Quebecor Inc. and Tricap Partners Ltd. Announce $400 Million Rescue Financing Proposal to Quebecor World Inc.

January 11 2008 - 5:26PM

Marketwired

MONTREAL, QUEBEC (TSX: QBR.B)and Tricap Partners, a private

equity fund managed by Brookfield Asset Management, announced today

that they have jointly submitted a binding proposal to Quebecor

World Inc. ("QWI)" for a $400 million Rescue Financing Facility

that would avert its liquidity challenges and recapitalize the

company. Quebecor Inc. and Tricap Partners are equal investors in

the facility.

This proposal is subject to certain conditions including the

consent of QWI's banking syndicate, the sponsors of its North

American securitization program and certain other stakeholders.

If the Proposal is accepted by QWI and the requisite consents

are obtained, QI and Tricap will immediately make available $200

million to QWI to ensure it has sufficient liquidity to the closing

date of the Rescue Financing Facility, which is expected to be

March 31, 2008.

QI and Tricap believe this proposal is in the best interests of

all of QWI's stakeholders given QWI's liquidity and balance sheet

challenges within the current North American credit crisis.

Genuity Capital Markets is the financial adviser to Quebecor

Inc.

Quebecor Inc.

Quebecor Inc. (TSX: QBR.A, QBR.B) is a communications company

with operations in North America, Europe, Latin America and Asia.

It has two operating subsidiaries, Quebecor World Inc. and Quebecor

Media Inc. Quebecor World is one of the largest commercial print

media services companies in the world. Quebecor Media owns

operating companies in numerous media related businesses: Videotron

Ltd., the largest cable operator in Quebec and a major Internet

Service Provider and provider of telephone and business

telecommunications services; Quebecor Media's Newspapers segment,

the largest publisher of newspapers in Canada; TVA Group Inc.,

operator of the largest French language over the air television

network in Quebec, a number of specialty channels, and the English

language over the air station Sun TV; Canoe Inc., operator of a

network of English and French language Internet properties in

Canada; Nurun Inc., a major interactive technologies and

communications agency with offices in Canada, the United States,

Europe and Asia; companies engaged in book publishing and magazine

publishing; and companies engaged in the production, distribution

and retailing of cultural products, namely Archambault Group Inc.,

the largest chain of music stores in eastern Canada, TVA Films, and

Le SuperClub Videotron ltee, a chain of video and video game rental

and retail stores. Quebecor Inc. has operations in 18

countries.

Tricap Partners Ltd.

Tricap Management Ltd. was established by Brookfield Asset

Management to provide a source of patient, long-term capital and

strategic assistance to companies experiencing financial or

operational difficulty and has invested and provided significant

financing commitments since its formation in 2001. With strong

industry and financial management expertise, Tricap Management is

well positioned to assist these companies in reaching their full

potential. Brookfield Asset Management, manages approximately $90

billion in assets under management.

Contacts: Quebecor Inc. Luc Lavoie Executive Vice President,

Corporate Affairs 514-380-1974 Cell: 514-947-6672

lavoie.luc@quebecor.com Brookfield Management Denis Couture -

Senior Vice-President, Investor Relations and International Affairs

416-956-5189 Cell: 647-262-2955 dcouture@brookfield.com

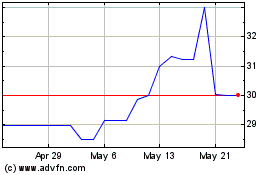

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024