Current Report Filing (8-k)

February 23 2021 - 7:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

February

23, 2021

Date

of Report (Date of earliest event reported)

Can

B̅ Corp.

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

000-55753

|

|

20-3624118

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

960

South Broadway, Suite 120

Hicksville,

NY

|

|

11801

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code 516-595-9544

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock

|

|

CANB

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

February 22, 2021, Can B̅ Corp. (the “Company”) entered into a material definitive agreement (“Acquisition

Agreement”) with its wholly owned subsidiary, Radical Tactical, LLC, a Nevada limited liability company and Imbibe Health

Solutions, LLC, a Delaware limited liability company (“Imbibe”), pursuant to which Imbibe agreed to sell certain of

its assets to Radical Tactical. The assets to be purchased (“Assets”) include the intellectual property rights, including

trademarks, logos, know how, formulations, productions procedures, copyrights, social media accounts, domain names and marketing

materials relating to its branded products containing CBD, including a muscle and joint salve, unscented fizzy bath soak, CALM

massage oil, Me x 3 Metabolic Energy (energy and dietary supplement), and Muscle, Joints & Back CBD Cryo Gel; inventory; and

goodwill. In exchange for the Assets, the Company has agreed to pay Imbibe Sixty-Five Thousand Dollars ($65,000) in the form of

shares of common stock of the Company (with standard restricted legend, the “Shares”) at a price per share equal to

the average price of the common stock of the Company during the ten (10) consecutive trading days immediately preceding the closing.

The

closing of the purchase and sale of Assets shall take place at the offices of Radical Tactical, on a date and at a time to be

determined, or at such other place, time or date (including by the exchange of facsimile and/or PDF signatures) as may be mutually

agreed upon in writing by the parties to the Acquisition Agreement. Radical Tactical has agreed to indemnify Imbibe for certain

breaches of covenants, representations and warranties and for claims relating to the Assets following closing. Imbibe has agreed

to indemnify Radical Tactical and the Company for certain breaches of covenants, representations and warranties, claims relating

to the Assets prior to closing, tax and employment claims relating to Imbibe’s business and liabilities of Imbibe. The parties

have agreed to keep each other’s confidential information confidential. Imbibe and its manager have agreed not to engage

in activity that would compete with the Assets for one year following closing. The Acquisition Agreement otherwise contains standard

representations, warranties and covenants common in transactions of this type.

Forward-

Looking Statements

Statements

contained in this Current Report that are not statements of historical fact are intended to be and are hereby identified as “forward-looking

statements” for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Generally,

forward-looking statements include expressed expectations of future events and the assumptions on which the expressed expectations

are based. All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning

future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results

to differ materially from those projected. The Company undertakes no obligation to update or revise the presentation or this Current

Report to reflect future developments except as otherwise required by the Securities Exchange Act of 1934.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Can

B̅ Corp.

|

|

|

|

|

|

Date:

February 23, 2021

|

By:

|

/s/

Marco Alfonsi

|

|

|

|

Marco

Alfonsi, CEO

|

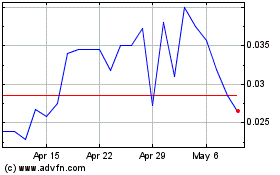

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

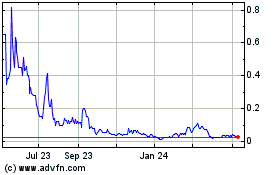

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024