less

because of lower taxes. These include "new genre" products brewed

from peas or corn to avoid Japan's taxes on malt.

Such peculiarities in taxes and distribution have turned the

nation's beer market into another example of what locals call the

Galapagos phenomenon, in which Japan evolves in isolation from

global trends. That is another reason Mr. Koji is confident

foreigners wouldn't try to buy Asahi.

"I wouldn't say there's no risk of being acquired," he said.

"But for foreign brewers, it would be extremely difficult to buy a

Japanese maker and further boost profitability."

AB InBev set up an office in Tokyo about a year ago to work more

effectively with local partners that handle its beer brands in

Japan, regional director Toon Van der Veer said in an email. He

declined to comment on whether AB InBev would be interested in

directly challenging Japanese beer makers in their home market.

Japan's other top beer makers, which include Suntory Holdings

Ltd. and Sapporo Holdings Ltd., have tried similar strategies of

holding on to their core beer market at home while branching out

abroad.

"AB InBev's acquisition of SABMiller could change power

relationships of the beer industry. However, it won't directly

affect Suntory because we mainly focus on premium beer, as well as

soft drinks, health food and other alcohol," Suntory Holdings

president Takeshi Niinami said in an email.

Suntory, which has long had a more diversified portfolio than

Asahi or Kirin, further broadened its business through the $16

billion acquisition of U.S. whiskey maker Beam in 2014.

Kirin, which bought a 55% stake in Myanmar Brewery for $560

million last year, says it is focusing on cost cuts to counteract a

shrinking home market. Part of its strategy has echoes of the

global consolidation trend, but it is consolidation with a Japanese

flavor: combining certain operations rather than entire companies.

Kirin and Asahi recently said they would open a joint logistics

center and share trains to ship their beer beginning next year.

(END) Dow Jones Newswires

September 01, 2016 02:50 ET (06:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

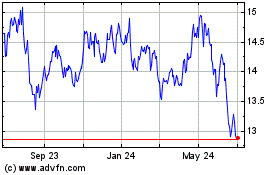

Kirin (PK) (USOTC:KNBWY)

Historical Stock Chart

From Dec 2024 to Jan 2025

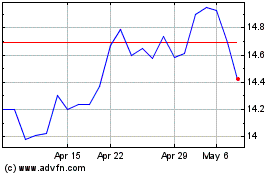

Kirin (PK) (USOTC:KNBWY)

Historical Stock Chart

From Jan 2024 to Jan 2025