Drilling on the First of Six Gold Hosting Mineralised Zones on Desert Gold's Farabantourou Permit Yields Better Than Anticipa...

April 23 2013 - 9:17AM

Marketwired Canada

Desert Gold Ventures Inc. (TSX VENTURE:DAU) (the "Company" or "Desert Gold") is

pleased to publish a NI43-101 compliant mineral resource statement following the

successful completion of a drilling program at the Barani East Gold Project

("the project") on its Farabantourou permit in Mali. Farabantourou is located in

Western Mali on the Senegal-Mali Fault Zone (SMFZ), 40km south of the

IAMGOLD/AngloGold Anshanti Sadiola Mine and 50km north of Randgold's Loulou

Mine. Both these mines are on the SMFZ.

Barani East is the first of 6 prospects with proven gold mineralization to be

developed by Desert Gold on the permit. The project was drilled to a depth of

120m and is open to depth in the southern part of the deposit.

Highlights include the following:

-- An indicated mineral resource of 514,000 tonnes at 2.46 grams per tonne

for 40,600 ounces of gold.

-- An inferred mineral resource of 828,000 tonnes at 2.53 grams per tonne

for 67,300 ounces of gold.

-- The mineral resource lends itself to an opencast mining operation.

-- Gold mineralization extends down from surface with high grade

intersections made at shallow depths e.g.

-- BERC12-002 13m at a gold grade of 7.81g/t from 17m to 30m. Estimated

true width 11.5m

-- BERC12-003 10m at a gold grade of 8.40g/t from 26m to 36m. Estimated

true width 8.8m

-- BERC12-005 8m at a gold grade of 3.54g/t from 1m to 9m. Estimated

true width 7m

-- Continuous gold mineralization over a lateral extend of 400m

Table 1: Barani East Mineral Resource Statement.

----------------------------------------------------------------------------

2013(April, 05)

Tonnes Grade (g/t) Gold Ounces

----------------------------------------------------------------------------

Indicated Mineral Resources 514,000 2.46 40,600

----------------------------------------------------------------------------

Inferred Mineral Resources 828,000 2.53 67,500

----------------------------------------------------------------------------

(i) Reported at cut-off grade of 1.0 grams of gold per tonne assuming an

open pit extraction scenario, a gold price of US$1,300 per ounce, and

metallurgical recoveries of 90%. Mineral resources are not mineral reserves

and do not have a demonstrated economic viability.

----------------------------------------------------------------------------

The Barani East indicated mineral resource has been defined to a maximum depth

of 120m below surface and over a strike length of 400m. The orientation of the

mineralized zone is NNE to SSW with mineralization occurring from surface,

dipping SSE at 45 degrees. Gold mineralization is associated with quartz

hematite rocks and kaolinite veins. Thickness of the mineralized zone varies

with an average thickness of 4.5m and a maximum width of up to 15m. As with

these types of deposits, gold grades vary significantly along strike and down

dip.

Farabantourou Strategy

Desert Gold's Farabantourou permit strategy is to develop the other 5 gold

prospects to a mineral resource definition stage similar to what has been

achieved at Barani East. Funding for drilling on the other 5 prospects may well

be provided out of mining revenue from a low cost opencast mining operation on

Barani East to extract the resource identified from surface to 120m depth. A

preliminary feasibility study is underway to define the capex and cost

associated with a potential mining operation to extract the resource as defined

from surface.

High grade Au intersections of 9.99g/t over 4m and 8.60g/t over 3.5m at 120m

vertical depth show potential for developing an underground resource at Barani

East following the exploitation of the open pit resource.

Historic drill intersections on other gold prospects on the Farabantourou permit

include:

-- Barani: 2m at 7.00g/t of gold, 3m at 3.2g/t of gold.

-- Keniegoulou: 4m at 5.9g/t of gold, 3m at 5.0g/t of gold and 20m at

1.6g/t of gold.

-- Linnguekoto: 2m at 3.75g/t of gold, 5m at 1.93g/t of gold

-- Dambamba: 3m at 4.80g/t of gold, 12m at 1.90g/t of gold

-- Kousilli: 4m at 6.20g/t of gold, 18m at 1.29g/t of gold

Technical Parameters

Drilling was conducted over 50m line spacing with holes 25m apart. Results are

based on 5954m of reverse circulation drilling in 58 holes and 452m of diamond

drilling in 5 holes. Historic drill results were verified by 12 reverse

circulation and 5 diamond drill holes in a twinning drill program. Drill chip

samples from the 2012 drilling campaign were assayed by ALS Chemex in Bamako, an

ISO approved facility. Core samples were assayed by SGS laboratories in

Johannesburg, South Africa. Quality assurance and quality control procedures

have been implemented including the use of blanks, standards and duplicates.

Samples were analysed by gold fire assay with an atomic absorption finish.

The Mineral resource for the Barani East Deposit was estimated by Minxcon (Pty)

Ltd, a South African based exploration, resource estimation and mining

consulting company. The mineral resource was estimated using a geostatistical

block modelling approach with blocks of 20 by 20 by 3m and were constrained by

mineralization wireframes. The resource statement mentioned is based on a 1g/t

Au cut-off.

To view the maps associated with this press release, please view the following

link: http://media3.marketwire.com/docs/DAU-Maps-423.pdf.

About Desert Gold

Desert Gold Ventures Inc. is an advanced exploration and development company

which holds mining assets in Mali, Rwanda and Senegal.

For further information concerning Desert Gold Ventures Inc. and the TransAfrika

material properties, please refer to Desert Gold's SEDAR profile at

www.sedar.com or visit our website at www.desertgold.ca.

The information in this report that relates to an indicated and inferred mineral

resource has been reviewed by CJ Muller, registered as a Professional Natural

Scientist with the South African Council for Natural Scientific Professions. He

has sufficient experience which is relevant to the style of mineralisation and

types of deposits under consideration and to the activity which he is

undertaking to qualify as a Qualified Person as defined in National Instrument

43-101.

This news release has been prepared on behalf of the board of directors of

Desert Gold, which accepts full responsibility for its contents.

For further information concerning Desert Gold and the TransAfrika material

properties, please refer to Desert Gold's SEDAR profile at www.sedar.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Desert Gold Ventures Inc.

Roeland van Kerckhoven

President and CEO

1 (604) 566-9240

1 (604) 408-9301 (FAX)

roelandvk@desertgold.ca

Desert Gold Ventures Inc.

Jared Scharf

CFO

1 (416) 662-3971

1 (604) 408-9301 (FAX)

jared.scharf@desertgold.ca

www.desertgold.ca

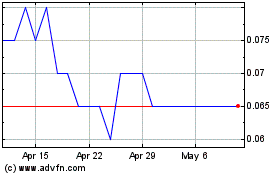

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jul 2023 to Jul 2024