UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

| [X] |

Preliminary

Information Statement |

| [_] |

Confidential, for Use of

the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| [_] |

Definitive Information

Statement |

CAPSTONE

COMPANIES, INC.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| [X] |

No fee required |

| [_] |

Fee paid previously with

preliminary materials. |

| [_] |

Fee computed on table in

exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and

0-11. |

CAPSTONE

COMPANIES, INC.

431

Fairway Drive, Suite 200, Deerfield Beach, Florida 33441

(888)

570-8889, ext. 315

May

10, 2023

IMPORTANT

NOTICE OF INTERNET AVAILABILITY OF INFORMATION STATEMENT AND ANNUAL REPORT ON FORM 10-K FOR FISCAL YEAR 2022

WE

ENCOURAGE YOU TO ACCESS AND REVIEW ALL OF THE IMPORTANT INFORMATION CONTAINED IN THE INFORMATION STATEMENT. COPIES OF THE INFORMATION

STATEMENT AND ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT URL: https://investors.capstonecompaniesinc.com/CAPC

Dear

holder of shares of Common Stock of Capstone Companies, Inc.:

As

of May 9, 2023, holders of shares of Common Stock, $0.0001 par value, (“Common Stock”) of Capstone Companies, Inc., a Florida

corporation, (“Company”) with the requisite votes approved the following corporate actions by written consent in lieu of

conducting a meeting of shareholders: (1) Election of the incumbent directors to the Company’s Board of Directors for a term ending

in 2024 when successors are elected and assume office; (2) ratification of Company’s current public auditor, D. Brooks and Associates,

CPAs, P.A., as Company’s public auditor for fiscal year 2023; and (3) Amendment of Article 1 of the Amended and Restated Articles

of Incorporation of the Company (“Articles”) to increase the authorized shares of capital stock from 60 million to 300 million,

specifically, to increase the authorized shares of Common Stock to 295 million and the authorized shares of serial Preferred Stock to

5 million. The increase in authorized shares of capital stock was deemed necessary by the Company to allow sufficient shares of Common

Stock for any future corporate funding or significant corporate transactions requiring issuance of shares of Common Stock. The Company

has 48,826,864 of Common Stock issued as of May 8, 2023. With respect to the 60 million shares of authorized capital stock authorized

under the existing Articles, there are 56,666,667 shares Common Stock authorized and 3,333,333 shares of Preferred Stock.

As

permitted by the Federal securities laws, we are making the Information Statement concerning the election of directors, increase in the

authorized shares of capital stock and ratification of D. Brooks and Associates, CPAs, P.A., as well as our Annual Report on Form 10-K

for fiscal year ending December 31, 2022, (“Form 10-K”), available to our Common Stock shareholders via the Internet instead

of mailing printed copies of these materials to each shareholder. As part of our efforts to conserve environmental resources and prevent

unnecessary corporate expenses, we are relying on this Notice of Internet Availability rules to provide required information to our Common

Stock shareholders. Shareholders may request a hardcopy of the Information Statement and Form 10-K at no charge and as explained below.

In

accordance with this rule, shareholders of record, at the close of business as of May 8, 2023, were mailed a Notice of Internet Availability

of Information Statement and Form 10-K (“Notice”) on or about May 19, 2023. The Notice contains instructions on how to access

our Information Statement and Form 10-K online. If you received this Notice by mail, you will not receive a printed copy of the Information

Statement and Form 10-K by mail, unless you request printed materials as explained below. If you wish to receive printed materials, you

should follow the instructions for requesting such materials contained below.

You

can request printed materials of Information Statement and Form 10-K by any of following means:

(1)

By Email: Email a request to gwolf@capstoneindustries.com

(2)

By Telephone: Call Company at 1-(888) 570-8889 extension 315

(3)

By Internet: Send request at Contact at URL: https://capstonecompaniesinc.com/contact/

If

your shares are held in certificate or book entry form, please contact our transfer agent:

Equiniti

Trust Company

EQ

Shareowner Services

P.O.

Box 64854

Saint

Paul, MN 55164-0854

Toll

Free: 866-877-6270

Outside

U.S. and Canada: 651-450-4064

shareowneronline.com

If

your shares are held in a brokerage account or trust account, please contact your broker or trustee for further assistance.

THIS

NOTICE WILL ENABLE YOU TO ACCESS

MATERIALS

FOR INFORMATIONAL PURPOSES ONLY

CAPSTONE

COMPANIES, INC.

431

Fairway Drive, Suite 200, Deerfield Beach, Florida 33441

Telephone:

(954) 570-8889, ext. 315

May

10, 2023

NOTICE

OF CORPORATE ACTION TAKEN BY WRITTEN CONSENT OF THE SHAREHOLDERS

(“NOTICE”)

This

Information Statement Is For Informational Purposes Only And No Action Is Requested On Your Part. We Are Not Asking You For A Proxy And

You

Are Requested Not To Send Us A Proxy.

To

the Common Stock Shareholders of Capstone Companies, Inc.:

This

Notice and the accompanying Information Statement are being furnished to the Common Stock shareholders of Capstone Companies, Inc., a

Florida corporation (the “Company,” “we,” “us,” or “our”), in connection with actions

taken pursuant to Florida Statutes and Article VII of our Amended and Restated Articles of Incorporation by the written consent of the

Common Stock shareholders who have the authority to vote a majority of the issued and outstanding shares of the Company’s Common

Stock. The actions taken are as described in, and subject to the conditions set out in, the Information Statement.

This

Information Statement is being furnished to our Common Stock shareholders (“Shareholders”) in accordance with Rule 14c-2

under the Securities Exchange Act of 1934, as amended, and the rules promulgated by the Securities and Exchange Commission (“SEC”)

thereunder, solely for the purpose of informing Shareholders of the actions taken by the written consent by Shareholders with the requisite

voting power to approve those actions.

THIS

IS NOT A NOTICE OF A MEETING, AND NO SHAREHOLDERS’ MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN.

By

Order of the Board of Directors,

/s/

Stewart Wallach

Stewart

Wallach, Chief Executive Officer and Chairman of the Board of Directors

Date:

May 10, 2023

CAPSTONE

COMPANIES, INC.

INFORMATION

STATEMENT

This

Information Statement is for informational purposes only and no action is requested on your part. We are not asking you for a proxy and

you are requested not to send us a proxy.

GENERAL

INFORMATION

Unless

otherwise noted, references to the “Company,” “we,” “us,” or “our” mean Capstone Companies,

Inc., a Florida corporation. Our principal executive offices are located at 431 Fairway Drive, Suite 200, Deerfield beach, Florida 33441,

and our telephone number is (888) 570-8889, Ext.

315.

This

Information Statement is first being made available by Notice of Internet Availability or by delivery on or about May 19, 2023, to the

Company’s Common Stock shareholders (“Shareholders”) as of record as of May 8, 2023 (the “Record Date”).

We expect that the actions set out herein will become effective on or about June 19, 2023.

We

are furnishing this Information Statement in connection with actions taken by written consent (“Written Consent”) by Shareholders

who have the requisite voting power to approve the corporate actions described in this Information Statement in lieu of conducting a

shareholders meeting.

By

written consent, dated May 9, 2023, (the “Written Consent”), as permitted by Florida Statutes and Article VII of the Company’s

Amended and Restated Articles of Incorporation (“Articles”), the Shareholders who had the authority to vote a majority of

the outstanding shares of Common Stock approved have approved the following corporate actions:

1.

Election of the following incumbent directors to the Company’s Board of Directors for a term commencing upon election and assumption

of office and ending upon election of successors in 2024:

a)

Stewart Wallach;

b)

George Wolf;

c)

Jeffrey Postal; and

d)

Jeffrey Guzy.

2.

Approval of an amendment to Article 1 of our Articles to increase our authorized shares of capital stock as follows: The maximum number

of shares of capital stock which the Company would be authorized to issue under the amendment of the Articles is 300,000,000 shares,

of which 295,000,0000 shares are Common Stock, par value $0.0001 per share (the "Common Stock"), and 5,000,000 shares are serial

Preferred Stock (the "Preferred Stock")(the increase in number of capital shares being referred to as the “Authorized

Capital Increase”). The existing Articles provide for a maximum of 60,000,000 authorized shares of capital stock, of which 56,666,667

shares are Common Stock and 3,333,333 shares are Preferred Stock. The amendment to the Articles set forth in Attachment One hereto.

3.

Ratify the Company’s current public auditor, D. Brooks and Associates, CPAs, PA, as Company’s public auditor for the Company

for fiscal year ended 2023. Audit Committee of Company’s Board of Directors has recommended engagement and ratification by Shareholders

of D. Brooks and Associates, CPAs, PA, as Company’s public auditors for 2023 fiscal year. Company’s Board of Directors recommended

ratification of D. Brooks CPA, PC, as public auditors of the Company for 2023 fiscal year.

The

above corporate actions are referred to as the “Corporate Actions” below. As of the Record Date, 48,826,864 shares of Common

Stock were outstanding.

Under

Florida law and our Articles, the votes represented by the holders signing the Written Consent are sufficient in number to authorize

the matters set forth in the Written Consent, without the vote or consent of any of our other shareholders. Florida statutes provide

that any action that is required to be taken, or that may be taken, at any annual

or special meeting of shareholders of a Florida corporation may be taken, without a meeting, without prior notice and without a vote,

if a written consent, setting forth the actions taken, is signed by the holders of outstanding capital stock having not less than the

minimum number of votes necessary to authorize such action.

This

Information Statement is being provided to shareholders on or about May 19, 2023. We will bear all expenses incurred in connection

with the distribution of this Information Statement. We will reimburse brokers or other nominees for reasonable expenses they incur in

forwarding this material to beneficial owners.

No

action is required by you. The accompanying Information Statement is furnished only to inform you of the above actions before such actions

take effect, in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended, (“Exchange Act”).

Shareholders

owning 26,663,665 shares of our issued and outstanding shares of Common Stock consented in writing on May 9, 2023, to the Authorized

Capital Increase, election of directors and ratification of public auditors. The shares that consented to these corporate actions

represent 55% of the issued and outstanding shares of Common Stock as of the Record Date. As such, no vote or further action of the shareholders

of the Company is required to approve or adopt those actions. Under federal law, however, such approval by written consent may

not become effective until at least twenty (20) days after this Information Statement has first been provided to Shareholders and these

actions shall become effective immediately thereon or, with respect to the Authorized Capital Increase, when the appropriate filing has

been made with the Florida Secretary of State after the 20 day period.

DISSENTER’S

RIGHT OF APPRAISAL

The

Florida Statutes do not provide for dissenter's rights of appraisal in connection with the Authorized Capital Increase.

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

The

voting power of the Company is vested in its Common Stock, with one vote per share. At the Record Date, 48,826,864 shares of Common

Stock were outstanding.

FORWARD-LOOKING

STATEMENTS

This

Information Statement and Annual Report may contain “forward-looking statements.” These statements are based on our current

expectations and involve risks and uncertainties which may cause results to differ materially from those set forth in the statements.

The forward-looking statements may include statements regarding actions to be taken in the future. Actual results may differ from those

set forth in the forward-looking statements. We undertake no obligation to publicly update any forward-looking statement, whether as

a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties

that affect our business, particularly those set forth in the section on forward-looking statements and in the risk factors in Item 1A

of the Form 10-K, as filed with the Securities and Exchange Commission on March 31, 2023.

FREQUENTLY

ASKED QUESTIONS

Why

am I receiving these materials? The Company is sending you this Information Statement to inform you of corporate actions approved

by the Board and approved by the written consent of holders of the shares of Common Stock representing more than 50% of the issued and

outstanding shares of the Common Stock. Shareholders do not need to take any actions in respect of the Corporate Actions.

Is

this a Proxy Statement? No. This is not a proxy statement. Company is not asking Shareholders for a proxy and Shareholders are requested

not to send us a proxy or take any other action.

What

vote is required to approve each proposed corporate action? Each of the corporate actions requires the approval of Shareholders representing

more than 50% of the issued and outstanding shares of Common Stock as of the Record Date. Written consents representing 26,663,665 shares

of Common Stock, or 55% of the issued and outstanding shares of Common Stock eligible to vote on or consent to the corporate actions

were received by the Company and approved

all Corporate Actions - without a vote against and without an abstention. As such, no shareholders meeting is required to approve the

Corporate Actions.

What

is the purpose of the proposals? Under its by-laws and Florida law, the Company has to periodically elect directors. We also routinely

seek shareholder ratification of the appointment of a public auditor as part of our policy of seeking qualified and independent public

auditors. The purpose of the Authorized Capital Increase is described in “Reasons for the Proposed Authorized Capital Increase”

below.

Why

is there no Annual Meeting of Shareholders? Fewer than five Shareholders have sufficient votes to approve or reject any of the Corporate

Actions by written consent. Florida law allows the Company to approve these proposals by written consent. As such, holding an annual

or special meeting of shareholders, while meetings have certain ancillary benefits, is not necessary to approve or reject the Corporate

Actions. A written consent avoids the cost of holding a shareholders’ meeting, which cost is significant for a smaller reporting

company like the Company, especially due to the current financial condition of the Company.

Who

is paying for the preparation and mailing of the Information Statement? The cost of preparing and mailing the Information Statement

will be borne entirely by the Company. Banks, brokerage houses and other nominees or fiduciaries will be requested to forward the material

to their principals, and the Company will, upon request, reimburse them for their expenses in so doing. The Company estimates the cost

of preparing and mailing the Information Statement to be $8,500.

What

was the recommendation of the Board of Directors on each of the corporate actions? THE BOARD OF DIRECTORS APPROVED AND RECOMMENDED

SHAREHOLDER APPROVAL OF ALL CORPORATE ACTIONS.

What

is being delivered to Shareholders (Householding)? If hard copies of the materials are requested, we will send only one Information

Statement and Form 10-K to Shareholders who share a single address unless we received contrary instructions from any Shareholder at that

address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, the Company

will deliver promptly upon written or oral request a separate copy of the Information Statement and Form 10-K to a Shareholder at a shared

address to which a single copy of the Information Statement and Form 10-K was delivered. If multiple Shareholders sharing an address

have received one copy of this Information Statement and Form 10-K or any other corporate mailing and would prefer the Company to mail

each Shareholder a separate copy of future mailings, you may mail notification to, or call the Company at, its principal executive offices.

Additionally, if current Shareholders with a shared address received multiple copies of this Information Statement and Form 10-K or other

corporate mailings and would prefer the Company to mail one copy of future corporate mailings to Shareholders at the shared address,

notification of such request may also be made by mail or telephone to the Company’s principal executive offices. Notification of

these requests may also be made by mail, email, or telephone call to our principal executive offices as follows: George Wolf, Corporate

Assistant Secretary, Capstone Companies, Inc., 431 Fairway Drive, Suite 200, Deerfield Beach, Florida 33441, or by sending an email to

him at gwolf@capstonecompanies.com, Telephone: (888) 570-8889, Ext 315.

E-Mail

Transmission of Documents. If Shareholders wish to reduce the Company’s cost of sending materials to Shareholders, please contact

George Wolf at the above email or telephone number for a consent form to receive corporate documents and mailings by email. Shareholders’

emails are only used to send corporate materials and mailings and not for any other purposes. Company does noy share Shareholders’

emails with others, excepting for successors to the Company.

What

do I need to do now? Nothing. These materials are provided to inform you and do not require or request you to do anything.

CORPORATE

ACTIONS

Item

1. Election of Directors. The Board nominated the four directors profiled below to stand for election to the Board until their successors

are elected and assume office in 2024. The Company received sufficient written consents to elect the four nominees. Shareholders with

requisite voting power (“Majority Shareholders”) cast all of their aggregate of 26,663,665 shares of the Common Stock,

which represents 55% of the issued and outstanding shares of Common Stock

as of Record Date, for election of each of the four nominees. The profiles of the directors, who are incumbent directors, nominated by

the Company’s Board of Directors and elected by Written Consent are:

DIRECTOR

PROFILES. Stewart Wallach, Age 71, Chief Executive Officer and Chairman of the Board of Directors since April 23, 2007, a

director of the Company since September 22, 2006, and the founder and Chief Executive Officer and Chairman of the Board of Directors

of Capstone Industries, Inc., a wholly owned subsidiary, and principal operating subsidiary of the Company, since September 20, 2006.

Mr. Wallach is an American entrepreneur and has founded and operated a number of successful businesses over his 35-year career. Over

the past 15 years, Mr. Wallach has been focused on technology-based companies in addition to consumer product businesses, the field in

which he has spent most of his career. Prior to founding Capstone Industries, Inc., he sold Systematic Marketing, Inc., which designed,

manufactured, and marketed automotive consumer products to mass markets, to Sagaz Industries, Inc., a leader in these categories. He

served as President of Sagaz Industries, Inc. for 10 years before forming Capstone Industries, Inc. In 1998, Mr. Wallach co-founded Examsoft

Worldwide, Inc. (“Examsoft”), which developed and delivered software technology solving security challenges of laptop-based

examinations for major educational institutions and state bar examiners. Mr. Wallach remained chairman of Examsoft until it was acquired

in late 2009. Mr. Wallach has designed and patented a number of innovations over the span of his career and has been traveling to China

establishing manufacturing and joint venture relationships since the early 1980s.

Dr.

Jeffrey Postal, Age 65. Director. He has served as a director of the Company since January of 2004. Dr. Postal presently is a businessman

and entrepreneur in the Miami, Florida region. Dr. Postal owns, founded or funded numerous successful businesses over the last few years,

including but not limited to: Sportacular Art, a company that was licensed by the National Football League, Major League Baseball and

National Hockey League to design and manufacture sports memorabilia for retail distribution in the U.S; Co-Owner of Natures Sleep, LLC,

a major distributor of Visco Memory Foam mattresses, both nationally and internationally; Dr. Postal is a Partner in Social Extract,

LLC, a Social Media company offering consulting services to many major companies in the U.S.; Dr. Postal is the principal investor of

Postal Capital Funding, LLC, a private investment fund whose mission is to find undervalued/under capitalized companies and extend funding

to them in exchange for equity and/or capital consideration; and Dr. Postal is the founder of Datastream Card Services, a company that

provides innovative billing solutions to companies conducting business on the internet.

Jeffrey

Guzy, Age 70. Director. He was appointed to the Company’s Board of Directors on May 3, 2007. He serves as Chairman and Chief

Executive Officer of CoJax Oil and Gas Corporation, an SEC reporting company. Mr. Guzy is an outside director of Leatt Corporation, an

SEC reporting company (OTCQB: LEAT). Mr. Guzy served, from October 2007 to August 2010 as President of Leatt Corporation. Mr. Guzy has

a MBA in Strategic Planning and Management from The Wharton School of the University of Pennsylvania; a M.S. in Systems Engineering from

the University of Pennsylvania; a B.S. in Electrical Engineering from Penn State University; and a Certificate in Theology from Georgetown

University. Mr. Guzy has served as an executive manager or consultant for business development, sales, customer service and management

in the telecommunications industry, specifically, with IBM Corp., Sprint International, Bell Atlantic Video Services, Loral CyberStar

and FaciliCom International. Mr. Guzy has also started his own telecommunications company providing Internet services in Western Africa.

He serves as an independent director and chairman of the audit committee of Purebase Corporation (OTC: PUBC) a public company.

George

Wolf, Age 72. Mr. Wolf has provided sales and business development consulting services to the Company since 2014. Prior to Mr. Wolf

providing these consulting services, he served as President and Chief Executive Officer of Systematic Development Group, LLC from 2010

into 2014, President and Chief Executive Officer of ExamSoft Worldwide, Inc. (1998 – 2009) and as Executive Vice President of Sagaz

Industries, Inc. (1986 – 1997).

There

are no agreements or understandings for any of our executive officers, directors, or significant employees to resign at the request of

another person and no officer or director is acting on behalf of nor will any of them act at the direction of any other person.

Qualifications,

Attributes, Skills and Experience Represented on the Board. The Board has identified qualifications, attributes, skills and experience

that are important to be represented on the board as a whole, in light of our current needs and business priorities. The Board believes

that each director is a recognized person of high integrity with a proven record of success in his field. Each director demonstrates

innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures

and a commitment to the business and operations of the Company. The Board has assessed the intangible qualities including the director’s

ability to

ask difficult questions and, simultaneously, to work collegially. The Board also considers diversity of age, cultural background, and

professional experiences in evaluating candidates for Board membership. Diversity is important because a variety of points of view contribute

to a more effective decision-making process.

Set

forth below is a tabular disclosure summarizing some of the specific qualifications, attributes, skills and experiences of our directors.

| NAME |

TITLE |

QUALIFICATIONS |

| Stewart

Wallach |

Chairman

of the Board and Chief Executive Officer |

He

has extensive experience in executive management of companies. He has experience in growing operations and merger and acquisition

transactions. He has extensive experience in arranging the design, development and production of products in foreign nations for

shipment and sale in the U.S. and conducting business abroad. His experience provides insight for the implementation of effective

operational, financial and strategic leadership of the Company. |

| Jeffrey

Postal |

Director |

He

has extensive experience in investing in companies. He has extensive experience in management and business. He has experience growing

a company and mergers and acquisitions. |

| Jeffrey

Guzy |

Director |

Through

his MBA in Strategic Planning & Management and his knowledge of U.S. capital markets, Mr. Guzy provides invaluable guidance and

perspective to the Board. He serves and has served as an officer and director of public companies and worked for large corporations

in business development. He brings this public company and management experience to the Board. |

| George

Wolf |

Director

and Assistant Secretary |

He

has extensive experience in sales and business development and has prior management experience. He is familiar with the Company’s

sales and business development strategies and operations and has worked closely with executive officers of the Company in sales and

business development. |

There

is no family relationship between any directors or senior officers of the Company.

Director

Nomination Process. The process that the Compensation and Nominating Committee of the Company’s Board of Directors (“CNC”)

follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors of the Company (“Board”)

is as follows:

For

purposes of identifying nominees for the Board, the CNC relies on personal contacts of the committee members and other members of the

Board but will consider director candidates recommended by Shareholders in writing. The CNC does not use an independent search firm to

identify nominees.

In

evaluating potential nominees, the CNC determines whether the candidate is eligible and qualified for service on the Board by evaluating

the candidate under certain selection criteria, which are discussed in more detail below. If such individual fulfills these criteria,

the CNC will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the

prospective nominee and the contributions he or she would make to the Board.

Criteria

for director nominees are: (1) business and financial experience of nominee, especially in respect of public companies; (2) prior experience

as a director or senior officer; (3) understanding of the Company’s business lines and industry; (4) understanding of requirements

applicable to the Company under federal and state laws and regulations and regulations of The OTC Market Group, Inc. for QB Venture Market

qouted companies; (5) moral character and absence of disqualifying events, including Bad Actor disqualification under SEC rules; (6)

whether the director nominee would be an independent director or financial expert under SEC rules; and (7) ability and qualifications

to serve on board committees.

Independent

Directors. The Board is typically comprised four to five directors, one of whom is an independent director under the listing

standards of quotation systems like The NASDAQ Stock Market. The Company has sought unsuccessfully to recruit additionally qualified

independent directors. Although we have directors’ and officers’ insurance, we believe that past operating losses, our

status as a OTC QB Venture Market quoted company and low public stock market price (as well as our Common Stock being deemed a

“penny stock” under SEC rules) discourages qualified candidates from serving as independent directors. This is a problem

commonly faced by micro-cap, “penny

stock” companies like our Company. Director Jeffrey Guzy is considered to be an “independent director” under NASDAQ

Stock Market standards.

Management

Structure. Our senior officers are responsible for the day-to-day management of risks the Company faces, while the Board, as a whole

and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility

to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

To do this, the Chairman of the Board and other non-officer directors met quarterly on average with management to discuss strategy and

the risks facing the Company. Senior management attends the Board meetings and is available to address any questions or concerns raised

by the Board on risk management and any other matters. The Chairman of the Board and members of the Board work together to provide strong,

independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings

of directors. Informal meetings between directors and officers also occur to discuss business risks or developments and appropriate corporate

responses.

Board

Committees. The Company has an Audit Committee and the CNC. Jeffrey Guzy and Jeffrey Postal are committee members of both board committees.

Mr. Guzy is deemed a “financial expert” for purposes of Audit Committee work and an independent director under NASDAQ Stock

Market rules.

Indemnification.

The Company maintains directors and officer’s liability insurance or “D&O insurance” coverage to reduce its

exposure to such obligations, and payments made under this coverage historically have not been material. Further, the Articles and Bylaws

of the Company provide for indemnification of directors and officers.

Compensation

of Directors. The following table sets forth the total director compensation earned by our directors during our fiscal years ended

December 31, 2021 and 2022. Directors Stewart Wallach and George Wolf do not receive compensation as directors.

| Name |

Fees

earned or paid in cash. ($) |

Stock

Awards |

Option

awards ($) |

All

other compensation ($) |

Total

Compensation ($) |

| 2021: |

|

|

|

|

|

| Jeffrey

Postal |

$13,365 |

- |

$7,501 |

- |

$20,866 |

| Jeffrey

Guzy |

$13,365 |

- |

$7,501 |

- |

$20,866 |

| 2022: |

|

|

|

|

|

| Jeffrey

Postal |

$4,500 |

- |

- |

- |

$4,500 |

| Jeffrey

Guzy |

$4,500 |

- |

- |

- |

$4,500 |

Item

2. Authorized Capital Increase. Approved the Authorized Capital Increase, which will increase the maximum number of shares which

the Company is authorized to issue is increased to 300,000,000 shares of capital stock, of which 295,000,0000 shares are Common Stock

and 5,000,000 shares are serial Preferred Stock. The existing Articles provide for a maximum of 60,000,000 authorized shares of capital

stock, of which 56,666,667 shares are Common Stock and 3,333,333 shares are Preferred Stock.

Reasons

for the Proposed Authorized Capital Increase. Purpose of the proposed Authorized Capital Increase is to provide sufficient shares

of Common Stock for equity financing or reserve of shares of Company Common Stock to cover: (1) any merger or other business combination

transaction involving the Company and an exchange of shares of Company Common Stock; (2) any funding requiring issuance of or escrow

of shares of Company Common Stock in a conversion of a convertible debt instrument, as part of consideration or payment of funding, or

other related reasons; or (3) a registered public or private offering of shares of Common Stock to fund a significant corporate action

or provide working capital. Company does not have a legally binding agreement to consummate any of the aforementioned corporate actions

or transactions, but the Company believes that having the available authorized shares permits the Company to act in the event of any

significant corporate action or transaction, especially fundings, without the delay of increasing the authorized number of shares of

capital stock.

Company’s

traditional business line of LED lighting products has matured and no longer produces revenue to sustain Company operations. Efforts

to establish the Company’s Connected Surfaces Smart Mirror as a primary product line

that generates sufficient revenues to support operations have not succeeded as of the date of this Information Statement. The Company

is exploring third party funding to sustain operations as well as exploring possible new product lines or new primary business lines

for the Company. There is no assurance that the Company will be able to consummate any corporate transaction to fund new products, a

new business line or new product lines, which failure to consummate may result in the Company being unable to sustain operations. Company

relies on funding from directors and affiliates to cover basic overhead.

Future

Dilution; Anti-Takeover Effects. SEC requires disclosure and discussion of the effects of any action, including the proposals

discussed herein, that may be used as an anti-takeover mechanism. Since the amendment to our Articles will provide that the number of

authorized shares of Common Stock will be Three Hundred Million (300,000,000), once effected, the increase in the number of shares authorized

for issuance will result in an increase in the number of authorized but unissued shares of our Common Stock which could, under certain

circumstances, have an anti-takeover effect, although this is not the purpose or intent of the Company in respect of the Authorized Capital

Increase. Company has not proposed the Authorized Capital Increase with the intention of using the additional authorized shares for anti-takeover

purposes. An increase in the number of authorized shares of Common Stock could have other effects on Shareholders, depending upon the

exact nature and circumstances of any actual issuances of authorized but unissued shares. An increase in our authorized shares could

potentially deter takeovers, including takeovers that the Board has determined are not in the best interest of Shareholders, in that

additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change

in control or takeover more difficult or too expensive to pursue. For example, we could issue additional shares so as to dilute the stock

ownership or voting rights of persons seeking to obtain voting control of the Company without our agreement. Similarly, the issuance

of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current

management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The increase in the number of shares

authorized for issuance may therefore have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation

of any such unsolicited takeover attempts, the increase in the number of shares authorized for issuance may limit the opportunity for

our shareholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under

a merger proposal that is favorable to public shareholders.

There

may be certain other disadvantages suffered by shareholders as a result of the Authorized Capital Increase. These disadvantages include

an increase in possible dilution to present shareholders' percentage ownership of the Common Stock because of the additional authorized

shares of Common Stock which would be available for future issuance by us. Current shareholders, in the aggregate, own approximately

81.37% of current authorized and issued shares of Common Stock under our present capital structure but would own only 16.27% of the authorized

and issued shares of Common Stock under our capital structure after the Authorized Capital Increase. The decision to issue shares of

Common Stock that could dilute the position of current Shareholders can be made by our Board alone, and no further shareholder vote or

consultation would be required for such an issuance.

Under

the current capitalization of the Company, two Shareholders, who are director and a director-senior officer of the Company, and one public

shareholder have sufficient shares of Common Stock to approve or block any proposed corporate action requiring shareholder approval.

There is no known agreement among these Shareholders to act as a group in voting their shares.

Item

3. Ratification of D. Brooks & Associates, CPAs, as Public Auditors. The Audit Committee of the Board recommended appointment

of D. Brooks & Associates, CPAs, as public auditors for the fiscal year end as of December 31, 2023 and the Board approved that appointment

and recommended Shareholder ratification of that appointment.

The

appointment of D. Brooks & Associates, CPAs, as the public auditors of the Company for fiscal year 2023 was ratified unanimously

by the Written Consent. D. Brooks & Associates, CPAs, has been the public auditor of the Company since November 23, 2020. There are

no pending disputes between the Company and D. Brooks & Associates, CPAs. D. Brooks & Associates, CPAs, is a Florida public audit

and accounting firm. The audit office of D. Brooks & Associates, CPAs, is located at 4440 PGA Boulevard, Suite 104, Palm Beach Gardens,

Florida 33410, Phone: (561) 426-6225, web site: http://www.dbrookscpa.com/.

The

following is a summary of the fees billed to date by D. Brooks & Associates CPA’s, P.A., for professional services rendered

for the years ended December 31, 2022 and 2021:

| | |

2022 | |

2021 |

| Audit Fees | |

$ | 85,000 | | |

$ | 64,700 | |

| Tax Fees | |

| — | | |

| — | |

| Total | |

$ | 85,000 | | |

$ | 64,700 | |

Audit

Fees. Consists of fees billed for professional services rendered for the audits of our consolidated financial statements, reviews

of our interim consolidated financial statements included in quarterly reports, services performed in connection with filings with the

SEC and related comfort letters and other services that are normally provided by the audit firm in connection with statutory and regulatory

filings or engagements.

Tax

Fees. Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance

regarding federal, state and local tax compliance and consultation in connection with various transactions and acquisitions.

Audit

Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors. The Audit Committee is to pre-approve

all audit and non-audit services provided by the independent auditors. These services may include audit services, audit-related services,

tax services and other services as allowed by law or regulation. Pre-approval is generally provided for up to one year and any pre-approval

is detailed as to the particular service or category of services and is generally subject to a specifically approved amount. The independent

auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent

auditors in accordance with this pre-approval and the fees incurred to date. The Audit Committee may also pre-approve particular services

on a case-by-case basis. The Audit Committee pre-approved 100% of the Company’s 2022 audit fees.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of May 10, 2023, for:

| · | each

of our named executive officers; |

| · | all

of our executive officers and directors as a group; and |

| · | each

stockholder known by us to be the beneficial owner of more than 5% of our outstanding Common

Stock based on shareholder list. |

| NAME, ADDRESS & TITLE | |

STOCK OWNERSHIP | |

% OF STOCK OWNERSHIP | |

SHARES - COMMON STOCK ISSUABLE UPON CONVERSION | |

STOCK OWNERSHIP AFTER CONVERSION -ALL OPTIONS, WARRANTS & THOSE EXERCISEABLE WITHIN NEXT 60 DAYS | |

% OF STOCK OWNED AFTER CONVERSION – OPTIONS, WARRANTS INCLUDES EXERCISEABLE WITHIN THE 60 DAYS | |

OPTIONS & WARRANTS VESTED | |

OPTIONS & WARRANTS EXPIRED | |

OPTIONS & WARRANTS NOT VESTED |

| Stewart Wallach, CEO, 431 Fairway Drive, Suite 200, Deerfield Beach, FL 33441 | |

| 9,831,745 | | |

| 20.1 | % | |

| |

| 499,950 | | |

| 9,831,745 | | |

| 19.9 | % | |

| — | | |

| 1,515,556 | | |

| — | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dana Eschenburg Perez, Interim CFO, 431 Fairway Drive Suite 200, Deerfield Beach, FL 33441 | |

| — | | |

| 0 | % | |

| |

| — | | |

| — | | |

| 0 | % | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeff Postal, Director, 431 Fairway Drive, Suite 200, Deerfield Beach, FL 33441 | |

| 9,034,120 | | |

| 18.5 | % | |

| |

| 499,950 | | |

| 9,338,264 | | |

| 18.9 | % | |

| 304,144 | | |

| 600,000 | | |

| — | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeff Guzy, Director, 3130 19th Street North, Arlington, VA 22201 | |

| 52,800 | | |

| 0.1 | % | |

| |

| — | | |

| 356,944 | | |

| 0.7 | % | |

| 304,144 | | |

| 600,000 | | |

| — | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| George Wolf Director, 431 Fairway Drive Suite 200, Deerfield Beach, FL 33441 | |

| — | | |

| | | |

| |

| — | | |

| — | | |

| | | |

| — | | |

| 66,667 | | |

| — | |

| | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| ALL OFFICERS & DIRECTORS AS A GROUP | |

| 18,918,665 | | |

| 39 | % | |

| |

| 999,900 | | |

| 19,526,953 | | |

| 40 | % | |

| 608,288 | | |

| 4,932,223 | | |

| — | |

Unless

otherwise indicated below, the address for each beneficial owner listed is c/o Capstone Companies, Inc., 431 Fairway Drive, Suite 200,

Deerfield Beach, Florida 34441.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

The

Corporate Actions were approved by the Shareholders and unanimously by the Board, except each director recused himself from voting on

his nomination to stand for election to the Board. We are not aware of any substantial interest, direct or indirect, by shareholders

or otherwise, that is in opposition to the corporate actions taken. Our officers and directors, since the beginning of the last fiscal

year, do not have any substantial interest in the matters acted upon pursuant to the written consent, other than in their respective

roles as officers or directors of the Company and to the extent affected by the terms of the Authorized Capital Increase as holders of

shares, or securities exercisable for shares, of our Common Stock.

PROPOSALS

BY SECURITY HOLDERS

The

Board knows of no other matters or proposals other than the actions described in this Information Statement which have been approved

or considered by the holders of a majority of the shares of the Company’s Common Stock.

SHAREHOLDER

COMMUNICATIONS

Any

shareholder or any other interested party who desires to communicate with our Board of Directors, our non-management directors or any

specified individual director, may do so by directing such correspondence to the attention of the Corporate Secretary at our offices

at c/o Capstone Companies, Inc., 431 Fairway Drive, Suite 200, Deerfield Beach, Florida 33441. The Corporate Secretary will forward the

communication to the appropriate director or directors as appropriate.

ADDITIONAL

INFORMATION

The

Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies

of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may

obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains a public

website that contains reports and other information about issuers that file electronically with the SEC. The address of that website

is www.sec.gov.

Annual

Report on Form 10-K

Company’s

Annual Report on Form 10-K, including financial statements for the fiscal year ended December 31, 2022, is available on:

(1)

SEC’s website at URL:

https://www.sec.gov/ix?doc=/Archives/edgar/data/814926/000190359623000255/capc_10-k.htm

(2)

Company’s website at URL:

https://investors.capstonecompaniesinc.com/CAPC/corporate_document/4957

OTHER

MATTERS

You

should not assume that the information contained in this Information Statement is accurate as of any date other than the date first written

above, unless expressly provided, and the mailing of this Information Statement to shareholders on or about May 19, 2023, or on any date

thereafter, does not create any implication to the contrary.

By

Order of the Board of Directors,

/s/

Stewart Wallach

Stewart

Wallach, Chief Executive Officer and Chairman of the Board of Directors

May

10, 2023

ATTACHMENT

ONE: Text of Amendment to Article 1 of the Articles

Article

1: Authorized Shares. The maximum number of shares which the Corporation is authorized to issue is 300,000,000 shares, of which

295,000,0000 shares shall be Common Stock, par value $0.0001 per share (the "Common Stock"), and 5,000,000 shares of Preferred

Stock (the "Preferred Stock").

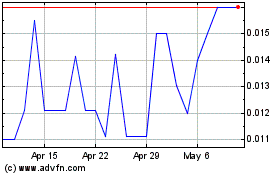

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

From Nov 2023 to Nov 2024