Quebecor Inc. ("Quebecor")(TSX:QBR.A)(TSX:QBR.B) today reported

Videotron Ltd.'s ("Videotron") 2011 full-year and fourth quarter

financial results.

Videotron's results are being released ahead of schedule due to

certain reporting requirements in Canada and the United States. The

financial year-end process and audit for Quebecor's other business

segments are in progress and have not yet been completed. Quebecor

plans to release its audited consolidated financial results for

2011 on March 15, 2012.

Quebecor and Videotron adopted International Financial Reporting

Standards ("IFRS") on January 1, 2011. Videotron's 2011 full-year

and fourth quarter consolidated financial statements have therefore

been prepared in accordance with IFRS and comparative data for 2010

have been restated. Fore more information, refer to "Transition to

IFRS" below.

2011 highlights

-- Videotron's revenues totalled $2.43 billion, up $201.9 million (9.1%)

from 2010.

-- Operating income(1) up $51.5 million (4.9%) to $1.10 billion.

-- Net income attributable to shareholder down $35.1 million (-6.9%) to

$469.0 million.

-- Videotron recorded its largest annual customer increase since 2008,

adding 375,800 revenue-generating units,(2) 39.3% more than the number

added in 2010.

-- Net increase of 49,900 cable television customers in 2011 (34,600 in

2010), including a 181,200-subscriber increase for the digital

service (135,500 in 2010), the strongest annual growth for the

digital service since it was launched in 1999. Total revenues from

cable television services passed the $1 billion mark.

-- Net increase of 80,400 customers for the cable Internet access

service (81,500 in 2010).

-- Net increase of 91,000 customers for the cable telephony service

(100,300 in 2010).

-- Net increase of 154,500 subscriber connections for the mobile

telephony service. At December 31, 2011, Videotron's 4G network was

available to nearly seven million people in Quebec and eastern

Ontario.

Fourth quarter 2011 highlights

-- Revenues up $43.6 million (7.4%) from the same quarter in 2010 to reach

$634.8 million.

-- Operating income up $31.5 million (12.0%) to $294.7 million.

-- Net income attributable to shareholder up $66.0 million (68.8%) to

$161.9 million.

(1) See "Operating income" under "Definitions."

(2) Revenue-generating units are the sum of cable television, Internet

access and cable telephony service subscriptions, plus subscriber

connections to the mobile telephony service.

2011 operating results

Revenues: $2.43 billion in 2011, an increase of $201.9 million

(9.1%).

-- Combined revenues from all cable television services topped $1 billion

for the first time, increasing by $62.0 million (6.5%) to $1.01 billion,

mainly because of the higher revenue per user generated by increases in

some rates, the success of high definition ("HD") packages, increased

pay TV orders, and the impact of customer base growth.

-- Revenues from Internet access services increased $54.0 million (8.4%) to

$698.2 million. The improvement was mainly due to customer growth,

increases in some rates, and customer migration to upgraded service

plans.

-- Revenues from cable telephony service increased $26.8 million (6.5%) to

$436.7 million, primarily as a result of customer base growth and more

lines per customer.

-- Revenues from mobile telephony service increased $59.6 million (112.1%)

to $112.7 million, essentially due to customer growth resulting largely

from the launch of the new network in September 2010.

-- Revenues of Videotron Business Solutions increased $3.2 million (5.4%)

to $63.0 million, mainly because of higher revenues from network

solutions.

-- Revenues from customer equipment sales decreased $4.0 million (-6.7%) to

$55.9 million, mainly because of campaigns promoting cable television

equipment leasing, partially offset by increased sales of mobile

telephony equipment.

-- Revenues of Le SuperClub Videotron ltee ("Le SuperClub Videotron")

decreased $1.6 million (-6.9%) to $21.6 million, mainly as a result of

store closures in 2011, partially offset by higher franchise fee

revenues.

-- Other revenues increased $1.9 million (6.8%) to $29.9 million.

Average monthly revenue per user(3) ("ARPU"): $103.28 in 2011

compared with $95.73 in 2010, an increase of $7.55 (7.9%).

Customer statistics

Revenue-generating units - As of December 31, 2011, the total

number of revenue-generating units stood at 4,689,900, an increase

of 375,800 (8.7%) from the end of 2010 (Table 1). The net increase

in revenue-generating units in 2011 was 39.3% greater than in 2010

and constituted the largest annual increase, in absolute terms, in

three years. This solid performance was due to the effective

strategy of marketing bundled services, including mobile telephony

service, at a time of technological change in television

broadcasting. The number of revenue-generating units had increased

by 269,700 in 2010.

Cable television - The combined customer base for all of

Videotron's cable television services increased by 49,900 (2.8%) in

2011 (Table 1), compared with an increase of 34,600 in 2010. As of

December 31, 2011, Videotron had 1,861,500 customers for its cable

television services, a household penetration rate of 70.1% (number

of subscribers as a proportion of total homes passed by Videotron's

network, i.e., 2,657,300 homes, as of the end of December 2011),

compared with 69.3% a year earlier.

-- The customer base for the Digital TV service stood at 1,400,800 as at

December 31, 2011, an increase of 181,200 (14.9%) during the year,

compared with a 135,500 increase in 2010 (Table 1). It was the largest

annual customer growth for Digital TV since the service was launched in

1999. As of December 31, 2011, illico Digital TV had a household

penetration rate of 52.7% versus 46.7% a year earlier.

-- Migration from analog to digital service was the main reason for the

131,300 (-22.2%) decrease in the customer base for analog cable

television services in 2011. By comparison, the number of subscribers to

analog cable services decreased by 100,900 in 2010.

Cable Internet access - The number of subscribers to cable

Internet access services stood at 1,332,500 as at December 31,

2011, an increase of 80,400 (6.4%) from year-end 2010, compared

with an increase of 81,500 in 2010 (Table 1). As at December 31,

2011, Videotron's cable Internet access services had a household

penetration rate of 50.1%, compared with 47.9% a year earlier.

Cable telephony service - The number of subscribers to cable

telephony service stood at 1,205,300 as at the end of December

2011, an increase of 91,000 (8.2%) from year-end 2010, compared

with an increase of 100,300 in 2010 (Table 1). As at December 31,

2011, the IP telephony service had a household penetration rate of

45.4%, compared with 42.7% a year earlier.

Mobile telephony service - As of December 31, 2011, the number

of subscriber connections to the mobile telephony service stood at

290,600, an increase of 154,500 (113.5%) from year-end 2010,

compared with an increase of 53,300 connections in 2010 (Table 1).

At December 31, 2011, there were 3,100 connections to the MVNO

network.

(3) The average monthly revenue per user is defined under "Definitions."

Table 1

Telecommunications segment year-end customer numbers (2007-2011)

(in thousands of customers)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2009 2008 2007

----------------------------------------------------------------------------

Cable television:

Analog 460.7 592.0 692.9 788.3 869.9

Digital 1,400.8 1,219.6 1,084.1 927.3 768.2

----------------------------------------------------------------------------

1,861.5 1,811.6 1,777.0 1,715.6 1,638.1

Cable Internet 1,332.5 1,252.1 1,170.6 1,063.8 933.0

Cable telephony 1,205.3 1,114.3 1,014.0 852.0 636.4

Mobile telephony(1) 290.6 136.1 82.8 63.4 45.1

----------------------------------------------------------------------------

Total (revenue-generating

units) 4,689.9 4,314.1 4,044.4 3,694.8 3,252.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Thousands of connections

Operating income: $1.10 billion, an increase of $51.5 million

(4.9%).

-- The increase in operating income was mainly due to:

-- impact of higher revenues;

-- reduction in the stock-based compensation charge.

-- Partially offset by:

-- increases in operating expenses, among them costs related to the

roll-out of the 4G network, including acquisition costs of

approximately $489 per subscriber addition (direct costs, including

selling, advertising and marketing expenses and equipment subsidies)

and site overhead costs;

-- capitalization of some operating expenses during the build-out of

the new mobile network, which also explains the unfavourable

variance in operating expenses in 2011 compared with 2010.

Net income attributable to shareholder: $469.0 million, a $35.1

million (-6.9%) decrease.

-- The decrease was mainly due to:

-- $116.4 million increase in amortization charge;

-- $4.8 million increase in financial expenses;

-- $1.2 million increase in charge for restructuring of operations and

other special items.

-- Partially offset by:

-- $51.5 million increase in operating income;

-- $31.8 million favourable variance in gain on valuation and

translation of financial instruments;

-- $4.1 million decrease in income tax expense.

Fourth quarter 2011 operating results

Revenues: $634.8 million, an increase of $43.6 million (7.4%),

essentially due to the same factors as those noted above under

"2011 operating results."

-- Combined revenues from all cable television services increased $15.9

million (6.5%) to $261.8 million.

-- Revenues from Internet access services increased $16.9 million (10.2%)

to $183.2 million.

-- Revenues from cable telephony service increased $4.6 million (4.3%) to

$111.5 million.

-- Revenues from mobile telephony service increased $17.4 million (103.0%)

to $34.3 million.

-- Revenues of Videotron Business Solutions increased $0.5 million (3.1%)

to $16.6 million.

-- Revenues from customer equipment sales decreased $11.2 million (-45.0%)

to $13.7 million.

-- Revenues of Le SuperClub Videotron decreased $0.5 million (-7.1%) to

$6.0 million.

-- Other revenues were flat at $7.7 million.

ARPU: $106.90 in the fourth of quarter 2011, compared with

$98.85 in the same period of 2010, an increase of $8.05 (8.1%).

Customer statistics

Revenue-generating units - 101,800 (2.2%) unit increase in the

fourth quarter of 2011, 20.0% more than the 84,800 unit increase in

the same period of 2010.

Cable television - 17,300 (0.9%) increase in the combined

customer base for all cable television services in the fourth

quarter of 2011, compared with an increase of 9,600 in the same

quarter of 2010.

-- Digital TV: 52,700 (3.9%) subscriber increase in the fourth quarter of

2011, compared with 37,300 in the same period of 2010.

-- Analog cable TV: 35,400 (-7.1%) subscriber decrease in the fourth

quarter of 2011, compared with a decrease of 27,700 in the same period

of 2010.

Cable Internet access - 26,100 (2.0%) increase in the fourth

quarter of 2011, compared with 18,300 in the same period of

2010.

Cable telephony - 25,900 (2.2%) subscriber increase in the

fourth quarter of 2011, compared with 16,200 in the same period of

2010.

Mobile telephony service - 32,500 (12.6%) increase in subscriber

connections in the fourth quarter of 2011, compared with 40,700 in

the same period of 2010.

Operating income: $294.7 million, an increase of $31.5 million

(12.0%).

-- The increase in operating income was mainly due to:

-- impact of higher revenues.

-- Partially offset by:

-- increases in operating costs, including costs related to the roll-

out of the 4G network.

Net income attributable to shareholder: $161.9 million, an

increase of $66.0 million (68.8%).

-- The increase was due mainly to:

-- $86.4 million favourable variance in gains and losses on valuation

and translation of financial instruments in the fourth quarter 2011,

compared with the same period of 2010;

-- $31.5 million increase in operating income;

-- $8.9 million decrease in the charge for restructuring of operations

and other special items.

-- Partially offset by:

-- $39.4 million increase in income tax expense;

-- $18.0 million increase in amortization charge;

-- $3.4 million increase in financial expenses.

Financing activities

-- On July 20, 2011, Videotron amended its $575.0 million revolving credit

facility to extend the expiry date from April 2012 to July 2016 and

modify some of the terms and conditions.

-- On July 5, 2011, Videotron issued 6 7/8% Senior Notes maturing in 2021

in the aggregate principal amount of $300.0 million, for a net principal

amount of $294.8 million. The net proceeds were used to finance the

early repayment and withdrawal of US$255.0 million principal amount of

Videotron's 6 7/8% Senior Notes maturing in 2014, and settlement of the

related hedges.

Detailed financial information

For a detailed analysis of Videotron's 2011 full year and fourth

quarter results, please refer to the Management Discussion and

Analysis and consolidated financial statements of Videotron,

available on Quebecor's website at www.quebecor.com/en/.

Transition to IFRS

On January 1, 2011, Canadian Generally Accepted Accounting

Principles ("GAAP"), as used by publicly accountable enterprises,

were fully converged into IFRS. Prior to the adoption of IFRS, for

all periods up to and including the year ended December 31, 2010,

Videotron's consolidated financial statements were prepared in

accordance with Canadian GAAP. IFRS uses a conceptual framework

similar to Canadian GAAP, but there are significant differences

related to recognition, measurement and disclosures.

The date of the opening balance sheet under IFRS and the date of

transition to IFRS is January 1, 2010. The financial data for 2010

have therefore been restated. Videotron is also required to apply

IFRS accounting policies retrospectively to determine its opening

balance sheet, subject to certain exemptions. However, Videotron is

not required to restate figures for periods prior to January 1,

2010 that were previously prepared in accordance with Canadian

GAAP.

The new significant accounting policies under IFRS are disclosed

in Note 1 to Videotron's consolidated financial statements for the

year ended December 31, 2011. Note 27 describes the adjustments

made by Videotron in preparing its IFRS opening consolidated

balance sheet as of January 1, 2010 and in restating its previously

published Canadian GAAP consolidated financial statements for the

year ended December 31, 2010. Note 27 also provides details on

exemption choices made by Videotron with respect to the general

principle of retrospective application of IFRS.

DEFINITIONS

Operating Income

In its analysis of operating results, Quebecor defines operating

income, as reconciled to net income under IFRS, as net income

before amortization, financial expenses, gain (loss) on valuation

and translation of financial instruments, charge for restructuring

of operations and other special items, and income tax. Operating

income as defined above is not a measure of results that is

consistent with IFRS. It is not intended to be regarded as an

alternative to other financial operating performance measures or to

the statement of cash flows as a measure of liquidity. It should

not be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. Management believes

that operating income is a meaningful measure of performance.

Quebecor uses operating income in order to assess the performance

of its investment in Quebecor Media. Quebecor's management and

Board of Directors use this measure in evaluating its consolidated

results as well as the results of its operating segments. This

measure eliminates the significant level of depreciation and

amortization of tangible and intangible assets and is unaffected by

the capital structure or investment activities of Quebecor and its

segments. Operating income is also relevant because it is a

significant component of the Quebecor's annual incentive

compensation programs. A limitation of this measure, however, is

that it does not reflect the periodic costs of tangible and

intangible assets used in generating revenues in Quebecor's

segments. In addition, measures like operating income are commonly

used by the investment community to analyze and compare the

performance of companies in the industries in which Quebecor is

engaged. Quebecor's definition of operating income may not be the

same as similarly titled measures reported by other companies.

Table 2 below provides a reconciliation of operating income to

net income as disclosed in the consolidated financial

statements.

Table 2

Reconciliation of Videotron's operating income, as reported in this press

release, to the net income measure used in the consolidated financial

statements

(in millions of Canadian dollars)

Year Ended Three months

December 31 ended December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

Operating Income $ 1,098.8 $ 1,047.3 $ 294.7 $ 263.2

Amortization (408.1) (291.7) (110.2) (92.2)

Financial expenses (158.0) (153.2) (39.1) (35.7)

Gain (loss) on valuation and

translation of financial

instruments 56.2 24.4 57.0 (29.4)

Restructuring of operations

and other special items (12.6) (11.4) (0.5) (9.4)

Income tax (107.0) (111.1) (39.9) (0.5)

----------------------------------------------------------------------------

Net income $ 469.3 $ 504.3 $ 162.0 $ 96.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average Monthly Revenue per User

ARPU is an industry metric that Videotron uses to measure its

monthly cable television, Internet access, cable telephony and

mobile telephony revenues per average basic cable customer. ARPU is

not a measurement that is consistent with IFRS and the Videotron's

definition and calculation of ARPU may not be the same as

identically titled measurements reported by other companies.

Videotron calculates ARPU by dividing its combined cable

television, Internet access, cable telephony and mobile telephony

revenues by the average number of basic customers during the

applicable period, and then dividing the resulting amount by the

number of months in the applicable period.

Forward-Looking Statements

The statements in this press release that are not historical

facts are forward-looking statements and are subject to significant

known and unknown risks, uncertainties and assumptions that could

cause Quebecor's actual results for future periods to differ

materially from those set forth in the forward-looking statements.

Forward-looking statements may be identified by the use of the

conditional or by forward-looking terminology such as the terms

"plans," "expects," "may," "anticipates," "intends," "estimates,"

"projects," "seeks," "believes," or similar terms, variations of

such terms or the negative of such terms. Certain factors that may

cause actual results to differ from current expectations include

seasonality (including seasonal fluctuations in customer orders),

operating risks (including fluctuations in demand for Quebecor's

products and pricing actions by competitors), insurance risk, risks

associated with capital investment (including risks related to

technological development and equipment availability and

breakdown), environmental risks, risks associated with labour

agreements, risks associated with commodities and energy prices

(including fluctuations in the cost and availability of raw

materials), credit risk, financial risks, debt risks, risks related

to interest rate fluctuations, foreign exchange risks, risks

associated with government acts and regulations, risks related to

changes in tax legislation and to changes in the general political

and economic environment. Investors and others are cautioned that

the foregoing list of factors that may affect future results is not

exhaustive and that undue reliance should not be placed on any

forward-looking statements. For more information on the risks,

uncertainties and assumptions that could cause Quebecor's actual

results to differ from current expectations, please refer to

Quebecor's public filings available at www.sedar.com and

www.quebecor.com including, in particular, the "Risks and

Uncertainties" section of Quebecor's Management Discussion and

Analysis for the year ended December 31, 2010.

The forward-looking statements in this press release reflect

Quebecor's expectations as of February 29, 2012 and are subject to

change after that date. Quebecor expressly disclaims any obligation

or intention to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws.

The Corporation

Quebecor Inc. (TSX:QBR.A)(TSX:QBR.B) is a holding company with a

54.7% interest in Quebecor Media Inc., one of Canada's largest

media groups, with more than 16,000 employees. Quebecor Media Inc.,

through its subsidiary Videotron Ltd., is an integrated

communications company engaged in cable television, interactive

multimedia development, Internet access services, cable telephone

services and mobile telephone services. Through Sun Media

Corporation, Quebecor Media Inc. is the largest publisher of

newspapers in Canada. It also operates Canoe.ca and its network of

English and French language Internet properties in Canada. In the

broadcasting sector, Quebecor Media Inc. operates, through TVA

Group Inc., the number one French language general interest

television network in Quebec, a number of specialty channels and

the SUN News English language channel. Another subsidiary of

Quebecor Media Inc., Nurun Inc., is a major interactive

technologies and communications agency with offices in Canada, the

United States, Europe and Asia. Quebecor Media Inc. is also active

in magazine publishing (TVA Publishing Inc.), book publishing and

distribution (Sogides Group Inc. and CEC Publishing Inc.), the

production, distribution and retailing of cultural products

(Archambault Group Inc. and TVA Films), video game development

(BlooBuzz Studios, L.P.), DVD, Blu-ray disc and videogame rental

and retailing (Le SuperClub Videotron Ltd), the printing and

distribution of regional newspapers and flyers (Quebecor Media

Printing Inc. and Quebecor Media Network Inc.), news content

production and distribution (QMI Agency), multiplatform advertising

solutions (QMI Sales) and the publishing of printed and online

directories, through Quebecor MediaPages(TM).

VIDEOTRON LTD.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

(restated) (restated)

Revenues

Cable television $ 261,751 $ 245,897 $ 1,012,604 $ 950,590

Internet 183,209 166,272 698,234 644,283

Cable telephony 111,474 106,868 436,694 409,858

Mobile telephony 34,297 16,892 112,743 53,167

Business solutions 16,562 16,122 63,025 59,803

Equipment sales 13,744 24,922 55,885 59,893

Other 13,747 14,214 51,529 51,214

----------------------------------------------------------------------------

634,784 591,187 2,430,714 2,228,808

Cost of sales and

operating expenses 340,123 327,973 1,331,935 1,181,535

Amortization 110,223 92,166 408,133 291,738

Financial expenses 39,115 35,775 158,042 153,193

(Gain) loss on

valuation and

translation of

financial

instruments (57,040) 29,363 (56,142) (24,373)

Restructuring of

operations and

other special items 506 9,366 12,619 11,380

----------------------------------------------------------------------------

Income before income

taxes 201,857 96,544 576,127 615,335

Income taxes

Current (2,584) (13,716) (22,549) 27,375

Deferred 42,507 14,211 129,424 83,642

----------------------------------------------------------------------------

39,923 495 106,875 111,017

----------------------------------------------------------------------------

Net income $ 161,934 $ 96,049 $ 469,252 $ 504,318

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income

attributable to:

Shareholder $ 161,882 $ 95,901 $ 469,023 $ 504,074

Non-controlling

interest 52 148 229 244

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

(restated) (restated)

Net income $ 161,934 $ 96,049 $ 469,252 $ 504,318

Other comprehensive

(loss) income:

Cash flow hedges:

(Loss) gain on

valuation of

derivative

financial

instruments (17,594) (25,750) 1,173 19,968

Deferred income

taxes 4,014 5,879 (2,879) (1,275)

Defined benefit

plans:

Actuarial loss

and net change

in asset limit

and in minimum

funding

liability (32,356) (8,109) (32,356) (9,427)

Deferred income

taxes 8,700 2,181 8,700 2,571

Reclassification to

income:

Other

comprehensive

loss related to

cash flow hedges - - 801 -

Deferred income

taxes - - (200) -

----------------------------------------------------------------------------

(37,236) (25,799) (24,761) 11,837

----------------------------------------------------------------------------

Comprehensive income $ 124,698 $ 70,250 $ 444,491 $ 516,155

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Comprehensive income

attributable to:

Shareholder $ 124,646 $ 70,102 $ 444,262 $ 515,911

Non-controlling

interest 52 148 229 244

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED STATEMENTS OF EQUITY

(in thousands of Canadian dollars) (unaudited)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Equity attributable to shareholder

Equity

Accumu- attribu-

lated table

other to non-

Contri- compre- control-

Capital buted Retained hensive ling Total

stock surplus earnings loss interest equity

----------------------------------------------------------------------------

Balance as of

December 31,

2009 as

previously

reported

under

Canadian GAAP

(restated) $ 1 $ 7,155 $ 726,444 $ (22,832)$ - $ 710,768

IFRS

adjustments - (7,155) (52,819) - 991 (58,983)

----------------------------------------------------------------------------

Balance as of

January 1,

2010 1 - 673,625 (22,832) 991 651,785

Net income - - 504,074 - 244 504,318

Other

comprehensive

(loss)

income - - (6,856) 18,693 - 11,837

Issuance of

shares 3,400 - - - - 3,400

Dividends - - (437,000) - (95) (437,095)

----------------------------------------------------------------------------

Balance as of

December 31,

2010 3,401 - 733,843 (4,139) 1,140 734,245

Net income - - 469,023 - 229 469,252

Other

comprehensive

loss - - (23,656) (1,105) - (24,761)

Acquisition of

a subsidiary

from an

affiliated

corporation - - (32,140) - - (32,140)

Dividends - - (140,000) - (55) (140,055)

----------------------------------------------------------------------------

Balance as of

December 31,

2011 $ 3,401 $ - $1,007,070 $ (5,244)$ 1,314 $1,006,541

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

(restated) (restated)

Cash flows related to

operating activities

Net income $ 161,934 $ 96,049 $ 469,252 $ 504,318

Adjustments for:

Amortization of

fixed assets 87,352 73,100 322,878 254,469

Amortization of

intangible

assets 22,871 19,066 85,255 37,269

(Gain) loss on

valuation and

translation of

financial

instruments (57,040) 29,363 (56,142) (24,373)

Amortization of

financing costs

and long-term

debt premium or

discount 1,372 901 4,238 3,556

Deferred income

taxes 42,507 14,211 129,424 83,642

Gain on debt

refinancing - - (2,713) -

----------------------------------------------------------------------------

Other (3,021) (37) (1,058) (9)

Net change in non-

cash balances

related to operating

activities (37,434) (83,651) (44,094) (77,397)

----------------------------------------------------------------------------

Cash flows provided

by operating

activities 218,541 149,002 907,040 781,475

Cash flows related to

investing activities

Additions to fixed

assets (189,158) (190,371) (725,404) (651,146)

Additions to

intangible assets (28,247) (24,124) (73,253) (72,244)

Acquisition of a

subsidiary from an

affiliated

corporation - - (32,140) -

Disposal

(acquisition) of

preferred shares

of a company under

common control - 930,000 - (370,000)

Acquisition of tax

deductions from

the ultimate

parent corporation - (5,974) - (5,974)

Net change in

temporary

investments - - - 30,000

Other 1,836 1,827 4,893 7,319

----------------------------------------------------------------------------

Cash flows (used in)

provided by

investing activities (215,569) 711,358 (825,904) (1,062,045)

Cash flows related to

financing activities

Issuance of long-

term debt, net of

financing fees - - 294,846 293,888

Net borrowings

under bank credit

facility 69,643 - 69,643 -

Financing costs (1,413) - (3,862) -

Repayment of long-

term debt and

settlement of

related hedging

contracts - - (303,068) -

(Repayment)

issuance of

subordinated loan

from parent

corporation - (930,000) - 370,000

Dividends (65,000) (102,000) (140,000) (437,000)

Other - - (14) (292)

----------------------------------------------------------------------------

Cash flows provided

by (used in)

financing activities 3,230 (1,032,000) (82,455) 226,596

Net change in cash

and cash equivalents 6,202 (171,640) (1,319) (53,974)

Cash and cash

equivalents at

beginning of period 88,814 267,975 96,335 150,309

----------------------------------------------------------------------------

Cash and cash

equivalents at end

of period $ 95,016 $ 96,335 $ 95,016 $ 96,335

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(in thousands of Canadian dollars)

(unaudited)

Three months ended Twelve months ended

December 31 December 31

----------------------------------------------------------------------------

2011 2010 2011 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Additional information on the consolidated

statements of cash flows

Cash and cash

equivalents consist

of:

Bank overdraft $ (21,483) $ (24,214) $ (21,483) $ (24,214)

Cash equivalents 116,499 120,549 116,499 120,549

----------------------------------------------------------------------------

$ 95,016 $ 96,335 $ 95,016 $ 96,335

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-cash investing

activities

Net change in

additions to fixed

and intangible

assets financed with

accounts payable $ (56,029) $ 11,611 $ (28,956) $ (16,589)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interest and taxes

reflected as operating

activities

Cash interest

payments $ 67,300 $ 59,464 $ 163,365 $ 150,241

Cash income tax

payments (net of

refunds) 5,164 2,058 6,141 6,456

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED BALANCE SHEETS

(in thousands of Canadian dollars)

(unaudited)

December 31, December 31,

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010

----------------------------------------------------------------------------

(restated)

Assets

Current assets

Cash and cash equivalents $ 95,016 $ 96,335

Accounts receivable 264,497 245,691

Income taxes 10,819 434

Amounts receivable from affiliated

corporations 33,391 10,608

Inventories 122,870 96,549

Prepaid expenses 16,319 21,689

----------------------------------------------------------------------------

Total current assets 542,912 471,306

----------------------------------------------------------------------------

Non-current assets

Investments 1,630,000 1,630,000

Fixed assets 2,602,215 2,179,600

Intangible assets 711,426 720,970

Derivative financial instruments 3,207 -

Other assets 43,434 46,028

Deferred income taxes 5,243 6,134

Goodwill 451,545 451,475

----------------------------------------------------------------------------

Total non-current assets 5,447,070 5,034,207

----------------------------------------------------------------------------

Total assets $ 5,989,982 $ 5,505,513

----------------------------------------------------------------------------

----------------------------------------------------------------------------

VIDEOTRON LTD.

CONSOLIDATED BALANCE SHEETS (continued)

(in thousands of Canadian dollars)

(unaudited)

December 31, December 31,

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010

----------------------------------------------------------------------------

(restated)

Liabilities and Equity

Current liabilities

Accounts payable and accrued charges $ 435,627 $ 382,162

Amounts payable to affiliated

corporations 23,789 23,248

Provisions 7,383 17,716

Deferred revenue 248,195 227,211

Income taxes - 19,603

Current portion of long-term debt 10,714 -

----------------------------------------------------------------------------

Total current liabilities 725,708 669,940

----------------------------------------------------------------------------

Non-current liabilities

Long-term debt 1,846,343 1,786,076

Subordinated loan from parent

corporation 1,630,000 1,630,000

Derivative financial instruments 222,212 289,032

Deferred income taxes 454,716 316,185

Other liabilities 104,462 80,035

----------------------------------------------------------------------------

Total non-current liabilities 4,257,733 4,101,328

----------------------------------------------------------------------------

Total liabilities 4,983,441 4,771,268

----------------------------------------------------------------------------

Equity

Capital stock 3,401 3,401

Retained Earnings 1,007,070 733,843

Accumulated other comprehensive loss (5,244) (4,139)

----------------------------------------------------------------------------

Equity attributable to shareholder 1,005,227 733,105

Non-controlling interest 1,314 1,140

----------------------------------------------------------------------------

Total equity 1,006,541 734,245

----------------------------------------------------------------------------

Total liabilities and equity $ 5,989,982 $ 5,505,513

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Jean-Francois Pruneau Chief Financial Officer Quebecor

Inc. and Quebecor Media Inc.jean-francois.pruneau@quebecor.com 514

380-4144 J. Serge Sasseville Vice President, Corporate and

Institutional Affairs Quebecor Media

Inc.serge.sasseville@quebecor.com 514 380-1864

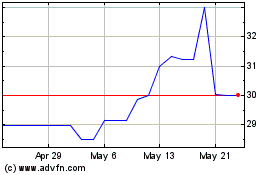

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024