FINEQIA CLOSES THIRD TRANCHE

OF PRIVATE PLACEMENT FOR TOTAL C$4.76 MLN TO DATE

Vancouver, British Columbia – December 12, 2022 --

InvestorsHub NewsWire -- Fineqia International Inc.

(the “Company” or “Fineqia”)

(CSE: FNQ) (OTC: FNQQF) (Frankfurt: FNQA) announces the closing

of the third tranche (the “Third Tranche”)

of its non-brokered private placement (the

“Offering”). The Company has issued 43,185,690

units (the “Units”) to raise gross proceeds of

C$431,856.90 in this tranche. The Company also issued 1,917,720

Units as finder’s fees on a portion of the Offering.

On a cumulative basis, the Company has issued 499,725,810 units

in the private placement to raise gross proceeds of C$4,756,105.90.

The Company also converted debts of C$221,975.00 and has issued

1,917,720 units as finder’s fees. The closing of the Third Tranche

follows the upsize of the offering to C$5 million from C$4 million,

announced on Oct. 12, 2022.

“We’ve been overwhelmed by the positive recognition received

from current and new shareholders on the recent upsize of our

private placement,” said Fineqia CEO Bundeep Singh Rangar. “The

increased participation will allow us to continue executing on our

growth plans.”

Each Unit consists of one common share of the Company and one

share purchase warrant (a “Warrant”) exercisable

for three years at a price of C$0.05 per share. The Company may, at

its option, accelerate the expiry date of the Warrants, provided

that closing price of the common shares is at or above C$0.15 per

share for any 20 consecutive trading day period at any time after

four months and one day after the issuance of the Warrants.

The issuance of certain of the Units to directors and officers

of the Company pursuant to the Offering will each be considered a

"related party transaction" as defined in Multilateral Instrument

61-101 - Protection of Minority Security Holders in Special

Transactions ("MI 61-101"). The Company will

rely upon exemptions from the valuation and minority shareholder

approval requirements of MI 61-101 contained in sections 5.5(a) and

5.7(1)(a), respectively, with respect to the issuance of the Units

to the directors and officers.

The proceeds from the Offering will be used to enhance the

Company's working capital.

The Company has paid the finder’s fees of C$19,177.20 in

connection with the Private Placement, paid in

Units.

The securities issued may not be traded for a period of four

months plus one day from the date of issuance. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the "1933

Act"). Accordingly, these securities may not be offered or

sold in the United States or to, or for the account or benefit of,

a U.S. person or person in the United States (as such terms are

defined in regulations under the 1933 Act), absent an exemption

from the registration requirements of the 1933 Act and applicable

state laws. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy securities in the

United States or in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Fineqia International Inc.

Fineqia is a listed entity in the Canada (CSE: FNQ), US (OTC: FNQQF) and Europe (Frankfurt: FNQA). Fineqia's

strategic focus has been to provide a platform and associated

services to support securities issuances and manage administration

of debt securities. Fineqia is currently building out its

alternative finance business and it currently holds a growing

portfolio of blockchain, fintech and cryptocurrency technology

companies worldwide.

For more information, visit www.fineqia.com

ON BEHALF OF THE FINEQIA BOARD

Bundeep Singh Rangar

CEO and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Katarina Kupcikova, Analyst

E. katarina.kupcikova@fineqia.com

T. +44 7806 730 769

Bundeep Singh Rangar, CEO

E. bundeep.rangar@fineqia.com

T.

+1 778 654 2324

FORWARD-LOOKING STATEMENTS

Some statements in

this release may contain forward-looking information (as defined

under applicable Canadian securities laws) ("forward-looking

statements"). All statements, other than of historical fact, that

address activities, events or developments that Fineqia (the

"Company") believes, expects or anticipates will or may occur in

the future (including, without limitation, statements regarding

potential acquisitions and financings) are forward-looking

statements. Forward-looking statements are generally identifiable

by use of the words "may", "will", "should", "continue", "expect",

"anticipate", "estimate", "believe", "intend", "plan" or "project"

or the negative of these words or other variations on these words

or comparable terminology. Forward-looking statements are subject

to a number of risks and uncertainties, many of which are beyond

the Company's ability to control or predict, that may cause the

actual results of the Company to differ materially from those

discussed in the forward-looking statements. Factors that could

cause actual results or events to differ materially from current

expectations include, among other things, without limitation, the

failure to obtain sufficient financing, and other risks disclosed

in the Company's public disclosure record on file with the relevant

securities regulatory authorities. Any forward-looking statement

speaks only as of the date on which it is made except as may be

required by applicable securities laws. The Company disclaims any

intent or obligation to update any forward-looking statement except

to the extent required by applicable securities laws.

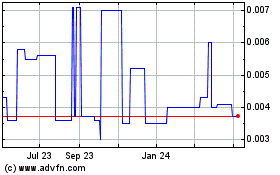

Fineqia Internationl (PK) (USOTC:FNQQF)

Historical Stock Chart

From Dec 2024 to Jan 2025

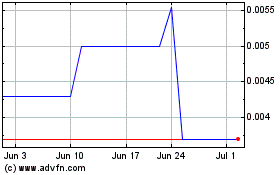

Fineqia Internationl (PK) (USOTC:FNQQF)

Historical Stock Chart

From Jan 2024 to Jan 2025