Walmart Weighs a U.K. Pullback as Rivals Gain Sway -- 3rd Update

April 28 2018 - 2:06PM

Dow Jones News

By Ben Dummett, Sarah Nassauer and Saabira Chaudhuri

LONDON -- Walmart Inc. is in advanced talks to sell a majority

stake in its U.K. grocery chain Asda Group Ltd. to rival J

Sainsbury PLC, according to people familiar with the situation, a

sign that the retail behemoth aims to reduce risk in one of the

world's most competitive markets as local players consolidate.

Such a deal would create a U.K. food giant with combined revenue

of about GBP50 billion ($68.9 billion), according to the latest

available financial results.

In a brief statement Saturday, Sainsbury, which has a market

value of $8.16 billion, confirmed the talks and said it would make

a further announcement Monday. Walmart will take a stake of about

40% in the new entity, according to a person familiar with the

situation.

The U.K., where Walmart operates about 600 Asda stores, is the

Bentonville, Ark., retailer's biggest overseas market by revenue.

It agreed to acquire Asda in 1999 for about $10.8 billion as part

of the U.S. retail giant's goal at the time to double its

international operations.

But since then the operation has also proven to be the most

problematic as sales have been hammered by competition from German

discounters Aldi and Lidl. The pair have kept prices low by

prioritizing speedy store deliveries, efficiency and high turnover

at the expense of range and customer service.

Although Sainsbury typically markets itself to slightly

wealthier shoppers, the chain, like its peers, has struggled to

compete against Aldi and Lidl. In March, it said it was cutting the

prices of 930 everyday grocery products in its stores and

online.

Because of this steep competition and large numbers of online

shoppers, the U.K. grocery market is billed by many retail

executives as the world's toughest.

In response, the U.K.'s market leaders have been moving to bulk

up.

Tesco PLC agreed last year to acquire Booker Group PLC, the

country's largest food wholesaler, for GBP3.7 billion, catapulting

it from the U.K.'s biggest supermarket chain to its largest food

business.

Like that deal, any merger between Asda and Sainsbury would

likely draw antitrust scrutiny amid worries that consolidation

could give the combined entity greater power to maintain or raise

prices for food.

"It is likely that scrutiny would be a high and an investigation

prolonged," said Neil Saunders, managing director of GlobalData

Retail. "Furthermore, we believe that even if a deal was ultimately

permitted, it may be subject to remedies such as store disposals

and other measures which would be disruptive."

Walmart and Sainsbury are likely to defend the merger in part by

arguing the additional scale will allow the combined entity to cut

operating costs and keep prices lower.

Should Sainsbury and Asda reach a deal, the combined entity

would have a 27% share of the U.K. grocery market, surpassing

Tesco, according to Kantar Worldpanel. The industry's leaders have

lost market share in recent years, while Aldi and Lidl have made

gains.

In recent years, Tesco, Sainsbury and rival Wm Morrison

Supermarkets PLC poured money into their operations, but Walmart

held back. It tapped a string of Asda's most senior executives,

including its operations chief, e-commerce head and two chief

financial officers, and put them in positions in its U.S. business,

weakening Asda's talent pool, say analysts.

Walmart executives have indicated since October that though Asda

isn't hugely profitable, they see it as a good source of cash flow.

Still in February, Walmart Chief Executive Doug McMillon said that

he sees the U.K. market as similar to the retailer's home market in

North America -- "largely built out."

According to Asda's latest available financial results, the

grocery-store operator generated GBP21.7 billion in revenue in

2016, down 3.2% from the prior year. By comparison, Sainsbury

increased sales 13% to GBP29.1 billion for its latest year ended

March 11, 2017. That gain, though, mainly reflected benefits from

its GBP1.4 billion takeover of Argos owner Home Retail Group in

2016. Argos, which sells everything from irons to furniture, has a

strong distribution network that Sainsbury has been leveraging to

compete with Amazon.

The talks between Walmart and Sainsbury were earlier reported by

Bloomberg.

Write to Ben Dummett at ben.dummett@wsj.com, Sarah Nassauer at

sarah.nassauer@wsj.com and Saabira Chaudhuri at

saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 28, 2018 13:51 ET (17:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

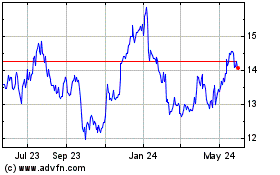

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jun 2024 to Jul 2024

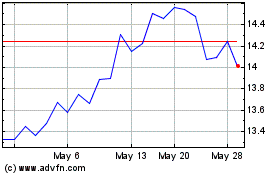

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jul 2023 to Jul 2024