Current Report Filing (8-k)

October 06 2020 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of report (Date

of earliest event reported) October 2, 2020

APPLIED ENERGETICS,

INC.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-14015

|

|

77-0262908

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2480 W Ruthrauff Road, Suite 140 Q, Tucson, Arizona

|

|

85705

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(520) 628-7415

(Registrant’s Telephone Number, Including

Area Code)

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company: ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value, $.001

|

|

AERG

|

|

OTCQB

|

Item 1.01 – Entry into a Material

Definitive Agreement.

Confidential Settlement Agreement and Release in Litigation

Involving Stein Riso Mantel McDonough, LLP, (now known as Mantel McDonough Riso, LLP)

Effective October 2, 2020, Applied Energetics,

Inc. entered into a Confidential Settlement Agreement and Release in the litigation involving Stein Riso Mantel McDonough, LLP,

(now known as Mantel McDonough Riso, LLP) (“Stein Riso”). Pursuant to the agreement, Stein Riso is to pay the company

three million dollars ($3,000,000) and return to the company ten million (10,000,000) shares of the company’s common stock,

par value $0.001 per share. Stein Riso entered into the Settlement Agreement without any admission of liability. The parties will

be filing a Stipulation of Dismissal with Prejudice as to all claims asserted or which could have been asserted in the lawsuit.

The agreement also contains standard mutual general release and confidentiality provisions.

Item 8.01 – Other Events

Update of Litigation Against Prior Management

and Related Parties

The following provides an update on events concerning

litigation involving Applied Energetics, Inc. Information regarding events occurring prior to the date of this Current Report on

Form 8-K can be found in the company’s prior Current, Annual and Quarterly Reports on Forms 8-K, 10-K and 10-Q on file with

the Securities and Exchange Commission.

See Item 1.01 for information regarding the

Settlement Agreement with Stein Riso.

As previously reported, the company has also settled its litigation with George Farley (“Farley”),

its former CEO, and AnneMarieCo, LLC (“AMC”). To clarify prior reporting on that settlement, funds in the amount of

$582,377.26, which were previously deposited by the company to secure a bond in favor of Farley and AMC in connection with the

litigation, were released once the stipulated judgment was entered by the court. Per the settlement agreement, $500,000 of those

funds were applied to the $1,500,000 purchase price for the company’s purchase of Farley and AMC’s 5 million shares

of the company’s common stock, par value $0.001 per share. The remaining funds were returned to the company.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

APPLIED ENERGETICS, INC.

|

|

|

|

|

|

By:

|

/s/ Gregory J. Quarles,

|

|

|

|

Gregory J. Quarles,

Chief Executive Officer

|

Date: October 5, 2020

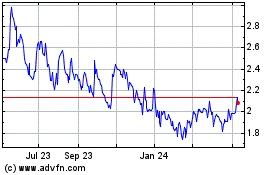

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Mar 2024 to Apr 2024

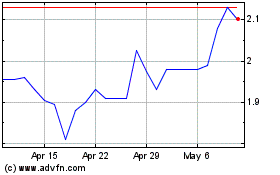

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Apr 2023 to Apr 2024