BAE Systems Saw Record Order Intake in 2022; Sees Further Top-Line Growth in 2023 -- Update

February 23 2023 - 4:57AM

Dow Jones News

By Anthony O. Goriainoff

BAE Systems PLC said Thursday that it benefited from a record

order intake in 2022 of 37.1 billion pounds ($44.69 billion) which

was propelled by an order backlog of GBP58.9 billion, despite

supply chain and inflation issues.

The U.K. defense-and-aerospace group said that its record orders

and financial performance gave it confidence in delivering

long-term growth and to continue investing in new technologies,

facilities and thousands of highly-skilled jobs.

"For 2023, we're forecasting further top-line growth, continued

margin expansion, higher EPS and we're also increasing our rolling

three-year cash targets, all of which demonstrate that the business

has growing momentum for the future," the company said.

The FTSE 100 company said its opportunity pipeline was growing

with domestic, export and collaboration opportunities, adding that

"we have the capabilities to support our U.K. customer in its

emerging space ambitions".

Moreover, BAE said it was well aligned with the U.S. Defense

Department's emphasis on advanced technologies and that its

products in areas such as electronic warfare, communications,

computers or intelligence "map directly into priorities in the U.S.

national defense strategy." Its participation in U.S. foreign

military sales enabled it to serve the European and NATO market

through multiple channels, it said.

The U.K.'s renewed commitments to its major programs in warship,

submarine and combat aircraft design and build allowed for

long-term investment in these capabilities, the company said.

BAE said that Europe's need for new equipment is urgent--given

the current threat level--and that many defense budgets are

rising.

In addition to its defense portfolio the company continued to

see a recovery in its commercial aviation product lines as

passenger flying hours continued to rise, it said.

The company said pretax profit for 2022 was GBP1.99 billion

compared with a profit of GBP2.11 billion for 2021.

Sales rose to GBP23.26 billion from GBP21.31 billion a year

earlier. The company said that it expects sales in 2023 to rise by

3% to 5%.

Net profit was GBP1.59 billion compared with GBP1.76 billion the

year before, and consensus of GBP1.59 billion, also taken from

FactSet and based on 12 analysts' forecasts.

Revenue rose to GBP21.26 billion from GBP19.5 billion the year

before.

Underlying earnings per share--a metric which strips out

exceptional and other one-off items--on a constant currency basis

rose 9.5% to 55.5 pence.

BAE said it expects 2023 underlying EPS to increase by 5% to

7%.

The board recommended a final dividend of 16.6 pence a share,

taking the total for the year to 27.0 pence.

Shares at 0910 GMT were down 25 pence, or 2.8%, at 877

pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

February 23, 2023 04:42 ET (09:42 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

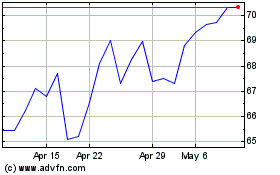

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Dec 2024 to Jan 2025

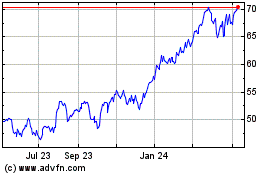

Bae Systems (PK) (USOTC:BAESY)

Historical Stock Chart

From Jan 2024 to Jan 2025