Vancouver, British Columbia - September 19, 2013. Nortec

Minerals Corp. ("Nortec") announces that Finore Mining

Inc., ("Finore") has filed an independent Technical Report

("Technical Report") on Sedar detailing the results on the updated

resources and potential on the Lantinen-Koillismma Project (the "LK

Project").

Nortec is the majority shareholder of Finore controlling 60% of

the issued and outstanding shares. Finore has an option to earn

100% of the Project through the acquisition of Nortec Minerals Oy

("NorMinOy"), a wholly-owned subsidiary of Nortec.

The Technical Report, entitled "A Technical Report on the

Lantinen Koillismaa Project, Finland For Finore Mining Inc.", was

prepared by Mining Plus Canada Consulting Ltd. ("MP Consulting"),

an accredited international mining consulting corporation. The

report complies with the NI 43-101 guidelines. Further details are

provided at the end of the press release.

Summary of Mineral Resource Estimates for

LK Project at a cut-off grade of O.1 g/t Palladium*

Kaukua Deposit (Main Zone)

-------------------------------------------------------

|Category |Tonnage Mt|Pd g/t|Pt g/t|Au g/t|Cu %|Ni** %|

| | | | | | | |

|-----------------------------------------------------|

|Indicated|10.4 |0.73 |0.26 |0.08 |0.15|0.1 |

|-----------------------------------------------------|

|Inferred |13.2 |0.63 |0.22 |0.06 |0.13|0.1 |

-------------------------------------------------------

Haukiaho Deposit (Melarame, Torkoaho and West

Torkoaho zones)

------------------------------------------------------

|Category|Tonnage Mt|Pd g/t|Pt g/t|Au g/t|Cu %|Ni** %|

| | | | | | | |

|----------------------------------------------------|

|Inferred|23.2 |0.31 |0.12 |0.10 |0.21|0.14 |

------------------------------------------------------

* A sharp boundary Pd assay at a cut-off of 0.1 g/t was

interpreted as the waste contact. The high correlation for Pt and

Pd means that both metals can be used for defining the geometry of

mineralization for the Kaukua and Haukiaho deposits. The grade is

continuous along the strike of both deposits. At higher cut-off

grades of 0.2 g/t Pd for Haukiaho and 0.3 g/t Pd for Kaukua the

total resource estimates do not change significantly.

**Ni is the total Nickel content.

The recent mineral resource estimates place the LK Project as

the second largest undeveloped PGE+Gold deposit in Finland," said

Peter Tegart, Director of Nortec and President & CEO of Finore

Mining Inc. "In addition, considerable upside potential remains to

these deposits, with opportunities to expand both deposits along

strike and depth. There is also excellent potential to discover

entirely new deposits within the Koillismaa-Narankavaara intrusive

complex which has only been investigated for a small portion of the

strike length as exposed on surface. I feel confident that we will

achieve our objective to efficiently define large, economically

viable Palladium-Platinum-Gold-Copper-Nickel near-surface resource

bodies through our implementation of (a) increasing the confidence

level of the known mineral resources, (b) expanding the known

deposits and (c) testing for potential new deposits."

The LK Project consists of 40 claims and 5 pending claims

totaling 3,787 hectares and covers three distinct ultramafic blocks

within the Koillismaa-Narankavaara intrusive complex. The LK

Project is located in north central Finland approximately 60 km

north of the company's exploration office in the village of

Taivalkoski. It is 130 km ESE of the town of Rovaniemi and 160 km

NE of the port town of Ouluand, is accessable by major paved roads

with local access on gravel or dirt roads.

There are four target areas on the LK Project, Haukiaho, Kaukua,

Murtolampi and Lipeavaara. Over 33,000 metres of drilling was

carried out by Nortec and Finore on Haukiaho and Kaukua with

historical drilling by Geological Survey of Finland ("GTK") on the

Mutolampi and Lipeavaara zones.

The Haukiaho Target consists of three mineralized fault

separated blocks: West Torkoaho (West) Zone, Torkoaho (Central)

Zone and Melarame (East) Zone. The Torkoaho Zone appears to thicken

and flatten to the east with only three drill holes Hau11-10,

Hau11-18 and the GTK drill hole R386 drilled over a strike distance

of 400 metres. As reported in the Company's and Nortec's press

releases dated September 11, 2012, the results from the three drill

holes are listed below. The intersections are core lengths only and

true thicknesses are not calculated.

Hole Hau11-010: 25.0 metres @ 0.72g/t PGE+Au; 0.23% Cu; 0.18% Ni

from 66 metres

Hole R-386: 46.65 metres @ 0.88g/t PGE+Au; 0.30% Cu; 0.20% Ni

from 36.05 metres

Hole Hau12-018: 26.0 metres @ 1.01g/t PGE+Au; 0.33% Cu; 0.26% Ni

from 104 metres

and 31.6 metres @ 1.04g/t PGE+Au; 0.34% Cu; 0.22% Ni from 134

metres

As recommended in the MP Consulting Report a systematic drilling

program is planned along strike and dip from these holes over a

length of 500 metres. The objective of this drilling is to improve

the confidence level of this inferred resource to an indicated

category.

It is also planned to infill drill the West Torkoaho Zone to

generate an indicated resource from an inferred resource now

estimated in the MP Consulting Report. As reported in the Company's

and Nortec's press releases dated September 11, 2012, the West

Torkoaho Zone was identified by only two holes drilled on the

western margins of the Torkoaho Zone where Hau11-16 returned 30

metres grading 1.04g/t PGE+Au, 0.30% Cu and 0.20% Ni including 16.3

metres of 1.45g/t PGE+Au, 0.42% Cu and 0.28% Ni. These

intersections are also core lengths only and more drilling is

required to calculate the true thicknesses. The West Torkoaho Zone

is open along strike to the west for over 500 metres. From the

drilling done to date, both Zones have the potential for higher

grades than what was identified thus far in the Melarame Zone.

In the Kaukua East Zone several intersections returned

significant results not included in the resource estimation by MP

Consulting and a systematic drilling campaign is recommended to

bring the Kaukua East Zone to resource level.

MP Consulting, in consultation with Finore, recommends

implementing a two phase program to increase the size and

definition of the Haukiaho and Kaukua zones. The budget for this

phase of the project is estimated to be about C$1,733,000. MP

Consulting, Nortec and Finore believe that additional mineral

resources will likely be found in these zones in addition to better

defining the Zones to an indicated category. A second phase of work

is recommended to explore along the strike extent of the

Kollismaa-Narankavaara ultrabasic intrusive complexes and defined

by geophysical surveys and owned by NorMinOy. This includes known

zones within the Lipeavaara and Murtolampi zones, where preliminary

drilling was carried out by GTK that is estimated to cost about

C$540,000.

Nortec and Finore's experience in Finland has been positive with

both the laws of the country and our interaction with the

professionals working for NorMinOy. Finland was ranked 1st in the

world on the Policy Potential Index of the Fraser Institute's

2012-2013 survey (PDAC International Convention 2013). The country

was also recently ranked as the best place in the world for mining

investments according to Resource Stocks Magazine's 2012 World Risk

Survey. According to the GTK website, a total of 50 mines and

quarries were operating in 2012.

Peter F. Tegart, Director of Nortec and President and CEO of

Finore and Mohan R. Vulimiri, M.Sc., P.Geo., Chairman and CEO of

Nortec and Director of Finore are the persons responsible for

initiating and guiding the work programs on the LK Project and

Mohan Vulimiri is the Qualified Person responsible for the contents

of this press release.

About Nortec Minerals Corp

Nortec is a mineral exploration and development company based in

Vancouver, British Columbia. Nortec is the majority shareholder of

Finore controlling 60% of the issued and outstanding shares. The

Company has a 100% interest in the Tammela Gold & Lithium

Project in South-West Finland; an option to earn from Akkerman

Exploration B.V., a 100% interest in the Seinajoki Gold Property

and Kaatiala Beryllium-Rare Earth Property in Western Finland. The

Company recently sold its 51% interest, subject to net smelter

royalties, in the TL Nickel-Copper-Cobalt Property in Northern

Labrador, Canada to Vulcan Minerals Inc.; Information on the

Company's projects can be referred to on

http://www.nortecminerals.com/.

On behalf of the Board of Directors,

NORTEC MINERALS CORP.

"Mohan R. Vulimiri"

Mohan R. Vulimiri, CEO and Chairman

The TSX Venture Exchange has not reviewed and does not

accept the responsibility for the adequacy or accuracy of this news

release.

This press release contains certain forward looking

statements which involve known and unknown risks, delays and

uncertainties not under the Company\'s control which may cause

actual results, performances or achievements of the Company to be

materially different from the results, performances or expectations

implied by these forward looking statements. This news release does

not constitute an offer to sell or a solicitation of an offer to

buy any of the securities in the United States.

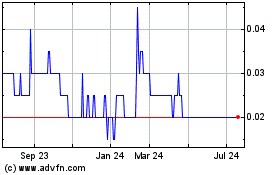

Nortec Minerals (TSXV:NVT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nortec Minerals (TSXV:NVT)

Historical Stock Chart

From Jan 2024 to Jan 2025