Associated British Foods Profit Hit By Strong Sterling, Tough Sugar Business -- Update

November 03 2015 - 9:48AM

Dow Jones News

By Maria Kunle and Razak Musah Baba

LONDON-- Associated British Foods PLC, the agricultural products

supplier that owns the Primark fast-fashion brand, on Tuesday

reported a 30% drop in fiscal 2015 profit as the strength of

sterling and a tough year at its sugar business hurt

performance.

ABF said pretax profit fell to GBP717 million ($1.11 billion) in

the 52 weeks ended Sept. 12 from GBP1.02 billion in the previous

fiscal year, on a 1.1% decline in revenue to GBP12.80 billion.

ABF said its underlying performance was less weak. Stripping out

exceptional items and other costs, pretax profit fell 7.2% to

GBP1.03 billion from GBP1.11 billion.

"The good underlying trading achieved by our businesses in 2015

is expected to continue," Chairman Charles Sinclair said. "We

intend to maintain investment in expansion opportunities, most

notably for Primark." The fashion chain, popular in Europe, in

September opened its first U.S. store, in Boston. The opening came

too late to be reflected in fiscal 2015 results.

Primark plans to open its second U.S. store Nov. 25 at the King

of Prussia mall near Philadelphia, and it plans seven other store

openings in the Northeast by the end of 2016. ABF offered no new

details on those locations Tuesday.

The company said it forecasts a turnaround at its sugar unit.

"After three years of large profit declines for AB Sugar, we expect

greater stability in profit next year ahead of the EU quota removal

in 2017," Mr. Sinclair said in a statement. The current European

Union production quota on sugar beets is due to end Sept. 30,

2017.

Analysts from Liberum Capital said they agreed with the outlook.

"We expect industry consolidation, lower beet prices and further

costs savings will boost sugar profits" from fiscal 2016, they said

in a report on Tuesday.

But volatile currency markets could still weigh on the group's

earnings, notably at Primark and British Sugar, Mr. Sinclair said.

"At this early stage we expect the currency pressures to lead to a

modest decline in adjusted operating profit and adjusted earnings

for the group for the coming year," he said.

Currency movements will significantly offset the benefits of

lower beet costs and potential recovery in EU prices in 2016,

Barclays analysts wrote. They said they expect ABF to turn in "a

modest decline in adjusted operating profit and adjusted earnings

for the group for the coming year."

Bernstein analysts also said ABF should expect "two consecutive

years of flat or negative earnings per share growth," so 2016

should "cool the enthusiasm" of investors. They "will have to look

further out for strong growth in 2017 and beyond," Bernstein

said.

Other analysts take a brighter view of ABF's future, noting the

growing margins of the Primark division, whose retail space ABF

plans to expand by 13% in 2016. Liberum Capital analysts said the

acceleration of Primark's new-store-opening program would double

ABF's sales and profit over the next five years. Hargreaves

Lansdown Stockbrokers equity analyst Keith Bowman agreed, noting

planned expansions in Germany, the Netherlands and Belgium, as well

as the long-term opportunity in the U.S.

ABF shares were down 0.4% to 3,422 pence in afternoon London

trading.

Write to Razak Musah Baba at Razak.Baba@wsj.com

Access Investor Kit for "Associated British Foods Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0006731235

Access Investor Kit for "Associated British Foods Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0455194029

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 09:33 ET (14:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

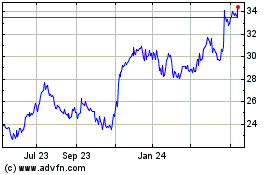

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From May 2024 to Jun 2024

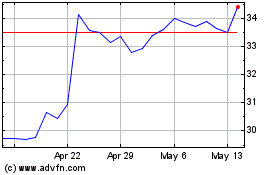

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jun 2023 to Jun 2024