Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF;

Frankfurt: MRDN) – “Medallion” or the “Company”), is

pleased to announce it has entered into a definitive agreement with

ACDC Metals Ltd. (“ACDC”) whereby ACDC has the right to use

Medallion’s proprietary monazite processing technology, the

Medallion Monazite Process (“MMP”) to extract rare earth elements

(“REE”) from monazite sourced as a by-product of heavy mineral sand

production.

ACDC has secured rights to acquire interests in

four heavy mineral sand properties in Victoria, Australia, three of

which have historical mineral resources which are not compliant

with the JORC Code or National Instrument 43-101. ACDC’s business

plan includes drilling the properties with the objective of

establishing resources that comply with JORC and establishing a

pilot processing facility to demonstrate the MMP and produce sample

materials for evaluation by potential customers. This will be

funded from the proceeds from an Initial Public Offering (“IPO”) of

ACDC’s shares on the Australian Stock Exchange (“ASX”) anticipated

before the end of 2022.

Medallion currently owns 4.8 million shares of

ACDC, or approximately 15% of ACDC’s issued capital before the IPO.

Upon successful completion of the pilot plant utilizing MMP,

Medallion will receive an additional 2.5 million shares of ACDC by

converting performance shares issued to Medallion at the time of

the IPO. Upon commercial production, Medallion will be entitled to

convert other performance rights into an additional 750,000 shares

of ACDC. Upon full conversion, Medallion would own 8.05 million

shares of ACDC.

Medallion has the right to purchase or place up

to 20% of the ACDC shares issued in the IPO subject to approval of

the lead underwriter and Medallion’s diluted ownership including

shares owned and the conversion of all its performance rights not

exceeding 19.9% of ACDC’s issued share capital.

Medallion will receive a 2% royalty on the sale

of mixed REE compounds and other minerals produced by ACDC and

processed using MMP.

Demand for rare earth elements is driven by the

essential role high strength REE permanent magnets (neo magnets)

play in a wide range of consumer goods, industrial, and defense

applications. Demand growth is led by the clean energy transition

including electric vehicles and wind turbines. Industry analysts

ADAMAS Intelligence estimates that the rare earth elements used in

permanent magnets, comprising neodymium, praseodymium, dysprosium,

and terbium (magnet REEs) represented approximately 95% of the

value of global production of REEs in 2021.

Medallion believes that extracting REEs as

by-products from processing other minerals will be an important

part of meeting anticipated demand, which is one of the biggest

challenges facing the REE industry.

Medallion developed the proprietary Medallion

Monazite Process to extract REEs from monazite, which is a

by-product of heavy mineral sand processing as well as a primary

ore at Lynas Corp’s Mt Weld mine and elsewhere. Medallion believes

MMP has competitive advantages compared with other processes

including a high degree of automation, lower energy consumption,

better health and safety standards, potential for zero-liquid

discharge, and low-cost separation of cerium (a low-value REE that

is in oversupply) and radionuclides. MMP has been tested

extensively at the Australian Nuclear Science and Technology

Organization (“ANSTO”) and other recognized facilities.

On July 14, 2021 Medallion reported summary

results of an independent Techno-Economic Assessment (“TEA”) of the

MMP by process engineering and simulation specialists Simulus

Engineering (Australia). Based on a different monazite feedstock

which may not be representative of the ACDC feedstock, the TEA

predicted that a 7,000 tonnes per annum facility would produce

approximately 910kg of Mag-REOs in a mixed rare earth compound with

a contained value of approximately US$150 million based on average

REO prices in the first nine months of 2022. Medallion estimates

that mixed rare earth compounds typically sell for approximately

half the contained value of the REOs. Medallion and

ACDC have also agreed to collaborate on advancing a rare earth

refinery to process mixed REE compounds to produce separated rare

earth oxides (REOs) using the Ligand Assisted Displacement (“LAD”)

Chromatography process. The LAD Chromatography process was

developed by Purdue University, and Medallion has exclusively

licensed this technology from Purdue Research Foundation to

separate REEs from all raw material feed stocks excluding coal

sources and excluding recycled materials from manufacturing wastes

and recyclates from battery and magnet sources.

Medallion believes that LAD Chromatography,

which targets individual elements in contrast to conventional

multi-stage group separation of elements, will have environmental,

health, financial, and operational advantages over established

liquid-liquid or alternative liquid-solid processes.

"The collaboration between Medallion and ACDC

has the potential to establish a new, long-term, secure source of

REEs required for the global transition to clean energy,” stated

Mark Saxon, CEO and director of Medallion, who has also been

appointed to the board of ACDC.

“The agreement between the two companies is an

innovative way to share the economic potential and development

risks, using Medallion’s technology to enable development of rare

earth element resources in southeastern Australia and reduce the

supply concentration in the rare earth supply chain,” Saxon

continued.

Andrew Shearer, Chairperson of ACDC added, “We

are very excited to be entering into the agreements with Medallion

and collectively advancing the extraction of REE products from

monazite, using Medallion’s proprietary monazite processing

technology. The innovative technology will leverage ACDC’s

considerable resource development experience to make an integrated

mineral sand and REE operation.”

About Medallion Resources

Ltd.Medallion Resources (TSX-V: MDL; OTCQB: MLLOF;

Frankfurt: MRDN) has exclusively licensed Ligand Assisted

Displacement (“LAD”) Chromatography developed by Purdue University

from Purdue Research Foundation to separate rare earth elements

from all raw material feed stocks excluding coal sources and

excluding recycled materials from manufacturing wastes and

recyclates from battery and magnet sources. Separately, Medallion

has developed a proprietary process and related business model to

achieve low-cost, near-term, extraction of rare earth elements from

monazite, a phosphate mineral that is a common byproduct of heavy

mineral sand operations.

REEs are critical inputs to electric and hybrid

vehicles, robotics, electronics, imaging systems, wind turbines and

strategic defense systems. Medallion is committed to following best

practices and accepted international standards in all aspects of

mineral transportation, processing, and the safe management of

waste materials. Medallion utilizes Life Cycle Assessment

methodology to support investment and process decision making.

More about Medallion can be found

at medallionresources.com.

About ACDC Metals LtdACDC

Metals Ltd is a privately-held Australian company focused on

early-stage mineral exploration and resource development projects

located in Victoria, Australia. ACDC has entered into entered into

agreements to acquire mineral tenements that it considered highly

prospective for heavy mineral sands and byproduct rare earth

elements. ACDC intends to seek to list on the ASX via an Initial

Public Offering Prospectus in late 2022.

Contacts: Mark Saxon, President

& CEO, Medallion Resources +1.604.681.9558 |

msaxon@medallionresources.com

Andrew Shearer, Chairman, ACDC

Metals+61 (0) 411 720 0516 | andrew.shearer@acdcmetals.com.au

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Medallion management takes full responsibility

for the content of and has prepared this news release. Some of the

statements contained in this release are forward-looking

statements, such as statements regarding the planned completion of

ACDC’s IPO, ACDC’s business plans including the completion of a

pilot plant and achieving commercial production, the conversion of

Medallion’s performance rights into additional shares of ACDC, and

any statements that describe Medallion’s plans with respect to

general strategic matters and the advancement of its business plan,

and Medallion’s ability to advance and commercialize its technology

platforms and negotiate commercial agreements with third

parties.

Forward-looking statements are frequently, but

not always, identified by words such as "expects," "anticipates,"

"believes," "intends," "estimates," "potential," "possible,"

"projects," "plans," and similar expressions, or statements that

events, conditions or results "will," "may," "could," or "should"

occur or be achieved or their negatives or other comparable words.

Since forward-looking statements address future events and

conditions, by their very nature, they involve inherent risks and

uncertainties, including the risks related to market conditions and

regulatory approval and other risks outlined in the Company’s

management discussions and analysis of financial results. Actual

results in each case could differ materially from those currently

anticipated in these statements. These forward-looking statements

are made as of the date of this press release, and, other than as

required by applicable securities laws, Medallion disclaims any

intent or obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or results or otherwise, except as required pursuant to applicable

laws.

This release is neither an offer to sell, nor

the solicitation of an offer to buy, the Company’s securities in

the U.S. Any such offer or solicitation can only be made by means

of a prospectus, which forms a part of the Company’s registration

statement filed with the U.S. Securities and Exchange Commission on

Form

F-1:https://www.sec.gov/Archives/edgar/data/0001370496/000149315222013128/formf-1.htm.

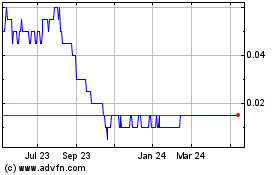

Medallion Resources (TSXV:MDL)

Historical Stock Chart

From Nov 2024 to Dec 2024

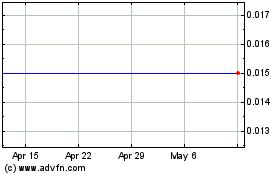

Medallion Resources (TSXV:MDL)

Historical Stock Chart

From Dec 2023 to Dec 2024