UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 7, 2015

General Steel Holdings, Inc.

(Exact name of registrant as specified

in its charter)

| Nevada |

001-33717 |

41-2079252 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification Number) |

Level 21, Tower B, Jia Ming Center

No. 27 Dong San Huan North Road

Chaoyang District, Beijing, China 100020

(Address of

principal executive offices)

Registrant’s telephone number,

including area code:

+ 86 (10) 57757691

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 3.01. Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 7, 2015, General Steel Holdings, Inc.,

a Nevada corporation (the “Company”), received a notice (the “NYSE Notice”) from NYSE Regulations, Inc.

that it is not in compliance with the continued listing standard set forth in Section 802.01C of the Listed Company Manual (“Section

802.01C”) of the New York Stock Exchange, Inc. (the “NYSE”). Such noncompliance is based on the average closing

price of the Company’s common stock being less than $1.00 over a consecutive 30 trading-day period. The Company will provide

the NYSE with the required response within 10 business days of its receipt of the NYSE Notice, stating its intent to cure this

deficiency. On May 13, 2015, the Company also issued a press release announcing, among other things, its receipt of the NYSE Notice.

In accordance with the NYSE Notice, the

Company has 6 months from the date of receipt of the NYSE Notice to achieve compliance with the continued listing standard of Section

802.01C. The Company’s common stock will continue to be listed and traded on the NYSE during this 6 month cure period, subject

to NYSE’s discretion, under the symbol “GSI,” but will continue to be assigned a “.BC” indicator

by the NYSE to signify that the Company is not currently in compliance with the NYSE’s continued listing standards. In the

event that the Company fails to achieve compliance with the continued listing standards of Section 802.01C by the expiration of

the 6 month cure period, the NYSE may commence suspension and delisting procedures.

ITEM 8.01. OTHER EVENTS.

On May 13, 2015, the Company issued a press

release pertaining to the NYSE Notice referenced above. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated

into this Item 8.01 by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit

No. |

|

Description |

| |

|

| 99.1 |

|

Press Release issued on May 13, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

General Steel Holdings, Inc. |

| |

|

|

| |

By: |

/s/ John Chen |

| |

Name: |

John Chen |

| |

Title: |

Chief Financial Officer |

Dated: May 13, 2015

Exhibit 99.1

General Steel Receives NYSE Notification

Regarding Closing Price Requirement Under NYSE’s Continued Listing Standard

BEIJING – May 13, 2015 –

General Steel Holdings, Inc. (“General Steel” or the “Company”) (NYSE: GSI), a leading non-state-owned

steel producer in China, announced today that the New York Stock Exchange, Inc. (the “NYSE”) has notified the Company

that it has fallen below the NYSE's continued listing standard set forth in Section 802.01C of the Listed Company Manual (“Section

802.01C”) that requires a minimum average closing price of $1.00 per share of the Company’s common stock over a consecutive

30-trading-day period.

Under the NYSE regulations, the Company

has a cure period of six months from receipt of the NYSE’s notice to achieve compliance with the continued listing standard

of Section 802.01C. The Company can regain compliance at any time during the six-month cure period if on the last trading day of

any calendar month during the cure period, the Company has a closing share price and an average closing share price of at least

$1.00 over the 30 trading-day period ending on the last trading day of that month.

The Company will provide the NYSE with

the required response within 10 business days of its receipt of the NYSE Notice, stating its intent to cure this deficiency. The

Company may consider implementing a reverse stock split of its common stock, which the Company received shareholder approval for

at its annual general meeting on December 29, 2014, in order to effect a cure of its non-compliance with the Pricing Standard within

the appropriate timeframe and to avoid any future non-compliance. If the Company decides to implement such a reverse stock split,

it will inform the NYSE in accordance with applicable NYSE rules.

Subject to compliance with the NYSE’s

other continued listing standards and ongoing oversight, the Company’s common stock will continue to be listed and traded

on the NYSE during the six-month cure period, under the symbol “GSI”, but will continue to be assigned a “.BC”

indicator. The Company’s business operations and United States Securities and Exchange Commission reporting requirements

are not affected by the receipt of the NYSE’s notice. The Company intends to actively monitor the closing price of its common

stock during the cure period and will evaluate all available options to resolve this non-compliance and regain compliance with

the Pricing Standard.

About General Steel

General Steel Holdings, Inc. is a leading

non-state-owned steel maker headquartered in Beijing, China. With seven million metric tons of crude steel production capacity

under management and operations in Tianjin municipality and China’s Shaanxi and Guangdong provinces, the Company produces

a variety of steel products including rebar and high-speed wire.

In addition to its steel business, the

Company also designs, manufactures, and integrates radio frequency identification (“RFID”) systems. The Company’s

RFID technology provides real-time data on supplies, inventory, and goods, thereby greatly enhancing its customers’ administration

and planning processes, as well as, asset tracking and supply chain management.

For more information, please visit www.gshi-steel.com.

To be added to the General Steel email list to receive Company news, or to request a hard copy of the Company’s Annual Report

on Form 10-K, please send your request to investor.relations@gshi-steel.com.

General Steel Holdings, Inc.

Page 2 of 2

Forward-Looking Statements

This press release may contain certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based

on management's current expectations or beliefs about future events and financial, political and social trends and assumptions

it has made based on information currently available to it. The Company cannot assure that any expectations, forecasts or assumptions

made by management in preparing these forward-looking statements will prove accurate, or that any projections will be realized.

Actual results could differ materially from those projected in the forward-looking statements as a result of inaccurate assumptions

or a number of risks and uncertainties. These risks and uncertainties are set forth in the Company's filings under the Securities

Act of 1933 and the Securities Exchange Act of 1934 under “Risk Factors” and elsewhere, and include, but are not limited

to: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect

such economic conditions; (b) whether the Company is able to manage its planned growth efficiently and operate profitable operations,

including whether its management will be able to identify, hire, train, retain, motivate and manage required personnel or that

management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether the Company

is able to generate sufficient revenues or obtain financing to sustain and grow its operations; (d) whether the Company is able

to successfully fulfill our primary requirements for cash; and (e) other risks, including those disclosed in the Company’s

most recent Annual Report on Form 10-K, filed with the United States Securities and Exchange Commission. Forward-looking statements

contained herein speak only as of the date of this release. The Company does not undertake any obligation to update or revise publicly

any forward-looking statements, whether to reflect new information, future events or otherwise.

Contact Us

General Steel Holdings, Inc.

Joyce Sung

Tel: +1-347-534-1435

Email: joyce.sung@gshi-steel.com

Asia Bridge Capital Limited

Carene Toh

Tel: +1-888-957-3362

Email: generalsteel@asiabridgegroup.com

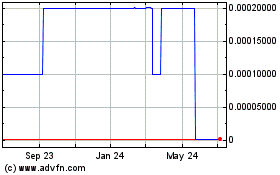

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

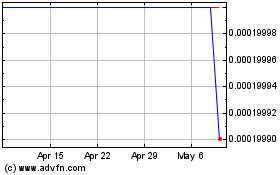

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jul 2023 to Jul 2024