Klondike Silver Increases Land Position in Slocan Silver Camp and Closes Private Placement

June 26 2009 - 11:07AM

Marketwired

Klondike Silver Gold Corp. (TSX VENTURE: KS) (the "Company") is

pleased to report that it has aggressively staked new mineral

properties in and around the Sandon Silver Camp of south-central

British Columbia. The newly expanded land package now encompasses

more than 4,500 hectares and includes 25 past-producing mines and a

fully permitted 100-tonne-per-day flotation mill.

Klondike Silver is by far the dominant landholder in the Slocan

Camp, which has produced more than 24 million ounces of silver plus

by-product base metals since the late 1800s. The Company's holdings

consist of 2,261 hectares of crown-granted mineral claims and

22,852 hectares of mineral claims, with new additions as

follows.

- Corrigan Mine Group: 145 hectares were added adjacent to the

active and promising Jackson Mine claims to cover three

past-producers. The Corrigan Mine was known for its high grades

(16,043.71 g/t silver, 34.1% lead and 2.6% zinc). The others are

the Rio Mine (8,025 g/t silver, 31.1% lead and 6.0% zinc) and the

Silver Bell Mine (5,130 g/t silver and 45.8% lead).

- Hewitt Mine Area: 956 hectares of new ground was staked

adjacent to the Company's 41 crown-granted claims.

- Silverton Creek Area: 951 hectares of new claims were staked,

including the past-producing Jennie Lind, Canadian and Ivanhoe

Mines on Silver Ridge. This area also covers the Iron Mask

silver-lead-zinc-gold showing near the valley bottom.

Klondike Silver's exploration efforts in and around the Sandon

Silver Camp are focused on reviving the most promising historic

mines near the existing mill and exploring a highly prospective

land package focused on five main project areas.

The newly expanded, contiguous land package extends from the

heights of Silver Ridge (Idaho Peak, Selkirk Peak and Sandon Peak)

to the valley bottom at Sandon, and up and over Payne Mountain

north to Three Forks and beyond.

The Company also announces an amendment to and the closing of a

private placement previously announced April 21, 2009. The total

number of units has been increased from 10,000,000 to 11,040,332

units for total proceeds of $662,420. Each of the units was priced

at $0.06 and consists of one flow-through or non flow-through

common share and one non flow-through non-transferable share

purchase warrant entitling the holder to purchase one additional

non-flow through common share for a period of two years at a price

of $0.10 per share. The financing has been fully subscribed and the

Company is pleased to announce the closing of this private

placement. The proceeds of the private placement will be used for

exploration programs, property option payments and general working

capital.

The securities issued under the private placement are subject to

a four month hold period. In connection with the closing of the

private placement, the Company paid a finder's fee of $7,996 to

Bolder Investment Partners Limited representing 8% of the gross

proceeds through Bolder Investment Partners Limited. The Company

also paid a finders' fee of $540 to Barrington Capital Corp. and

$540 to Richardson Partners Financial Limited representing 8% of

the gross proceeds through Barrington Capital Corp. and Richardson

Partners Financial Limited.

The Company also announces an amendment to and the closing of a

private placement previously announced May 29, 2009. The total

number of units has been increased from 12,500,000 to 13,700,332

units for total proceeds of $820,820. Each of the units was priced

at $0.06 and consists of one flow-through or non flow-through

common share and one non flow-through non-transferable share

purchase warrant entitling the holder to purchase one additional

non-flow through common share for a period of two years at a price

of $0.10 per share. The financing has been fully subscribed and the

Company is pleased to announce the closing of this private

placement. The proceeds of the private placement will be used for

exploration programs, property option payments and general working

capital.

The securities issued under the private placement are subject to

a four month hold period. Included in the private placement was the

sale of 8,333,332 flow-through units to MineralFields Group. In

connection with the transaction, Limited Market Dealer Inc. was

paid a total cash commission of $40,000 and Mr. Ben Lee was paid

$4,224 representing 8% of the gross proceeds of the private

placement through Ben Lee.

About MineralFields

MineralFields Group (a division of Pathway Asset Management) is

a Toronto-based mining fund with significant assets under

administration that offers its tax-advantaged super flow-through

limited partnerships to investors throughout Canada during most of

the calendar year, as well as hard-dollar resource limited

partnerships to investors throughout the world. Information about

the MineralFields Group is available at www.mineralfields.com.

The Qualified Person for the purpose of National Instrument

43-101 is Trygve Hoy, PEng, PhD who has read and agreed with the

technical information in this news release.

About Klondike Silver:

Klondike Silver Corp. has assembled a quality portfolio of

silver properties in historic mineral districts in North America,

and is applying advanced exploration technologies to add value to

these core assets. Klondike Silver is reviving the Gowganda and Elk

Lake silver camps in Ontario, and the world-famous Klondike

district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently

processing material from one of its Yukon properties and local

mines in the historic Slocan Silver Camp.

Klondike Silver is a member of the Hughes Exploration Group of

Companies and is led by a team with a stellar track record of

discovery and development in Canada.

The statements made in this news release may contain

forward-looking statements that may involve a number of risks and

uncertainties. Actual events or results could differ materially

from the Company's expectations and projections.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy or contents of this news release.

Contacts: Corporate Inquiries: Klondike Silver Corp. Kevin Hull

or Alan Campbell (604)-685-2222 info@klondikesilver.com Or visit

Klondike Silver's web-site: www.klondikesilver.com to see Smartstox

interviews with Company President, Richard Hughes AGORACOM Investor

Relations KS@agoracom.com

http://www.agoracom.com/ir/KlondikeSilver

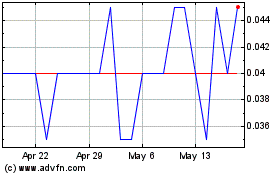

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jun 2024 to Jul 2024

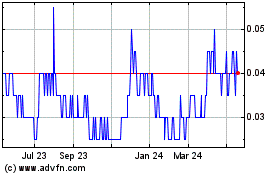

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jul 2023 to Jul 2024