0001850767

true

FY

0001850767

2022-01-01

2022-12-31

0001850767

2022-06-30

0001850767

2023-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 1 to

FORM

10-K/A

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Fiscal Year ended December 31, 2022

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

file number: 000-56257

ACCUSTEM

SCIENCES, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

87-3774438 |

(State

of other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| 5

Penn Plaza, 19th Floor, #1954 New York, NY |

|

10001 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 00 44 2074952379

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ACUT |

|

OTCQB

Venture Marketplace (“OTCQB”) |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐ No ☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b 2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant whether the registrant has filed a report on and attestation to its management’s assessment

of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b))

by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of the Company’s common stock held by non-affiliates of the registrant was $3,098,285, computed by reference

to the closing sale price of the common stock on the OTCQB Venture Marketplace on June 30, 2022, the last business day of the registrant’s

most recently completed second fiscal quarter.

As

of February 15, 2023, there were 11,346,535 shares of Common Stock, $0.001 par value outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

| Audit

Firm Id |

|

Auditor

Name: |

|

Auditor

Location: |

| 339 |

|

Mazars

USA LLP |

|

New

York, NY |

EXPLANATORY

NOTE

Accustem

Sciences, Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A to amend its Annual Report on Form 10-K for

the year ended December 31, 2022, as filed with the Securities and Exchange Commission on February 15, 2023 (the “Original Filing”),

to include the information required by Part III of Form 10-K. The Part III information was previously omitted from the Original Filing

in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated

in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal

year-end. The information required by Items 10-14 of Part III is no longer being incorporated by reference to the proxy statement relating

to our 2023 Annual Meeting of Shareholders. The reference on the cover of the Original Filing to the incorporation by reference to portions

of our definitive proxy statement into Part III of the Original Filing is hereby deleted. This Amendment No. 1 is not intended to update

any other information presented in the Original Filing. In addition, as required by Rule 12b-15 promulgated under the Securities Exchange

Act of 1934, as amended (Exchange Act), new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 by our principal

executive officer and principal financial officer are filed herewith as exhibits to this Amendment No.1. Because no financial statements

have been included in this Amendment No. 1 and this Amendment No. 1 does not contain or amend any disclosure with respect to Items 307

and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance

The

following table sets forth the names and ages of all of our current directors and executive officers. Our officers are appointed by,

and serve at the pleasure of, the Company’s Board of Directors (referred to herein as the “Board”) and/or our Chief

Executive Officer.

| Name |

|

Age |

|

Position |

| Wendy

Blosser |

|

56 |

|

Chief

Executive Officer and Director |

| Jeff

Fensterer |

|

43 |

|

Chief

Operating Officer |

| Joe

Flanagan |

|

48 |

|

Chief

Business Officer |

| Keeren

Shah |

|

46 |

|

Chief

Financial Officer |

| Gabriele

Cerrone |

|

50 |

|

Director |

| Willy

Simon |

|

70 |

|

Director |

| John

Brancaccio |

|

74 |

|

Director |

| Sean

McDonald |

|

62 |

|

Director |

Wendy

Blosser

Wendy

E. Blosser has served as our Chief Executive Officer since March 2022. Prior to joining our company, Ms. Blosser held various roles launching,

relaunching and building organizations in the diagnostic, surgical and capital spaces, with a primary focus in oncology and women’s

health. Prior to joining us, Ms. Blosser took a one year sabbatical for personal reasons. From May of 2019 through March 2021, Ms. Blosser

served as Chief Commercial Officer at Agendia N.V.. From March 2018 to May 2019, Ms. Blosser held multiple executive roles for the Caravel

Ventures portfolio (Animated Dynamics, Strand Diagnostics). From February 2015 to March 2018, Ms. Blosser was Vice President of Sales

(February 2015 to March 2017) and then Chief Commercial Officer (March 2017 to March 2018) for Biodesix. Prior to that, Ms. Blosser served

as VP of Sales with Integrated Oncology (LabCorp subsidiary). Ms. Blosser began her career in diagnostics at Cytyc Corporation holding

several leadership positions in her eight years with the company. We believe Ms. Blosser’s background launching and relaunching

products in the diagnostics space, experience providing advisory support to various companies and track record in corporate leadership

roles qualifies her to be a member of the Board of Directors.

Jeff

Fensterer

Jeff

Fensterer has been our Chief Operating Officer since December 2021. Prior to joining us, Mr. Fensterer served as Vice President of Global

Marketing and Market Strategy at Agendia N.V. from July 2019 to December 2021. During that time he led product strategy to commercialize

novel technologies and developed a marketing program resulting in strong sales volume and revenue growth. From March 2018 to June 2019,

Mr. Fensterer held multiple leadership roles for the Caravel Ventures portfolio (Animated Dynamics, Strand Diagnostics). From February

2015 to March 2018, Mr. Fensterer held various commercial leadership roles including Senior Director of Commercial Strategy for Biodesix.

Mr. Fensterer received an MBA from Carnegie Mellon Tepper School of Business in May 2015 and a BS degree from Saint Vincent College in

May 2001.

Joe

Flanagan

Joe

Flanagan has been our Chief Business Officer since January 2022. Mr. Flanagan has more than 25 years of sales excellence experience and

is a strategic expert, playing a leading role in the commercial development and successful launch of several product offerings from early-stage

diagnostic startups to large pharmaceutical companies. Prior to joining us, from April 2021 to January 2022, Mr. Flanagan held a commercial

leadership role with Ambry Genetics in their oncology franchise. From July 2019 to March 2021, Mr. Flanagan served as the Vice President

of Market Development for Agendia N.V. where he led strategic sales initiatives. From July 2018 to July 2019, he was Vice President of

Sales for Circulogene where he led the company’s efforts to sell blood-based genomic and genetic testing for patients with cancer.

From March 2015 through July 2018, Mr. Flanagan was the Area Vice President of Sales, East for Biodesix where he was responsible for

sales and revenue for the Eastern United States.

Keeren

Shah

Keeren

Shah has been our Chief Financial Officer since August 2021. Ms. Shah has also served as the Chief Financial Officer of OKYO Pharma Limited

since March 2021 and the Finance Director of Tiziana Life Sciences Limited and Rasna Therapeutics, Inc. since August 2020, having previously

served as the Financial Controller for Tiziana and its related companies from June 2016 to July 2020. Previously, Ms. Shah spent ten

years at Visa, Inc. as a senior leader in its finance team where she was responsible for key financial controller activities, financial

planning and analysis, and core processes as well as leading and participating in key transformation programmes and Visa Inc.’s

initial public offering. Before joining Visa, Ms. Shah also held a variety of finance positions at other leading companies including

Arthur Andersen and BBC Worldwide. She holds a Bachelor of arts with honours in Economics and is a member of the Chartered Institute

of Management Accountants.

Gabriele

Cerrone

Mr.

Gabriele Marco Antonio Cerrone has served as a director of our company since March 2021. Mr. Cerrone founded ten biotechnology companies

in oncology, infectious diseases and molecular diagnostics, and has listed seven of these companies on Nasdaq, two on the London Stock

Exchange Main Market and AIM Market in London. Mr. Cerrone founded Tiziana Life Sciences Ltd. and has been its Executive Chairman since

April 2014. Mr. Cerrone co-founded Cardiff Oncology, Inc., an oncology company and served as its Co-Chairman; he was a co-founder and

served as Chairman of both Synergy Pharmaceuticals, Inc. and Callisto Pharmaceuticals, Inc. and was a Director of and led the restructuring

of Siga Technologies, Inc. Mr. Cerrone also co-founded FermaVir Pharmaceuticals, Inc. and served as Chairman of the Board until its merger

in September 2007 with Inhibitex, Inc. Mr. Cerrone served as a director of Inhibitex, Inc. until its US$2.5bn sale to Bristol Myers Squibb

Co in 2012. Mr. Cerrone is the Co-Founder of Rasna Therapeutics Inc., a company focused on the development of therapeutics for leukemias;

Co-Founder of Hepion Pharmaceuticals, Inc.; Executive Chairman and Co-Founder of Gensignia Life Sciences, Inc., a molecular diagnostics

company focused on oncology using microRNA technology; and founder of BioVitas Capital Ltd. Mr. Cerrone graduated from New York University’s

Stern School of Business with a master’s degree in business administration (MBA). We believe Mr. Cerrone’s business and financial

expertise qualifies him to be a member of the Board.

Willy

Simon

Mr.

Simon has served as a director of the company since March 2021. He is a banker and worked at Kredietbank N.V. and Citibank London before

serving as an executive member of the Board of Generale Bank NL from 1997 to 1999 and as the chief executive of Fortis Investment Management

from 1999 to 2002. He acted as chairman of Bank Oyens & van Eeghen from 2002 to 2004. He was chairman of AIM-tradedVelox3 plc (formerly

24/7 Gaming Group Holdings plc) until 2014 and had been a director of Playlogic Entertainment Inc., a Nasdaq OTC listed company. Willy

Simon has been the chairman of Bever Holdings, a company listed in Amsterdam, since 2006 and Chairman of Ducat Maritime since 2015. He

is also a non-executive director of OKYO Pharma Ltd. and Tiziana Life Sciences Ltd. We believe Mr. Simon’s business expertise qualifies

him to be a member of the Board.

John

Brancaccio

Mr.

Brancaccio, a retired CPA, has served as a director of our company since March 2021 . From April 2004 until May 2017, Mr. Brancaccio

was the Chief Financial Officer of Accelerated Technologies, Inc., an incubator for medical device companies. Mr. Brancaccio served as

a director of Callisto Pharmaceuticals, Inc. from April 2004 until its merger with Synergy Pharmaceuticals, Inc. in January 2013 and

has been a director of Tamir Biotechnology, Inc. (formerly Alfacell Corporation) since April 2004, as well as a director of Hepion Pharmaceuticals,

Inc. since December 2013, Rasna Therapeutics, Inc. since September 2016, Okyo Pharma Ltd. since June 2020 and Tiziana Life Sciences Ltd.

since July 2020. Mr. Brancaccio served as a director of Synergy from July 2008 until April 2019. We believe Mr. Brancaccio’s financial

experience qualifies him to be a member of the Board.

Sean

McDonald

Mr.

McDonald has served as a director of our company since November 2022. Since January 2015, Mr. McDonald has been President and CEO of

Ocugenix, Inc., a biotech company focused on ocular diseases. From 2015 to 2016 Mr. McDonald was

a venture partner with Adams Capital Management, a venture capital firm specializing in early-stage applied technology investments. Prior

to that, from 2001 to 2014, Mr. McDonald served as the CEO of Precision Therapeutics, one of the first biotechnology companies

to marry breakthroughs in understanding of cancer biology and the use of machine learning with the goal of developing products that would

help cancer patients get the most effective cancer treatment. We believe Mr. McDonald’s business and management experience qualifies

him to be a member of the Board.

Board

of Directors

Our

Board of Directors currently consists of five members consisting of the CEO and four Non-Executive Directors.

Board

of Directors Meetings and Committees

Our

Board of Directors has established an audit committee, a nomination committee and a compensation committee. Each of these committees

operates under formally delegated duties and responsibilities.

Audit

Committee

The

audit committee of the Board comprises John Brancaccio and Willy Simon. It is chaired by John Brancaccio, and is responsible for:

| |

● |

monitoring

the quality of internal controls and ensuring our financial performance is properly measured and reported on; |

| |

|

|

| |

● |

consideration

of the Directors’ risk assessment and suggesting items for discussion at the full Board; |

| |

|

|

| |

● |

receipt

and review of reports from our management and auditors relating to the interim and annual accounts, including a review of accounting

policies, accounting treatment and disclosures in the financial reports; |

| |

● |

consideration

of the accounting and internal control systems in use throughout the Company and its subsidiaries; and |

| |

|

|

| |

● |

overseeing

our relationship with external auditors, including making recommendations to the Board as to the appointment or re-appointment of

the external auditors, reviewing their terms of engagement, and monitoring the external auditors’ independence, objectivity

and effectiveness. |

The

audit committee meets not less than twice in each financial year and has unrestricted access to our auditors.

Our

Board of Directors has determined that John Brancaccio is an “audit committee financial expert” as defined under section

5605(a)(2) of the Nasdaq Listing Rules.

In

order to satisfy the independence criteria for audit committee members set forth in Rule 10A-3 under the Exchange Act, each member of

an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors,

or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company

or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries. We believe that the

composition of our audit committee will meet the requirements for independence under current SEC rules and regulations.

Compensation

Committee

The

compensation committee of the Board comprises Willy Simon and John Brancaccio. It is chaired by Willy Simon, and is responsible for:

| |

● |

the

review of the performance of the Executive Directors; |

| |

|

|

| |

● |

recommendations

to the Board on matters relating to the remuneration and terms of service of the Executive Directors; and |

| |

|

|

| |

● |

recommendations

to the Board on proposals for the granting of share options and other equity incentives pursuant to any share option scheme or equity

incentive scheme in operation from time to time. |

In

making their recommendations, the compensation committee will have due regard to our stockholders’ interests and our performance.

In

order to satisfy the independence criteria for compensation committee members set forth in Rule 10C-1 under the Exchange Act, all factors

specifically relevant to determining whether a director has a relationship to such company which is material to that director’s

ability to be independent from management in connection with the duties of a compensation committee member must be considered, including,

but not limited to: (1) the source of compensation of the director, including any consulting advisory or other compensatory fee paid

by such company to the director; and (2) whether the director is affiliated with the company or any of its subsidiaries or affiliates.

We believe the composition of our compensation committee will meet the requirements for independence under current SEC rules and regulations.

None

of the members of our compensation committee is, or has ever been, an officer or employee of our company.

Nomination

Committee

The

nomination committee of the Board comprises John Brancaccio and Willy Simon. It is chaired by John Brancaccio, and is responsible for:

| |

● |

drawing

up selection criteria and appointment procedures for Directors; |

| |

|

|

| |

● |

recommending

nominees for election to our Board of Directors and its corresponding committees; |

| |

|

|

| |

● |

assessing

the functioning of individual members of our Board of Directors and executive officers and reporting the results of such assessment

to our Board of Directors; and |

| |

|

|

| |

● |

developing

corporate governance guidelines. |

Code

of Ethics

We

have adopted a formal Code of Business Conduct and Ethics applicable to all Board members, officers and employees. Our Code of Business

Conduct and Ethics can be found on our website at www.AccuStem.com. A copy of our Code of Business Conduct and Ethics may be obtained

without charge upon written request to Secretary, AccuStem Sciences, Inc., 5 Penn Plaza, 19th Floor, #1954 New York, NY 10001. If we

make any substantive amendments to our Code of Business Conduct and Ethics or grant any waiver from a provision of the Code of Business

Conduct and Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website,

www.AccuStem.com, and/or in our public filings with the SEC.

Item

11. Executive Compensation

Summary

Compensation Table

The

following table provides certain summary information concerning compensation awarded to, earned by or paid to our Principal Executive

Officer and our other highest paid executive officers whose total annual salary and bonus exceeded $100,000 (collectively, the “named

executive officers”) for fiscal year ended December 31, 2022. For the year ended December 31, 2021, we did not pay any cash compensation

or benefits, such as pension, retirement or similar benefits, to our executive officers.

| Name and Principal Position | |

Year | | |

Salary ($) | | |

All Other Compensation ($) | | |

Total ($) | |

| | |

| | |

| | |

| | |

| |

| Wendy Blosser | |

| 2022 | | |

| 349,263 | | |

| 105,841 | 1 | |

| 455,104 | |

| Chief Executive Officer | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Jeff Fensterer | |

| 2022 | | |

| 317,308 | | |

| 30,000 | 2 | |

| 347,308 | |

| Chief Operating Officer | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Joe Flanagan | |

| 2022 | | |

| 287,692 | | |

| 30,000 | 2 | |

| 317,692 | |

| Chief Business Officer | |

| | | |

| | | |

| | | |

| | |

| |

1) |

$58,028

relates to consultancy compensation prior to full time appointment on March 4, 2023 and $47,813 relates to bonus payment |

| |

2) |

Amount

relates to bonus payment |

Offer

Letters

Wendy

Blosser

We

entered into an offer letter with Ms. Blosser on February 18, 2022 which was effective on March 4, 2022. This offer letter entitles Ms.

Blosser to receive an initial annual base salary of $425,000 per year. Ms. Blosser is eligible to receive an annual bonus of up to 45%

of her base salary, such bonus amount to be determined by our board of directors in its sole discretion, provided that $47,813 of such

bonus was guaranteed as paid in the first quarter of 2022. Ms. Blosser received a stock option to purchase 81,667 shares of common stock

at an exercise price of $15.96 per share which options vest 10% of the shares on each of the first, second, and third anniversaries of

March 4, 2022, 20% of the shares upon the fourth anniversary of March 4, 2022, 25% of the shares upon our completion of a single equity

financing which results in net proceeds to us of not less than $30,000,000 and 25% of the shares upon us launching a CLIA certified lab

in the US by the end of 2023. The agreement provides that Ms. Blosser’s employment with us is at-will. Additionally,

Ms. Blosser is subject to a one year non-competition and non-solicitation covenant.

Jeff

Fensterer

We

entered into an offer letter with Mr. Fensterer on November 25, 2021 which was effective on December 13, 2021. This offer letter entitles

Mr. Fensterer to receive an initial annual base salary of $300,000 per year. Mr. Fensterer is eligible to receive an annual bonus of

up to 40% of his base salary, such bonus amount to be determined by our board of directors in its sole discretion. Mr. Fensterer received

a stock option to purchase 16,500 shares of common stock at an exercise price of $15.96 per share which options vest 10% of the shares

on each of the first, second, and third anniversaries of March 4, 2022, 20% of the shares upon the fourth anniversary of March 4, 2022,

25% of the shares upon our completion of a single equity financing which results in net proceeds to us of not less than $30,000,000 and

25% of the shares upon us launching a CLIA certified lab in the US by the end of 2023. The agreement provides that Mr. Fensterer’s

employment with us is at-will. Additionally, Mr. Fensterer is subject to a one year non-competition

and non-solicitation covenant.

Joe

Flanagan

We

entered into an offer letter with Mr. Flanagan on December 6, 2021 which was effective on January 17, 2022. This offer letter entitles

Mr. Flanagan to receive an initial annual base salary of $300,000 per year. Mr. Flanagan is eligible to receive an annual bonus of up

to 40% of his base salary, such bonus amount to be determined by our board of directors in its sole discretion. Mr. Flanagan received

a stock option to purchase 16,500 shares of common stock at an exercise price of $15.96 per share which options vest 10% of the shares

on each of the first, second, and third anniversaries of March 4, 2022, 20% of the shares upon the fourth anniversary of March 4, 2022,

25% of the shares upon our completion of a single equity financing which results in net proceeds to us of not less than $30,000,000 and

25% of the shares upon us launching a CLIA certified lab in the US by the end of 2023. The agreement provides that Mr. Flanagan employment

with us is at-will. Additionally, Mr. Flanagan is subject to a one year non-competition and non-solicitation covenant.

Consulting

Agreements

Keeren

Shah

We

entered into a consultancy agreement with Ms. Shah on March 1, 2021 to provide finance director services. This agreement entitles Ms.

Shah to receive a base fee of £15,000 ($18,122, based on an exchange ratio of £1.00 to $1.2081 of as of December 31, 2022)

per annum. Ms. Shah may also be eligible to receive a bonus in an amount to be determined in our sole discretion.

Ms.

Shah is not entitled to any fringe benefits. If Ms. Shah’s consultancy with the Company is terminated without cause, Ms. Shah will

be entitled to a payment in lieu of the fee in an amount equal to her base fee for all or any remaining part of the relevant period of

notice.

Ms.

Shah is also subject to a 6-month non-solicitation covenant.

Gabriele

Cerrone

We

entered into a consultancy agreement with Mr. Cerrone on January 1, 2022 to provide business development, strategic planning and corporate

finance advice, as well as to fulfill the role of Executive Chairman of the board. This agreement entitles Mr. Cerrone to receive a base

fee of $66,000 per annum. Mr. Cerrone may also be eligible to receive a bonus in an amount to be determined in our sole discretion.

Mr.

Cerrone is not entitled to any fringe benefits. If Mr. Cerrone’s consultancy with the Company is terminated without cause, Mr.

Cerrone will be entitled to a payment in lieu of the base fee in an amount equal to his base fee for all or any remaining part of the

relevant period of notice.

Mr.

Cerrone is also subject to a six-month non-solicitation covenant.

Annual

Bonus

Currently,

our senior leadership team has annual bonus opportunities of 40-45% of his or her respective salaries. The bonus plan is based upon achievement

of key corporate milestones and is contingent upon board approval. We plan to expand the bonus program as the company hires additional

employees.

Outstanding

equity awards at fiscal year end

The

following table sets forth information for the named executive officers regarding the number of shares subject to both exercisable and

unexercisable stock options as well as the exercise prices and expiration dates thereof, as of December 31, 2022. Except for the options

set forth in the table below, no other equity awards were held by any of our named executive officers as of December 31, 2022.

| | |

Option Awards1 | | |

| | |

| | |

|

| Name and Principal Position | |

Number of Securities Underlying Unexercised Options (#) Exercisable | | |

Number of Securities Underlying Unexercised Options (#) Unexercisable | | |

Option Exercise

Price ($) | | |

Option

Expiration Date |

| | |

| | |

| | |

| | |

|

| Wendy Blosser | |

| - | | |

| 490,000 | (2)(4) | |

$ | 2.13 | | |

3/23/2032 |

| Chief Executive Officer | |

| | | |

| | | |

| | | |

|

| | |

| | | |

| | | |

| | | |

|

| Jeff Fensterer | |

| - | | |

| 99,000 | (3)(4) | |

$ | 2.13 | | |

1/25/2032 |

| Chief Operating Officer | |

| | | |

| | | |

| | | |

|

| | |

| | | |

| | | |

| | | |

|

| Joe Flanagan | |

| - | | |

| 99,000 | (3)(4) | |

$ | 2.13 | | |

1/25/2032 |

| Chief Business Officer | |

| | | |

| | | |

| | | |

|

| |

1) |

For

each executive officer, the shares listed in this table are subject to a single stock option award carrying the varying exercise

prices as set forth herein. The option awards remain exercisable until they expire ten years from the date of grant, subject to earlier

expiration following termination of employment. |

| |

2) |

49,000

stock options vested on January 25, 2023 |

| |

3) |

9,900

stock options vested on January 25, 2023 |

| |

4) |

50%

of the options are time-based and 50% are performance based. |

Director

and Non-Employee Compensation

The

following table presents the total compensation for each person who served as a non-employee member of our Board and received compensation

for such service during the fiscal year ended December 31, 2022. Other than as set forth in the table and described more fully below,

we did not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee

members of our Board in 2022. Directors who are also employees do not receive cash or equity compensation for service on our Board of

Directors in addition to compensation payable for their service as employees of the Company.

| Name | |

2022

Fees

Earned

or Paid in Cash ($) | | |

2021

Fees

Earned

or Paid in Cash ($) | |

| Dr. Kunwar Shailubhai (1) | |

| 39,000 | | |

| - | |

| Gabriele Cerrone | |

| 66,000 | | |

| - | |

| Willy Simon | |

| 50,000 | | |

| 4,166 | |

| John Brancaccio | |

| 50,000 | | |

| 4,166 | |

| Sean McDonald (2) | |

| 8,333 | | |

| - | |

| |

(1) |

Dr.

Shailubhai resigned as a director on June 20, 2022. |

| |

(2) |

Sean

McDonald was appointed to the Board of Directors on November 14, 2022. A portion of the fees earned was related to services provided

prior to appointment to the Board of Directors. |

Item

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The

following table sets forth information with respect to the beneficial ownership of our common stock as of December 31, 2022 by:

| |

● |

each

of our Directors; |

| |

|

|

| |

● |

each

of our executive officers; and |

| |

|

|

| |

● |

each

person, or group of affiliated persons, who is known by us to beneficially own more than 5 per cent. of our outstanding Common Stock. |

| Name of Beneficial Owner | |

Shares | | |

Number of Ordinary

Shares Beneficially Owned

Percentage(1) | |

| Named Executive Officers and Directors | |

| | | |

| | |

| Gabriele Cerrone (2) (3) (4) | |

| 3,872,264 | | |

| 34.00 | % |

| Willy Simon | |

| 9,789 | | |

| * | |

| Keeren Shah (5) | |

| 5,251 | | |

| * | |

| John Brancaccio (6) | |

| 8,964 | | |

| * | |

| Wendy Blosser (7) | |

| 51,000 | | |

| * | |

| Sean McDonald | |

| - | | |

| - | |

| Jeff Fensterer (8) | |

| 9,900 | | |

| * | |

| Joe Flanagan (8) | |

| 9,900 | | |

| * | |

| All executive officers and directors as a group (eight persons) | |

| 3,967,068 | | |

| 34.59 | % |

| 5% Stockholders | |

| | | |

| | |

| Planwise Group Limited (1) (2) | |

| 3,294,338 | | |

| 29.03 | % |

| Tiziana Lifesciences Ltd | |

| 1,337,970 | | |

| 11.79 | % |

| * |

Represents beneficial ownership of less than one percent. |

| |

|

| (1) |

“Percentage of Shares Beneficially Owned” is based on 11,346,535 common stock issued and outstanding as at December 31, 2022. |

| |

|

| (2) |

Gabriele Cerrone, a director of our company, is the beneficial owner of the entire issued share capital of Planwise Group Limited. Planwise Group Limited is incorporated in the British Virgin Islands with a registered address at Offshore Incorporations Centre, P.O. Box 957, Road Town, Tortola, British Virgin Islands. |

| |

|

| (3) |

This includes shares held by Mr. Cerrone personally and shares held by Planwise Group Limited and Panetta Partners Limited (being entities in which Mr. Cerrone is considered to have a beneficial interest). |

| |

|

| (4) |

Consists of 41,041 stock options which are currently exercisable or exercisable within 60 days of December 31, 2022 |

| |

|

| (5) |

Consists of 5,001 stock options which are currently exercisable or exercisable within 60 days of December 31, 2022 |

| |

|

| (6) |

Consists of 8,964 stock options which are currently exercisable or exercisable within 60 days of December 31, 2022 |

| |

|

| (7) |

Consists of 49,000 stock options which are currently exercisable or exercisable within 60 days of December 31, 2022 |

| |

|

| (8) |

Consists of 9,900 stock options which are currently exercisable or exercisable within 60 days of December 31, 2022 |

Beneficial

ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect

to our common stock. Common stock subject to options that are currently exercisable or exercisable within 60 days after December 31,

2022 are considered outstanding and beneficially owned by the person holding the options for the purpose of calculating the percentage

ownership of that person but not for the purpose of calculating the percentage ownership of any other person. Except as otherwise noted,

the persons and entities in this table have sole voting and investment power with respect to all of the common stock beneficially owned

by them, subject to community property laws, where applicable. The information in the table above is based on information known to us

or ascertained by us from public filings made by the shareholders We have also set forth below information known to us regarding any

significant change in the percentage ownership of our common stock by any major shareholders during the past three years. The major shareholders

listed below do not have voting rights with respect to their common stock that are different from the voting rights of other holders

of our common stock. To our knowledge there has been no significant change in the percentage ownership held by the major shareholders

listed above in the last three years. We are not aware that the Company is directly owned or controlled by another corporation, any foreign

government or any other natural or legal person (s) severally or jointly. We are not aware of any arrangement, the operation of which

may result in a Change of Control of the Company.

Equity

Compensation Plan Information

Summary

Description of the 2021 Omnibus Equity Incentive Plan

Effective

August 1, 2021 (“Adoption Date”), the Company adopted the 2021 Omnibus Equity Incentive Plan (the “Incentive Plan”)

to provide an additional incentive, strengthen the commitment, motivate to faithful and diligently perform responsibilities, attract

and retain competent and dedicated individuals whose efforts will result in the long-term growth and profitability of the company, to

selected employees, directors, and independent contractors of the company or its affiliates whose contributions are essential to the

growth and success of the company. The Plan provides that the company may grant Options, Stock Appreciation Rights, Restricted Stock,

Restricted Stock Units, and Other Stock-Based Awards. Any employee, director or consultant of the Company or any of its subsidiaries

will be eligible to participate in the 2021 Plan. The number of shares of the Company Common Stock that reserved for issuance under the

2021 Plan is 2,500,000.

Item

13. Certain Relationships and Related Transactions, and Director Independence

The

following includes a summary of transactions since January 1, 2020 to which we have been a party in which the amount involved exceeded

or will exceed the lesser of $120,000 or 1% of the average of our total assets as of December 31, 2022 and 2021, and in which any of

our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock or any member of the immediate

family of any of the foregoing persons had or will have a direct or indirect material interest, other than equity and other compensation,

termination, change in control and other arrangements, which are described elsewhere in this prospectus. We also describe below certain

other transactions with our directors, executive officers, and stockholder.

Corporate

Reorganization

AccuStem

Sciences Limited was created in connection with its demerger (spin-off) from Tiziana Life Sciences plc (“Tiziana”) and AccuStem

Sciences Limited (“Old AccuStem”) was incorporated in England and Wales on June 5, 2020 as a private company with limited

liability under the Companies Act with indefinite life and company number 12647178. The demerger was conditional upon, among other things,

court approval of a Tiziana capital reduction, which was approved by special resolution of Tiziana’s stockholders on October 2,

2020. The court sanctioned the related Tiziana capital reduction on October 27, 2020, and the demerger became effective on October 30,

2020.

The

demerger agreement provides for the transfer by Tiziana to us of the entire issued share capital of StemPrintER Sciences Limited (“StemPrintER

Sciences”), the Tiziana entity to which Tiziana contributed all of the assets and intellectual property relating to the StemPrint

project and $1,353,373 (£1,000,000) in cash.

For

the purposes of the demerger, Tiziana first transferred the assets relating to the StemPrint project (primarily the benefit of the license

from IEO/University of Milan and an outsourced research program) to a separate company, StemPrintER Sciences, together with $1,353,373

(£1,000,000) in cash. As a result of this step, StemPrintER Sciences became an operating entity. In the next step, Tiziana transferred

StemPrintER Sciences’ shares to us in return for shares to Tiziana’s stockholders, on a one for one basis, and Tiziana declared

a dividend in specie to its stockholders of those shares.

Tiziana

has and will continue to provide certain limited management and administrative services to us following the completion of the demerger

pursuant to the terms of the shared services agreement entered into with us on January 1, 2021. Pursuant to the terms of the shared services

agreement, Tiziana agreed to provide various administrative, financial, legal, tax, insurance, facility, information technology and other

services to us at a price based on a mutually agreed to cost allocation. The shared services agreement had an initial term through December

2021 and has been renewed automatically thereafter for successive three month terms. The parties may mutually terminate the shared services

agreement at any time. In addition, we can terminate the shared services agreement upon 30 days prior written notice. Both parties may

terminate the agreement upon the failure of the other party to perform its respective material obligations.

Agreements

with Our Executive Officers and Directors

We

entered into a consulting agreement with Ms. Shah on March 1, 2021 to provide finance director services. This agreement entitles Ms.

Shah to receive a base fee of £15,000 ($18,122, based on an exchange ratio of £1.00 to $1.2081 of as of December 31, 2022)

per annum. Ms. Shah may also be eligible to receive a bonus in an amount to be determined in our sole discretion.

Ms.

Shah is not entitled to any fringe benefits. If Ms. Shah’s consulting agreement is terminated without cause, Ms. Shah will be entitled

to a payment in lieu of notice to the equal to her base fee for all or any remaining part of the relevant period of notice.

Ms.

Shah is also subject to a six-month non-solicitation covenant.

Gabriele

Cerrone

We

entered into a consultancy agreement with Mr. Cerrone on January 1, 2022 to provide business development, strategic planning and corporate

finance advice, as well as to fulfill the role of Executive Chairman of the board. This agreement entitles Mr. Cerrone to receive a base

fee of $66,000 per annum. Mr. Cerrone may also be eligible to receive a bonus in an amount to be determined in our sole discretion.

Mr.

Cerrone is not entitled to any fringe benefits. If Mr. Cerrone’s consultancy with the Company is terminated without cause, Mr.

Cerrone will be entitled to a payment in lieu of the base fee in an amount equal to his basic fee for all or any remaining part of the

relevant period of notice.

Mr.

Cerrone is also subject to a 6-month non-competition and non-solicitation covenant.

GenSignia

IP Ltd. License Agreement

On

June 23, 2022, we entered into an Assignment and Assumption Agreement with GenSignia pursuant to which GenSignia assigned all of its

rights under a license agreement between Biomirna Holdings Ltd. and GenSignia Inc. effective as of December 21, 2011, as amended (the

“MSC License”), to us. Gabriele Cerrone, our Chairman is the Chairman of GenSignia. The MSC License provides for the payment

of up to $400,000 in milestone payments and low single digit percentage in royalties based on net sales. The MSC License remains in effect

until the royalty term has expired with respect to all licensed products in all countries. The MSC License may be terminated by either

party in the event of a material breach and in addition, we may terminate the MSC License at any time upon 90 days’ notice.

Family

Relationships

There

are no family relationships among any of our directors or executive officers.

Director

Independence

Our

board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning

his background, employment and affiliations, our board of directors has determined that Messrs. Simon, Brancaccio and McDonald do not

have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director

and that each of these directors is “independent” as that term is defined under the listing standards of the Nasdaq Capital

Market. In making these determinations, our board of directors considered the current and prior relationships that each non-employee

director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence,

including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described

in this section.

Item

14. Principal Accountant Fees and Services

Mazars

LLP has been our auditor since our incorporation on June 5, 2020 and for registration statement filed on Form 20-F filed under International

Financial Reporting Standards (IFRS); its address is Tower Bridge House, St Katharine’s Way, London E1W 1DD, United Kingdom. Mazars

is registered to perform audits in the U.K. by the Institute of Chartered Accountants in England and Wales and is a registered auditor

with the PCAOB. In March 2022, the Audit Committee approved the appointment of Mazars USA LLP; its address 135 West 50th Street, New

York 10020 as the Company’s new independent registered public accounting firm. Mazars USA LLP completed the audit of the Company

under US GAAP for the periods ended December 31, 2022 and 2021.

Current

Independent Registered Public Accounting Firm Fees

The

Audit Committee works with our management in order to negotiate appropriate fees with its independent registered public accounting firm

and is ultimately responsible for approving those fees. The following is a summary and description of fees for services provided by the

independent registered public accounting firms in fiscal years 2022 and 2021. Other than as set forth below, no professional services

were rendered or fees billed by Mazars USA LLP or Mazars LLP during fiscal years 2022 and 2021.

| | |

2022 | | |

2021 | |

| Audit Fees* | |

$ | 155,567 | | |

$ | 44,187 | |

| Audit Related Fees | |

| — | | |

| — | |

| Tax Fees | |

| — | | |

| — | |

| All Other Fees | |

| — | | |

| — | |

| Total | |

$ | 155,567 | | |

$ | 44,187 | |

*

Mazars USA LLP was not engaged until 2022, accordingly no fees were paid to Mazars USA LLP in 2020 or 2021. The amount billed in 2022

includes invoices for the audit for the year ended 2022 and 2021. In 2023, we have been billed or expect to be billed approximately $76,000

for the audit for the year ended 2022.

Item

15. Exhibits, Financial Statement Schedules

| 3.1 |

Amended and Restated Certificate of Incorporation of AccuStem Sciences Inc. (incorporated by reference to Exhibit 3.1 to Form 8-K filed December 3, 2021) |

| |

|

| 3.2 |

Bylaws of AccuStem Sciences Inc. (incorporated by reference to Exhibit 3.2 to Form 8-K filed December 2, 2021) |

| |

|

| 4.1 |

Form of common stock certificate (incorporated by reference to Exhibit 4.1 to Form S-1 filed November 17, 2022) |

| |

|

| 4.2 |

Demerger Agreement between Tiziana Life Sciences PLC and AccuStem Sciences Limited dated October 5, 2020 (incorporated by reference to Exhibit 4.3 to Form 20-F filed March 12, 2021) |

| |

|

| 4.3 |

Supplemental Demerger Agreement between Tiziana Life Sciences PLC and AccuStem Sciences Limited dated October 30, 2020 (incorporated by reference to Exhibit 4.4 to Form 20-F filed March 12, 2021) |

| |

|

| 4.4* |

Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of 1934 |

| |

|

| 10.1 |

License Agreement dated June 24, 2014 by and between TTFactor Srl and Fondazione Firc per l’Oncologia Molecolare and Universita degli Studi di Milano and Tiziana Life Sciences plc (incorporated by reference to Exhibit 4.5 to Form 20-F filed May 7, 2021) |

| |

|

| 10.2 |

Form of Indemnification Agreement (incorporated by reference to Exhibit 10.1 to Form 8-K filed December 3, 2021) |

| |

|

| 10.3 |

AccuStem Sciences Inc. 2021 Omnibus Equity Incentive Plan (incorporated by reference to Exhibit 10.2 to Form 8-K filed December 3, 2021) |

| |

|

| 10.4 |

Shared Services Agreement by and between Accustem Sciences Ltd. and Tiziana Life Sciences plc dated as of January 1, 2021 (incorporated by reference to Exhibit 10.4 to Form S-1 filed November 17, 2022). |

| |

|

| 10.5 |

Offer Letter dated February 18, 2022 between Accustem Sciences, Inc. and Wendy Blosser (incorporated by reference to Exhibit 10.5 to Form S-1 filed November 17, 2022). |

| |

|

| 10.6 |

Offer Letter dated November 25, 2021 between Accustem Sciences, Inc. and Jeff Fensterer (incorporated by reference to Exhibit 10.6 to Form S-1 filed November 17, 2022) |

| |

|

| 10.7 |

Offer Letter dated December 6, 2021 between Accustem Sciences, Inc. and Joe Flanagan (incorporated by reference to Exhibit 10.7 to Form S-1 filed November 17, 2022) |

| |

|

| 10.8 |

Consulting Agreement dated March 21, 2021 between Keeren Shah and Accustem Sciences, Inc. (incorporated by reference to Exhibit 10.8 to Form S-1 filed November 17, 2022) |

| |

|

| 10.9 |

Consulting Agreement dated January 1, 2022 between Gabriele Cerrone and Accustem Sciences, Inc. (incorporated by reference to Exhibit 10.9 to Form S-1 filed November 17, 2022) . |

| |

|

| 10.10 |

First Amendment to License Agreement by and between AccuStem Sciences, Inc., Istituto Europeo di Oncologia Srl and Universita degli Studi di Milano, dated November 9, 2022 (incorporated by reference to Exhibit 10.10 to Form S-1 filed November 17, 2022) . |

| |

|

| 10.11 |

Amendment to Consulting Agreement dated July 22, 2021 between Keeren Shah and Accustem Sciences, Inc. (incorporated by reference to Exhibit 10.11 to Form S-1 filed November 17, 2022) |

| |

|

| 21.1 |

List of Subsidiaries (incorporated by reference to Exhibit 8.1 to Form 20-F filed May 7, 2021) |

| |

|

| 24.1* |

Power of Attorney (included on signature page) |

| |

|

| 31.1 |

Certification of Principal Executive Officer required under Rule 13a-14(a)/15d-14(a) under the Exchange Act. |

| |

|

| 31.2 |

Certification of Principal Financial Officer required under Rule 13a-14(a)/15d-14(a) under the Exchange Act. |

| |

|

| 32.1* |

Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| |

|

| 32.2* |

Certification of Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

101.INS*

Inline XBRL Instance Document

101.SCH*

Inline XBRL Taxonomy Extension Schema Document

101.CAL*

Inline XBRL Taxonomy Extension Calculation Linkbase Document

101.DEF*

Inline XBRL Taxonomy Extension Definition Linkbase Document

101.LAB*

Inline XBRL Taxonomy Extension Label Linkbase Document

101.PRE*

Inline XBRL Taxonomy Extension Presentation Linkbase Document

104

Cover Page Interactive Data File (embedded within the Inline XBRL document)

*

Previously filed.

Item

16. Form 10-K Summary

Not

applicable.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed

on its behalf by the undersigned, thereunto duly authorized on April 28, 2023.

| |

ACCUSTEM

SCIENCES, INC. |

| |

(Registrant) |

| |

|

| |

/s/

Keeren Shah |

| |

Keeren

Shah |

| |

Chief

Financial Officer |

In

accordance with the Securities Exchange Act of 1934, this Report has been signed below on April 28, 2023 by the following persons on

behalf of the Registrant and in the capacities indicated.

| * |

|

| Wendy

Blosser |

|

| Chief

Executive Officer and Director |

|

| |

|

| * |

|

| Keeren

Shah |

|

| Chief

Financial Officer |

|

| |

|

| * |

|

| Gabriele

Cerrone |

|

| Director |

|

| |

|

| * |

|

| Sean

McDonald |

|

| Director |

|

| |

|

| * |

|

| Willy

Simon |

|

| Director |

|

| * |

|

| John

Brancaccio |

|

| Director |

|

| *By: |

/s/

Keeren Shah |

|

| Attorney-in- Fact |

|

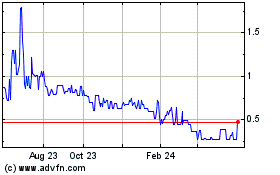

Accustem Sciences (QB) (USOTC:ACUT)

Historical Stock Chart

From Nov 2024 to Dec 2024

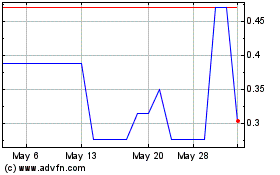

Accustem Sciences (QB) (USOTC:ACUT)

Historical Stock Chart

From Dec 2023 to Dec 2024