Investment Objective

The Fund seeks current income consistent with the preservation of capital.

Fee Table

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and

your family invest, or agree to invest in the future, at least $50,000 in the Sterling Capital Funds. More information about these and other discounts is available from your financial professional and in “Distribution Arrangements/Sales

Charges” on page 155 of the Fund’s prospectus and in “Sales Charges” on page 42 of the Fund’s statement of additional information (“SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder Fees

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

Shares

|

|

|

Class B

Shares

|

|

|

Class C

Shares

|

|

Maximum Sales Charge (load) on Purchases

(as a % of offering price)

|

|

|

2.00%

|

|

|

|

None

|

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (load) (as a % of the lesser of the cost of your shares or their net asset value at the time of redemption)

|

|

|

None

|

|

|

|

5.00%

|

(1)

|

|

|

1.00%

|

|

|

Redemption Fee

|

|

|

None

|

|

|

|

None

|

|

|

|

None

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as

a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A

Shares

|

|

|

Class B

Shares

|

|

|

Class C

Shares

|

|

|

Management Fees

|

|

|

0.43%

|

|

|

|

0.43%

|

|

|

|

0.43%

|

|

|

Distribution and Service (12b-1) Fees

|

|

|

0.25%

|

|

|

|

1.00%

|

|

|

|

1.00%

|

|

|

Other Expenses

|

|

|

0.26%

|

|

|

|

0.26%

|

|

|

|

0.26%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.94%

|

|

|

|

1.69%

|

|

|

|

1.69%

|

|

(1)

A contingent deferred sales

charge (“CDSC”) on Class B Shares declines over six years starting with year one and ending on the sixth anniversary from the date of purchase: 5%, 4%, 3%, 3%, 2%, 1%.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods

indicated and then redeem all of your shares at the end of those periods. The example also assumes, that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher

or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Year

|

|

|

3

Years

|

|

|

5

Years

|

|

|

10

Years

|

|

|

Class A Shares

|

|

$

|

294

|

|

|

$

|

494

|

|

|

$

|

710

|

|

|

$

|

1,332

|

|

|

Class B Shares

|

|

$

|

572

|

|

|

$

|

833

|

|

|

$

|

1,018

|

|

|

$

|

1,799

|

|

|

Class C Shares

|

|

$

|

172

|

|

|

$

|

533

|

|

|

$

|

918

|

|

|

$

|

1,998

|

|

You would pay the following expenses if you did not redeem your shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Year

|

|

|

3

Years

|

|

|

5

Years

|

|

|

10

Years

|

|

|

Class A Shares

|

|

$

|

294

|

|

|

$

|

494

|

|

|

$

|

710

|

|

|

$

|

1,332

|

|

|

Class B Shares

|

|

$

|

172

|

|

|

$

|

533

|

|

|

$

|

918

|

|

|

$

|

1,799

|

|

|

Class C Shares

|

|

$

|

172

|

|

|

$

|

533

|

|

|

$

|

918

|

|

|

$

|

1,998

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s

portfolio turnover rate was 66.16% of the average value of its portfolio.

Strategy, Risks and Performance

Principal Strategy

To pursue its investment objective, the

Fund will invest, under normal circumstances, at least 80% of its net assets plus borrowings for investment purposes in bonds issued or guaranteed by the U.S. government or its agencies and instrumentalities (“U.S. government securities”).

Bonds for this purpose include Treasury bills (maturities

|

|

|

|

|

|

|

Summary Prospectus

|

|

1 of 4

|

|

Sterling Capital Intermediate U.S. Government Fund

|

of less than one year), bonds (maturities of ten years or more) and notes (maturities of one to ten years) of the U.S. government. The Fund invests, under normal market conditions, in U.S.

government securities, some of which may be subject to repurchase agreements, or in “high grade” (rated at the time of purchase in one of the three highest rating categories by a nationally recognized statistical rating organization or are

determined by the portfolio manager to be of comparable quality) mortgage-backed securities, including collateralized mortgage obligations.

The Fund

will also invest in short-term obligations, asset-backed securities, corporate bonds and the shares of other investment companies. The Fund may also invest in Yankee bonds, which are U.S.-dollar denominated bonds and notes issued by foreign

corporations or governments. The Fund will maintain an average duration between 2.5 and 7 years. The Fund’s dollar-weighted average maturity is expected to be more than 3 years but less than 10 years.

In managing the portfolio, the portfolio manager uses a “top down” investment management approach focusing on duration, yield curve structure and sector

allocation based upon economic outlook and market expectations. The portfolio manager then selects individual securities consistent with the target by looking for the best relative values within particular sectors. The portfolio manager may consider

selling a security owned by the Fund to manage the Fund’s price sensitivity, to reposition the Fund to a more favorable portion of the yield curve, or to purchase securities that the portfolio manager believes offer greater total return

potential than existing holdings.

Principal Risks

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. An investment in the Fund is not a

deposit or obligation of any bank, is not endorsed or guaranteed by any bank and is not insured by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. You may lose money by investing in the Fund. Below are

all of the principal risks of investing in the Fund.

Interest Rate Risk:

The possibility that the value of the Fund’s investments will

decline due to an increase in interest rates. Interest rate risk is generally higher for longer-term bonds and lower for shorter-term bonds.

Income

Risk:

The possibility that the Fund’s income will decline due to a decrease in interest rates. Income risk is generally high for shorter-term bonds and low for longer term bonds.

Liquidity Risk:

The possibility that certain securities may be difficult or impossible to sell at the time and the price that would normally prevail in the market. The seller may have to lower the price,

sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

Prepayment/Call Risk:

When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest in securities with a

lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss. Call risk is the possibility that, during periods of declining interest rates, a bond issuer

will “call” — or repay — higher-yielding bonds before their stated maturity date. In both cases, investors receive their principal back and are typically forced to reinvest it in bonds that pay lower interest rates.

Estimated Maturity Risk:

The possibility that an underlying security holder will exercise its right to pay

principal on an obligation earlier or later than expected. This may happen when there is a rise or fall in interest rates. These events may shorten or lengthen the duration (

i.e.

, interest rate sensitivity) and potentially reduce the value of

these securities.

Credit Risk:

The possibility that an issuer cannot make timely interest and principal payments on its debt securities, such as

bonds. The lower a security’s rating, the greater its credit risk.

U.S. Government Securities Risk:

The Fund invests in securities issued or

guaranteed by the U.S. government or its agencies (such as Fannie Mae or Freddie Mac securities). Although U.S. government securities issued directly by the U.S. government are guaranteed by the U.S. Treasury, other U.S. government securities issued

by an agency or instrumentality of the U.S. government may not be. No assurance can be given that the U.S. government would provide financial support to its agencies and instrumentalities if not required to do so by law.

Mortgage-Backed and Asset-Backed Securities Risk:

Mortgage-backed and other asset-backed securities may be particularly sensitive to changes in prevailing

interest rates. Rising interest rates tend to extend the duration of mortgage-backed securities, making them more sensitive to changes in interest rates, and may reduce the market value of the securities. Mortgage-backed securities are also subject

to pre-payment risk. Due to their often complicated structures, various mortgage-backed and asset-backed securities may be difficult to value and may constitute illiquid securities. Furthermore, debtors may be entitled to the protection of a number

of state and federal consumer protection credit laws with respect to these securities, which may give the debtor the right to avoid or reduce payment.

Yankee Bond Risk:

Yankee bonds are subject to the same risks as other debt issues, notably credit risk, market risk, currency and liquidity risk. Other risks

include adverse political and economic developments; the extent and quality of government regulations of financial markets and institutions; the imposition of foreign withholding taxes; and the expropriation or nationalization of foreign issuers.

For more information about the Fund’s risks, please see the “Additional Investment Strategies and Risks” section in this Prospectus.

Performance

The following bar chart and table

provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund’s performance from year to year for Class A Shares. The table shows how the Fund’s average annual returns for 1, 5 and

10 years and since the Fund’s inception compared with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Updated performance information is available at no cost by visiting www.sterlingcapitalfunds.com or by calling

1-800-228-1872.

|

|

|

|

|

|

|

Summary Prospectus

|

|

2 of 4

|

|

Sterling Capital Intermediate U.S. Government Fund

|

Sales charges are not reflected in the bar chart, and if these charges were included, returns would be less than

those shown.

Class A Shares Annual Total Returns for years ended 12/31

|

|

|

|

|

|

|

|

|

|

|

Best quarter:

|

|

|

5.67%

|

|

|

|

12/31/08

|

|

|

Worst quarter:

|

|

|

–2.52%

|

|

|

|

06/30/04

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

as of December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Year

|

|

|

5

Years

|

|

|

10

Years

|

|

|

Since

Inception

(1)

|

|

|

Class A Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10/9/92

|

)

|

|

Return Before Taxes

|

|

|

–4.41%

|

|

|

|

1.95%

|

|

|

|

3.19%

|

|

|

|

4.72%

|

|

|

Return After Taxes on Distributions

|

|

|

–5.56%

|

|

|

|

0.87%

|

|

|

|

1.93%

|

|

|

|

2.95%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

–2.49%

|

|

|

|

1.11%

|

|

|

|

2.00%

|

|

|

|

2.94%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1/1/96

|

)

|

|

Class B Shares

|

|

|

–6.91%

|

|

|

|

1.43%

|

|

|

|

2.79%

|

|

|

|

4.48%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2/1/01

|

)

|

|

Class C Shares

|

|

|

–3.19%

|

|

|

|

1.61%

|

|

|

|

2.64%

|

|

|

|

4.37%

|

|

|

Barclays Intermediate Government Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9/30/92

|

)

|

|

(reflects no deductions for fees, expenses, or taxes)

|

|

|

–1.25%

|

|

|

|

2.20%

|

|

|

|

3.74%

|

|

|

|

5.09%

|

|

(1)

Performance for Class B and

Class C Shares for periods prior to inception on January 1, 1996 and February 1, 2001, respectively, is based on the performance of Class A Shares of the Fund.

After-tax returns are shown only for Class A Shares and are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement

accounts. After-tax returns for Class B and C Shares will vary.

Management

Investment Adviser

Sterling Capital Management LLC

(“Sterling Capital”)

Portfolio Manager

Brad D. Eppard, CFA

Director of Sterling Capital and Portfolio

Manager

Since July 2003

Purchase and Sale

of Fund Shares

|

|

|

|

|

|

|

|

|

|

|

Account Type

|

|

Minimum

Initial

Investment

|

|

|

Minimum

Subsequent

Investment

|

|

|

Regular Account

|

|

$

|

1,000

|

|

|

$

|

0

|

|

|

Automatic Investment Plan

|

|

$

|

25

|

|

|

$

|

25

|

|

You may buy or sell Class A or C Shares on any business day by contacting your financial representative or contacting the Fund

(i) by mail at Sterling Capital Funds, P.O. Box 9762, Providence, RI 02940-9762; or (ii) by telephone at 1-800-228-1872. In addition, Class A and Class C Shares are available for purchase at www.sterlingcapitalfunds.com. Class B

Shares are not offered for new purchases.

Tax Information

The Fund normally distributes its net investment income and net realized capital gains, if any, to shareholders. These distributions are generally taxable to you as ordinary income or capital gains, unless you are

investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other

Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

|

|

|

|

|

|

|

Summary Prospectus

|

|

3 of 4

|

|

Sterling Capital Intermediate U.S. Government Fund

|

IUSG-0214

|

|

|

|

|

|

|

Summary Prospectus

|

|

4 of 4

|

|

Sterling Capital Intermediate U.S. Government Fund

|

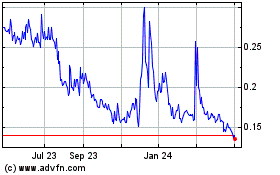

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Jun 2024 to Jul 2024

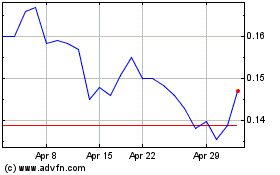

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Jul 2023 to Jul 2024