Yellow Media Limited (TSX:Y) (the "Company") released its operational and

financial results today for the first quarter ended March 31, 2013. The Company

continues to make progress on its transformation into an industry- leading,

digital media and marketing solutions company.

Revenues for the first quarter ended March 31, 2013 decreased 12.4% to $253.3

million, compared to $289.1 million last year. The decline is primarily due to

lower print revenues and the discontinuation of duplicate directories published

by Canpages. On a comparable basis, excluding Canpages, revenues decreased by

10.2% versus last year's results.

Digital revenues for the first quarter of 2013 grew to $98.9 million compared to

$85.9 million the year prior, representing growth of 15.2%. On a comparable

basis, excluding Canpages, digital revenues grew 20.1% versus the same period

last year. Digital revenues represented approximately 39.1% of total revenues

during the first quarter of 2013, compared to 29.7% for the same period in 2012.

Continued growth in digital revenues is currently unable to offset print revenue

declines. This is a result of challenges associated with migrating print

revenues towards digital products and services, predominantly amongst larger

advertisers. The Company also continues to experience a decline in advertiser

acquisition.

As at March 31, 2013, the number of advertisers was 300,000. This compares to

333,000 advertisers, excluding Canpages, at the same period last year. The

advertiser renewal rate fell slightly from 87% in the first quarter of 2012 to

86% in the first quarter of 2013, while advertiser acquisition over the past

twelve months declined to approximately 14,700 for the period ending March 31,

2013 from approximately 23,000 last year.

"Despite continued pressure in print revenues, our digital revenues continue to

grow at a steady pace", said Marc P. Tellier, President and Chief Executive

Officer of Yellow Media. "As we work towards growing overall revenues, our near

term focus lies in properly addressing the needs of our larger clients through

enhanced servicing and the introduction of new digital products. We will also be

focused on developing dedicated acquisition channels to acquire valuable

customers and address our falling advertiser acquisition rate. Execution of

these projects is key in promoting Yellow Media's long- term success."

EBITDA declined to $115.5 million during the first quarter of 2013, as compared

to $144.9 million last year. This is due principally to print revenue pressure.

The EBITDA margin for the first quarter declined from 50.1% in 2012 to 45.6% in

2013.

"We expect EBITDA margins to gradually decline from current levels due to a

shift in revenue mix and investments required to advance the Company's digital

transformation," said Ginette Maille, Chief Financial Officer of Yellow Media.

Free cash flow for the first quarter increased from $14.2 million in 2012 to

$67.7 million in 2013, attributable to favorable working capital inflows, lower

interest payments, and lower income taxes paid, partly offset by lower EBITDA.

For the quarter ending March 31, 2013, the Company recorded net earnings of

$53.5 million. For the same period last year, the Company recorded a net loss of

$2.9 billion as a result of a goodwill impairment charge, net of taxes, of $2.9

billion. Net earnings before the goodwill impairment charge, net of taxes, were

of $54.9 million for the first quarter of 2012. The decrease is due primarily to

lower EBITDA, partly offset by a lower depreciation and amortization expense and

lower financial charges.

For the quarter ending March 31, 2013, the Company recorded basic net earnings

per share of $1.91, which compares to basic net earnings per share of $1.77

before the goodwill impairment charge, net of taxes, for the first quarter of

2012.

Delivering Value to Advertisers through the Yellow Pages 360 degrees Solution

The Yellow Pages(TM) 360 degrees Solution directly addresses the need of many

businesses for a comprehensive, single-source marketing service provider. By

offering dedicated access to online, mobile and print media platforms, managed

website services, customized search engine marketing, search engine

optimization, and Yellow Pages(TM) Analytics, the Yellow Pages 360 degrees

Solution makes agency-level solutions accessible to small and medium-sized

businesses.

As at March 31, 2013, the penetration of our 360 degrees Solution offering among

our advertiser base, which we define as advertisers who purchase three product

categories or more, grew to 18.9%. This compares to 7.9% at the end of the same

period last year.

During the first quarter of 2013, Google selected Yellow Pages Group ("YPG") as

a Canadian Google AdWords Premier SMB Partner. Partners in the Premier Google

AdWords SMB Partner Program are required to meet the highest standards of

excellence for qualification, training and customer service. They must also have

a strong knowledge of the local search marketing landscape and experience

working with small and medium-sized businesses. Obtaining the certification as a

Canadian Google AdWords Premier SMB Partner further reinforces the Company's

positioning in the digital marketplace and its ability to offer valuable

products and services to its network of advertisers.

Continued Growth in Mobile

Mobile remains a growing component of the Yellow Pages 360 degrees Solution

product suite. As at March 31, 2013, the Company had approximately 26,200

advertisers purchasing mobile products, representing approximately 49,800 mobile

units.

During the first quarter of 2013, our mobile placement product construct was

integrated across the ShopWise(TM) mobile platform, further increasing the

exposure of our advertisers' business listings across our network of mobile

applications. The ShopWise mobile application, which now includes a product

catalogue featuring over seven million items and a list of 600 local and

national retailers, was also chosen by the Local Search Association as the New

App Gold Award Winner at the 2013 Industry Excellence Awards.

Differentiated Offering for Larger, High-Spend Advertisers

In order to optimize revenues from our larger, high-spend advertisers, the

Company has in place a differentiated product and servicing model known as

PriorityPlus (previously called the High Priority Accounts management process).

A comprehensive profiling methodology, which includes the review of Yellow Pages

Analytics results, website audits and competitive rankings, search engine

marketing estimates, and social media and search engine reviews, is currently in

place for these advertisers. Various premium digital products are also

available, and include:

-- Digital PowerPlay, which establishes and optimizes a business' digital

presence by determining the necessary steps to maximize qualified leads

across various digital channels while offering the highest level of

service and support;

-- SEM TouchPoint, which provides a customized paid-search ad campaign

inclusive of unique access to a dedicated SEM expert and in-depth

performance reporting; and

-- Web Prestige, a fully customizable and dedicated website service

offering which includes enhanced features such as unlimited web pages,

richer design and content, and e-commerce capabilities.

The number of advertisers receiving the PriorityPlus service and purchasing

high-end products increased in the first quarter of 2013, with this trend

expected to continue throughout the year. These initiatives have also resulted

in an improved customer experience and an abatement of the revenue pressure

stemming from our larger, high- spend advertisers.

Enhancing the User Experience

Improving the user experience is key in attracting the right consumer audiences

to our network of properties and promoting the success of our advertisers.

During the first quarter of 2013, YPG's network of sites reached 8.5 million

unduplicated unique visitors, representing 31% of Canada's online population.

User adoption of the Company's mobile applications also continues to grow, with

total downloads having exceeded 5.5 million by the end of the first quarter of

2013. This compares to 4 million downloads at the same period last year. During

the quarter, the Yellow Pages(TM) application was launched on the new BlackBerry

10 and Windows 8 platforms. The ShopWise application was also enhanced to

deliver a native experience for Android users.

YellowAPI is currently one of the largest business information databases in the

country, holding curated content on over 1.5 million Canadian business listings.

The network currently enrolls over 2,750 developers who build mobile

applications using YPG's business information. YellowAPI also powers local

search in Canada through partnerships with Yahoo! Canada web and mobile, Poynt

and Telus. In addition, YPG maintains a strategic relationship with Google to

provide local listings and has agreements in place for data exchange with

TripAdvisor and OpenTable.

In April 2013, the Company launched a second installation of its Meet the New

Neighbourhood ad campaign to solidify brand perception and introduce the Yellow

Pages brand to generations unfamiliar with our digital products and services.

The second installation of the campaign highlights the Yellow Pages mobile

application and the role it plays in connecting mobile consumers with local

businesses. The ad campaign can be viewed at www.ypg.com, and will run on

television stations and local cinemas in major cities across Canada until June

2013.

Capital Structure

As at March 31, 2013, Yellow Media had approximately $724 million of net debt.

This compares to $782 million of net debt as at December 31, 2012.

The net debt to latest twelve month EBITDA ratio as at March 31, 2013 was 1.3

times compared to 1.4 times as at December 31, 2012.

Pursuant to the indenture governing the 9.25% Senior Secured Notes due November

30, 2018, the Company is required to use an amount equivalent to 75% of its

consolidated Excess Cash Flow for the immediately preceding six-month period

ending March 31 or September 30 to redeem the Senior Secured Notes at par. These

mandatory redemption payments will be made on a semi-annual basis on the last

day of May and November of each year, commencing on May 31, 2013.

The Company is required to make a minimum annual aggregate mandatory redemption

payment of $100 million for the combined payments due on May 31, 2013 and

November 30, 2013. The Company anticipates making a $26 million mandatory

redemption payment on May 31, 2013, and has sufficient financial liquidity to

meet the minimum annual aggregate mandatory redemption payment of $100 million

in 2013.

CEO Transition

On March 21, 2013, the Board of Directors of Yellow Media and Marc P. Tellier

agreed that Mr. Tellier will be leaving the position of President and Chief

Executive Officer. Mr. Tellier will remain with the Company until the new CEO is

appointed, but no later than August 15, 2013. A search committee of the Board

has been appointed to undertake the search for a new Chief Executive Officer.

Mr. Tellier will not stand for re-election to the current Board of Directors.

"I would like to thank Marc for his leadership and years of devoted service to

YPG. During his tenure, Yellow Media evolved from a single-product publisher in

Ontario and Quebec to become a national, diversified digital marketing solutions

company," said Robert MacLellan, Chairman of the Board of Directors of Yellow

Media. "The recruitment process for a new CEO is currently in place, and our

objective is to find a leader with a focus on execution and who will allow

Yellow Media to advance in its digital transformation."

Investor Conference Call

Yellow Media Limited will hold an analyst and media call at 2:00 p.m. (Eastern

Time) on May 7, 2013 to discuss the first quarter 2013 results. The call may be

accessed by dialing (416) 340-2218 within the Toronto area, or 1 866 226-1793

outside of Toronto.

The call will be simultaneously webcast on the Company's website at

http://www.ypg.com/en/investors/financial-reports/2013/quarterly-reports/first-quarter-webcast

The conference call will be archived in the Investor Center of the site at

www.ypg.com.

A playback of the call can also be accessed from May 7 to May 14, 2013 by

dialing (905) 694-9451 within the Toronto area, or 1 800 408-3053 outside

Toronto.

The conference passcode is 1605088.

About Yellow Media Limited

Yellow Media Limited (TSX:Y) is a leading media and marketing solutions company

in Canada. The Company owns and operates some of Canada's leading properties and

publications including Yellow Pages(TM) print directories, YellowPages.ca(TM),

Canada411.ca and RedFlagDeals.com(TM). Its online destinations reach 8.5 million

unique visitors monthly and its mobile applications for finding local businesses

and deals have been downloaded over 5.5 million times. Yellow Media Limited is

also a leader in national digital advertising through Mediative, a digital

advertising and marketing solutions provider to national agencies and

advertisers. For more information, visit www.ypg.com.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements about the objectives,

strategies, financial conditions, results of operations and businesses of the

Company. These statements are forward-looking as they are based on our current

expectations, as at May 7, 2013, about our business and the markets we operate

in, and on various estimates and assumptions. Our actual results could

materially differ from our expectations if known or unknown risks affect our

business, or if our estimates or assumptions turn out to be inaccurate. As a

result, there is no assurance that any forward-looking statements will

materialize. Risks that could cause our results to differ materially from our

current expectations are discussed in section 6 of our May 7, 2013 Management's

Discussion and Analysis. We disclaim any intention or obligation to update any

forward-looking statements, except as required by law, even if new information

becomes available, as a result of future events or for any other reason.

Financial Highlights

(in thousands of Canadian dollars - except share and per share information)

----------------------------------------------------------------------------

For the three-month periods

ended March 31,

Yellow Media Limited 2013 2012

----------------------------------------------------------------------------

Revenues $253,277 $289,073

Income (loss) from operations $95,595 ($2,853,054)

Net earnings (loss) $53,465 ($2,871,821)

Basic earnings (loss) per share attributable

to common shareholders $1.91 ($102.93)

Cash flow from operating activities $86,588 $22,407

----------------------------------------------------------------------------

EBITDA(1) $115,478 $144,874

EBITDA margin(1) 45.6% 50.1%

----------------------------------------------------------------------------

Weighted average number of common shares

outstanding 27,955,077 27,955,077

----------------------------------------------------------------------------

Non-IFRS Measures(1)

In order to provide a better understanding of the results, the Company uses the

term EBITDA, defined as income from operations before depreciation and

amortization, impairment of goodwill and restructuring and special charges.

Management believes this measure is reflective of ongoing operations. This term

is not a performance measure defined under IFRS. EBITDA does not have any

standardized meaning and is therefore not likely to be comparable to similar

measures used by other publicly traded companies. Management believes EBITDA to

be an important measure.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations

Amanda Di Gironimo

Senior Manager, Corporate Finance

and Investor Relations

(514) 934-2680

Amanda.DiGironimo@ypg.com

Media

Fiona Story

Senior Manager, Public Relations

(514) 934-2672

Fiona.Story@ypg.com

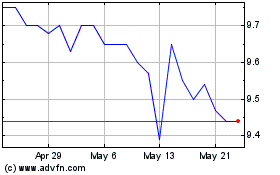

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jun 2024 to Jul 2024

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jul 2023 to Jul 2024