Endeavour Silver Options El Inca Silver-Gold Properties in Northern Chile

August 08 2012 - 8:00AM

Marketwired Canada

Endeavour Silver Corp. (TSX:EDR)(NYSE:EXK)(FRANKFURT:EJD) announces that it has

signed a memorandum of understanding for an option and joint venture agreement

with La Sociedad Quimica Minera de Chile SA ("SQM") to earn a 75% interest in

the El Inca silver-gold properties located about 250 kilometers (km) northeast

of Antofagasta and 27 km northwest of Calama in northern Chile.

The properties cover 447 hectares and are readily accessible by road only 14 to

22 km west of Codelco's huge Chuquicamata copper mine. Elevations range from

2,200 meters (m) to 2,900 m, vegetation is sparse and the climate is dry,

typical of the Atacama desert. Bedrock at El Inca is relatively well exposed but

covered in places by talus on the mountain slopes and outwash gravels in the

valleys. Click here to view map:

http://www.edrsilver.com/s/el-inca.asp?ReportID=540085

El Inca is believed to lie within the southern extension of the Bolivian

silver-tin belt. This belt hosts the very large Cerro Rico deposit, the San

Bartolome mine (Couer D'Alene) as well as the San Cristobal mine (Sumitomo) in

Bolivia and the Pirquitas mine (Silver Standard) in Argentina. The belt has been

a world renowned source of silver production since the 16th century.

Barry Devlin, Vice President of Exploration for Endeavour commented, "The El

Inca properties have excellent exploration potential for both bulk tonnage, open

pit silver-lead-zinc mines like San Cristobal and high grade, underground

silver-gold mines like El Penon (south of El Inca in Chile) so we are pleased to

strike this deal with SQM. El Inca represents another district scale, silver

exploration opportunity to add to Endeavour's portfolio of exciting exploration

properties."

Bolivian-type silver-tin deposits generally consist of large alteration zones

encompassing zinc-lead sulphide and quartz vein swarms typically containing

silver in sulphide and sulphosalt minerals. The vein systems are spatially and

genetically associated with sub-volcanic dacite dome intrusions one to two

kilometres in diameter although the mineralization is often also hosted by the

surrounding country rocks.

El Inca covers a large argillic alteration zone containing abundant

iron-manganese oxides and sulphates measuring 2.5 km by 1.5 km. Mineralization

consists of silver-lead-zinc sulfides associated with quartz-calcite-barite

disseminations, stock-works and veins. Four main veins are hosted in dacite dome

intrusions and volcaniclastic rocks of the Eocene Cerro Los Picos Intrusive

Complex, they outcrop for up to 1.6 km along strike, range up to 4 m wide and

are surrounded by altered and mineralized low grade envelopes up to 100 m thick.

The properties were originally exploited as small, high grade, underground mines

in the late 1880's. El Inca was last explored and mined until 1982 by Codelco

who mined underground and heap-leached 128,000 tonnes grading 227 grams per

tonne (gpt). At closure, Codelco reported a resource totalling 1.49 million

tonnes grading 158 gpt silver (7.6 million oz Ag). This resource estimate is now

considered to be historic, it is not 43-101 compliant, has not been verified by

Endeavour and should not be relied upon.

A total of 64 check samples were collected by Endeavour from El Inca. Sixteen

(25%) assayed more than 10 gpt Ag and six (9%) assayed more than 100 gpt Ag.

Individual samples ran up to 1,255 gpt Ag and 0.375 gpt Au with highly anomalous

lead, zinc and copper.

In addition to the main El Inca property, the transaction also includes the San

Julian and San Marcos properties situated 8 km east of El Inca. They were

explored and mined on a small scale by Codelco until 1978. At closure, Codelco

reported a resource totaling 335,000 tonnes grading 523 gpt silver and 1.2 gpt

gold (5.6 million oz Ag and 13,300 oz Au). This resource estimate is now

considered to be historic, it is not 43-101 compliant, has not been verified by

Endeavour and should not be relied upon.

A total of 5 check samples were collected by Endeavour from San Julian and San

Marcos. Individual samples ran up to 706 gpt Ag and 1.12 gpt Au with highly

anomalous lead, zinc and copper.

Pursuant to the memorandum of understanding, Endeavour has an option to acquire

a 75% interest in the El Inca properties by making staged cash payments totaling

US$2 million and staged exploration expenditures totaling US$5 million over a 4

year period. Endeavour must also complete an NI 43-101 resource estimate and

prefeasibility study. A joint venture will then be formed with Endeavour as the

operator, SQM will retain a 3.5% NSR royalty on mineral production and Endeavour

has the right to purchase 1% of the NSR for US$1 million at any time.

ENDEAVOUR SILVER CORP.

BRADFORD COOKE, Chief Executive Officer

Qualified Person - Barry Devlin, M.Sc., P.Geo. Vice President, Exploration is

the Qualified Person who reviewed this news release and supervised the sampling

programs at El Inca. A Quality Control sampling program of reference standards,

blanks and duplicates was used to ensure the integrity of all assay results. All

samples were shipped to ALS-Chemex Labs, where they were dried, crushed, split

and 50 gram pulp samples were prepared for analysis. Gold and silver were

determined by fire assay with an atomic absorption (AA) finish and other

elements are determined by AA.

About Endeavour Silver Corp. - Endeavour Silver is a premier mid-tier silver

mining company focused on the growth of its silver production, reserves and

resources in Mexico. Since start-up in 2004, Endeavour has posted seven

consecutive years of growing silver production, reserves and resources. The

organic expansion programs now underway at Endeavour's three operating silver

mines in Mexico combined with its strategic acquisition and exploration programs

should facilitate Endeavour's goal to become the next premier senior silver

mining company.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of

the United States private securities litigation reform act of 1995 and

"forward-looking information" within the meaning of applicable Canadian

securities legislation. Such forward-looking statements and information herein

include, but are not limited to, statements regarding Endeavour's anticipated

performance in 2012, including revenue, cash cost and capital cost forecasts,

silver and gold production, the option of the Lourdes property, timing and

expenditures to explore and develop new silver mines and mineralized zones,

silver and gold grades and recoveries, cash costs per ounce, capital

expenditures and sustaining capital and the use of the Company's working

capital. The Company does not intend to, and does not assume any obligation to

update such forward-looking statements or information, other than as required by

applicable law.

Forward-looking statements or information involve known and unknown risks,

uncertainties and other factors that may cause the actual results, level of

activity, performance or achievements of Endeavour and its operations to be

materially different from those expressed or implied by such statements. Such

factors include, among others: fluctuations in the prices of silver and gold,

fluctuations in the currency markets (particularly the Mexican peso, Canadian

dollar and U.S. dollar); fluctuations in the price of consumed commodities,

changes in national and local governments, legislation, taxation, controls,

regulations and political or economic developments in Canada and Mexico;

operating or technical difficulties in mineral exploration, development and

mining activities; risks and hazards of mineral exploration, development and

mining (including environmental hazards, industrial accidents, unusual or

unexpected geological conditions, pressures, cave-ins and flooding); inadequate

insurance, or inability to obtain insurance; availability of and costs

associated with mining inputs and labour; the speculative nature of mineral

exploration and development, reliability of calculation of mineral reserves and

resources and precious metal recoveries, diminishing quantities or grades of

mineral reserves as properties are mined; risks in obtaining necessary licenses

and permits, global market events and conditions and challenges to the Company's

title to properties; as well as those factors described in the section "risk

factors" contained in the Company's most recent form 40F/Annual Information Form

filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be

reasonable, including but not limited to: the continued operation of the

Company's mining operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products will be

completed in accordance with management's expectations and achieve their stated

production outcomes, and such other assumptions and factors as set out herein.

Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements or information, there may be other factors that cause

results to be materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any forward-looking

statements or information will prove to be accurate as actual results and future

events could differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance on

forward-looking statements or information.

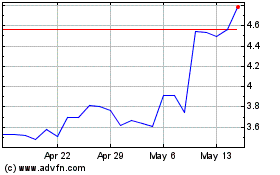

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Jun 2024 to Jul 2024

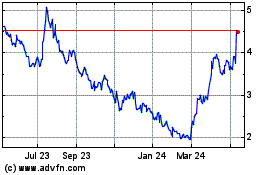

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Jul 2023 to Jul 2024