Medallion Resources Announces Completion of Techno Economic Assessment for Extraction of Rare Earth Elements From Mineral San...

July 14 2021 - 6:00AM

Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF;

Frankfurt: MRDN) – (“Medallion” or the “Company”), is

pleased to provide a summary of an independent Techno-Economic

Assessment (“TEA”) for Medallion’s proprietary process (the

“Medallion Monazite Process”) that enables sustainable extraction

of rare earth elements (“REE”) from mineral sand monazite. The TEA

was completed by process engineering and simulation specialists

Simulus Engineers (Australia).

The Medallion Monazite Process is a

proprietary method and related business model to achieve low-cost

REE production utilizing mineral sand monazite. Monazite is a rare

earth phosphate mineral globally available as a by-product from

heavy mineral sand mining operations.

The Medallion Monazite Process is a unique

commercial offering, developed by utilizing process intensification

principles. It is a highly optimized and automated design that is

transferable to many global locations and scalable in size as REE

demand grows. Medallion has recently paired this process with

patented REE separation technology developed by Purdue

University.

Key Points

- Medallion has

received from Simulus Engineers comprehensive process flow

diagrams, equipment lists, reagent, energy and personnel

requirements and energy, heat and mass balances for the Medallion

Monazite Process.

- Engineering was

completed at an assumed 7,000 tonnes per annum scale. The TEA has

demonstrated the technical and financial viability of the Medallion

Monazite Process at this scale.

- Such a facility

would deliver approximately 870 tonnes per annum of neodymium

(“Nd”) and praseodymium (“Pr”) oxide in cerium-depleted mixed

carbonate form.

- Nd and Pr oxide

are the key inputs for rare earth element permanent magnet

production, currently priced at around US$80,000 per tonne.

- REE permanent

magnets are high growth markets due to their importance for

electric mobility and renewable power generation.

- Other products

from the Medallion Monazite Process include cerium (“Ce”) oxide and

trisodium phosphate (“TSP”).

- The developed

process is zero-liquid waste delivering a high degree of

flexibility in the choice of prospective operating locations.

- The engineered

plant is very modest in land use footprint, energy and transport

needs, and is comprised of conventional off-the-shelf plant and

equipment, allowing for a short procurement to production lead

time.

-

The engineering data has allowed development of an independent and

comprehensive financial model prepared by Denco Strategic Research

& Consulting Inc. that can be easily updated for changes to

process location and operating assumptions. In the modelled “base

case” scenario, a southeastern USA setting was assumed for capital

and operating costs, while REE ratios from US-sourced mineral sand

monazite was used to model REE outputs.

- a capital cost

estimate of US$34m was determined from engineered components (not

including site specific costs) for an assumed 7,000 tonne monazite

per annum process facility. Capital costs can now be scaled for

offtake or partner specific supply conditions.

- an operating

cost of US$12 per kg of cerium-depleted mixed REE oxide (not

including monazite supply costs).

- an operating

cost of US$28 per kg of NdPr in cerium-depleted mixed REE oxide

(not including monazite supply costs; no discounting for co-product

value) is modelled.

- labor is the

largest individual operating cost, providing the possibility to

markedly lower operating costs by expanding processing capacity and

throughput to achieve labor efficiencies.

- NdPr is the

largest market by value in the REE sector and accounts for

approximately 80% of revenue achieved from typical mineral sand

monazite feedstock.

- Medallion

recently invested with Purdue University to gain an exclusive

license for proprietary environmentally-friendly REE separation

technology (Ligand Assisted Displacement (“LAD”) Chromatography).

- This process,

while presenting a substantial value add option, has not been

modelled in the TEA.

- LAD

Chromatography provides the opportunity to directly pass a pregnant

leach solution from extraction stage to separation stage,

maximizing recovery and minimizing cost.

-

A parallel Life Cycle Assessment (“LCA”) model will be delivered by

Minviro Ltd in coming weeks that summarizes the environmental

impact of the process and highlights the advantages of utilizing

by-product materials.

-

The TEA integrates and summarizes research completed to date on the

Medallion Monazite Process and is a pivotal engineering and

financial study. The models used in the TEA are designed to be

iterative and can be updated for any global setting/scenario. It is

designed to guide the Medallion Board of Directors in the future

investment decisions of the Company.

-

Research and execution plans are being developed internally for

both the monazite and LAD processes to guide on-going

research.

Based on the operating assumptions of the TEA,

results indicate the Medallion Monazite Process is technically

viable and presents positive economics for the extraction of REE

from mineral sand monazite. The specific process conditions and

supporting financial results constitute proprietary information for

Medallion that will be shared with partners and prospective

licensees under non-disclosure agreements.

“We are very pleased to have reached the TEA

milestone, which indicates the technical and financial viability of

the Medallion Monazite Process,” commented Mark Saxon, President

and CEO. “Over the past decade, Medallion has remained committed to

the vision of developing technology to reduce the environmental

impact of REE production. The process developed does not require

new mining but utilizes a high-grade relatively low-value

by-product from heavy mineral sand mining. We are now discussing

opportunities with partners and prospective licensees under NDA’s

and developing business models to maximize value from past

investment.”

Medallion has completed ten years of research

and test work with various service providers to develop a

proprietary technology for the extraction of rare earth elements

from mineral sand monazite. Medallion’s caustic cracking method was

developed with economic and sustainability goals, seeking to

minimize process cost while maximizing the resource efficiency of

REE production and ensuring waste materials are minimized and

captured. More than 90% of the raw material feedstock becomes

saleable products within the Medallion Monazite Process.

The developed technology is a modular and

transferable method to sustainably produce rare earth elements from

a by-product mineral widely available from global operating mineral

sand mines. A vast majority of mineral sand mining occurs within

the Australia, Africa and Southeast Asian regions. Currently

monazite from these operations is either sold to Chinese customers

or left on site where it achieves no value. A sustainable and

efficient process to extract REEs from mineral sand monazite can

deliver REE security without the need for additional mining.

The Medallion Board is reviewing the TEA results

to make determinations about Medallion’s further investments toward

developing and monetizing the Medallion Monazite Process.

Independent financial modelling and market research has indicated a

licensing/partnership business approach with parties that have

access to mineral sand monazite is likely most appropriate during

the current high monazite price environment. As a result, Medallion

is actively seeking opportunities for collaboration and technology

licensing with mineral sand mining companies within favorable

jurisdictions.

Medallion continues to assess acquisition and

investment opportunities within the REE and mining sectors.

CLICK HERE TO VIEW FIGURE 1.

Envisaged rare earth element monazite to magnet supply chain

utilizing the Medallion Monazite Process and Purdue’s LAD

Chromatography. Red box outlines the system boundary for the

current Techno Economic Assessment.

About Medallion Resources

Medallion

Resources (TSX-V: MDL; OTCQB: MLLOF;

Frankfurt: MRDN) has developed a proprietary process and related

business model to achieve low-cost, near-term, rare-earth element

(REE) production by exploiting monazite. Monazite is a rare-earth

phosphate mineral that is widely available as a by-product from

mineral sand mining operations. Furthermore, Medallion has recently

licensed an innovative REE separation technology from Purdue

University which can be utilized by Medallion and sub-licensed by

Medallion to third party REE producers.

REEs are critical inputs to electric and hybrid

vehicles, electronics, imaging systems, wind turbines and strategic

defense systems. Medallion is committed to following best practices

and accepted international standards in all aspects of mineral

transportation, processing and the safe management of waste

materials. Medallion utilizes Life Cycle Assessment methodology to

support investment and process decision making.

More about Medallion (TSX-V: MDL; OTCQB: MLLOF;

Frankfurt: MRDN) can be found

at medallionresources.com.

Contact(s):

Mark Saxon, President & CEO

+1.604.681.9558 or info@medallionresources.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Medallion management takes full responsibility

for content and has prepared this news release. Some of the

statements contained in this release are forward-looking

statements, such as statements that describe Medallion’s plans with

respect to further investment in and options for monetizing the

Medallion Monazite Process, and the potential for Medallion to

complete further acquisitions within the REE and mining sectors.

Since forward-looking statements address future events and

conditions, by their very nature, they involve inherent risks and

uncertainties, including the risks related to market conditions and

regulatory approval and other risks outlined in the company’s

management discussions and analysis of financial results. Actual

results in each case could differ materially from those currently

anticipated in these statements. In addition, in order to proceed

with Medallion’s plans, additional funding will be necessary and,

depending on market conditions, this funding may not be forthcoming

on a schedule or on terms that facilitate Medallion’s

plans. These forward-looking statements are made as of the

date of this press release, and, other than as required by

applicable securities laws, Medallion disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, except as required pursuant to applicable laws.

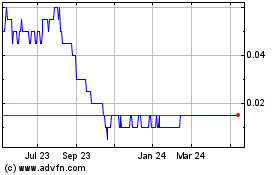

Medallion Resources (TSXV:MDL)

Historical Stock Chart

From Dec 2024 to Jan 2025

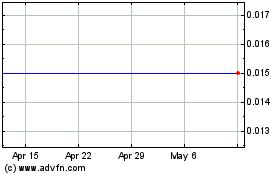

Medallion Resources (TSXV:MDL)

Historical Stock Chart

From Jan 2024 to Jan 2025