AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $2,695,000 for the first quarter of 2014. Earnings per

share (basic) in the first quarter of 2014 were $0.54 versus $0.81

in the first quarter of 2013. During the first quarter of 2013, the

Bank was able to harvest gains from its securities portfolio to add

to capital. After adjusting results for securities gains on an

after-tax basis, “core” earnings per share increased 24% to $0.54

in the first quarter of 2014 versus $0.44 in the first quarter of

2013.

“In 2013 we took advantage of having a number of securities

where the market price made it advantageous for us to sell them at

a profit and increase our capital accounts. This year, we are back

to basics, generating the bulk of our income through the spread

business. With that in mind, we think that we have gotten off to a

great start in 2014,” said Wes Schaefer, Vice Chairman and CFO.

“Core earnings are what count. Opportunities will arise to take

one-time gains in our bond portfolio from time to time and we may

choose to take advantage of those situations. However, the strength

of our Bank is based upon earnings derived from providing our

clients with superior service every day. This is a very traditional

model and one that won’t change at American Business Bank,” said

Robert Schack, Chairman.

Total assets increased 6% or $79 million to $1.387 billion at

March 31, 2014 as compared to $1.308 billion at March 31, 2013. The

loan portfolio (net) increased 14% or $72 million to $588 million

at March 31, 2014 as compared to $516 million at March 31, 2013.

Deposits increased 11.6% or $130 million to $1.243 billion at March

31, 2014 as compared to $1.113 billion at March of 2013. Borrowings

from the Federal Home Loan Bank were reduced from $70 million at

the end of the first quarter in 2013 to $34 million at the end of

the first quarter in 2014.

During the first quarter of 2014, Net Interest Income increased

$509,000 or 5% to $10,068,000 from $9,559,000 during the first

quarter in 2013.

Non-Interest income during the first quarter of 2014 decreased

$2,188,000 to $522,000 from $2,710,000 during the first quarter of

2013. This change was centered in investment gains as mentioned

above.

Non-Interest expense during the first quarter of 2014 increased

$408,000 or 6.7% to $6,473,000 from $6,065,000 during the first

quarter in 2013.

Asset quality at the end of the first quarter of 2014 remains

excellent, with $279,000 of non-performing loans, or 0.05% of total

loans; and, no OREO. At the end of March 2014, the allowance for

loan losses stood at $11,661,000 or 1.94% of loans.

AMERICAN BUSINESS BANK, headquartered in downtown Los Angeles,

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

American Business Bank Figures in $000, except per share

amounts

CONSOLIDATED BALANCE SHEET

(unaudited)

As of:

March March Change

2014 2013 %

Assets:

Cash & Equivalents $ 62,170 $ 44,290 40.4 % Fed Funds Sold

3,000 1,000 200.0 % Interest Bearing Balances 28 28 0.0 %

Investment

Securities:

US Agencies 379,423 376,582 0.8 % Mortgage Backed Securities

149,878 170,832 -12.3 % State & Municipals 162,264 157,425 3.1

% Other 2,988 2,995 -0.2

% Total Investment Securities 694,553 707,834 -1.9 %

Gross

Loans:

Commercial Real Estate 362,397 292,808 23.8 % Commercial &

Industrial 191,905 191,709 0.1 % Other Real Estate 39,783 36,864

7.9 %

Other

5,642 5,220 8.1 % Total

Gross Loans 599,727 526,601 13.9 % Allowance for Loan & Lease

Losses (11,661 ) (10,211 ) 14.2 % Net

Loans 588,066 516,390 13.9 % Premises & Equipment 955 640 49.2

% Other Assets 38,274 37,929

0.9 %

Total Assets

$ 1,387,046 $

1,308,111 6.0 %

Liabilities:

Demand Deposits $ 577,242 $ 515,501 12.0 % Money Market 595,105

517,871 14.9 % Time Deposits and Savings 71,034

80,345 -11.6 % Total Deposits 1,243,381

1,113,717 11.6 % FHLB Advances / Other Borrowings 34,500 70,500

-51.1 % Other Liabilities 5,740

19,330 -70.3 %

Total Liabilities $

1,283,621 $ 1,203,547 6.7

%

Shareholders'

Equity:

Common Stock & Retained Earnings $ 110,364 $ 94,696 16.5 %

Accumulated Other Comprehensive Income / (Loss)

(6,939 ) 9,868 -170.3 %

Total Shareholders'

Equity $ 103,425 $

104,564 -1.1 %

Total Liabilities &

Shareholders' Equity $ 1,387,046

$ 1,308,111 6.0 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.46 % 7.99 % -- Tier 1

Leverage Ratio 7.96 % 7.54 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 15.95 % 15.96 % -- Total Risk-Based Ratio 17.20 %

17.22 % --

Per Share

Information:

Common Shares Outstanding 4,945,774 4,876,664 -- Book Value Per

Share $ 20.91 $ 21.44 -2.5 % Tangible Book Value Per Share $ 20.91

$ 21.44 -2.5 %

American Business Bank Figures in

$000, except per share amounts

CONSOLIDATED

INCOME STATEMENT (unaudited) For the 3-month

period ended: March March Change

2014 2013 %

Interest

Income:

Loans & Leases $ 6,551 $ 5,870 11.6 % Investment Securities

3,921 4,215 -7.0 % Total

Interest Income 10,472 10,085 3.8 %

Interest

Expense:

Money Market, NOW Accounts & Savings 321 368 -12.8 % Time

Deposits 71 104 -31.7 % Repurchase Agreements / Other Borrowings

12 54 -77.8 % Total

Interest Expense 404 526 -23.2 % Net Interest Income

10,068 9,559 5.3 % Provision for Loan Losses (300 )

(300 ) 0.0 % Net Interest Income After Provision for

Loan Losses 9,768 9,259 5.5 %

Non-Interest

Income:

Deposit Fees 325 270 20.4 % Realized Securities Gains 7 2,689 -99.7

% Other 190 (249 ) -176.3 %

Total Non-Interest Income 522 2,710 -80.7 %

Non-Interest

Expense:

Compensation & Benefits 3,909 3,691 5.9 % Occupancy &

Equipment 516 510 1.2 % Other 2,048

1,864 9.9 % Total Non-Interest Expense 6,473 6,065

6.7 % Pre-Tax Income 3,817 5,904 -35.3 % Provision

for Income Tax (1,122 ) (1,970 ) -43.0

%

Net Income $ 2,695 $

3,934 -31.5 % Less: After-Tax Realized Securities

Gains $ 5 $ 1,792

Core Net Income $ 2,690

$ 2,142 25.6 %

Per Share

Information:

Average Shares Outstanding (for the quarter) 4,945,774 4,876,664 --

Earnings Per Share - Basic $ 0.54 $ 0.81 -32.5 %

Earnings Per Share "CORE" - Basic

$ 0.54 $ 0.44 23.8 %

American Business Bank Figures

in $000, except per share amounts

March March Change 2014

2013 %

Performance

Ratios

Return on Average Assets (ROAA) 0.79 % 1.23 % -- Return on Average

Equity (ROAE) 10.76 % 15.06 % --

Return on Average Assets "CORE" (ROAA)

0.79 % 0.67 % --

Return on Average Equity "CORE" (ROAE)

10.74 % 8.20 % --

Asset Quality

Overview

Non-Performing Loans $ - $ 322 NA Loans 90+Days Past Due

279 933 -70.1 % Total

Non-Performing Loans $ 279 $ 1,255 -77.8 % Restructured

Loans (TDR's) $ 2,563 $ 6,472 -60.4 % Other Real Estate

Owned 0 0 -- ALLL / Gross Loans 1.94 % 1.94 % -- ALLL /

Non-Performing Loans * 4179.57 % 813.63 % -- Non-Performing Loans /

Total Loans * 0.05 % 0.24 % -- Non-Performing Assets / Total Assets

* 0.02 % 0.10 % -- Net Charge-Offs $ (209 ) $ 626 -- Net

Charge-Offs / Average Gross Loans -0.04 % 0.12 % --

* Excludes Restructured Loans

AMERICAN BUSINESS BANKWes E. SchaeferVice Chairman and Chief

Financial Officer213-430-4000

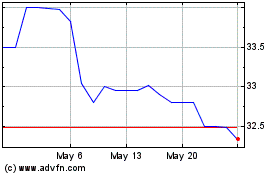

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025