Yellow Media Limited (TSX:Y) (the "Company") released its

operational and financial results today for the second quarter

ended June 30, 2013. The Company continues to invest in its digital

transformation, and remains focused on becoming the leading digital

media and marketing solutions provider for small and medium sized

businesses nationwide.

Revenues for the second quarter ended June 30, 2013 were $243.2

million compared to $286.5 million for the second quarter in 2012.

The 15.1% decline is due principally to lower print revenues and

the discontinuation of duplicate directories published by Canpages.

On a comparable basis, excluding Canpages, revenues decreased by

11.2% versus last year's results.

Digital revenues for the second quarter of 2013 grew to $98.4

million compared to $89.7 million the year prior, representing

growth of 9.7%. On a comparable basis, excluding Canpages, digital

revenues grew 12.8% versus the same period last year. Digital

revenues represented approximately 40.5% of total revenues during

the second quarter of 2013, compared to 31.3% for the same period

in 2012.

Digital revenue growth is currently unable to offset print

revenue declines. This is principally due to a decline in the

acquisition of valuable advertisers, and challenges associated with

migrating print revenues from larger advertisers towards digital

products.

EBITDA declined to $107.2 million during the second quarter of

2013, as compared to $144.9 million last year. This decline is due

to continued print revenue pressure and a lower EBITDA margin. The

EBITDA margin declined from 50.6% in the second quarter of 2012 to

44.1% in 2013, and continues to be impacted by investments required

to advance the Company's digital transformation and product mix

changes.

Free cash flow for the second quarter of 2013 declined to $68.5

million compared to $96.2 million last year, mainly due to lower

EBITDA. The Company continues to generate adequate free cash flow

to service its financial obligations and invest in its digital

transformation.

For the quarter ending June 30, 2013, the Company recorded net

earnings of $50.3 million compared to $65.7 million last year. The

decrease is due primarily to lower EBITDA and a higher provision

for income taxes, partly offset by lower financial charges and a

lower depreciation and amortization expense. The provision for

income taxes in 2012 was lower compared to 2013 due to the impact

of the impairment of goodwill.

For the quarter ending June 30, 2013, the Company recorded basic

net earnings per share of $1.81, which compares to basic net

earnings per share of $2.15 the year prior.

Delivering Value to Advertisers through the Yellow Pages 360

degrees Solution

The Yellow Pages(TM) 360 degrees Solution is the most

comprehensive full-serve digital and traditional media and

marketing solution in Canada. Backed by a national team of

marketing experts, the Yellow Pages 360 degrees Solution helps

advertisers generate valuable business leads through online, mobile

and print media advertising, website services, customized search

engine marketing and search engine optimization, and performance

reporting tools.

As at June 30, 2013, the penetration of our 360 degrees Solution

offering among our advertiser base, which we define as advertisers

who purchase three product categories or more, grew to 21.1%. This

compares to 11.2% at the end of the same period last year.

Online priority placement is the Company's highest penetrated

digital offering. Online priority placement penetration increased

to 40% as at June 30, 2013, compared to 28% last year.

Mobile priority placement and digital services (which includes

websites and search engine solutions) are the fastest growing

components of the Yellow Pages 360 degrees Solution. Advertiser

penetration of mobile priority placement and digital services each

grew from 5% last year to 10% and 8%, respectively, as at June 30,

2013.

Increased advertiser penetration across online priority

placement products, mobile priority placement products and digital

services is due to the continued migration of print revenues

towards digital products and services, the successful execution of

the Yellow Pages 360 degrees Solution sales approach across our

sales channels, and the introduction of mobile and premium digital

products throughout 2012.

Growing the Acquisition of Valuable Advertisers

The Company had 291,000 advertisers as at June 30, 2013. This

compares to 326,000 advertisers, excluding Canpages, at the same

period last year. Over the last twelve months, the advertiser

renewal rate fell slightly from 87% last year to 85% for the period

ending June 30, 2013. Advertiser acquisition declined from

approximately 20,000 last year to 12,400 for the twelve month

period ending June 30, 2013.

"Our advertiser renewal rate remains among the strongest in the

industry, however, we are working to address challenges in

advertiser acquisition. We've implemented effective strategies to

attract and retain valuable advertisers, as well as help small

businesses better understand the importance of digital marketing in

today's multi-channel society," said Marc P. Tellier, President and

Chief Executive Officer of Yellow Media.

The Company recently expanded its dedicated advertiser

acquisition strategy to increase the number of valuable advertisers

and protect its revenue base. The Company's acquisition strategy is

centered on increasing advertiser leads and conversions through the

following key initiatives:

-- Inbound: The Company is investing in traditional and digital advertising

campaigns to raise advertiser awareness around YPG's products and

services and increase traffic towards its Yellow Pages 360 degrees

Solution business-to-business website. An inbound call center was also

established to support all incoming leads.

-- Outbound: An outbound call center was created to target prospective,

smaller-spend advertisers.

-- Face-to-Face Network: A face-to-face network of over 100 media account

consultants was established to service larger-spend advertisers.

The Company also launched two new entry-level product packages

designed exclusively to help new, prospective advertisers gain a

media presence. These include Business Builder Bundle and Booster

Packs, two fully-integrated media solutions which allow new

advertisers to boost ROI through the development of content-rich

virtual business profiles, priority placement across YPG's network

of digital properties and access to print media products.

Differentiated Offering for Larger, High-Spend Advertisers

In order to support retention efforts, increase loyalty and

optimize revenue growth from larger advertisers, the Company

established the PriorityPlus program in early 2012. PriorityPlus

offers a more attentive and specialized service by providing

high-spend advertisers with dedicated account teams, a thorough

evaluation of account needs and opportunities, and effective

execution of their digital and traditional marketing strategy. The

Company also offers larger, high-spend advertisers a suite of

premium products designed to optimize their digital and traditional

media presence.

PriorityPlus is now deployed across Canada and is made up of

approximately 230 managers and media account consultants. Results

to date remain positive as the number of advertisers receiving the

PriorityPlus service and purchasing high-end products continues to

increase.

Enhancing the User Experience

Improving the user experience and building valuable traffic

towards our network of digital properties is key in promoting the

success of our advertisers. Our online properties reached 8.7

million unduplicated unique visitors during the second quarter of

2013, representing 31% of Canada's online population.

Total mobile downloads exceeded 5.9 million by the end of the

second quarter of 2013, as compared to 4.3 million downloads at the

same period last year. During the quarter, the Yellow Pages

application was also highlighted by the Apple Store as one of the

top 25 most downloaded applications of all time.

During the second quarter of 2013, the Company developed a new

search algorithm designed to optimize user performance on

YellowPages.ca (online and mobile) and promote merchant ROI. The

new algorithm provides more user-relevant search results, as

results are now dependant on features such as proximity of

location, business content, popularity, quality of reviews, etc.

YellowPages.ca is now also equipped with an enhanced auto-complete

service, which allows for quicker results and reduced failed

searches.

As part of its brand re-positioning ad campaign, the Company

launched a six-week advertising blitz in Toronto beginning in June

2013. The campaign was designed to build awareness of the Yellow

Pages brand amongst the key millennial generation demographic and

promote the download and use of the Yellow Pages mobile

application. Advertisements were placed in newspapers, transit

shelters and stations, restaurants, fitness centers, night

projections and outdoor billboards, alongside online, mobile and

social media sites. Brand takeovers were also staged at restaurant

and pub patios within the downtown area and highly trafficked

millennial hangouts. The volume of the campaign was designed to

expose individuals to the Yellow Pages brand, on a daily basis, in

and around areas they live, work and play.

Capital Structure

As at June 30, 2013, Yellow Media had reduced net debt to

approximately $664 million. This compares to $782 million of net

debt as at December 31, 2012.

The net debt to latest twelve month EBITDA ratio as at June 30,

2013 was 1.3 times compared to 1.4 times as at December 31, 2012.

The Company had approximately $213 million of cash and cash

equivalents as at August 7, 2013.

Pursuant to the indenture governing the 9.25% Senior Secured

Notes due November 30, 2018, the Company is required to use an

amount equivalent to 75% of its consolidated Excess Cash Flow for

the immediately preceding six-month period ending March 31 or

September 30 to redeem the Senior Secured Notes at par. These

mandatory redemption payments will be made on a semi-annual basis

on the last day of May and November of each year.

The Company made a $26.1 million mandatory redemption payment on

May 31, 2013, and has sufficient financial liquidity to meet the

minimum annual aggregate mandatory redemption payment of $100

million in 2013.

In August 2013, the Company entered into a five-year, $50

million asset-based loan (ABL) expiring in August 2018. The ABL has

a first priority lien over the receivables of the Company and will

be used for general corporate purposes.

As at August 7, 2013, the ABL was fully available and was

undrawn.

Investor Conference Call

Yellow Media Limited will hold an analyst and media call at

10:00 a.m. (Eastern Time) on August 8, 2013 to discuss the second

quarter 2013 results. The call may be accessed by dialing (416)

340-8427 within the Toronto area, or 1 866 225-6564 outside of

Toronto.

The call will be simultaneously webcast on the Company's website

at

http://www.ypg.com/en/investors/financial-reports/2013/quarterly-reports/second-quarter-webcast

The conference call will be archived in the Investor Center of

the site at www.ypg.com.

A playback of the call can also be accessed from August 8 to

August 15, 2013 by dialing (905) 694-9451 within the Toronto area,

or 1 800 408-3053 outside Toronto.

The conference passcode is 4799718.

About Yellow Media Limited

Yellow Media Limited (TSX:Y) is a leading media and marketing

solutions company in Canada. The Company owns and operates some of

Canada's leading properties and publications including Yellow

Pages(TM) print directories, Yellow Pages.ca(TM), Canada411.ca and

RedFlagDeals.com(TM). Its online destinations reach 8.7 million

unique visitors monthly and its mobile applications for finding

local businesses and deals have been downloaded over 5.9 million

times. Yellow Media Limited is also a leader in national digital

advertising through Mediative, a division of Yellow Pages Group

devoted to digital marketing and performance media services for

national agencies and advertisers. For more information, visit

www.ypg.com.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements about the

objectives, strategies, financial conditions, results of operations

and businesses of the Company.

These statements are forward-looking as they are based on our

current expectations, as at August 8, 2013, about our business and

the markets we operate in, and on various estimates and

assumptions. Our actual results could materially differ from our

expectations if known or unknown risks affect our business, or if

our estimates or assumptions turn out to be inaccurate. As a

result, there is no assurance that any forward-looking statements

will materialize. Risks that could cause our results to differ

materially from our current expectations are discussed in section 6

of our August 8, 2013 Management's Discussion and Analysis. We

disclaim any intention or obligation to update any forward-looking

statements, except as required by law, even if new information

becomes available, as a result of future events or for any other

reason.

Financial Highlights

(in thousands of Canadian dollars - except share information)

----------------------------------------------------------------------------

For the three-month For the six-month periods

periods ended June 30, ended June 30,

Yellow Media Limited 2013 2012 2013 2012

----------------------------------------------------------------------------

Revenues $243,183 $286,484 $496,460 $575,557

Income (loss) from

operations $92,455 $120,719 $188,050 ($2,732,335)

Net earnings (loss) $50,326 $65,681 $103,791 ($2,806,140)

Basic earnings (loss)

per share

attributable to

common shareholders $1.81 $2.15 $3.71 ($100.78)

Cash flow from

operating activities $86,457 $104,777 $173,045 $127,184

----------------------------------------------------------------------------

EBITDA(1) $107,234 $144,939 $222,712 $289,813

EBITDA margin(1) 44.1% 50.6% 44.9% 50.4%

----------------------------------------------------------------------------

Weighted average

number of common

shares outstanding 27,872,822 27,955,077 27,913,722 27,955,077

----------------------------------------------------------------------------

Non-IFRS Measures(1 )

In order to provide a better understanding of the results, the

Company uses the term EBITDA, defined as income from operations

before depreciation and amortization, impairment of goodwill and

restructuring and special charges. Management believes this measure

is reflective of ongoing operations. This term is not a performance

measure defined under IFRS. EBITDA does not have any standardized

meaning and is therefore not likely to be comparable to similar

measures used by other publicly traded companies. Management

believes EBITDA to be an important measure.

Contacts: Investor Relations Amanda Di Gironimo Senior Manager,

Corporate Finance and Investor Relations (514)

934-2680Amanda.DiGironimo@ypg.com Media Fiona Story Senior Manager,

Public Relations (514) 934-2672Fiona.Story@ypg.com

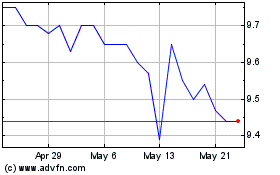

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jun 2024 to Jul 2024

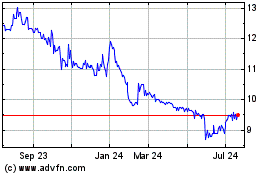

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jul 2023 to Jul 2024