AB Foods No Longer Sees Full-Year Adjusted EPS Fall After Currency Boost

July 07 2016 - 2:55AM

Dow Jones News

By Rory Gallivan

LONDON--Associated British Foods PLC (ABF.LN) Thursday said it

no longer expects a decline in adjusted earnings per share for the

full year after benefiting from the falling pound after the EU

referendum.

The food and ingredients supplier, which also operates the

fashion chain Primark, said revenue for the 40 weeks ended June 18

was 3% ahead of last year stripping out the effect of currency

movements, and by 1%, including exchange rate movements. Third

quarter growth was 4% at constant currency and 7% at actual

exchange rates.

The underlying operating performance of the group during the

third quarter was ahead of its expectation, boosted by an

improvement in the sugar business, AB Foods said.

"Following the result of the E.U. referendum, sterling has

weakened further and at these rates we expect a bigger translation

benefit in the final quarter with no material transactional

effect," the company said.

Primark sales in the 40 weeks ended June 18 were 7% ahead of

last year at constant and actual exchange rates.

AB Foods in April said it expected a "marginal decline" in

adjusted earnings per share for the full year, but now no longer

predicts any decline.

AB Foods supplies food ingredients including sugar and enzymes

and also owns food brands such as Ryvita crisp bread and Twinings

tea. Primark has almost 300 stores in the U.K., Ireland, mainland

Europe and the U.S.

Write to Rory Gallivan at rory.gallivan@wsj.com; Twitter:

@RoryGallivan

(END) Dow Jones Newswires

July 07, 2016 02:40 ET (06:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

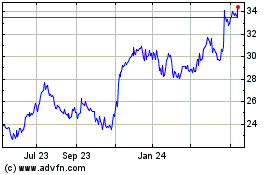

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From May 2024 to Jun 2024

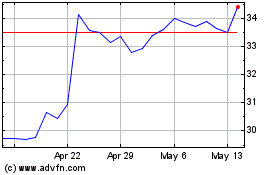

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2023 to Jun 2024