Crew Energy Inc. Announces Acquisition of Strategic Montney Acreage, Sale of Alberta Natural Gas and Associated Liquids Asset...

April 09 2014 - 4:07PM

Marketwired Canada

Crew Energy Inc. ("Crew" or the "Company") (TSX:CR) of Calgary, Alberta is

pleased to announce the successful completion of an acquisition of certain

strategic Montney liquids rich natural gas properties in northeast British

Columbia for approximately $105 million. The acquired assets include 75 net

sections of land that are either contiguous with existing Crew land or increase

Crew's working interest in joint interest lands. An updated map of the Company's

Montney acreage is posted on the Company's website at www.crewenergy.com.

In a separate transaction, Crew has entered into an agreement to sell certain

petroleum and natural gas assets (75% natural gas) focused primarily in the Deep

Basin of Alberta in exchange for approximately $222 million in cash before

closing adjustments plus approximately 400 bbls per day of heavy oil production.

Upon completion of the disposition, Crew plans to expand its previously

announced 2014 exploration and development capital program by $39 million to

$285 million to accelerate the Company's Montney development.

Northeast British Columbia Acquisition

In two transactions completed in late March 2014 Crew purchased approximately 75

sections of highly prospective Montney rights in the Septimus and Groundbirch

areas of operation in northeast British Columbia for approximately $105 million.

Pursuant to these transactions, the Company acquired:

-- Current production of 1,400 boe per day (98% natural gas) based on field

estimates;

-- Total proved reserves of 4.7 million boe (94% natural gas) (1);

-- Total proved plus probable reserves of 8.5 million boe (93% natural gas)

(1);

-- Significant resource to be evaluated in the near term; and

-- 48,100 net acres (75 net sections) of highly prospective Montney lands.

(1) Reflects Company internally estimated "gross" reserves, prepared by a

qualified reserves evaluator effective December 31, 2013 in accordance with the

definitions and provisions contained in the COGE Handbook.

The majority of the existing reserve estimates and production are from the

Halfway and Belloy formations with only four Montney locations included in the

reserve assessment. Crew also acquired underutilized strategic infrastructure

consisting of 130 kilometers of pipelines and over 6,200 hp of field

compression. All of the acquired lands are in what Crew has identified as the

"wet" gas hydrocarbon window. Crew now owns 544 (452 net) Montney sections in

northeast British Columbia of which an estimated 138 net sections are located in

the Montney "oil" window, 238 net sections are located in the Montney "wet" gas

window and 76 net sections are located in the Montney "dry" gas window.

The strategic importance of aggregating this large contiguous block of land is

expected to result in optimal operating efficiencies through:

-- Consolidating working interest in 54 sections to 100% which were

previously 50%;

-- Ability to drill longer horizontal wells at preferred orientations;

-- Economies of scale from optimized pad drilling;

-- Control of timing and pace of development; and

-- Additional infrastructure access and ownership.

Alberta Gas Disposition

Crew has entered into an agreement to dispose of certain petroleum and natural

gas assets focused in the Deep Basin area of Alberta. Total consideration to be

received for the disposition consists of $222 million in cash, before customary

closing adjustments, plus approximately 400 bbls per day of heavy oil production

which is located in Crew's Lloydminster operating area. The disposition is

scheduled to close on or about May 30, 2014 with an effective date of April 1,

2014, subject to satisfaction of customary industry closing conditions.

The assets to be sold consist of:

-- Current production of 7,000 boe per day (75% natural gas) based on field

estimates;

-- Total proved reserves of 34.1 million boe (71% natural gas) (1);

-- Total proved plus probable reserves of 60.4 million boe (71% natural

gas) (1); and

-- 254,000 net acres of land.

(1) Reflects "gross" reserves assigned by the Company's independent reserves

evaluator, Sproule Associates Limited, effective December 31, 2013 in accordance

with the definitions and provisions contained in the COGE Handbook.

The heavy oil assets to be acquired by Crew as consideration consist of:

-- Expected production at closing of 400 boe per day (99% oil) based on

field estimates;

-- Total proved reserves of 0.6 million boe (99% oil) (1);

-- Total proved plus probable reserves of 0.8 million boe (99% oil) (1);

and

-- 2,750 net acres of land.

(1) Reflects "gross" reserves assigned by the purchasers independent reserves

evaluator, Sproule Associates Limited, extracted from their report effective

December 31, 2013 prepared in accordance with the definitions and provisions

contained in the COGE Handbook.

Inclusive of all of these transactions, Crew expects to have the following

pro-forma operational and financial attributes:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Post-Transactions Corporate Summary Pro-forma (1)

----------------------------------------------------------------------------

Production metrics (boe per day):

At closing (2) 23,800

Forecasted average 2014 25,500 - 26,500

Forecasted exit 2014 26,000 - 27,000

Forecasted exit 2015 (4) 38,000 - 40,000

Financial metrics

Estimated 2014 funds from operations ($ mm) 200

Estimated net debt at closing ($ mm) 280

Reserves and Land

Estimated proved reserves (mmboe) (3) 87.2

Estimated proved plus probable reserves (mmboe) (3) 146.2

Montney lands (sections) 544 (452 net)

Total Company acreage (net) 831,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1. Pro-forma assuming transactions completed on dates specified.

2. Based on field estimates.

3. Based upon the reserve report prepared by the Company's independent

reserves evaluator, Sproule Associates Limited, effective December 31,

2013 in respect of the Company's oil and gas interests owned as at such

date, and after removing the reserves assigned to the Company's Alberta

Gas assets which are subject to the disposition, and adding the

internally estimated reserves attributed to the Company's northeast

British Columbia acquisitions completed in late March, 2014. Reflects

"gross" reserves as such term is defined in the COGE Handbook.

4. Reflects target production based on internal long range planning which

are subject to change as more definitive capital plans and budgets are

prepared in respect of 2015.

Strategic Rationale

Regarding the acquired Montney lands, Crew's CEO, Dale Shwed was quoted as

saying; "The acquired assets fit like integral pieces of a puzzle and are

contiguous to, or have joint interest, with Crew's existing land base.

Operationally, the acquired assets are a great strategic fit that provide the

economies of scale and logistics that are complementary to Crew's existing

operations and future development plans." The acquisition of the joint interest

lands (approximately 54 gross sections) will allow Crew to control the timing

and pace of development of a significant land block at Groundbirch which is

supported by underutilized pipeline infrastructure and field compression. With

75 net sections acquired and a development strategy that includes 8 to 12 wells

per section, this acquisition adds over 600 net drilling locations to our

Montney inventory which now stands at over 2,100 estimated locations. More

importantly, with Montney type curve wells in the Septimus area recently

exhibiting a net present value of $8.2 million per well, the successful

development of only 1.5 net sections of the acquired lands (based on 12.8

development wells) would payout this entire acquisition.

The disposition of the Alberta gas assets will provide the Company with a

non-dilutive clear line of sight to funding the acceleration of our five year

Montney growth plan. We will be able to focus our resources in a play which, in

2013, achieved a recycle ratio of 3.1x versus our corporate average of 2.3x.

With the disposition of a significant portion (31%) of our proved plus probable

reserves, including future development costs of $394 million, the Company is

well positioned to replace these reserves with the continued development of the

Montney where, prior to these British Columbia acquisitions, only 0.5 TCFE

(12.2%) has been booked out of a previously announced best estimate contingent

resource of 4.1 TCFE. Production rates and expected ultimate recoveries ("EURs")

have continued to improve with the latest subset of wells producing at 6 to 8

mmcf per day with associated liquids of 30 bbls per mmcf (60% condensate). EURs

have steadily improved since 2011 (2.8 bcf/well) to 2012 (3.2 bcf/well) to 2013

(4.3 bcf/well) and are expected to continue to improve over time as Crew

continues to better understand the Montney reservoir and how to apply new

technologies related to drilling and completion practices.

Operations Update

Crew drilled 21 (19.0 net) wells in the first quarter. The Company drilled five

(5.0 net) Montney wet gas wells, nine (7.6 net) heavy oil wells at Lloydminster,

six (6.0 net) oil wells at Princess and one (0.4 net) oil well at Pine Creek.

Crew currently has two rigs operating in northeast British Columbia drilling a

two well pad at Groundbirch and a six well pad at Septimus. Crew's results at

Septimus continued to be strong with two wells coming on production at the end

of the quarter at 6 to 8 mmcf per day. Crew re-tested the fourth quarter 2013,

1-24 oil well at Tower for 11 days with an average flow rate of 720 boe per day

(540 bbl per day of oil) validating light oil production 11 kilometers northwest

of the Company's existing Montney oil production. This well is expected to be

tied-in during the third quarter. Current production based on field estimates is

30,400 boe per day which is inclusive of the 1,400 boe per day acquisition which

closed in late March. Production in the first quarter is expected to average

approximately 28,000 boe per day as the majority of first quarter drilled wells

came on production late in March. Extreme weather conditions experienced in

western Canada in the first quarter caused operational delays and outages and

there were an abnormally high number of wells which were required to be shut-in

due to offsetting drilling operations in the Company's Lloydminster operations.

In addition, the compressor at Crew's Sierra property in northeastern British

Columbia (approximately 350 boe per day) experienced a fire late in 2013 and the

Company elected to accept an insurance settlement rather than replacing the

equipment and restoring production levels.

After spring break-up subsides, Crew's plans include the following:

-- Complete two Groundbirch wells;

-- Complete a six well pad at Septimus;

-- Spud a five well pad at Septimus;

-- Spud a six well pad at Tower;

-- Resume drilling operations at Lloydminster and Princess; and

-- Begin construction of the Tower oil facility and the new Septimus gas

facility.

Expanded Capital Program

After the closing of the Alberta Gas disposition, Crew plans to expand its

exploration and development capital program by $39 million to $285 million. The

expanded program will be entirely focused on Montney development with the

drilling well count increasing by 50% to 30 wells from the previously budgeted

20 wells to supply production volumes to the new 60 mmcf per day plant at

Septimus expected to be onstream early in the third quarter of 2015. Capital

expenditures for Lloydminster (25 wells and $36 million capital) and Princess

(16 wells and $39 million capital) remain as previously forecasted.

Advisors

Cormark Securities Inc. has acted as financial advisor to Crew on the

transactions, TD Securities Inc. acted as strategic advisor on the transactions

and Macquarie Capital Markets Canada Ltd. and GMP Securities LP have acted as

strategic advisors to Crew with respect to the Montney acquistions.

Cautionary Statements

Forward-Looking Information and Statements

This news release contains certain forward-looking information and statements

within the meaning of applicable securities laws. The use of any of the words

"expect", "anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" "forecast" and similar expressions are

intended to identify forward-looking information or statements. In particular,

but without limiting the foregoing, this news release contains forward-looking

information and statements pertaining to the following: various matters related

to the proposed transactions disclosed herein including completion of the

proposed Alberta Gas asset disposition (and related heavy oil acquisition) and

acquisition and the timing thereof, satisfaction of closing conditions thereto,

the amount of and use of proceeds, the effect of the transaction on continuing

operations and the benefits anticipated to be derived therefrom,

post-transaction strategy, plans, opportunities and operations; Crew's plans to

expand its 2014 capital program and budget on a post-transaction basis; the

anticipated potential of Crew's asset base; the volume and product mix of Crew's

oil and gas production; production estimates including 2014 forecast average and

exit productions and 2015 estimated exit target; estimated 2014 funds from

operations; projected debt levels including forecast 2014 net debt on a

post-transaction basis; future oil and natural gas prices and Crew's commodity

risk management programs; future liquidity and financial capacity; future

results from operations and operating metrics; anticipated reductions in

operating costs; future costs, expenses and royalty rates; future interest

costs; the exchange rate between the $US and $Cdn; future development,

exploration, acquisition and development activities and related capital

expenditures and the timing thereof; the number of wells to be drilled,

completed and tied-in and the timing thereof; the amount and timing of capital

projects; the total future capital associated with development of reserves and

resources; and methods of funding our capital program, including possible

non-core asset divestitures and asset swaps.

Forward-looking statements or information are based on a number of material

factors, expectations or assumptions of Crew which have been used to develop

such statements and information but which may prove to be incorrect. Although

Crew believes that the expectations reflected in such forward-looking statements

or information are reasonable, undue reliance should not be placed on

forward-looking statements because Crew can give no assurance that such

expectations will prove to be correct. In addition to other factors and

assumptions which may be identified herein, assumptions have been made

regarding, among other things: that all conditions to closing of the Gas

disposition are satisfied or waived; the impact of increasing competition; the

general stability of the economic and political environment in which Crew

operates; the timely receipt of any required regulatory approvals; the ability

of Crew to obtain qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of the projects

in which Crew has an interest in to operate the field in a safe, efficient and

effective manner; the ability of Crew to obtain financing on acceptable terms;

field production rates and decline rates; the ability to replace and expand oil

and natural gas reserves through acquisition, development and exploration; the

timing and cost of pipeline, storage and facility construction and expansion and

the ability of Crew to secure adequate product transportation; future commodity

prices; currency, exchange and interest rates; regulatory framework regarding

royalties, taxes and environmental matters in the jurisdictions in which Crew

operates; the ability of Crew to successfully market its oil and natural gas

products. There are a number of assumptions associated with the potential of

resource volumes including the quality of the Montney reservoir, future drilling

programs and the funding thereof, continued performance from existing wells and

performance of new wells, the growth of infrastructure, well density per

section, and recovery factors and discovery and development necessarily involves

known and unknown risks and uncertainties, including those identified in this

press release. Included herein is an estimate of Crew's year end net debt based

on assumptions as to cash flow, capital spending in 2014 and the other

assumptions utilized in arriving at Crew's 2014 capital budget on a

post-transaction basis. To the extent such estimate constitutes a financial

outlook, it is included herein to provide readers with an understanding of

estimated capital expenditures and the effect thereof on debt levels and readers

are cautioned that the information may not be appropriate for other purposes.

The forward-looking information and statements included in this news release are

not guarantees of future performance and should not be unduly relied upon. Such

information and statements, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to defer materially from those anticipated in such

forward-looking information or statements including, without limitation: changes

in commodity prices; the potential for variation in the quality of the Montney

formation; changes in the demand for or supply of Crew's products; unanticipated

operating results or production declines; changes in tax or environmental laws,

royalty rates or other regulatory matters; changes in development plans of Crew

or by third party operators of Crew's properties, increased debt levels or debt

service requirements; inaccurate estimation of Crew's oil and gas reserve and

resource volumes; limited, unfavourable or a lack of access to capital markets;

increased costs; a lack of adequate insurance coverage; the impact of

competitors; and certain other risks detailed from time-to-time in Crew's public

disclosure documents (including, without limitation, those risks identified in

this news release and Crew's Annual Information Form).

The forward-looking information and statements contained in this news release

speak only as of the date of this news release, and Crew does not assume any

obligation to publicly update or revise any of the included forward-looking

statements or information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities laws.

Reserves

The recovery and reserves estimates contained herein are estimates only and

there is no guarantee that the estimated reserves will be recovered. In relation

to the disclosure of estimates for individual properties, such estimates may not

reflect the same confidence level as estimates of reserves and future net

revenue for all properties, due to the effects of aggregation.

Resource Estimates

This news release contains references to estimates of oil and gas classified as

Contingent Resources in the Montney region in northeastern British Columbia

which are not, and should not be confused with, oil and gas reserves. Such

estimates are based upon independent resource evaluations effective as at April

30, 2013 and May 31, 2013, respectively, prepared in accordance with the

Canadian Oil and Gas Evaluation Handbook. Such estimates are subject to a number

of cautionary statements, assumptions, risks, positive and negative factors

relevant to the estimates and contingencies, the details of which were set forth

in Crew's previously disseminated press release dated July 9, 2013. Accordingly,

readers are referred to and encouraged to review the sections entitled "Montney

Resource Evaluation", "Definitions of Oil and Gas Resources and Reserves" and

"Information Regarding Disclosure on Oil and Gas Reserves, Resources and

Operational Information" in the July 9, 2013 press release for applicable

definitions, cautionary language, explanations and discussion of resources

estimated herein, all of which is incorporated herein by reference.

Test Results and Initial Production Rates

A pressure transient analysis or well-test interpretation has not been carried

out and thus certain of the test results provided herein should be considered to

be preliminary until such analysis or interpretation has been completed. Test

results and initial production rates disclosed herein may not necessarily be

indicative of long term performance or of ultimate recovery.

BOE Equivalent

Barrel of oil equivalents or BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 mcf:1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given that the value ratio

based on the current price of crude oil as compared to natural gas is

significantly different than the energy equivalency of 6:1, utilizing a 6:1

conversion basis may be misleading as an indication of value.

Crew is an oil and gas exploration and production company whose shares are

traded on The Toronto Stock Exchange under the trading symbol "CR".

FOR FURTHER INFORMATION PLEASE CONTACT:

Crew Energy Inc.

Dale Shwed

President and C.E.O.

(403) 231-8850

dale.shwed@crewenergy.com

Crew Energy Inc.

John Leach

Senior Vice President and C.F.O.

(403) 231-8859

john.leach@crewenergy.com

Crew Energy Inc.

Rob Morgan

Senior Vice President and C.O.O.

(403) 513-9628

rob.morgan@crewenergy.com

www.crewenergy.com

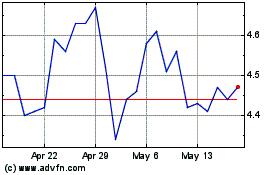

Crew Energy (TSX:CR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crew Energy (TSX:CR)

Historical Stock Chart

From Jul 2023 to Jul 2024