Yellow Media Limited (TSX:Y)

-- The Company experiences a 10.6% year-over-year growth in digital

revenues across its core YPG operations during the first quarter of 2014

-- Customer penetration of the Yellow Pages 360 degrees Solution reaches

29.9% as at March 31, 2014, as compared to 18.9% last year

-- The Company records net earnings of $39.2 million during the first

quarter of 2014, as compared to $53.5 million for the same period last

year

-- A $73.5 million principal mandatory redemption payment on the 9.25%

Senior Secured Notes is anticipated to be made on June 2, 2014

-- Yellow Media develops a Return to Growth Plan to support its digital

transformation and return the Company to revenue growth and stable

profitability

Yellow Media Limited (TSX:Y) (the "Company" or "Yellow Media") released its

operational and financial results today for the first quarter ended March 31,

2014. The Company continues to advance the second phase of its digital

transformation, designed to bring Yellow Media closer to its long-term objective

of becoming Canada's leading local digital company.

"Supported by a healthier capital structure, the first phase of our

transformation established a solid digital foundation for us to build upon,"

said Julien Billot, President and Chief Executive Officer of Yellow Media. "We

are currently executing the second phase of our digital transformation, using

this strengthened foundation to gain a leadership position within Canada's local

digital advertising market while returning the Company to growth."

First Quarter 2014 Financial Results

Revenues for the first quarter of 2014 decreased 11.9% to $223.2 million, as

compared to $253.3 million for the same period last year.

For the first quarter of 2014, digital revenues across our core YPG operations,

which exclude the impact of Mediative and Wall2Wall, increased by 10.6%

year-over-year. Consolidated digital revenues reached $104 million in the first

quarter of 2014, representing a growth of 5.1%, and were negatively impacted by

the loss of a national account at Mediative during the second quarter of 2013.

During the first quarter of 2014, consolidated digital revenues represented

46.6% of total revenues, up from 39.1% during the same period in 2013.

Growth in digital revenues continues to result from the ongoing migration of

traditional media customers towards digital products and services, as well as

continued customer adoption of the Yellow Pages(TM) 360 degrees Solution. The

penetration of the Yellow Pages 360 degrees Solution offering amongst Yellow

Media's customer base, which is defined as customers who purchase three product

categories or more, grew to 29.9% as at March 31, 2014 compared to 18.9% the

year prior.

Print revenues continued to show stable declines during the first quarter of

2014, decreasing 22.7% year-over-year to reach $119.3 million.

EBITDA decreased to $94.6 million during the first quarter of 2014, as compared

to $115.5 million last year. EBITDA remains adversely impacted by print revenue

pressure and a lower EBITDA margin.

The EBITDA margin decreased to 42.4% for the three-month period ended March 31,

2014, as compared to 45.6% for the same period last year. The EBITDA margin for

the first quarter of 2014 was primarily affected by lower print revenues, a

change in product mix and investments required to advance the Company's digital

transformation. The EBITDA margin for the first quarter of 2014 was also

impacted by a non-recurring benefit associated with a litigation outcome.

Excluding this element, the EBITDA margin for the first quarter of 2014

decreased to 41%.

In an effort to promote long-term profitability, the Company continues to invest

in business efficiencies and the streamlining of operational processes. During

the first quarter of 2014, YPG enhanced its digital fulfillment processes by

automating the creation of Virtual Business Profiles. In addition, the Company

is presently standardizing its existing legacy architecture through

consolidation of print publishing systems and IT data centers.

For the first quarter ended March 31, 2014, the Company recorded net earnings of

$39.2 million and basic earnings per share of $1.43. This compares to net

earnings of $53.5 million and basic earnings per share of $1.91 for the same

period last year. The decrease is mainly explained by lower EBITDA.

The Company used free cash flow of $3.3 million for the first quarter of 2014,

as compared to free cash flow generation of $67.7 million last year. This

decline results mainly from higher income taxes paid in 2014, as the Company was

not required to pay income tax installments in 2013, lower EBITDA and higher

restructuring payments related to the November 2013 workforce realignment.

Yellow Media expects to generate sufficient cash flow from its operations to

invest in its digital transformation and service all future debt obligations. As

at March 31, 2014, net debt totaled $541.2 million, which compares to $533.1

million as at

December 31, 2013. On June 2, 2014, the Company anticipates making a $73.5

million mandatory redemption payment on its Senior Secured Notes.

"Yellow Media remains committed to delivering long-term, sustainable value to

its shareholders," said Ginette Maille, Chief Financial Officer of Yellow Media.

"We will increase shareholder value through execution of our digital

transformation, thereby investing in projects that promote revenue growth and

protect profitability. In addition, we will further strengthen and optimize our

capital structure by maintaining a focus on debt repayment."

Operational Update

"Yellow Media's long-term objective remains unchanged, and we strive to develop

into Canada's leading local digital company," said Billot. "The realization of

this objective will come in multiple, distinct phases to be executed over the

medium-to-long-term. As part of our second phase of transformation and Return to

Growth Plan, we have focused our investments in projects that enhance our brand,

media assets and go-to-market strategy, and, ultimately, improve our positioning

within the local digital advertising market."

Extending our Brand Promise

-- The Company repositioned its flagship local search property from

"yellowpages.ca" to "YP.ca" to boost brand recognition and strengthen

the Company's digital identity.

-- A television and digital advertising campaign was launched across Canada

to grow usage and traffic on the YP mobile application. The campaign

introduces Canadians to the new YP brand, while also highlighting the

enhancements made on the mobile application to provide shoppers with an

improved search experience.

Strengthening our Media Assets

-- Total digital visits, which measures the number of visits made across

the YP, RedFlagDeals and ShopWise desktop and mobile properties, grew to

94.1 million. This compares to 93.8 million visits for the same period

last year.

-- The Company launched its redesigned YP online and mobile properties to

provide users with more relevant search results, quick access to

trending local search themes, an improved ability to discover local

deals and popular merchants in and around their neighborhoods, as well

as faster response times.

-- Yellow Media expanded its database of business information by creating

250,000 new, more targeted business categories and adding richer

information to its national and local merchant pages. The Company also

continued the rollout of Merchant Content Collection Applications across

its sales force to promote the real-time collection and publishing of

customer information.

Enhancing our Go-to-Market Strategy

a) Promoting Customer Acquisition

-- Total customer count was 270,000 as at March 31, 2014, compared to

300,000 at the end of the same period last year.

-- Customer acquisition for the twelve-month period ended March 31, 2014

stood at 16,500. The rate of customer acquisition continued to improve,

with customer acquisition for the twelve month periods ended March 31,

2013 and December 31, 2013 having totaled 16,400 and 15,200,

respectively.

-- A new Customer Relationship Management platform was implemented across

the Company's acquisition call centers, automating the routing and

assignment of incoming leads to promote effective leads management and

nurturing.

b) Promoting Customer Retention

-- The customer renewal rate declined slightly to reach 85% as at

March 31, 2014, as compared to 86% for the same period last year.

-- The Company remains committed to providing local businesses with the

industry's most valuable, diversified and comprehensive digital

services. Yellow Media recently launched Smart Digital Display across

its sales channels, a display advertising solution that helps small and

medium enterprises ("SMEs") build an online presence by exposing their

digital banner ads to local online audiences.

-- Yellow Media also introduced a social media solution to help SMEs

establish and maintain visibility on Facebook. Currently being rolled

out to customers in Ontario and Western Canada and anticipated to be

launched nationally by June 2014, this solution provides customers with

professional Facebook Page creation, optimization of their social media

presence and Facebook Ad campaign management.

The Return to Growth Plan

Following the Company's progress in the first quarter of 2014, the Return to

Growth Plan (the "Plan") has been established to efficiently guide the Company

as it continues to execute upon its second phase of digital transformation. The

Plan serves to leverage investments made in 2013, as well as the Company's

strengthened digital foundation, to gain a leadership position within Canada's

local digital advertising market.

Successful implementation of the Plan will be promoted through ongoing focus on

the following pillars of transformation:

-- Extending the Brand Promise - Investments will be made to evolve legacy

perceptions of the brand and boost awareness of the Company's platforms

and solutions. A simplified brand architecture will be implemented,

positioning Yellow Media as a differentiated, unique digital player

within the local neighborhood economy. National multi-media campaigns

will also be deployed to increase usage of its properties and promote

customer acquisition.

-- Strengthening its Media Assets - Investments will be made across the

Company's owned and operated digital media to attract and grow

audiences. Improved content and functionalities will be added onto the

YP properties to help users best fulfill their daily needs. In addition,

the Company will develop new verticals to deliver a more targeted search

experience and expand Yellow Media's share of business search in

underpenetrated categories such as shopping, restaurants, real-estate

and leisure. An enhanced focus will also be maintained on evolving the

Company's mobile and tablet properties and providing an upgraded on-the-

go local search experience.

-- Enhancing its Go-to-Market Strategy - The Company will evolve its suite

of digital products and services by introducing simplified and more

verticalized offerings, as well as performance-based solutions that best

leverage the power of its owned and operated digital properties and

protect profitability. In conjunction with improved customer acquisition

and retention efforts, Yellow Media anticipates returning to a growth in

customer count by 2017. An expanded sales force, as well as new

technologies, processes and training programs, will be developed to

promote an acquisition-centric sales culture throughout the

organization. Furthermore, Yellow Media will enhance customer

satisfaction by improving basic service levels and introducing more

personalized levels of customer service to its clients. Lastly,

Meditative will invest to strengthen its offerings to national agencies,

customers and retailers. They will also engage in research, development

and innovation within digital marketing to help support Yellow Media's

ongoing transformation.

The Company has put in place an internal Transformation Office to implement the

Return to Growth Plan. Reporting to the Chief Executive Officer, the

Transformation Office will be led by Stephen Port, Vice President -

Transformation Office, and assume full ownership and delivery of projects

supporting the Plan.

"Successful execution of our Return to Growth Plan will significantly improve

our relationship with Canadian businesses and audiences," said Billot. "Upon

completion of the Return to Growth Plan, Yellow Media will be equipped with a

strengthened platform onto which it can diversify, start new digital businesses

and, ultimately, meet its objective of becoming Canada's leading local digital

company."

The Plan is expected to allow the Company to achieve consolidated revenue growth

by 2018. Digital revenues are anticipated to surpass print revenues in 2015 and

grow at high single-digit annual rates thereafter. As print revenue

stabilization remains challenging to forecast, the Company will continue to

optimize the profitability of the print platform through redesigned offers,

targeted directory distribution, as well as the streamlining of operational

processes. Profitability will also be promoted through the automation of various

digital fulfillment processes and improved productivity across our sales

channels.

The Company will be required to make incremental operating and capital

expenditures over the short-to-medium term to promote proper execution of the

Return to Growth Plan. Consequently, EBITDA margins will remain under pressure

relative to 2013, as additional investments will be made during the remainder of

2014 and in 2015 to strengthen the brand promise, improve the user experience

and grow and maintain digital audiences.

Annual capital expenditures will increase to approximately $85 to $90 million in

2014 and $70 to $75 million in 2015 as the Company develops IT platforms to

support growth in digital audiences, customer acquisition, customer retention

and new product introduction.

By 2018, upon returning to revenue growth, the Company anticipates EBITDA

margins to stabilize between 30% and 35% and capital expenditures to be

maintained at approximately 5% of consolidated revenues.

"The Return to Growth Plan will significantly strengthen Yellow Media's

financial profile, allowing it to maintain a sustainable level of revenue growth

and profitability," said Maille. "In conjunction, the Company will continue to

maintain an enhanced focus on debt repayment and aim to significantly delever

its balance sheet by 2018."

The Company has made organizational changes to ensure it has the right expertise

in place to implement the Return to Growth Plan. Among these changes, Rene

Poirier, Chief Information Officer of Yellow Media, will lead the organization's

Information Services and Information Technology functions and direct the

end-to-end fulfillment of all related projects. Paul Ryan, previously Chief

Technology Officer of Yellow Media, will become Mediative's Chief Technology

Officer to support their growth in the Canadian national digital advertising

market as well as foster an environment of continued digital innovation.

Investor Conference Call

Yellow Media Limited will hold an analyst and media call at 2:00 p.m. (Eastern

Time) on May 8, 2014 to discuss the first quarter 2014 results. The call may be

accessed by dialing (416) 340-2218 within the Toronto area, or 1 866 225-2055

outside of Toronto.

The call will be simultaneously webcast on the Company's website at

http://www.ypg.com/en/investors/financial-reports/2014/quarterly-reports/first-quarter-webcast.

The conference call will be archived in the Investors section of the site at

www.ypg.com.

A playback of the call can also be accessed from May 8 to May 15, 2014 by

dialing (905) 694-9451 within the Toronto area, or 1 800 408-3053 outside

Toronto.

The conference passcode is 3237581.

About Yellow Media Limited

Yellow Media Limited (TSX:Y) is a Canadian digital and print media company,

offering businesses comprehensive media solutions to meet their key marketing

objectives and providing consumers with platforms to access reliable local

business information. By helping local businesses foster stronger relationships

with their consumers through its various media, the Company encourages the

growth of thriving neighbourhood economies. Yellow Media holds some of Canada's

leading local search properties and publications including YP.ca(TM),

Canada411.ca and RedFlagDeals.com(TM), the YP, ShopWise and RedFlagDeals mobile

applications and Yellow Pages(TM) print directories. Yellow Media is also a

leader in national digital advertising through Mediative, a division of Yellow

Pages Group devoted to digital marketing and performance media services for

national-scale agencies and customers. For more information, visit www.ypg.com.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements about the objectives,

strategies, financial conditions, results of operations and businesses of the

Company. These statements are forward-looking as they are based on our current

expectations, as at May 8, 2014, about our business and the markets we operate

in, and on various estimates and assumptions. Our actual results could

materially differ from our expectations if known or unknown risks affect our

business, or if our estimates or assumptions turn out to be inaccurate. As a

result, there is no assurance that any forward-looking statements will

materialize. Risks that could cause our results to differ materially from our

current expectations are discussed in section 7 of our May 8, 2014 Management's

Discussion and Analysis. We disclaim any intention or obligation to update any

forward-looking statements, except as required by law, even if new information

becomes available, as a result of future events or for any other reason.

Financial Highlights

(in thousands of Canadian dollars - except share information)

----------------------------------------------------------------------------

For the three-month

periods ended March 31,

Yellow Media Limited 2014 2013

----------------------------------------------------------------------------

Revenues $223,203 $253,277

Income from operations $73,302 $95,595

Net earnings $39,222 $53,465

Basic earnings per share attributable to common

shareholders $1.43 $1.91

Cash flow from operating activities $10,910 $86,588

----------------------------------------------------------------------------

EBITDA(1) $94,621 $115,478

EBITDA margin(1) 42.4% 45.6%

----------------------------------------------------------------------------

Weighted average shares outstanding 27,419,026 27,955,077

----------------------------------------------------------------------------

Non-IFRS Measures(1)

In order to provide a better understanding of the results, the Company uses the

term EBITDA, defined as income from operations before depreciation and

amortization and restructuring and special charges. Management believes this

measure is reflective of ongoing operations. This term is not a performance

measure defined under IFRS. EBITDA does not have any standardized meaning and

are therefore not likely to be comparable to similar measures used by other

publicly traded companies. Management believes EBITDA to be an important

measure.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations

Amanda Di Gironimo

Senior Manager, Corporate Finance and Investor Relations

(514) 934-2680

Amanda.DiGironimo@ypg.com

Media

Fiona Story

Senior Manager, Public Relations

(514) 934-2672

Fiona.Story@ypg.com

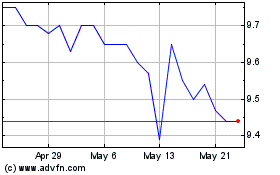

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jun 2024 to Jul 2024

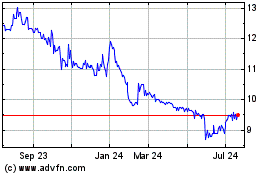

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jul 2023 to Jul 2024