Associated British Foods Roiled by Sterling After Brexit Vote

September 12 2016 - 10:58AM

Dow Jones News

By Tapan Panchal

LONDON--The British pound's post-Brexit tumble benefited the

Primark discount fashion chain, but the disadvantages resulting

from the currency's fall have also grown.

Associated British Foods PLC, the food and ingredients company

that owns Primark, said Monday that the weaker pound after the

U.K.'s June 23 vote to leave the European Union would bolster its

results for fiscal 2016, ending Saturday. But it warned that the

currency move would hurt profit margins in fiscal 2017, because it

has many expenses in dollars and earns much of its revenue in

pounds and euros, and would turn its modest pension surplus into a

GBP200 million ($267.7 million) deficit.

AB Foods shares plunged in London trading Monday, down 10% to

GBP28.29 at 1400 GMT.

The London-based company blamed the pension deficit on a marked

decline in U.K. long-term bond yields following the EU referendum.

The company uses bond yields to value its pension obligations.

AB Foods Finance Director John Bason said the company's pension

plan is well funded and he expects several other U.K. companies to

report pension deficits due to falling bond yields.

The company vowed to maintain Primark's rock-bottom prices

despite the squeeze in margins and said the brand has been well

received in the world's largest clothing market, the U.S.

"All of our U.S. stores are growing in sales," Mr. Bason said,

adding that the stores are meeting sales expectations set by the

company. He declined to provide specific sales figures for the U.S.

stores.

Primark, popular in the U.K. and much of Europe, is expanding

gradually in the U.S. It opened its first store there a year ago,

in the former Boston location of the original Filene's Basement

discount store, and since has opened four more elsewhere in the

U.S. Northeast.

The chain now plans to expand selling space at the

77,000-square-foot Boston store by 20%, and it aims to have five

more U.S. stores in operation by fiscal 2018. That is a slower pace

than it planned a year ago, when it forecast nine U.S. stores by

the end of calendar 2016.

"There has been some slippage in phasing and delay in handling

over the stores" to Primark, Mr. Bason said. The company is poised

to open all of the U.S. stores as soon as it can, he added.

Kate Ormrod, an analyst at retail research agency Verdict

Retail, said a "more aggressive" expansion plan would be required

to fully seize Primark's U.S. potential and drive the volume

required for success.

"A Primark that trades well in the U.S. will have vast growth

potential, but if the brand fails to gain traction in the

notoriously competitive U.S. apparel sector, then a lot of hopes

will have been dashed," said George Salmon, an analyst at

Hargreaves Lansdown.

AB Foods said Primark's operating profit margin for fiscal 2016

would be close to the 11.7% it achieved in the first half. It said

it expects Primark's same-store sales to fall by 2%, citing adverse

weather conditions.

The company said the weak pound would help its sugar unit's

profit margins in the coming fiscal year, as well as delivering a

benefit on its profits earned outside the U.K.

Write to Tapan Panchal at Tapan.Panchal@wsj.com

(END) Dow Jones Newswires

September 12, 2016 10:43 ET (14:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

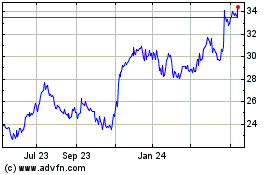

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From May 2024 to Jun 2024

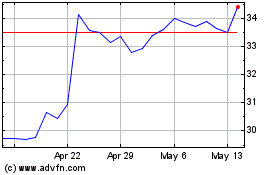

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2023 to Jun 2024