European Uranium Resources Signs Share Purchase Agreement to Sell Slovak Uranium Projects

May 09 2014 - 2:00AM

Business Wire

European Uranium Resources Ltd. (the "Corporation") (TSXV: EUU)

has signed a share purchase agreement (“SPA”) that supersedes a

binding heads of agreement signed and announced on April 4, 2014.

The SPA relates to the sale of the Corporation’s Kuriskova and

Novoveska Huta, Slovakia uranium projects to Forte Energy NL

(“Forte”) (ASX/AIM: FTE).

This sale represents the sale of the Corporation’s only

remaining mineral projects. The Corporation intends to investigate

mineral projects to option or acquire in multiple commodities in

the general European area. On completing this transaction, the

Corporation will have its initial funding to implement its business

plan.

The SPA is subject to regulatory approval and the approval of

the shareholders of both the Corporation and Forte. The terms of

the agreement require that:

1. Forte will issue 915,937,500 fully paid

ordinary shares (the “Consideration Shares”), which on April 4,

2014, had an approximate value of $7,500,000;

2. Forte will pay the Corporation $1,000,000

on closing; and

3. Forte will grant Corporation a 1%

production royalty over the Kuriskova and Novoveska Huta uranium

licenses in perpetuity.

On April 4, 2014, the sale price was equivalent to approximately

$8.5 million before assigning value to the production royalty. The

market capitalization of the Corporation’s stock at the time its

stock was halted in early December 2013 was $6.3 million. The sale

price represented a premium approaching 35%.

The heads of agreement and the Corporation’s announcement on

April 4, 2014, contemplated that the Corporation would distribute

on a pro-rata basis to the shareholders of the Corporation

854,875,000 of the Consideration Shares.

The SPA now contemplates that the Consideration Shares will be

issued to the Corporation in installments in order to avoid a

breach of the Australia Takeovers Prohibition, which prohibits,

among other things and subject to certain exceptions, the

acquisition of a relevant interest in issued voting shares in a

corporation in a transaction which would result in a person

acquiring more than 20% of the voting shares of the corporation or

increases a person's holding of voting shares from above 20% to an

amount that is less than 90%.

At closing of the SPA, the Corporation will receive the number

of the Consideration Shares that would result in the Corporation

holding approximately 19.9% of the Forte common shares outstanding

immediately following the closing (the "Initial Consideration

Shares"), with the balance of the Consideration Shares (such

balance, from time to time, the "Deferred Consideration Shares"),

to be issued over time, and from time to time.

In addition to the Australia Takeovers Prohibition, it became

apparent that while an exemption from prospectus was available to

distribute the Consideration Shares to the Corporation’s

shareholders there was not an available exemption for those

shareholders to be able to then sell the Consideration Shares if

they chose to do so.

For these reasons, the Corporation will instead receive and

retain the Consideration Shares and will not be distributing them

it is shareholders. The Corporation may sell some of its

Consideration Shares from time to time to fund its operations, in

which case Forte will be given an opportunity to assist in placing

the stock so that any sale is conducted in an orderly manner.

EUROPEAN URANIUM RESOURCES LTD.

"Dusty Nicol"

Dorian L. (Dusty) Nicol, President and CEO

For further information please contact: Dorian (Dusty) Nicol,

at (604) 536-2711, or visit www.euresources.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement:This news

release contains forward-looking statements that are based on the

Corporation's current expectations and estimates. Forward-looking

statements are frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate",

"suggest", "indicate" and other similar words or statements that

certain events or conditions "may" or "will" occur. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that could cause actual events or

results to differ materially from estimated or anticipated events

or results implied or expressed in such forward-looking statements.

Such factors include, among others: the actual results of current

exploration activities; conclusions of economic evaluations;

changes in project parameters as plans to continue to be refined;

possible variations in ore grade or recovery rates; accidents,

labour disputes and other risks of the mining industry; delays in

obtaining governmental approvals or financing; and fluctuations in

metal prices. There may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. Any

forward-looking statement speaks only as of the date on which it is

made and, except as may be required by applicable securities laws,

the Corporation disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information,

future events or results or otherwise. Forward-looking statements

are not guarantees of future performance and accordingly undue

reliance should not be put on such statements due to the inherent

uncertainty therein.

European Uranium Resources Ltd.Dorian (Dusty) Nicol,

604-536-2711President and CEO

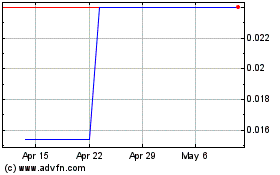

Azarga Metals (PK) (USOTC:EUUNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

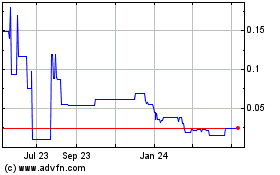

Azarga Metals (PK) (USOTC:EUUNF)

Historical Stock Chart

From Feb 2024 to Feb 2025