UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

To Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 5, 2014

FIRST ACCEPTANCE CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-12117 |

|

75-1328153 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 3813 Green Hills Village Drive

Nashville, Tennessee |

|

37215 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(615) 844-2800

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On August 5, 2014, First Acceptance Corporation issued a press release announcing its results of operations for the quarter ended

June 30, 2014. The text of the release is set forth in Exhibit 99 attached to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K is being furnished pursuant to Item 2.02 and shall not be deemed to be

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, except as expressly set forth in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99 |

|

Press release dated August 5, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

|

|

|

| FIRST ACCEPTANCE CORPORATION |

|

|

| By: |

|

/s/ Brent J. Gay |

|

|

Brent J. Gay |

|

|

Chief Financial Officer |

Date: August 5, 2014

INDEX TO EXHIBITS

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99 |

|

Press release dated August 5, 2014 |

Exhibit 99

First Acceptance Corporation Reports Operating Results for the Three and Six Month Periods Ended June 30, 2014

NASHVILLE, TN, August 5, 2014 — First Acceptance Corporation (NYSE: FAC) today reported its financial results for the three and six month periods

ended June 30, 2014.

Income before income taxes for the three months ended June 30, 2014 was $3.7 million, compared with income

before income taxes of $2.3 million for the same period in the prior year. Net income for the three months ended June 30, 2014 was $3.5 million, or $0.08 per share on a basic and diluted basis, compared with net income of $2.1 million, or $0.05

per share on a basic and diluted basis, for the same period in the prior year.

Income before income taxes for the six months ended

June 30, 2014 was $4.3 million, compared with income before income taxes of $4.4 million for the same period in the prior year. Net income for the six months ended June 30, 2014 was $4.0 million, or $0.10 per share on a basic and diluted

basis, compared with net income of $4.1 million, or $0.10 per share on a basic and diluted basis, for the same period in the prior year.

Joe Borbely, the Company’s President commented “We are pleased that the recent investment in our people, operations and product is

being realized in our top-line results. Acceptance is becoming recognized as a market leader for auto insurance in the communities we serve. Our multi-channel approach offers our customers the ability to purchase insurance products the way they

want: by clicking, calling or visiting one of our 353 neighborhood locations.”

Revenues. Revenues for the three months ended

June 30, 2014 were $67.1 million, compared with $62.5 million for the same period in the prior year. Revenues for the six months ended June 30, 2014 were $129.7 million, compared with $121.8 million for the same period in the prior year.

Premiums earned for the three months ended June 30, 2014 were $55.9 million, compared with $52.1 million for the same period in the

prior year. Premiums earned for the six months ended June 30, 2014 were $107.6 million, compared with $101.5 million for the same period in the prior year. This improvement was primarily due to a higher percentage of full coverage policies sold

and our recent pricing actions.

Loss Ratio. The loss ratio was 73.5 percent for the three months ended June 30, 2014,

compared with 75.0 percent for the three months ended June 30, 2013. The loss ratio was 72.4 percent for the six months ended June 30, 2014, compared with 71.5 percent for the six months ended June 30, 2013. We experienced favorable

development related to prior periods of $2.4 million for the three months ended June 30, 2014, compared with favorable development of $1.4 million for the three months ended June 30, 2013. For the six months ended June 30, 2014, we

experienced favorable development related to prior periods of $4.4 million, compared with favorable development of $2.5 million for the six months ended June 30, 2013. The favorable development for the three and six month periods ended

June 30, 2014 was primarily due to lower than expected development related to bodily injury emergence in recent accident quarters.

Excluding the development related to prior periods, the loss ratios for the three months ended

June 30, 2014 and 2013 were 77.8 percent and 77.7 percent, respectively. Excluding the development related to prior periods, the loss ratios for the six months ended June 30, 2014 and 2013 were 76.5 percent and 74.0 percent, respectively.

The year-over-year increase in the loss ratio was primarily due to weather-related claims frequency in the collision and property damage coverages.

Expense Ratio. The expense ratio was 20.7 percent for the three months ended June 30, 2014, compared with 21.7 percent for the

three months ended June 30, 2013. The expense ratio was 24.9 percent for the six months ended June 30, 2014, compared with 25.2 percent for the six months ended June 30, 2013. The year-over-year decrease in the expense ratio was

primarily due to the increase in premiums earned which resulted in a lower percentage of fixed expenses in our retail operations (such as rent and base salary).

Combined Ratio. The combined ratio was 94.2 percent for the three months ended June 30, 2014, compared with 96.7 percent for the

same period in the prior year. For the six months ended June 30, 2014, the combined ratio was 97.3 percent, compared with 96.7 percent for the same period in the prior year.

2

About First Acceptance Corporation

We are principally a retailer, servicer and underwriter of non-standard personal automobile insurance based in Nashville, Tennessee. We

currently write non-standard personal automobile insurance in 12 states and are licensed as an insurer in 13 additional states. Non-standard personal automobile insurance is made available to individuals because of their inability or unwillingness

to obtain standard insurance coverage due to various factors, including payment history, payment preference, failure in the past to maintain continuous insurance coverage, driving record and/or vehicle type, and in most instances who are required by

law to buy a minimum amount of automobile insurance.

At June 30, 2014, we leased and operated 353 retail locations, staffed with

employee-agents. Our employee-agents primarily sell non-standard personal automobile insurance products underwritten by us, as well as certain commissionable ancillary products. In most states, our employee-agents also sell a complementary insurance

product providing personal property and liability coverage to renters underwritten by us. In addition, select retail locations in highly competitive markets in Illinois and Texas began offering non-standard personal automobile insurance serviced and

underwritten by other third-party insurance carriers. In addition to our retail locations, we are able to complete the entire sales process over the phone via our call center or through the internet via our consumer-based website or mobile platform.

We also sell our products through 11 retail locations operated by independent agents. Additional information about First Acceptance Corporation can be found online at www.acceptanceinsurance.com.

This press release contains forward-looking statements. These statements, which have been included in reliance on the “safe harbor”

provisions of the federal securities laws, involve risks and uncertainties. Investors are hereby cautioned that these statements may be affected by important factors, including, among others, the factors set forth under the caption “Risk

Factors” in Item 1A. of our Annual Report on Form 10-K for the year ended December 31, 2013 and in our other filings with the Securities and Exchange Commission. Actual operations and results may differ materially from the results discussed in

the forward-looking statements. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

3

FIRST ACCEPTANCE CORPORATION AND SUBSIDIARIES

Consolidated Statements Income

(Unaudited)

(in

thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Premiums earned |

|

$ |

55,854 |

|

|

$ |

52,118 |

|

|

$ |

107,602 |

|

|

$ |

101,521 |

|

| Commission and fee income |

|

|

10,051 |

|

|

|

9,162 |

|

|

|

19,226 |

|

|

|

17,759 |

|

| Investment income |

|

|

1,257 |

|

|

|

1,268 |

|

|

|

2,794 |

|

|

|

2,544 |

|

| Net realized gains (losses) on investments, available-for-sale (includes $(42), $(55), $40 and $(42), respectively, of accumulated

other comprehensive income (loss) reclassification for unrealized gains (losses)) |

|

|

(42 |

) |

|

|

(55 |

) |

|

|

40 |

|

|

|

(42 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67,120 |

|

|

|

62,493 |

|

|

|

129,662 |

|

|

|

121,782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses and loss adjustment expenses |

|

|

41,066 |

|

|

|

39,087 |

|

|

|

77,883 |

|

|

|

72,592 |

|

| Insurance operating expenses |

|

|

21,162 |

|

|

|

19,909 |

|

|

|

45,191 |

|

|

|

42,249 |

|

| Other operating expenses |

|

|

245 |

|

|

|

223 |

|

|

|

478 |

|

|

|

452 |

|

| Stock-based compensation |

|

|

66 |

|

|

|

56 |

|

|

|

112 |

|

|

|

140 |

|

| Depreciation and amortization |

|

|

437 |

|

|

|

537 |

|

|

|

880 |

|

|

|

1,108 |

|

| Interest expense |

|

|

421 |

|

|

|

427 |

|

|

|

848 |

|

|

|

870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63,397 |

|

|

|

60,239 |

|

|

|

125,392 |

|

|

|

117,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income before income taxes |

|

|

3,723 |

|

|

|

2,254 |

|

|

|

4,270 |

|

|

|

4,371 |

|

| Provision for income taxes (includes $(15), $(19), $14 and $(15), respectively, of income tax expense from reclassifications

items) |

|

|

254 |

|

|

|

188 |

|

|

|

290 |

|

|

|

281 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

3,469 |

|

|

$ |

2,066 |

|

|

$ |

3,980 |

|

|

$ |

4,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.08 |

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.08 |

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of shares used to calculate net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

40,978 |

|

|

|

40,921 |

|

|

|

40,974 |

|

|

|

40,915 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

41,274 |

|

|

|

40,948 |

|

|

|

41,278 |

|

|

|

40,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

FIRST ACCEPTANCE CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

2014 |

|

|

2013 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Investments, available-for-sale at fair value (amortized cost of $124,959 and $126,873, respectively) |

|

$ |

131,284 |

|

|

$ |

130,248 |

|

| Cash and cash equivalents |

|

|

85,408 |

|

|

|

72,033 |

|

| Premiums and fees receivable, net of allowance of $407 and $311 |

|

|

53,185 |

|

|

|

46,228 |

|

| Limited partnership interests |

|

|

9,053 |

|

|

|

7,513 |

|

| Other assets |

|

|

5,974 |

|

|

|

6,471 |

|

| Property and equipment, net |

|

|

3,121 |

|

|

|

3,512 |

|

| Deferred acquisition costs |

|

|

3,314 |

|

|

|

2,902 |

|

| Identifiable intangible assets |

|

|

4,800 |

|

|

|

4,800 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

296,139 |

|

|

$ |

273,707 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Loss and loss adjustment expense reserves |

|

$ |

88,797 |

|

|

$ |

84,286 |

|

| Unearned premiums and fees |

|

|

65,617 |

|

|

|

55,983 |

|

| Debentures payable |

|

|

40,321 |

|

|

|

40,301 |

|

| Other liabilities |

|

|

17,406 |

|

|

|

16,205 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

212,141 |

|

|

|

196,775 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $.01 par value, 10,000 shares authorized |

|

|

— |

|

|

|

— |

|

| Common stock, $.01 par value, 75,000 shares authorized; 401,000 and 40,983 shares issued and outstanding, respectively |

|

|

410 |

|

|

|

410 |

|

| Additional paid-in capital |

|

|

457,129 |

|

|

|

456,993 |

|

| Accumulated other comprehensive income |

|

|

6,325 |

|

|

|

3,375 |

|

| Accumulated deficit |

|

|

(379,866 |

) |

|

|

(383,846 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

83,998 |

|

|

|

76,932 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

296,139 |

|

|

$ |

273,707 |

|

|

|

|

|

|

|

|

|

|

5

FIRST ACCEPTANCE CORPORATION AND SUBSIDIARIES

Supplemental Data

(Unaudited)

PREMIUMS EARNED BY STATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Gross premiums earned: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Georgia |

|

$ |

10,322 |

|

|

$ |

9,887 |

|

|

$ |

19,902 |

|

|

$ |

19,538 |

|

| Florida |

|

|

8,657 |

|

|

|

8,092 |

|

|

|

16,620 |

|

|

|

15,713 |

|

| Texas |

|

|

7,169 |

|

|

|

6,168 |

|

|

|

13,638 |

|

|

|

11,990 |

|

| Ohio |

|

|

5,757 |

|

|

|

4,684 |

|

|

|

10,906 |

|

|

|

9,044 |

|

| Alabama |

|

|

5,604 |

|

|

|

5,523 |

|

|

|

10,857 |

|

|

|

10,571 |

|

| Illinois |

|

|

5,092 |

|

|

|

5,327 |

|

|

|

9,821 |

|

|

|

10,644 |

|

| South Carolina |

|

|

4,235 |

|

|

|

4,036 |

|

|

|

8,242 |

|

|

|

7,694 |

|

| Tennessee |

|

|

3,208 |

|

|

|

3,182 |

|

|

|

6,394 |

|

|

|

6,222 |

|

| Pennsylvania |

|

|

2,257 |

|

|

|

2,228 |

|

|

|

4,403 |

|

|

|

4,372 |

|

| Indiana |

|

|

1,562 |

|

|

|

1,355 |

|

|

|

2,994 |

|

|

|

2,599 |

|

| Missouri |

|

|

1,275 |

|

|

|

982 |

|

|

|

2,413 |

|

|

|

1,870 |

|

| Mississippi |

|

|

789 |

|

|

|

703 |

|

|

|

1,539 |

|

|

|

1,361 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross premiums earned |

|

|

55,927 |

|

|

|

52,167 |

|

|

|

107,729 |

|

|

|

101,618 |

|

| Premiums ceded to reinsurer |

|

|

(73 |

) |

|

|

(49 |

) |

|

|

(127 |

) |

|

|

(97 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net premiums earned |

|

$ |

55,854 |

|

|

$ |

52,118 |

|

|

$ |

107,602 |

|

|

$ |

101,521 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMBINED RATIOS (INSURANCE OPERATIONS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Loss |

|

|

73.5 |

% |

|

|

75.0 |

% |

|

|

72.4 |

% |

|

|

71.5 |

% |

| Expense |

|

|

20.7 |

% |

|

|

21.7 |

% |

|

|

24.9 |

% |

|

|

25.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Combined |

|

|

94.2 |

% |

|

|

96.7 |

% |

|

|

97.3 |

% |

|

|

96.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POLICIES IN FORCE (FAC ONLY)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Policies in force – beginning of period |

|

|

168,607 |

|

|

|

169,424 |

|

|

|

143,077 |

|

|

|

145,938 |

|

| Net change during period |

|

|

(9,314 |

) |

|

|

(15,829 |

) |

|

|

16,216 |

|

|

|

7,657 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Policies in force – end of period |

|

|

159,293 |

|

|

|

153,595 |

|

|

|

159,293 |

|

|

|

153,595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

FIRST ACCEPTANCE CORPORATION AND SUBSIDIARIES

Supplemental Data (continued)

(Unaudited)

NUMBER OF RETAIL LOCATIONS

Retail location counts are based upon the date that a location commenced or ceased writing business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

June 30, |

|

|

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Retail locations – beginning of period |

|

|

355 |

|

|

|

367 |

|

|

|

360 |

|

|

|

369 |

|

| Opened |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Closed |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

(7 |

) |

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retail locations – end of period |

|

|

353 |

|

|

|

366 |

|

|

|

353 |

|

|

|

366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETAIL LOCATIONS BY STATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

2013 |

|

|

2012 |

|

| Alabama |

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

|

|

24 |

|

| Florida |

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

|

|

30 |

|

| Georgia |

|

|

60 |

|

|

|

60 |

|

|

|

60 |

|

|

|

60 |

|

|

|

60 |

|

|

|

60 |

|

| Illinois |

|

|

60 |

|

|

|

62 |

|

|

|

61 |

|

|

|

62 |

|

|

|

61 |

|

|

|

63 |

|

| Indiana |

|

|

17 |

|

|

|

17 |

|

|

|

17 |

|

|

|

17 |

|

|

|

17 |

|

|

|

17 |

|

| Mississippi |

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

| Missouri |

|

|

10 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

| Ohio |

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

|

|

27 |

|

| Pennsylvania |

|

|

16 |

|

|

|

16 |

|

|

|

16 |

|

|

|

16 |

|

|

|

16 |

|

|

|

16 |

|

| South Carolina |

|

|

25 |

|

|

|

26 |

|

|

|

25 |

|

|

|

26 |

|

|

|

25 |

|

|

|

26 |

|

| Tennessee |

|

|

19 |

|

|

|

19 |

|

|

|

19 |

|

|

|

19 |

|

|

|

19 |

|

|

|

19 |

|

| Texas |

|

|

58 |

|

|

|

67 |

|

|

|

58 |

|

|

|

68 |

|

|

|

63 |

|

|

|

69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

353 |

|

|

|

366 |

|

|

|

355 |

|

|

|

367 |

|

|

|

360 |

|

|

|

369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOURCE: First Acceptance Corporation

INVESTOR RELATIONS CONTACT:

Michael J. Bodayle

615.844.2885

7

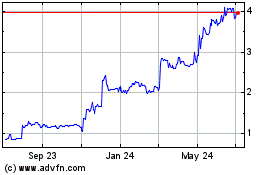

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Jul 2024 to Aug 2024

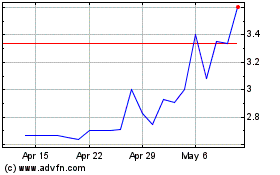

First Acceptance (QX) (USOTC:FACO)

Historical Stock Chart

From Aug 2023 to Aug 2024