International Tower Hill Mines Ltd. ("ITH" or "the Company") -

(TSX: ITH)(NYSE Amex: THM)(FRANKFURT: IW9) is pleased to announce

positive initial metallurgical test results for mill processing of

the major types of mineralization at the Money Knob deposit at the

Livengood Gold Project, Alaska.

On average, 88% of the gold reported to the concentrates during

initial combined gravity and flotation gold recovery tests. Results

are highly encouraging for the use of a pre-concentration gold

recovery system for the Money Knob mineralization (Table 1). These

initial pre-concentration gold recovery results suggest that the

economics of a mining operation at Livengood could benefit

significantly from the utilization of standard flotation and

gravity circuits.

Potentially, both the operating and capital costs for a milling

operation could be reduced by decreasing the amount of material

required during the intensive treatment for gold extraction. The

initial test results indicate that concentration produces an 80%

reduction in the material volume requiring further treatment to

recover gold. The Company is currently engaged in further testing

and optimization of both the concentration process and the

extraction of gold from the concentrates.

Initial tests of conventional milling using gravity recovery

combined with intensive CIL (Carbon-in-Leach) leaching of gravity

recovered gold concentrate and CIL leaching of the tails produced

gold recoveries averaging 86% for the major types of mineralization

identified in the Money Knob deposit (Table 2).

Jeff Pontius, President and CEO of ITH, states: "These initial

results are highly encouraging for ITH as we move the Livengood

Project up our value expansion curve. The data provides an

opportunity to make a major increase in the economic value of the

project through a low cost, pre-concentration milling circuit which

would significantly increase gold recovery and provide a game

changing direction for the Project and its development path."

The Company intends to utilize the results of this ongoing

metallurgical test work in the mill-heap leach based Preliminary

Economic Assessment (PEA) of the Livengood Project currently being

conducted by SRK Consulting for completion in Q2 2010. A key

benefit from use of flotation-gravity pre-concentration is that it

would dramatically reduce the volume of material requiring cyanide

extraction while increasing the grade of the treated concentrate.

This would reduce both reagent costs and capital costs. These

results are consistent with the character of the Money Knob

mineralization, which has a very high native gold content. The

Company has expanded its metallurgical program to fully evaluate

and optimize this exciting new development.

Table 1

Initial Flotation-Gravity Metallurgical Results

(Averages of 20 composites from two major mineralization types

with varying grade and degrees of oxidation)

Concentrate % of Total Sample

Mineralization Type % In-Pit ResourceHead Grade (g/t gold)Flotation RecoveryAdditional Gravity RecoveryTotal Flotation + Gravity Recoveries Weight

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volcanics 26% 1.23 69% 21% 90% 21%

Sediments 26% 1.45 60% 24% 84% 18%

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total or Weighted Average 52% 1.34 65% 23% 88% 20%

Table 2

Initial Gravity-CIL Leaching Metallurgical Results

(Averages of 20 composites from five major mineralization types

with varying grade and degrees of oxidation)

Mineralization Type % In-Pit ResourceGold Recovery from Gravity ConcentrateTotal Gold Recovery Con + Tails

---------------------------------------------------------------------------------------------------------------

Cambrian 11% 97% 92%

Volcanics 26% 98% 90%

Upper Seds 26% 92% 82%

KINT 4% 94% 73%

Lower Sand 11% 95% 83%

---------------------------------------------------------------------------------------------------------------

Total or Weighted Average 78% 95% 86%

Metallurgical Test Methodology

Metallurgical testing was conducted by Kappes, Cassiday and

Associates in Reno, Nevada on 20 representative samples from

various mineralization types. Each sample was split from composites

weighing 200 kilograms which had been constructed from numerous

drill intersections representative of the Money Knob deposit. The

composites were selected to represent partially oxidized, trace

oxidized and un-oxidized material from higher and lower grade

intervals in both sediments and volcanic rocks. Flotation tests

were run on material ground to 80% passing 0.075mm material. The

tails from the flotation concentration process were then run

through a Knelson Gravity Recoverable Gold system to ensure that

maximum coarse gold was recovered. Optimization testing will focus

on improvement of the recovery percentage, reducing the volume of

the concentrate and maximizing recovery from the concentrate.

In a separate study of gravity concentration, CIL leaching tests

were run on a gravity concentrate, middlings tail and fine tail

developed by a Knelson Gravity Recoverable Gold system on material

sized to 80% passing 0.075 mm.

Livengood Project Highlights

-- Ongoing drilling at the Project continues to expand the deposit at a

rapid rate, and the current estimated resource remains open for further

expansion. The latest resource estimate (October 2009) of 296.8 Mt at an

average grade of 0.85 g/t gold (8.09 Moz) (Indicated) and 164.2 Mt at an

average grade of 0.84 g/t gold (4.4 Moz) (Inferred), both at a 0.5g/t

gold cutoff, makes it one of the largest new gold discoveries in North

America.

-- The recently completed PEA shows that with a USD 850/oz gold price,

mining the oxide portion of the deposit using only heap leach processing

could yield 5.8M recoverable ounces of gold and an NPV(5%) of USD 440M

and an IRR of 14.6% over a 13 year mine life.

-- Ongoing metallurgical studies focusing on the potential to mill the

Livengood mineralization are underway, and the next PEA will consider a

combined Mill and Heap Leach operation. Preliminary metallurgical test

results indicate that, on average, 56% of the gold will report to a

gravity concentrate and that CIL processing of tails will provide

significant additional recovery. Final results of these studies are

expected in late Q1 or early Q2 2010.

-- The outcropping, shallow dipping, thick, tabular deposit in the November

2009 PEA has a low overall strip ratio of 0.8:1 (waste to ore) in the

USD 700 pit. The deposit geometry is favourable for a high production

mining operation.

-- No major permitting hurdles have been identified to date.

The Company wishes to emphasize that the Livengood project has a

very favourable logistical location, being situated 110 road

kilometres north of Fairbanks, Alaska along the paved, all weather

Elliott Highway, the Trans Alaska Pipeline Corridor, and the

proposed Alaska natural gas pipeline route. The terminus of the

Alaska State power grid lies approximately 55 kilometres to the

south.

Project Background

ITH controls 100% of its 44 square kilometre Livengood land

package, which is primarily made up of fee land leased from the

Alaska Mental Health Trust and a number of smaller private mineral

leases. The Company and its predecessor, AngloGold Ashanti (U.S.A.)

Exploration Inc., have been exploring the Livengood area since

2003, with the project's first indicated resource estimate being

announced in early 2008. The 2009/10 drilling program is part of a

series of drill initiatives which mark the first grid drilling

resource definition campaign for the project and is only the

initial step in what the Company envisions as a major long-term

exploration program to define one of the world's larger new gold

deposits.

Geological Overview

The Livengood Deposit is hosted in a thrust-interleaved sequence

of Proterozoic to Palaeozoic sedimentary and volcanic rocks.

Mineralization is related to a 90 million year old (Fort Knox age)

dike swarm that cuts through the thrust stack. Primary ore controls

are a combination of favourable lithologies and crosscutting

structural zones. In areas distal to the main structural zones, the

selective development of disseminated mineralization in favourable

host rocks is the main ore control. Within the primary structural

corridors all lithologies can be pervasively altered and

mineralized. Devonian volcanic rocks and Cretaceous dikes represent

the most favourable host lithologies and are pervasively altered

and mineralized throughout the deposit. Two dominant structural

controls are present: 1) the major shallow south-dipping faults

which host dikes and mineralization which are related to dilatant

movement on structures of the original fold-thrust architecture

during post-thrusting relaxation, and 2) steep NNW trending linear

zones which focus the higher-grade mineralization which cuts across

all lithologic boundaries. The net result is a broad, flat-lying

zone of stratabound mineralization around more vertically

continuous, higher grade core zones with a resulting low strip

ratio for the overall deposit and higher grade areas that could be

amenable for starter pit production.

The surface gold geochemical anomaly at the Livengood Project

covers an area 6 kilometres long by 2 kilometres wide, of which an

area approximately 3 kilometres by 1.5 kilometres has been explored

by drilling to date. Surface exploration is ongoing as new targets

are developed to the northeast of the known mineralization.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by

National Instrument 43-101, has supervised the preparation of the

scientific and technical information that forms the basis for this

news release and has approved the disclosure herein. Mr. Pontius is

not independent of ITH, as he is the President and CEO and holds

common shares and incentive stock options.

The work program at Livengood was designed and is supervised by

Dr. Russell Myers, Vice President, Exploration, and Chris Puchner,

Chief Geologist (CPG 07048), of the Company, who are responsible

for all aspects of the work, including the quality control/quality

assurance program. On-site personnel at the project photograph the

core from each individual borehole prior to preparing the split

core. Duplicate reverse circulation drill samples are collected

with one split sent for analysis. Representative chips are retained

for geological logging. On-site personnel at the project log and

track all samples prior to sealing and shipping. All sample

shipments are sealed and shipped to ALS Chemex in Fairbanks, Alaska

for preparation and then on to ALS Chemex in Vancouver, B.C. for

assay. ALS Chemex's quality system complies with the requirements

for the International Standards ISO 9001:2000 and ISO 17025: 1999.

Analytical accuracy and precision are monitored by the analysis of

reagent blanks, reference material and replicate samples. Quality

control is further assured by the use of international and in-house

standards. Finally, representative blind duplicate samples are

forwarded to ALS Chemex and an ISO compliant third party laboratory

for additional quality control.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. is a resource exploration

company, focused in Alaska and Nevada, which controls a number of

exploration projects representing a spectrum of early stage

projects to the advanced multimillion ounce gold discovery at

Livengood. ITH is committed to building shareholder value through

new discoveries while maintaining a majority interest in its key

holdings, thereby giving its shareholders the maximum value for

their investment.

On behalf of international tower hill mines ltd.

Jeffrey A. Pontius, President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 27E of

the Exchange Act. All statements, other than statements of

historical fact, included herein including, without limitation,

statements regarding the anticipated content, commencement and cost

of exploration programs, anticipated exploration program results,

the discovery and delineation of mineral

deposits/resources/reserves, the potential for the expansion of the

estimated resources at Livengood, the potential for any production

at the Livengood project, the completion of the heap-mill

preliminary economic analysis of the Livengood project, the

potential for higher grade mineralization to form the basis for a

starter pit component in any production scenario, the potential low

strip ratio of the Livengood deposit being amenable for low cost

open pit mining that could support a high production rate and

economies of scale, the potential for cost savings due to the high

gravity concentration component of some of the Livengood

mineralization, business and financing plans and business trends,

are forward-looking statements. Information concerning mineral

resource estimates also may be deemed to be forward-looking

statements in that it reflects a prediction of the mineralization

that would be encountered if a mineral deposit were developed and

mined. Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will

prove to be correct. Forward-looking statements are typically

identified by words such as: believe, expect, anticipate, intend,

estimate, postulate and similar expressions, or are those, which,

by their nature, refer to future events. The Company cautions

investors that any forward-looking statements by the Company are

not guarantees of future results or performance, and that actual

results may differ materially from those in forward looking

statements as a result of various factors, including, but not

limited to, variations in the nature, quality and quantity of any

mineral deposits that may be located, variations in the market

price of any mineral products the Company may produce or plan to

produce, the Company's inability to obtain any necessary permits,

consents or authorizations required for its activities, the

Company's inability to produce minerals from its properties

successfully or profitably, to continue its projected growth, to

raise the necessary capital or to be fully able to implement its

business strategies, and other risks and uncertainties disclosed in

the Company's Annual Information Form filed with certain securities

commissions in Canada and the Company's annual report on Form 20-F

filed with the United States Securities and Exchange Commission

(the "SEC"), and other information released by the Company and

filed with the appropriate regulatory agencies. All of the

Company's Canadian public disclosure filings may be accessed via

www.sedar.com and its United States public disclosure filings may

be accessed via www.sec.gov, and readers are urged to review these

materials, including the technical reports filed with respect to

the Company's mineral properties.

Cautionary Note Regarding References to Resources and

Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral

Projects ("NI 43-101") is a rule developed by the Canadian

Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by

reference in this press release have been prepared in accordance

with NI 43-101 and the guidelines set out in the Canadian Institute

of Mining, Metallurgy and Petroleum (the "CIM") Standards on

Mineral Resource and Mineral Reserves, adopted by the CIM Council

on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the requirements

and terminology of NI 43-101 and the CIM Standards differ

significantly from the requirements and terminology of the SEC set

forth Industry Guide 7. Accordingly, the Company's disclosures

regarding mineralization may not be comparable to similar

information disclosed by companies subject to the SEC's Industry

Guide 7. Without limiting the foregoing, while the terms "mineral

resources", "inferred mineral resources" and "indicated mineral

resources" are recognized and required by NI 43-101 and the CIM

Standards, they are not recognized by the SEC and are not permitted

to be used in documents filed with the SEC by companies subject to

Industry Guide 7. Mineral resources which are not mineral reserves

do not have demonstrated economic viability, and United States

shareholders are cautioned not to assume that all or any part of a

mineral resource will ever be converted into reserves. Further,

inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically. It cannot be assumed that all or any part of the

inferred resources will ever be upgraded to a higher resource

category. In addition, the NI 43-101 and CIM Standards definition

of a "reserve" differs from the definition adopted by the SEC in

Industry Guide 7. In the United States, a mineral reserve is

defined as a part of a mineral deposit which could be economically

and legally extracted or produced at the time the mineral reserve

determination is made.

This press release is not, and is not to be construed in any way

as, an offer to buy or sell securities in the United States.

NR10-06

Contacts: International Tower Hill Mines Ltd. Quentin Mai

Vice-Presdient - Corporate Communications 1-888-770-7488 (toll

free) or (604) 683-6332 (604) 408-7499 (FAX)

qmai@internationaltowerhill.com www.internationaltowerhill.com

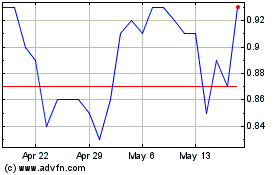

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jun 2024 to Jul 2024

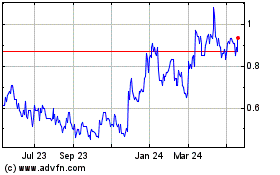

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jul 2023 to Jul 2024