Klondike Silver Acquires Former Producers in Slocan Silver Camp

July 23 2009 - 11:23AM

Marketwired Canada

Klondike Silver Corp. (the "Company") (TSX VENTURE:KS) is pleased to report that

it has acquired additional mineral properties in and around the Sandon Silver

Camp of south-central British Columbia, including several past-producing mines.

Klondike Silver is the dominant landholder in the Slocan Camp, which has

produced more than 70 million ounces of silver plus by-product base metals since

the late 1800s. The Company's holdings now encompass 29 former producers,

extensive exploration lands and a fully permitted 100-tonne-per-day flotation

mill.

The Company acquired the following properties and historic mines from Locke

Goldsmith, an internationally experienced mine and mineral exploration geologist

credited with several mineral discoveries in the Slocan Mining Camp. Soil

geochemistry is now underway or completed on the majority of these properties

and results are forthcoming.

- HALLMAC: This former producer (1980-1984) has rail in place and natural

ventilation and strong air flow from the adit. Proposed work, including

drill-testing, would focus on the projected position of the lode on the 1690

Level.

- VULTURE: Historical mapping and soil sampling suggest that an offset portion

of the previously mined lode at this former producer (pre-1900 and 1952) may be

present upslope and east of the drift. A second mineralized lode is exposed on

an adjacent claim. The lower Vulture adit has not yet been located. A soil

sampling program has recently begun and proposed work includes hand-trenching

and underground mapping.

- ENTERPRISE: This former producer was worked by various parties to 1972, with

production from a "dry" ore silica vein with high silver and low base metals.

Sampling in 1980 returned positive results at the face of the 8 Level (lowest

adit). Large dumps at several portals were selectively sampled, with results

suggesting some fractions contain appreciable mineralization. Further sampling

is proposed, along with site work (road clearing, etc.).

- CHAMBERS: One adit and several stopes to surface have been located at this

past-producing mine, which operated intermittently to 1984. Proposed work will

focus on higher grade, silver-rich areas if the adit portal is open.

- ADAMS LODE: Several adits were developed to explore lodes on the Chicago and

Cristein claims. The Adams Lode has been projected by soil geochemistry to

continue from Sandon Creek through these claims. A sample of the lode assayed

28.36 oz silver per ton, 52.42% lead and 1.40% zinc. Hand-trenching along the

trend of the geochemical anomalies is proposed.

- CONDUCTOR: The Conductor Lode may be a northeastern extension of the formerly

productive Alamo Lode. Soil geochemistry and geological mapping have identified

three or more lodes and two mineralized breccia zones. Samples from an exposed

lode and nearby dumps have returned positive results. More work is planned,

including sampling, mapping, hand-trenching, and drilling of the Conductor Lode

and possibly other lodes.

- TUFA: This former crown grant has no recorded history, although adits and

trenches exist on the property. Results are awaited from recent soil sampling

and may be followed by an underground sampling program using existing adits.

- VERNON: This area has no published history, but covers a weak geochemical

anomaly that may be tested with further soil sampling.

Klondike Silver's exploration efforts in and around the Sandon Silver Camp are

focused on reviving the most promising historic mines near the existing mill and

exploring historic and more recently discovered lodes with production potential.

The Company is also pleased to announce that it has completed a private

placement announced on June 17, 2009. This private placement consisted of

9,500,000 flow through units at a price of $0.06 per unit. Each unit consisted

of one flow-through common share and one common share purchase warrant. Each

common share purchase warrant will entitle the holder to purchase one common

share until July 13, 2011 at $0.10 per share. Any shares issued will be subject

to a hold period expiring on November 15, 2009. Barrington Capital Corp. was

paid a cash commission totaling $45,600.

The Company also announces an amendment and the closing of a private placement

previously announced June 25, 2009. The total number of units is increased from

10,000,000 units to 10,610,000 units. The private placement consisted of

2,310,000 flow through units and 8,300,000 non flow-through units, totaling

10,610,000 units at a price of $0.06 per unit. Each unit consisted of one

flow-through common share or non flow-through share and one common share

purchase warrant. Each common share purchase warrant will entitle the holder to

purchase one common share until July 12, 2011 at $0.10 per share. Any shares

issued will be subject to a hold period expiring on November 14, 2009. Union

Securities Ltd. and Wolverton Securities Ltd. were paid a cash commission

totaling $5,520.

Proceeds of the private placements will primarily be used for exploration

programs, property option payments and general working capital.

The Qualified Person for the purpose of National Instrument 43-101 is Trygve

Hoy, PEng, PhD who has read and agreed with the technical information in this

news release.

About Klondike Silver:

Klondike Silver Corp. has assembled a quality portfolio of silver properties in

historic mineral districts in North America, and is applying advanced

exploration technologies to add value to these core assets. Klondike Silver is

reviving the Gowganda and Elk Lake silver camps in Ontario, and the world-famous

Klondike district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently processing material

from one of its Yukon properties and local mines in the historic Slocan Silver

Camp.

Klondike Silver is a member of the Hughes Exploration Group of Companies and is

led by a team with a stellar track record of discovery and development in

Canada.

Visit Klondike Silver's web-site: www.klondikesilver.com to see Smartstox

interviews with Company President, Richard Hughes.

The statements made in this news release may contain forward-looking statements

that may involve a number of risks and uncertainties. Actual events or results

could differ materially from the Company's expectations and projections.

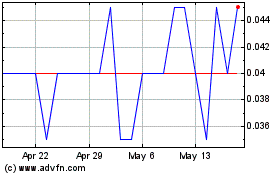

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jun 2024 to Jul 2024

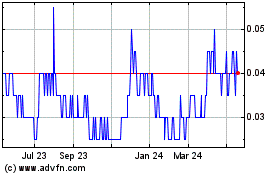

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jul 2023 to Jul 2024