K92 Mining Inc. (“

K92” or

the “

Company”) (TSX:

KNT;

OTCQB:

KNTNF) is pleased to announce that K92

and its Papua New Guinea subsidiary, K92 Mining Limited

(“

K92 PNG”), have entered into two separate credit

facilities (the “

Credit Facilities” and

individually the “

Canadian Credit Facility” and

the “

PNG Credit Facility”, respectively) with

Trafigura Pte Ltd (“

Trafigura”). The Credit

Facilities replace the previous loan agreement with Trafigura

announced in September 2023 (see September 26, 2023 press

release) (the “

2023 Loan Facility”) and upsize, on

an aggregate basis, the 2023 Loan Facility amount from

US$100 million to US$120 million, with an accordion

feature to increase the aggregate amount available under the Credit

Facilities to US$150 million (the “

Accordion

Feature”). The key terms of the Credit Facilities are set

out below.

The Credit Facilities may be used for general

corporate purposes, working capital purposes, and capital

expenditure. No hedging is required for the Credit Facilities. All

conditions precedent for advance of US$100 million under the

Canadian Credit Facility have been satisfied, with the remaining

US$20 million subject to a Condition Precedent under K92’s control

and expected to be satisfied later this month, with the funds for

the additional US$20 million available January 1, 2025. The

Accordion Feature will become effective by mutual agreement between

K92 and Trafigura. The 2023 Loan Facility has been terminated and

the parties have entered into an agreement to release all security

therewith. The Credit Facilities further strengthen K92’s strong

financial position, with US$73.4 million in cash and treasury

bills and no debt as at March 31, 2024.

In addition, K92 PNG and Trafigura have entered

into a new offtake agreement for the purchase by Trafigura of 100%

of K92 PNG’s copper/gold concentrates produced at the Kainantu Gold

Mine in Papua New Guinea (the “New Offtake

Agreement”), replacing the amended offtake agreement

announced on September 26, 2023 which did not come into effect (the

“Amended and Restated Offtake Agreement”). Key

terms of the New Offtake Agreement remain substantially the same as

the Amended and Restated Offtake Agreement described in the

Company’s September 26, 2023 press release. K92 is pleased to

confirm the New Offtake Agreement has received regulatory approval

in Papua New Guinea subject to compliance with certain conditions,

including but not limited to, K92 PNG observing the conditions of

its gold export license.

John Lewins, K92 Chief Executive Officer and

Director, stated, “The closing and upsizing of the loan to up to

US$150 million is an important financial de-risking milestone

for delivering the Stage 3 and 4 Expansions which will

transform K92 and the Kainantu Gold Mine into a Tier 1

Mid-Tier Producer. Importantly, this boost to liquidity enables K92

to confidently continue to rapidly advance multiple high priority

exploration targets concurrently.

We would also like to acknowledge our

relationship with Trafigura, which has been our offtake counterpart

since the start of operations at the Kainantu Gold Mine. These

agreements further reinforce our strong relationship. The New

Offtake Agreement also secures long-term competitive terms and

provides security and confidence in our income from the sale of our

concentrate product.”

Key Terms

1. Credit Facilities

Up to an aggregate US$150 Million Senior

Secured Credit Facilities

- 4-year term for each facility from

the date of signing.

- Competitive interest rates.

- Nine month interest-only repayment

grace period for the PNG Credit Facility. Interest-only repayment

grace period up to 1 July 2025 for the Canadian Credit

Facility.

- No hedging conditions.

- The Canadian Credit Facility is

secured, inter alia, by a pledge of the shares of K92 Holdings

International Limited and a conversion right in connection with the

shares of the Company (the “Security”). Should an

event of default occur under the Canadian Credit Facility,

Trafigura has, among other rights, the right to accelerate

repayment of the Canadian Credit Facility, realize upon the shares

of K92 Holdings International Limited (which holds indirectly

through K92 PNG the Kainantu Gold Mine in Papua New Guinea) and

convert all or any portion of the Canadian Credit Facility into

common shares of the Company, up to a cap of 4.5% of the issued and

outstanding common shares of the Company.

- US$30 million Accordion

Feature to increase the aggregate amount available under both

Credit Facilities to US$150 Million with competitive interest

rates, no hedging conditions and secured by the same Security.

- The Accordion Feature must be

exercised within 12 months of the first draw under the

Canadian Credit Facility.

- K92 has, among other things,

guaranteed the obligations of K92 PNG under the PNG Credit

Facility.

2. New Offtake Agreement

- The term of 7 consecutive calendar

years, commencing January 1, 2026, and continuing either until

December 31, 2032 or until a minimum quantity of 600,000 dry

metric tons of concentrate has been delivered to Trafigura.

- Competitive industry terms in

relation to all metrics at London Metals Exchange spot prices.

- Attractive payment arrangements

which provide for upfront payment on delivery of concentrates to

port of dispatch and provision of certain shipping documents.

- Amended and improved metals

payabilities for deliveries of concentrates, which includes

amending penalties, treatment and refining charges, and transport

charges, all of which are better than the assumptions outlined in

the Kainantu Integrated Development Plan Definitive Feasibility and

Preliminary Economic Assessment cases (see September 12, 2022 press

release – K92 Mining Inc. Announces Robust Kainantu Gold Mine

Integrated Development Plan).

- The original offtake agreement

dated July 1, 2019 (as referred to in the September 26, 2023 press

release) will be performed prior to the New Offtake Agreement

coming into effect and/or upon the New Offtake Agreement ceasing to

be effective.

About K92

K92 Mining Inc. is engaged in the production of

gold, copper and silver at the Kainantu Gold Mine in the Eastern

Highlands province of Papua New Guinea, as well as exploration and

development of mineral deposits in the immediate vicinity of the

mine. The Company declared commercial production from Kainantu in

February 2018 and is in a strong financial position. A maiden

resource estimate on the Blue Lake copper-gold porphyry project was

completed in August 2022. K92 is operated by a team of mining

company professionals with extensive international mine-building

and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact David

Medilek, P.Eng., CFA, President and Chief Operating Officer at

+1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain “forward-looking

statements” under applicable Canadian securities legislation. Such

forward-looking statements include, without limitation: (i) the

estimated use of proceeds of the Credit Facilities and the

Accordion Feature; and (ii) the satisfaction of the conditions

precedent to the Credit Facilities including the satisfaction of

the additional conditions for the Accordion Feature.

All statements in this news release that address

events or developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally,

although not always, identified by words such as “expect”, “plan”,

“anticipate”, “project”, “target”, “potential”, “schedule”,

“forecast”, “budget”, “estimate”, “intend” or “believe” and similar

expressions or their negative connotations, or that events or

conditions “will”, “would”, “may”, “could”, “should” or “might”

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made. Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and

unknown risks, uncertainties and other factors, many of which are

beyond our ability to control, that may cause our actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

information. Such factors include, without limitation, Public

Health Crises, including the COVID-19 virus; changes in the price

of gold, silver, copper and other metals in the world markets;

fluctuations in the price and availability of infrastructure and

energy and other commodities; fluctuations in foreign currency

exchange rates; volatility in price of our common shares; inherent

risks associated with the mining industry, including problems

related to weather and climate in remote areas in which certain of

the Company’s operations are located; failure to achieve

production, cost and other estimates; risks and uncertainties

associated with exploration and development; uncertainties relating

to estimates of mineral resources including uncertainty that

mineral resources may never be converted into mineral reserves; the

Company’s ability to carry on current and future operations,

including development and exploration activities at the Arakompa,

Kora, Judd and other projects; the timing, extent, duration and

economic viability of such operations, including any mineral

resources or reserves identified thereby; the accuracy and

reliability of estimates, projections, forecasts, studies and

assessments; the Company’s ability to meet or achieve estimates,

projections and forecasts; the availability and cost of inputs; the

availability and costs of achieving the Stage 3 Expansion or the

Stage 4 Expansion; the ability of the Company to achieve the inputs

the price and market for outputs, including gold, silver and

copper; failures of information systems or information security

threats; political, economic and other risks associated with the

Company’s foreign operations; geopolitical events and other

uncertainties, such as the conflicts in Ukraine, Israel and

Palestine; compliance with various laws and regulatory requirements

to which the Company is subject to, including taxation; the ability

to obtain timely financing on reasonable terms when required; the

current and future social, economic and political conditions,

including relationship with the communities in Papua New Guinea and

other jurisdictions it operates; other assumptions and factors

generally associated with the mining industry; and the risks,

uncertainties and other factors referred to in the Company’s Annual

Information Form under the heading “Risk Factors”.

Forward-looking statements are not a guarantee

of future performance, and actual results and future events could

materially differ from those anticipated in such statements.

Although we have attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking statements, there may be other factors that

cause actual results to differ materially from those that are

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

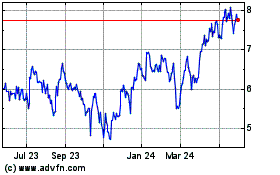

K92 Mining (TSX:KNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

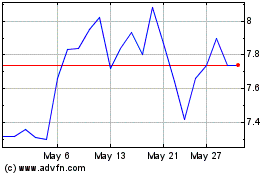

K92 Mining (TSX:KNT)

Historical Stock Chart

From Dec 2023 to Dec 2024