Newcore Gold Ltd. ("Newcore" or the "Company")

(TSX-V: NCAU, OTCQX: NCAUF) is pleased to announce it has engaged

the independent engineering consultants Lycopodium, Micon

International Limited and SEMS Exploration to prepare an updated

National Instrument 43-101 ("NI 43-101") Preliminary Economic

Assessment ("PEA") study for the Company’s 100%-owned Enchi Gold

Project ("Enchi" or the "Project") in Ghana. Newcore is targeting

completion and announcement of the results of the study by the end

of H1 2024.

Luke Alexander, President & CEO of Newcore

stated, "We believe updating our PEA is an important step in

continuing to advance the development of our Enchi Gold Project in

Ghana. The update will incorporate the current Mineral Resource

Estimate that was announced earlier this year, updated cost

estimates, as well as the significant metallurgical testwork that

has been completed on the Project since the last economic study was

completed in 2021.This low-cost de-risking work will continue to

advance the development of our district-scale Enchi Gold Project,

showcase its potential as an open pit, heap leach operation, while

also providing an underpinning of value for Newcore Gold."

Updated PEA Study

Newcore has engaged the independent engineering

consultants Lycopodium, Micon International Limited and SEMS

Exploration to prepare an updated NI 43-101 PEA Technical Report

for the Enchi Gold Project. The PEA will incorporate the Mineral

Resource Estimate completed in 2023, as well as the significant

metallurgical testwork completed since the last study in 2021. The

study will be led by Lycopodium, who will conduct a process plant

and infrastructure evaluation using their knowledge on operating

Ghanaian gold projects. Micon is providing mine design and

environmental services with mineral resource assessment supplied by

SEMS Exploration. The combined study team has significant

experience in successful development of not only PEA studies, but

also subsequent studies and services including construction and

operation.

Enchi Gold Project Mineral Resource

Estimate

The Enchi Gold Project hosts an Indicated

Mineral Resource of 41.7 million tonnes grading 0.55 g/t Au

containing 743,500 ounces gold and an Inferred Mineral Resource of

46.6 million tonnes grading 0.65 g/t Au containing 972,000 ounces

(see Newcore news release dated March 7, 2023). Mineral resource

estimation practices are in accordance with CIM Estimation of

Mineral Resource and Mineral Reserve Best Practice Guidelines

(November 29, 2019) and follow CIM Definition Standards for Mineral

Resources and Mineral Reserves (May 10, 2014), that are

incorporated by reference into National Instrument 43-101 ("NI

43-101"). The Mineral Resource Estimate is from the technical

report titled "Mineral Resource Estimate for the Enchi Gold

Project" with an effective date of January 25, 2023, which was

prepared for Newcore by Todd McCracken, P. Geo, of BBA E&C Inc.

and Simon Meadows Smith, P. Geo, of SEMS Exploration Services Ltd.

in accordance with NI 43-101 Standards of Disclosure for Mineral

Projects, and is available under the Company’s profile on SEDAR at

www.sedar.com. Todd McCracken and Simon Meadows Smith are

independent qualified persons ("QP") as defined by NI 43-101.

Qualified Person

Mr. Gregory Smith, P. Geo, Vice President of

Exploration at Newcore, is a Qualified Person as defined by NI

43-101, and has reviewed and approved the technical data and

information contained in this news release.

About Lycopodium

Lycopodium brings extensive studies and project

delivery experience in gold mineral processing plants in West

Africa, including Ghana. Over the past 25+ years they have

participated or delivered over 30 greenfield projects in West

Africa, and 13 within Ghana. Lycopodium have an established office

in Accra and are currently participating in a similar greenfield

gold project, located approximately 200 kilometres north of

Newcore’s Enchi Gold Project. Through their long-term and current

project experience Lycopodium have developed extensive knowledge of

Ghanian and West African suppliers and contractors, as well as

local capital and operating costs. Lycopodium has a demonstrated

track record for the development and delivery of value-optimised,

fit-for-purpose, fast to ramp up and easy to operate mineral

processing plant projects, delivered in a timely manner.

About Micon International

Limited

Micon International Limited is an independent

firm of senior geologists, mining engineers, and metallurgists

headquartered in Toronto, Ontario, Canada. Micon also maintains a

fully integrated office in Norwich, United Kingdom, as well as

retaining full-time consultants based in other locations within the

UK and France. Micon’s professional staff have extensive experience

in the mining industry with both mining companies and leading

consultancy firms. Since 1988, Micon has offered a broad range of

consulting services to clients involved in the mineral industry.

The firm maintains a substantial practice in the geological

assessment of prospective properties, the independent estimation of

mineral resources and mineral reserves, the compilation and review

of feasibility studies, the economic evaluation of mineral

properties, due diligence reviews, and the monitoring of mineral

developments on behalf of financing institutions. Micon’s practice

is worldwide and includes precious and base metals, energy

minerals, and a wide variety of industrial and specialty

minerals.

About SEMS Exploration

SEMS Exploration is the leading full-services

mineral exploration and mining consultancy company in West Africa.

Since 2002, SEMS Exploration has provided independent geological

consultancy and in-country support services to the mineral

exploration and mining industry of West Africa. During this time,

SEMS Exploration has established a reputation for dedicated, high

quality work for a wide range of clients from major mining

companies to junior exploration companies and private investors.

SEMS Exploration provides a full range of geological, mining

engineering and environmental services; from grassroots

reconnaissance through mineral resource estimations, project

management and mine design.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold Project

located in Ghana, Africa’s largest gold producer (1). The Project

currently hosts an Indicated Mineral Resource of 743,500 ounces of

gold at 0.55 g/t and an Inferred Mineral Resource of 972,000 ounces

of gold at 0.65 g/t (2). Newcore Gold offers investors a unique

combination of top-tier leadership, who are aligned with

shareholders through their 20% equity ownership, and prime district

scale exploration opportunities. Enchi’s 216 km2 land package

covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold

belt which hosts several 5 million-ounce gold deposits, including

the Chirano mine 50 kilometers to the north. Newcore’s vision is to

build a responsive, creative and powerful gold enterprise that

maximizes returns for shareholders.

On Behalf of the Board of Directors of

Newcore Gold Ltd.

Luke AlexanderPresident, CEO & Director

For further information, please

contact:

Mal Karwowska | Vice President, Corporate

Development and Investor Relations+1 604 484

4399info@newcoregold.com www.newcoregold.com

(1) Source: Production volumes for 2022 as

sourced from the World Gold Council(2) Notes for Mineral Resource

Estimate:

1. Canadian Institute of Mining Metallurgy and Petroleum ("CIM")

definition standards were followed for the resource estimate.

2. The 2023 resource models used ordinary kriging (OK) grade

estimation within a three-dimensional block model with mineralized

zones defined by wireframed solids and constrained by pits shell

for Sewum, Boin and Nyam. Kwakyekrom and Tokosea used Inverse

Distance squared (ID2).

3. Open pit cut-off grades varied from 0.14 g/t to 0.25 g/t Au

based on mining and processing costs as well as the recoveries in

different weathered material.

4. Heap leach cut-off grade varied from 0.14 g/t to 0.19 g/t in

the pit shell and 1.50 g/t for underground based on mining costs,

metallurgical recovery, milling costs and G&A costs.

5. CIL cut off grade varied from 0.25 g/t to 0.27 g/t in a pit

shell and 1.50 g/t for underground based on mining costs,

metallurgical recovery, milling costs and G&A costs.

6. A US$1,650/ounce gold price was used to determine the cut-off

grade.

7. Metallurgical recoveries have been applied to five individual

deposits and in each case three material types (oxide, transition,

and fresh rock).

8. A density of 2.19 g/cm3 for oxide, 2.45 g/cm3 for

transition, and 2.72 g/cm3 for fresh rock was applied.

9. Optimization pit slope angles varied based on the rock

types.

10. Reasonable mining shapes constrain the mineral resource in

close proximity to the pit shell.

11. Mineral Resources that are not mineral reserves do not have

economic viability. Numbers may not add due to rounding.

12. The Mineral Resource Estimate is from the technical report

titled "Mineral Resource Estimate for the Enchi Gold Project" with

an effective date of January 25, 2023, which was prepared for

Newcore by Todd McCracken, P. Geo, of BBA E&C Inc. and Simon

Meadows Smith, P. Geo, of SEMS Exploration Services Ltd. in

accordance with National Instrument 43-101 Standards of

Disclosure for Mineral Projects and is available under Newcore’s

SEDAR profile at www.sedar.com. Todd McCracken and Simon Meadows

Smith are independent qualified persons ("QP") as defined by

National Instrument 43-101.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes statements that

contain "forward-looking information" within the meaning of the

applicable Canadian securities legislation ("forward-looking

statements"). All statements, other than statements of historical

fact, are forward-looking statements and are based on expectations,

estimates and projections as at the date of this news release. Any

statement that involves discussion with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often, but not always using phrases

such as "plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "believes"

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. In this news release, forward-looking statements

relate, among other things, to: statements about the estimation of

mineral resources; timing and completion of an updated PEA; results

of metallurgical testwork, results of drilling, magnitude or

quality of mineral deposits; anticipated advancement of mineral

properties or programs; and future exploration prospects.

These forward-looking statements, and any

assumptions upon which they are based, are made in good faith and

reflect our current judgment regarding the direction of our

business. The assumptions underlying the forward-looking statements

are based on information currently available to Newcore. Although

the forward-looking statements contained in this news release are

based upon what management of Newcore believes, or believed at the

time, to be reasonable assumptions, Newcore cannot assure its

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Forward-looking information also involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include, among others: risks related to the speculative

nature of the Company’s business; the Company’s formative stage of

development; the Company’s financial position; possible variations

in mineralization, grade or recovery rates; actual results of

current exploration activities; fluctuations in general

macroeconomic conditions; fluctuations in securities markets;

fluctuations in spot and forward prices of gold and other

commodities; fluctuations in currency markets (such as the Canadian

dollar to United States dollar exchange rate); change in national

and local government, legislation, taxation, controls, regulations

and political or economic developments; risks and hazards

associated with the business of mineral exploration, development

and mining (including environmental hazards, unusual or unexpected

geological formations); the presence of laws and regulations that

may impose restrictions on mining; employee relations;

relationships with and claims by local communities; the speculative

nature of mineral exploration and development (including the risks

of obtaining necessary licenses, permits and approvals from

government authorities); and title to properties.

Forward-looking statements contained herein are

made as of the date of this news release and the Company disclaims

any obligation to update any forward-looking statements, whether as

a result of new information, future events or results, except as

may be required by applicable securities laws. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

information.

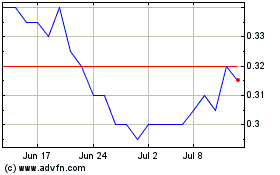

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Jan 2024 to Jan 2025