France's Axa Plows $49 Million Into Amazon Reforestation

July 18 2023 - 7:29AM

Dow Jones News

By Paulo Trevisani

Brazil's Mombak Gestora de Recursos said Tuesday that France's

AXA Investment Managers has committed $49 million to support its

efforts to remove carbon dioxide from the air by reforesting the

Amazon.

AXA has also taken a minority stake in Mombak, a start-up

focused on carbon removal using native species. The Brazilian firm

aims to generate credits that can be sold to companies willing to

reduce their carbon footprint.

"It is impossible to reach [climate protection goals] if we

don't remove carbon from the atmosphere," besides curbing

emissions, Mombak Chief Executive Peter Fernandez said. "And the

largest opportunity to do carbon removal is in Brazil."

Fernandez said a major global technology corporation is under

contract to buy Mombak's carbon credits, but he declined to reveal

the buyer's name.

So-called voluntary carbon markets, where offsets are traded

regardless of government-imposed emission caps, have been under

scrutiny amid doubts about whether the credits really equal the

amount of carbon reductions they are supposed to represent.

Fernandez said credits linked to Mombak's reforestation projects

are high-quality ones.

Carbon removal projects have attracted the interest of global

corporations. Last year, Stripe, Alphabet, Meta Platforms, Shopify

and McKinsey Sustainability launched Frontier, a so-called advance

market commitment, to link buyers and sellers of carbon

removal.

AXA IM Alts, the French firm's alternative investment unit, has

over 185 billion euros (around $208 billion) of assets under

management. In September, it launched its Natural Capital strategy

to invest in nature-based solutions to climate change.

"We were drawn to Mombak because they share our focus on

operational and scientific excellence," said Adam Gibbon, who leads

Natural Capital, in an email. Gibbon said such initiatives need to

be scaled "if we are to achieve net-zero and avert the ongoing

biodiversity crisis."

Mombak said it plans to reforest more than 10,000 hectares, or

nearly 25,000 acres, an area larger than Lake Superior, of degraded

pastureland and generate up to six million carbon credits, each one

equal to 1 metric ton of CO2 removed from the air.

A variety of approaches are being deployed around the world to

remove greenhouse gas from the air, including machines that suck

CO2 for underground storage. Growing trees is a more traditional

way to achieve similar results. Regrowing a complex ecosystem such

as the Amazon rainforest, however, can be challenging.

"Crucially, rapid reforestation is vital for the Amazon," said

Eduardo Ferreira, managing director of Latin America as Climate

Impact Partners, a provider of carbon offset projects that isn't

involved with Mombak. "This does not mean that there isn't a need

for engineered removals, but as they become more readily available,

they should be used alongside nature-based removals."

Mombak's Fernandez says his firm is making one of the largest

private, nature-based carbon removal projects in the Brazilian

Amazon.

Brazil, as large as the contiguous U.S., is home to around 60%

of the Amazon, the world's largest rainforest. It is a rich

ecosystem that has been shrinking fast, attacked by loggers, cattle

ranchers, soy farmers, miners and land grabbers.

Fernandez said Mombak already has a contract with a farm about

half the size of Manhattan, N.Y. It is in the municipality of Mae

do Rio, in Para, a mineral-rich state three times as large as

California where for decades cattle ranches and soy crops have

increasingly replaced the rainforest.

More than 500 trees have already been planted since the farm was

acquired in January, he said, with funds from its initial

investors, including U.S.-based Bain Capital Partnership

Strategies.

Mombak plans to plant up to 90 different species, all native to

the Amazon, Fernandez said.

Write to Paulo Trevisani at paulo.trevisani@wsj.com

(END) Dow Jones Newswires

July 18, 2023 07:14 ET (11:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

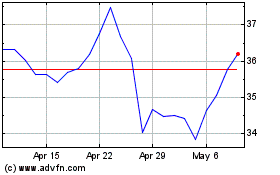

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Nov 2023 to Nov 2024