Barisan Gold Extends Two of Its Exploration Licenses

December 24 2012 - 7:30AM

Marketwired Canada

Barisan Gold Corporation (TSX VENTURE:BG) wishes to inform shareholders that

that two of its majority-owned Indonesian subsidiaries, PT Linge Mineral

Resources ("Linge") and PT Takengon Mineral Resources ("Takengon"), have

received extensions to their Exploration Izin Usaha Pertambangan ("IUP"). The

two IUPs have been extended until December 28, 2014. Exploration IUPs are

exploration licenses, which allow their owners the right to conduct mineral

exploration on the ground they cover, subject to other relevant permits,

government and local approvals, if applicable. Exploration IUPs are granted for

up to a total period of eight years, covering one year for general surveys,

three years for exploration, extendable for one year, with a maximum extension

of twice the respective extension period, and one year for a feasibility study,

extendable for one year, following which they must either be relinquished or

upgraded to Production-Operation IUPs.

The Linge IUP is 80% owned by Barisan Gold and is solely operated by the

Company. The IUP contains the Abong gold deposit which at a 0.4g/t gold cut-off,

has an estimated an NI 43-101 compliant inferred resource of 8.5 million tonnes

of 1.49g/t gold and 10.7 g/t silver, containing 405,000 ounces of gold and 2.9

million ounces of silver. The IUP also contains the Bahu, Middle Ise-Ise and

Lower Ise-Ise gold-copper porphyry prospects. Linge continues to work with local

government authorities seeking forestry borrow-use permits, which would allow

Linge to resume drilling at Abong and other gold-copper porphyries.

The Takengon IUP is 75% owned by Barisan Gold and is solely operated by the

Company. The IUP contains the Collins epithermal gold prospect as well as the

Semelit, West Semelit and Tanga gold-copper porphyry prospects.

Barisan Gold also wishes to advise that it has just begun exploratory drilling

at the Collins epithermal gold prospect, located within the Takengon IUP. The

previous owner of the project had conducted mapping and sampling at Collins over

the past few years, the results of which were positive and identified narrow

high-grade gold veins at surface. Recent mapping by Barisan Gold has confirmed

and has re-defined at least two sub-parallel quartz vein zones which contain

high grade gold besides a low grade 1.6-3.2 meter wide main quartz vein. The

Collins prospect is located in Areal Penggunaan Lain ("APL"), which means an

area that is not classified as forest pursuant to a decree of the Ministry of

Forestry. The initial program consists of 2,000 meters of drilling to test the

continuity of the veins with grade at depth. The initial drilling program is

expected to cost less than $300,000 and will count towards the work commitment

under the Takengon IUP documentation. Barisan Gold strives to conduct

economically sensible drilling that targets high probability targets while

conserving the Company's financial resources.

Dibiansyah Hamid, MAIG, the designated QP within the meaning of NI 43-101, has

reviewed and approved the content of this release.

To receive or stop receiving BG news via email, please email

info@barisangold.com and state your preference in the subject line.

FOR FURTHER INFORMATION, visit the Company's website at www.barisangold.com.

About Barisan Gold Corporation

Barisan Gold (TSX VENTURE:BG) is a Canadian-based minerals exploration company

listed on the TSX Venture Exchange under the symbol "BG". The Company is engaged

in the exploration, acquisition and development of mineral properties in

Indonesia. Barisan Gold currently owns and operates three gold and gold-copper

properties in Indonesia's Aceh Province on the northern tip of Sumatra Island,

namely the Barisan gold-copper porphyry belt, the Abong epithermal gold project

and the Takengon gold-copper porphyry prospect. Barisan Gold currently has

40,706,186 shares outstanding.

Caution Regarding Forward Looking Statements

Certain statements in this News Release, which are not historical in nature,

constitute "forward looking statements" within the meaning of that phrase under

applicable Canadian securities law. These statements reflect management's

current assumptions and expectations regarding future work programs (such as

those planned for the Collins epithermal gold prospect), results, performance or

events as of the date hereof and by their nature are subject to certain

underlying assumptions, known and unknown risks and uncertainties and other

factors which may cause actual results, performance or events to be materially

different from those expressed or implied by such forward looking statements.

Those risks include the interpretation of drill results and the estimation of

mineral resources and reserves; the geology, grade and continuity of mineral

deposits; the possibility that future exploration, development or mining results

will not be consistent with our expectations; commodity and currency price

fluctuation; failure to obtain adequate financing; regulatory, permitting and

licensing risks; and general market and mining exploration risks.

Forward-looking statements should not be construed as investment advice. Readers

should perform a detailed, independent investigation and analysis of the Company

and are encouraged to seek independent professional advice before making any

investment decision. Accordingly, readers should not place undue reliance on any

forward looking statement. Except as required by applicable securities laws, the

Company disclaims any obligation to update or revise any forward looking

statements to reflect events or changes in circumstances that occur after the

date hereof.

FOR FURTHER INFORMATION PLEASE CONTACT:

Barisan Gold Corporation

Kristy Reynolds

Investor Relations

Vancouver: +1 604 684 2183

reynolds@barisangold.com

www.barisangold.com

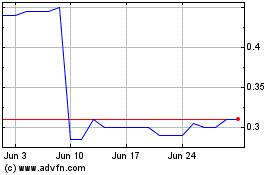

Appulse (TSXV:APL)

Historical Stock Chart

From May 2024 to Jun 2024

Appulse (TSXV:APL)

Historical Stock Chart

From Jun 2023 to Jun 2024