- Q3’23 revenue increased approximately 13% Q/Q

quarter-over-quarter to $12.8 million, and approximately 105%

year-over-year;

- Core Virtual Pharmacy patient count increased quarter over

quarter, growing by more than 9% to ~8,000 in Q3’23 versus ~6,900

in Q2’23;

- New business partnerships signed, including Mednow’s

partnership with Medcan

Mednow Inc. (“Mednow'' or the “Company”)

(TSXV:MNOW) (OTCQX:MDNWF), Canada’s on-demand virtual pharmacy, is

pleased to announce it has released its financial results for the

period ending April 30, 2023 (“Q3 2023”). Mednow’s Financial

Statements and Management, Discussion & Analysis are available

on sedar.com and on the Company’s website,

https://investors.mednow.ca. With a renewed focus on its core

offerings of technology-enabled virtual pharmacy and virtual care

experiences, Mednow is executing on its plan to modernize the $47

Billion pharmacy industry.(1) This update outlines the key areas of

our strategic plan and showcases the early success of our

disruptive virtual pharmacy experience.

Operational highlights focus on increased growth in core

virtual pharmacy and virtual pharmacy services

- Virtual Pharmacy Growth: Strong base developed in the

“build phase” and now ready to pursue large partnership launches;

- Annualized monthly revenue for virtual care pharmacy and

Medvisit grew in May 2023 to $4.7M on an annualized

basis.

- User growth has been strong with Mednow app registrations at

17K and pharmacy patients of 8K as of May 2023 (up

approximately 700% from 1K pharmacy patients in January

2022);

- Gross margin expansion roadmap includes a focus on higher

margin: chronic conditions, virtual clinical services,

non-prescription sales and regularly scheduled subscription drug

sales, all coupled with high customer retention.

The pharmacy industry is ready for a change to digital

pharmacy

- Pharmacy is a large “offline” industry

- $47 billion dollar Canadian pharmacy market(1),

has a relatively small penetration rate online today based on

management estimates;

- Canada has a favorable competitive environment for virtual

pharmacy; and

- The U.S. already has large virtual pharmacy players (2)

- $4 billion in annual costs to the Canadian health care

system from 5% of emergency room and physician visits due to drug

non-adherence(3)

- 20% of family doctors are anticipated to retire in the

next 5 years in Toronto(4)

- 6.5 million Canadians without a family doctor(5)

- 28% of Canadians believe health care is in crisis

compared to 10% one decade earlier(6)

- 48% of Canadians are dissatisfied with health care

system(7)

Business-to-Business focus

Driven by a convergence of factors, there has been an increase

in demand for virtual pharmacy partnerships from payors and

providers, including insurance companies, union groups, employers,

and medical service providers. We believe escalating drug costs,

which constitute the largest portion of health benefit expenditure

(8), have prompted payors to seek cost-containment strategies and

greater transparency. Mednow Pharmacy, with its partnerships and

positive patient reviews, believes it is positioned to address

these needs, considering its differentiated patient and technology

experience.

In March 2022, Mednow released its new patient app into the

market with a focus on business and doctor clients. In just over a

year since its release, Mednow for Business has secured

partnerships with groups that service over 500,000 lives, making

Mednow the preferred virtual pharmacy for these individuals. With

an average patient spend of over $1,000(9) per year, even a modest

capture rate would represent significant strides for Mednow.

Although business-to-consumer marketing was part of Mednow’s

expenses in 2022 while it was building its technology and

establishing its brand, since late 2022 and for 2023 Mednow has

solely been focused on patient growth from business-to-business

partnership development.

Virtual pharmacy services for providers and patients

Medical clinics and providers are increasingly seeking ways to

reduce administrative burdens associated with prescription

management, including medication reconciliations and refill

requests, while moving away from outdated communication methods

such as faxes with pharmacies. Mednow's technology-enabled pharmacy

focuses on addressing these challenges and aims to empower medical

clinics to focus more on patient care.

Mednow aims to supplement the clinical support provided by

prescribers to their patients. For example Mednow’s Virtual

Diabetes Program in partnership with Dexcom, ensures that allied

health care professionals’ diabetic patients have access to the

best practices when it comes to medication adherence and disease

state education.

Our recent partnership announcement with Medcan, one of Canada's

largest private healthcare organizations, exemplifies the type of

growth Mednow is prioritizing—innovative, digital-first, and

interdisciplinary healthcare solutions.

Further, we believe that our services play a vital role in

bridging the healthcare gap in Canada. As an example, pharmacist

minor ailment prescribing is now permitted in provinces such as

Ontario just this year. These services, delivered by Mednow's

existing pharmacists and covered by the government, incur no costs

for patients. Paid virtual pharmacist clinical services is a new

concept and Mednow’s technology based pharmacy platform is well

positioned to address the need for free virtual care for patients

for our existing and growing patient base.

Technology investments and roadmap

Since the launch of our app in the spring of 2022, Mednow has

introduced features such as Dependents and Single Sign-On,

enhancing the pharmacy experience for our customers. Moving

forward, we remain committed to investing in software development.

Over the next 12 months, we plan on focusing on the expansion of

our over-the-counter product offerings and providing white-labeled

storefronts for other businesses to sell their products, with

Mednow acting as a trusted fulfillment partner.

As part of our commitment to advanced technology, Mednow

currently utilizes artificial intelligence (“AI”) in our

fulfillment processes through PAC vision—a machine that employs

photo analysis to identify pills in medication packages, helping

prevent medication errors and increasing central fill efficiency.

Looking ahead, we are exploring the use of AI, both internally

developed and through strategic partnerships, in areas such as

off-hours non-medical triaging, drug claims analysis, and

medication adherence. The inclusion of AI in healthcare represents

an exciting frontier, and Mednow's tech-enabled pharmacy platform

positions us to efficiently adopt AI solutions.

Lastly, Mednow aims to expand its capabilities by enabling

third-party pharmacies to serve as local last-mile fulfillment

partners. With already 70+ partnerships in place, Mednow boasts a

large pharmacy network to complement its online offering. Mednow

believes that this digital-first and robust national fulfillment

infrastructure will be competitive as more and more businesses look

for virtual pharmacy partners.

Key Financials

- Revenue increased by 13% quarter-over-quarter, to $12,785,913

during the three month period ended April 30, 2023, driven

primarily by sales from the Company's Pharmacy operating segment.

- Pharmacies based in British Columbia, Manitoba, Ontario and

Nova Scotia collectively generated revenue of $12,264,903, as

compared to $5,712,574 in the prior year’s comparative period.

- Revenue generated by doctor services was $469,536 as compared

to $486,924 in the prior year’s comparative period.

- Gross margin for the quarter increased approximately 21%

year-over-year to $1,484,859, as compared to $1,232,876 in the

prior year’s comparative period.

- EBITDA for the period was a loss of $3,133,142, as compared to

a loss of $5,056,149 in the prior year’s comparative period,

representing an increase in EBITDA of $1,927,007 compared to the

prior comparative period.

- The change is primarily due to the increase in gross profit,

resulting from higher revenues during the period, and a decrease in

share-based compensation expenses, a decrease in marketing costs,

and a decrease in headcount, partially offset against general and

administrative expenses, which are corporate costs, such as

technology.

- EBITDA is a non-IFRS financial measure and has been adjusted

for certain items. Refer to the disclosure under the heading

“Definitions of Certain Non-IFRS Financial Measures” for more

information on this non-IFRS financial measure.

- Adjusted EBITDA for the quarter was a loss of $2,881,447, as

compared to a loss of $4,285,204 in the prior year comparative

period, representing an increase in adjusted EBITDA of $1,403,757.

- Adjusted EBITDA is a non-IFRS financial measure and has been

adjusted for certain items. Refer to the disclosure under the

heading “Definitions of Certain Non-IFRS Financial Measures” for

more information on this non-IFRS financial measure. The

composition of Adjusted EBITDA has changed from the comparative

period to the current period discussed herein, as explained further

under the heading “Definitions of Certain Non-IFRS Financial

Measures - Reconciliation of Non-IFRS Financial Measures.”

Summary of Financial Results

Below is a summary of each operating segment's performance for

the three-month period ended April 30, 2023 and 2022.

For the three months ended

April 30,

2023

Pharmacies

Doctor

Services

Mednow Inc.

Total

Revenue

$ 12,264,903

$ 469,536

$ 51,474

$ 12,785,913

Cost of sales

10,938,695

351,976

10,383

11,301,054

General and administrative

2,335,953

194,215

1,910,094

4,440,262

Share based compensation

—

—

183,638

183,6387

Marketing and sales

—

867

4,327

5,914

Depreciation

335,403

6,496

306,607

648,506

Income tax expense

57,562

—

—

57,562

Other amounts in loss

97,154

590

76,409

174,153

Net loss

$ (1,499,864)

$ (84,608)

$ (2,439,984)

$ (4,024,456)

For the three months ended

April 30,

2022

Pharmacies

Doctor

Services

Mednow Inc.

Total

Revenue

$ 5,712,574

$ 486,924

$ 41,400

$ 6,240,898

Cost of sales

4,633,414

367,034

7,574

5,008,022

General and administrative

1,308,767

236,419

3,425,488

4,970,674

Share based compensation

—

—

612,713

612,713

Marketing and sales

867

1,362

891,916

894,145

Depreciation

261,765

7,293

305,128

574,186

Income tax expense

(recovery)

—

—

(134,353)

(134,353)

Other amounts in loss

—

—

(9,927)

(9,927)

Net loss

$ (492,239)

$ (125,184)

$ (5,057,139)

$ (5,674,562)

Source: Mednow’s MD&A as of

April 30, 2023

RECONCILIATIONS OF NON-IFRS

MEASURES

Three months ended

April

30,

Nine months ended April

30,

2023

2022

2023

2022

Net loss and comprehensive loss

for the

period

$ (4,024,456)

$

(5,674,562)

$

(12,859,224)

$

(16,187,042)

Interest expense

131,246

44,227

364,341

59,031

Interest expense on

convertible

debenture

54,000

—

54,000

—

Depreciation and amortization

648,506

574,186

2,035,022

970,834

Current income tax expense

57,562

—

144,947

—

EBITDA1

$ (3,133,142)

$

(5,056,149)

$

(10,260,914)

$

(15,157,177)

Loss on investment in equity

securities

—

28,392

—

117,558

Share-based compensation

183,638

612,713

862,754

3,178,535

Acquisition costs

—

129,840

11,400

217,492

Severance expenses

—

—

250,000

—

Accretion expense on

convertible

debenture

57,113

—

57,113

—

Change in FV of derivative

liability

10,944

—

10,944

—

Loss on disposal of assets and

leases

—

—

183,399

—

Adjusted EBITDA1

$ (2,881,447)

$

(4,285,204)

$ (8,885,304)

$

(11,643,592)

1 EBITDA and Adjusted EBITDA are

non-IFRS financial measures and have been discussed in the section

Definitions of Non-IFRS Financial Measures.

DEFINITIONS OF CERTAIN NON-IFRS FINANCIAL

MEASURES

This press release discloses certain non-IFRS financial measures

which are defined below (including non-IFRS financial measures for

prior year comparative periods). Non-IFRS financial measures are

not standardized financial measures under IFRS. As such, these

measures may not be comparable to similar financial measures that

are disclosed by other companies. These measures include “EBITDA”

and “Adjusted EBITDA”. These measures are provided as additional

information that is disclosed to provide further insight into the

Company's results of operations from management's perspective.

These measures should not be reviewed and assessed as a substitute

for financial information reported under IFRS. A reconciliation of

the non-IFRS measures to the IFRS measure is in the section

"Selected Financial Information".

EBITDA and Adjusted EBITDA

EBITDA represents net loss and comprehensive loss for the period

before interest expense, income taxes, and depreciation and

amortization expenses. Adjusted EBITDA represents net loss and

comprehensive loss for the period before interest expense, income

taxes, depreciation and amortization expenses, loss on investment

in equity securities, share-based compensation expense, acquisition

costs incurred, asset impairment charges, the fair value

remeasurement of the note receivable from Doko and severance

expenses. These adjustments to calculate the non-IFRS measures of

EBITDA and Adjusted EBITDA are for items that are not necessarily

reflective of the Company’s underlying operating performance. As

there is no generally accepted or standard method of calculating

EBITDA, these measures are not necessarily comparable to similarly

titled measures reported by other issuers. EBITDA and Adjusted

EBITDA are presented as management believes it is a useful

indicator of the Company’s relative financial performance. These

measures should not be considered by an investor as an alternative

to net income or other IFRS financial measures as determined in

accordance with IFRS.

The Company presents EBITDA and Adjusted EBITDA to indicate

ongoing financial performance from period to period, including

comparative prior year periods.

Reconciliation of Non-IFRS Financial Measures

The most directly comparable financial measure to EBITDA and

Adjusted EBITDA that is disclosed in the Company’s financial

statements is net loss and comprehensive loss. The following are

reconciliations of net loss and comprehensive loss to EBITDA. The

adjustments include:

- The amortization and depreciation expenses of intangible

assets, fixed assets, and the right-of-use assets of the

Company.

- The net interest expenses, which primarily includes interest

expense on the Company's credit facility and interest expense and

interest income recorded in accordance with IFRS 16.

- The underlying income taxes recorded.

The following are reconciliations of EBITDA to Adjusted EBITDA.

The adjustments include:

- The loss on investment in equity securities in connection with

the Company's investment in Life Support.

- The share-based compensation expense recorded by the Company in

connection with the stock option plan.

- The acquisition costs incurred by the Company.

- The asset impairment charges recorded by the Company as part of

its annual impairment test of goodwill and intangible assets.

- The fair value remeasurement of the promissory note with

Doko.

- The severance expenses incurred by the Company.

The composition of Adjusted EBITDA has changed from prior

comparative periods disclosed herein. Information on the reason for

the change is incorporated by reference to the Company’s Management

Discussion and Analysis (“MD&A”) for the three month period

ended October 31, 2022. The information can be found in the

MD&A under the heading “Definition of Certain Non-IFRS

Financial Measures - Reconciliation of Non-IFRS Financial

Measures.” The Company’s MD&A is available on SEDAR at

www.sedar.com under the Company’s profile.

The exclusion of certain items in calculating the non-IFRS

measures does not imply that they are non-recurring, infrequent,

unusual or not useful to investors.

- IBISWorld, Pharmacies & Drug Stores in Canada, 2020; this

figure represents the total amount spent on this industry in Canada

in 2019

- https://www.forhims.com/; https://www.capsule.com/;

https://alto.com/

-

https://add.albertadoctors.org/issues/september-october-2018/sponsored-article-2/

-

https://www.cbc.ca/news/canada/toronto/family-doctors-quitting-toronto-survey-shows-1

-

https://healthydebate.ca/2023/03/topic/millions-adults-lack-canada-primary-care

-

https://policyoptions.irpp.org/magazines/may-2023/canadian-healthcare-system-crisis-survey/.

-

https://www.ctvnews.ca/health/less-than-half-of-canadians-are-satisfied-with-provincial-

health-care-survey-1.6346995

-

https://innovativemedicines.ca/wp-content/uploads/2022/11/2022CostDriversReporFINwithLinks.pdf

- CIHI National Health Expenditure, 2019

About Mednow Inc.

Mednow (TSXV: MNOW) (OTCQX:MDNWF) is a healthcare technology

company offering virtual access with a high-standard of care.

Designed with accessibility and quality of care in mind, Mednow

provides virtual pharmacy and telemedicine services as well as

doctor home visits through an interdisciplinary approach to

healthcare that is focused on the patient experience. Mednow’s

services include free at-home delivery of medications, doctor

consultations, a user-friendly interface for easy upload, transfer,

and refill of prescriptions, access to healthcare professionals

through an intuitive chat experience and the specialized PillSmart™

system that packages prescriptions in easy-to-use daily dose packs,

each labeled with the date and time of the next dose.

To learn more, follow Mednow on Facebook, Twitter, LinkedIn, and

Instagram, or visit our website at www.mednow.ca/.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements:

This release includes certain statements and information that

may constitute forward-looking information within the meaning of

applicable Canadian securities laws. All statements in this news

release, other than statements of historical facts, including

statements regarding future estimates, plans, objectives, timing,

assumptions or expectations of future performance, including

without limitation, that Mednow expects operate in regions in

Canada other than BC and ON by way of Preferred Pharmacy Partners

and franchisees; that Mednow expects to collect technology fees

from participating pharmacies in its preferred pharmacy network,

MFB has a pipeline of groups which are expected to be launched in

the coming months and that Mednow Pharmacists are expected to

perform an in-home medication review and medication cabinet cleanup

for eligible housebound patients under the Ontario Drug benefits

program are forward-looking statement and contains forward-looking

information.

Generally, forward-looking statements and information can be

identified by the use of forward-looking terminology such as

“intends” or “anticipates”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “should”, “would” or “occur”. Forward-looking statements

are based on certain material assumptions and analysis made by the

Company and the opinions and estimates of management as of the date

of this press release,

including that Mednow will operate in regions in Canada other

than BC and ON by way of Preferred Pharmacy Partners and

franchisees; Mednow will collect technology fees from participating

pharmacies in its preferred pharmacy network, MFB has a pipeline of

groups which will be launched in the coming months and Mednow

Pharmacists will perform an in-home medication review and

medication cabinet cleanup for eligible housebound patients under

the Ontario Drug Benefits Program.

These forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking statements or forward-looking

information. Important factors that may cause actual results to

vary, include, without limitation that Mednow will not operate in

regions in Canada other than BC and ON by ways of Preferred

Pharmacy Partners and franchise or at all; Mednow will not be

successful in collecting technology fees from participating

pharmacies in its preferred pharmacy network, MFB’s pipeline of

groups will not be successfully launched in the coming months or at

all, Mednow Pharmacists will not perform an in-home medication

review and medication cabinet cleanup under the Ontario Drug

Benefits Program and the risk factors discussed or referred to in

the Company’s disclosure documents under the Company’s profile at

www.sedar.com

Although management of the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and

forward-looking information. Readers are cautioned that reliance on

such information may not be appropriate for other purposes. The

Company does not undertake to update any forward-looking statement,

forward-looking information or financial out-look that are

incorporated by reference herein, except in accordance with

applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230630044157/en/

Investor Relations: Lorraine

Cardenas ir@mednow.ca 1.855.686.6300

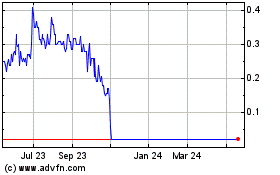

Mednow (TSXV:MNOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

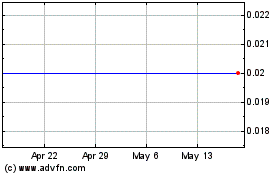

Mednow (TSXV:MNOW)

Historical Stock Chart

From Jan 2024 to Jan 2025