0001618835

true

0001618835

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 1)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 10, 2023

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

7770

Regents Road, Suite 113-618

San

Diego, CA 92122

(Address

of Principal Executive Offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

Not

applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

This

Amendment No. 1 to the Current Report on Form 8-K (this “Amendment”) is being filed by Evofem Biosciences Inc. (the

“Company”) for the purpose of amending Item 1.01 Material Agreements and Item 5.07 Submission of Matters to a Vote

of Security Holders of that certain Current Report on Form 8-K originally filed by the Company with the U.S. Securities and Exchange

Commission (“SEC”) on August 10, 2023 (the “Original Form 8-K”).

This

Amendment is being filed for Item 1.01 to clarify the rights of Note Holders in that certain August 4, 2023 offering. Additionally, this

Amendment is being filed for Item 5.07 to address the Amendment to the Charter Amendment passed by the board of directors of the Company

(the “Board”). The Board has approved both the charter amendment and the amendment to the preliminary proxy statement

on Schedule 14A, as filed with the SEC on August 18, 2023.

Item

1.01 Material Definitive Agreement Securities Purchase Agreement.

Notes

The

Notes will be the senior subordinate obligations of the Company and not the financial obligations of our subsidiaries. The principal

amount of the Notes accrue interest at a rate of 8% per annum (the “Interest Rate”), which will adjust to 12% upon

an Event of Default (the “Default Rate”). The Notes are convertible at conversion price of $1.25 per share, subject

to adjustment as described therein. Unless earlier converted, or redeemed, the Notes will mature on August 4, 2026, which we refer to

herein as the “Maturity Date”, subject to the right of the investor to extend the date:

(i)

if an event of default under the Notes has occurred and is continuing (or any event shall have occurred and be continuing that with the

passage of time and the failure to cure would result in an event of default under the Notes); and

(ii)

for a period of 20 business days after the consummation of a fundamental transaction if certain events occur.

We

are required to pay a late charge of 12% per annum (“Late Charges”) on any amount of principal or other amounts that

are not paid when due. We are required to pay, on the Maturity Date, all outstanding principal, accrued and unpaid interest and accrued

and unpaid late charges on such principal and interest, if any.

Beneficial

Ownership Limitation on Conversion

The

Notes may not be converted and shares of Common Stock may not be issued under Notes if, after giving effect to the conversion or issuance,

the applicable holder of Notes (together with its affiliates, if any) would beneficially own in excess of 4.99% of our outstanding shares

of Common Stock, which we refer to herein as the “Note Blocker”. The Note Blocker may be raised or lowered to any other percentage

not in excess of 9.99% at the option of the applicable holder of Notes, except that any raise will only be effective upon 61-days’

prior notice to us.

Fundamental

Transactions

The

Notes prohibit us from entering specified fundamental transactions (including, without limitation, mergers, business combinations and

similar transactions) unless we (or our successor) is a public company that assumes in writing all of our obligations under the Notes.

Change

of Control Redemption Right

In

connection with a change of control of the Company, each holder may require us to redeem in cash all, or any portion, of the Notes at

the greater of the product of the 25% redemption premium multiplied by (i) the conversion amount to be redeemed, (ii) the product of

the conversion amount to be redeemed multiplied by the equity value of our Common Stock underlying the Notes and (iii) the product of

the conversion amount to be redeemed multiplied by the equity value of the change of control consideration payable to the holder of our

Common Stock underlying the Notes.

The

equity value of our Common Stock underlying the Notes is calculated using the greatest closing sale price of our Common Stock during

the period immediately preceding the consummation or the public announcement of the change of control and ending the date the holder

gives notice of such redemption.

The

equity value of the change of control consideration payable to the holder of our Common Stock underlying the Notes is calculated using

the aggregate cash consideration per share of our Common Stock to be paid to the holders of our Common Stock upon the change of control.

Covenants

The

Notes contain a variety of obligations on our part not to engage in specified activities, which are typical for transactions of this

type, as well as the following covenants:

| |

○ |

we

and our subsidiaries will not initially (directly or indirectly) incur any other indebtedness except for permitted

indebtedness; |

| |

|

|

| |

○ |

we

and our subsidiaries will not initially (directly or indirectly) will not incur any liens, except for permitted liens; |

| |

|

|

| |

○ |

we

and our subsidiaries will not, directly or indirectly, redeem or repay all or any portion of any indebtedness (except for certain

permitted indebtedness) if at the time the payment is due or is made or, after giving effect to the payment,

an

event constituting, or that with the passage of time and without being cured would constitute, an event of default has occurred and

is continuing; |

| |

|

|

| |

○ |

we

and our subsidiaries will not redeem, repurchase or pay any dividend or distribution on our respective capital stock; |

| |

|

|

| |

○ |

we

and our subsidiaries will not initially, directly or indirectly, permit any indebtedness to mature or accelerate prior to the

Maturity Date of the Notes; and |

| |

|

|

| |

○ |

we

will maintain engagement with an independent auditor to audit its financial statements that is registered with the Public Company

Accounting Oversight Board. |

Events

of Default

The

Notes contain standard and customary events of default including but not limited: (i) the failure of the Registration Statement (pursuant

to the Registration Rights Agreement) to be filed with the SEC on or prior to five days prior to the Filing Deadline (as defined therein);

(ii) the lapse of the effectiveness of that Registration Statement, the suspension from trading on the Eligible Market; (iii) the failure

to cure a Conversion Failure (as defined therein) (iv) the failure to maintain the Authorized Share Allocation (as defined therein);

(v) failure to make payments when due under the Notes; (vi) bankruptcy or insolvency of the Company; and/or (vii) the occurrence of default

under redemption or acceleration prior to Maturity of an aggregate $100,000 of Indebtedness (as defined therein).

If

an event of default occurs, each holder may require us to redeem all or any portion of the Notes (including all accrued and unpaid interest

and late charges thereon), in cash, at the greater of a 125% redemption premium multiplied by the conversion amount to be redeemed, and

solely with respect to certain events of the default, the equity value of our Common Stock underlying the Notes.

The

equity value of our Common Stock underlying the Notes is calculated using the greatest closing sale price of our Common Stock on any

trading day immediately preceding such event of default and the date we make the entire payment required.

Subsequent

Placement Optional Redemption Rights

At

any time from and after the earlier of (x) the date the Holder becomes aware of the occurrence of a Subsequent Placement (as defined

in the Securities Purchase Agreement) (the “Holder Notice Date”) and (y) the time of consummation of a Subsequent

Placement (in each case, other than with respect to Excluded Securities (as defined in the Securities Purchase Agreement)) (each, an

“Eligible Subsequent Placement”), so long as No Permitted Senior Indebtedness remains outstanding or undefeased (unless

the Company has obtained the prior written consent of such holders of Permitted Senior Indebtedness) (the “Senior Debt Condition”),

the Holder shall have the right, in its sole discretion, to require that the Company redeem (each an “Subsequent Placement Optional

Redemption”) all, or any portion, of the Conversion Amount under this Note not in excess of (together with any Subsequent Placement

Optional Redemption Amount (as defined in the applicable other Note of the Holder) of any other Notes of the Holder) the Holder’s

Holder Pro Rata Amount of 25% of the gross proceeds of such Eligible Subsequent Placement (the “Eligible Subsequent Placement

Optional Redemption Amount”).

Asset

Sale Optional Redemption

At

any time from and after the earlier of (x) the date the Holder becomes aware of the occurrence of an Asset Sale (including any insurance

and condemnation proceeds thereof) and (y) the time of consummation of an Asset Sale (other than sales of inventory and product in the

ordinary course of business and amounts reinvested in assets to be used in the Company’s business within 12 months of the date

of consummation of such Asset Sale) (each, an “Eligible Asset Sale”), subject to the satisfaction of the Senior Debt

Condition, the Holder shall have the right, in its sole discretion, to require that the Company redeem (each an “Asset Sale

Optional Redemption”) all, or any portion, of the Conversion Amount under this Note not in excess of (together with any Asset

Sale Optional Redemption Amount (as defined in the applicable other Note of the Holder) of any other Notes of the Holder) the Holder’s

Holder Pro Rata Amount of 100% of the net proceeds (including any insurance and condemnation proceeds with respect thereto, but excluding

legal and investment banking reasonable fees and expenses) of such Eligible Asset Sale (the “Eligible Asset Sale Optional Redemption

Amount”) by delivering written notice thereof (an “Asset Sale Optional Redemption Notice”) to the Company.

The

Notes will be governed by, and construed in accordance with, the laws of the State of New York without regard to its conflicts of law

principles.

Registration

Rights Agreement

In

connection with the Offering, the Company has entered into a Registration Rights Agreement (the “RRA”) wherein the

Company is required to file a Registration Statement on Form S-1 by the 90th calendar day after the Closing Date and (ii) with respect

to any additional Registration Statements that may be required to be filed by the Company pursuant to this Agreement, the date on which

the Company was required to file such additional Registration Statement pursuant to the terms of this Agreement.

The

Company is required to obtain effectiveness of the Registration Statement on Form S-1 the earlier of (A) the later of (x) 60 calendar

days after the Stockholder Approval Date (as defined in the Securities Purchase Agreement) and (y) 90th calendar day after the Closing

Date and (B) 2nd Business Day after the date the Company is notified (orally or in writing, whichever is earlier) by the SEC that such

Registration Statement will not be reviewed or will not be subject to further review and (ii) with respect to any additional Registration

Statements that may be required to be filed by the Company pursuant to this Agreement, the earlier of the (A) 90th calendar day following

the date on which the Company was required to file such additional Registration Statement and (B) 2nd Business Day after the date the

Company is notified (orally or in writing, whichever is earlier) by the SEC that such Registration Statement will not be reviewed or

will not be subject to further review.

The

Company shall pay to each holder of Registrable Securities relating to such Registration Statement an amount in cash equal to two percent

(2%) of such Investor’s original principal amount stated in such Investor’s Note on the Closing Date (1) on the date of such

Filing Failure, Effectiveness Failure, Maintenance Failure or Current Public Information Failure, as applicable, and (2) on every thirty

(30) day anniversary of (I) a Filing Failure until such Filing Failure is cured; (II) an Effectiveness Failure until such Effectiveness

Failure is cured; (III) a Maintenance Failure until such Maintenance Failure is cured; and (IV) a Current Public Information Failure

until the earlier of (i) the date such Current Public Information Failure is cured and (ii) such time that such public information is

No longer required pursuant to Rule 144 (in each case, pro rated for periods totaling less than thirty (30) days).

The

foregoing is intended to provide a summary of the terms of the agreements and securities related to the Offering. This summary is

qualified in its entirety by reference to the full text of the agreements, each of which is attached as an exhibit to this Current

Report on Form 8-K (this “Report”) as Exhibit 10.1, 10.2, 10.3 and 10.4,

respectively. Readers should review those agreements for a complete understanding of the terms and conditions associated with these

transactions. The representations, warranties and covenants contained in the agreements relating the Offering were made as of a

specified date, may be subject to a contractual standard of materiality different from what might be viewed as material to

investors, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and

warranties in the agreements relating the Offering are not necessarily characterizations of the actual state of facts about the

Company and its subsidiaries at the time they were made or otherwise and should be read only in conjunction with the other

information that the Company makes publicly available in reports, statements and other documents filed with the Commission.

Item

5.07 Submission of Matters to a Vote of Security Holders.

On

September 14, 2023, the Company will convene its 2023 Annual Meeting of Stockholders (the “Annual Meeting”) being held to

consider and vote on the following items:

| |

(1) |

To

elect one director to serve a three-year term expiring 2026; |

| |

(2) |

To

approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| |

(3) |

To

approve an amendment to the certificate of incorporation to increase the outstanding shares from 500,000,000 to

3,000,000,000; |

| |

(4) |

To

ratify the selection of BPM, LLP as the company’s auditors for the fiscal year ending 2023; and |

| |

(5) |

To

authorize the board to adjourn the meeting. |

The

foregoing proposals shall be more fully described in the Preliminary Proxy Statement on Schedule 14A to filed by the Company with the

Securities and Exchange Commission (the “Commission”). The board of directors of the Company shall set the record

date as of August 7, 2023.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

|

| Date:

August 18, 2023 |

By: |

/s/

Ivy Zhang |

| |

|

Ivy

Zhang |

| |

|

Chief

Financial Officer |

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

Amendment

No. 1

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-36754

|

| Entity Registrant Name |

EVOFEM

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001618835

|

| Entity Tax Identification Number |

20-8527075

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7770

Regents Road

|

| Entity Address, Address Line Two |

Suite 113-618

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

EVFM

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

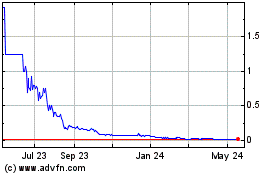

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Nov 2024 to Dec 2024

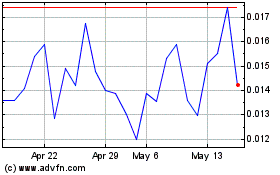

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Dec 2023 to Dec 2024