NevGold Announces Convertible Securities Financing of up to C$8 Million

August 26 2024 - 8:45AM

NevGold Corp. (“

NevGold” or the

“

Company”) (

TSXV:NAU) (OTCQX:NAUFF)

(Frankfurt:5E50) is pleased to announce a financing of

unsecured convertible securities (“the Financing”) with Mercer

Street Global Opportunity Fund II, LP, managed by C/M Global GP,

LLC (“the Investor” or “Mercer”). The Financing is structured in

two tranches with the funded amounts being C$3.5 million for the

first tranche and a potential of up to C$4.5 million in a second

tranche pursuant to the terms of a convertible security funding

agreement dated August 23, 2024 between the Company and the

Investor.

NevGold CEO, Brandon Bonifacio,

comments: “We are pleased to announce this financing

package and further capital support from Mercer, who have been a

strong supportive shareholder of the Company over recent years. The

financing will allow us to continue to advance our high-quality

portfolio of gold and copper assets in the Western USA, with the

proceeds focused on drilling our Nutmeg Mountain and Limousine

Butte oxide, heap-leach gold projects, along with advancing our

Zeus copper project through the first phase of systematic

exploration. Although the financing markets remain challenging with

commodity prices reaching all-time highs, this funding package

provides a flexible structure which will allow us to rapidly

advance our portfolio leading to significant news flow and

developments over the coming year.”

Use of ProceedsThe Company

intends to use the aggregate net proceeds raised from the Financing

for general working capital purposes and to strategically advance

its Nutmeg Mountain (Idaho) and Limousine Butte (Nevada) oxide,

heap-leach gold projects, and its Zeus Copper Project (Idaho).

Closing of each tranche of the Financing is

subject to customary closing conditions, including the approval of

the TSX Venture Exchange (the “Exchange”).

Key Terms of the Financing

Tranche 1 (“First

Convertible Security”)

|

Term: |

24 months |

|

Funded Amount: |

$3,500,000 |

|

Use of Proceeds: |

General working capital and to advance mineral properties |

|

Original Issue Discount (“OID”) |

$650,000 |

|

First Investment Conversion Terms: |

Principal amount of $3,500,000 will be convertible at the option of

the Investor for a 24-month period into up to 10,000,000 common

shares of the Company (each, a “Share”) at a price per Share equal

to the greater of (i) 90% of the volume-weighted average trading

per Share (in Canadian dollars) for the five (5) consecutive

trading days immediately prior to the applicable date that the

Investor provides notice of conversion, and (ii) $0.35. |

Tranche 2 (“Second

Convertible Security”)

|

Term: |

24 months |

|

Funded Amount: |

Up to $4,500,000 |

|

Use of Proceeds: |

General working capital and to advance mineral properties |

|

Original Issue Discount (“OID”) |

Up to $810,000 |

The second tranche of the Financing remains

subject to confirmation by the Company and the Investor, with

pricing and further details regarding the Second Convertible

Security to be disclosed in a subsequent press release if the

parties decide to proceed with the second tranche.

Other Key Terms

Other key terms of the Financing include:

- The Company has the right of

prepayment of the securities, at any time during the term;

- For the purposes of conversion, the

OID on the First Convertible Security and the Second Convertible

Security accrues in equal monthly installments over the 24-month

term of the applicable security. The OID will be settled in cash or

in Shares, at the option of the Investor, with any issuance of

Shares in settlement thereof subject to the approval of the

Exchange;

- Warrant Issuance: Common share

purchase warrants of the Company (each, a “Warrant”) are to be

issued to the Investor in two tranches concurrently with issuance

of the First Convertible Security (the “First Warrants”) and the

Second Convertible Security (the “Second Warrants”). The Warrants

for each tranche of the Financing will equal 50% of all funded

amounts for the applicable tranche (less the First Closing Fee if

applicable for the First Warrants). A total of up to 5,000,000

First Warrants will be issued concurrently with the First

Convertible Security. Each Warrant shall entitle the holder to

acquire one Share at the warrant exercise price for a period of 24

months from the date of issuance of the Warrant. The Warrant

exercise price is equal to 150% of the market price of the Shares

as of the price reservation date for the First Warrants or the

Second Warrants, as applicable. The exercise price for the First

Warrants will be $0.525 per Share; and

- The Company will pay a closing fee

of $120,000 (the “First Closing Fee”) to the Investor as

consideration for the First Convertible Security that will either

be settled in 342,857 Shares at the issue price of $0.35 per Share,

subject to the approval of the Exchange, or will be settled in

cash.

The First Convertible Security, the Second

Convertible Security, the Warrants and the securities issued under

such securities will be subject to a hold period expiring four

months and one day following the date of issue of the First

Convertible Security or the Second Convertible Security, as

applicable, in accordance with applicable Canadian securities

laws.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons (as defined in the U.S. Securities Act) unless registered

under the U.S. Securities Act and applicable state securities laws

or an exemption from such registration is available.

ON BEHALF OF THE BOARD

“Signed”

Brandon Bonifacio, President &

CEO

For further information, please contact Brandon

Bonifacio at bbonifacio@nev-gold.com, call 604-337-4997, or visit

our website at www.nev-gold.com.

About the CompanyNevGold is an

exploration and development company targeting large-scale mineral

systems in the proven districts of Nevada and Idaho. NevGold owns a

100% interest in the Limousine Butte and Cedar Wash gold projects

in Nevada, and 100% of the Nutmeg Mountain gold project in

Idaho.

Please follow @NevGoldCorp on

Twitter, Facebook, LinkedIn, Instagram, and YouTube.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

statements that are based on the Company’s current expectations and

estimates. Forward-looking statements are frequently characterized

by words such as “plan”, “expect”, “project”, “intend”, “believe”,

“anticipate”, “estimate”, “suggest”, “indicate” and other similar

words or statements that certain events or conditions “may” or

“will” occur. Forward looking statements in this news release

include, but are not limited to, statements regarding the planned

completion of the Financing, regulatory approval, exploration and

development plans of the Company and use of proceeds from the

Financing. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Risks, uncertainties and other factors

that could cause the Company’s plans to change include risks

related to completing the conditions precedent for each tranche of

the Financing, regulatory approval, changes in demand for and price

of gold and other commodities and currencies, and changes or

disruptions in the securities markets generally. Any

forward-looking statement speaks only as of the date on which it is

made and, except as may be required by applicable securities laws,

the Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information,

future events or results or otherwise. Forward-looking statements

are not guarantees of future performance and accordingly undue

reliance should not be put on such statements due to the inherent

uncertainty therein.

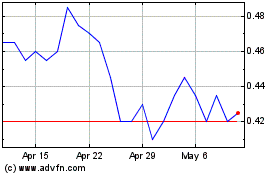

Nevgold (TSXV:NAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nevgold (TSXV:NAU)

Historical Stock Chart

From Nov 2023 to Nov 2024