Century Global Commodities Corporation (“Century”

or the “Company”) is pleased to announce that it has filed its

condensed consolidated interim financial statements for the third

fiscal quarter ended December 31, 2020 and the related management

discussion and analysis (“MD&A”). Copies of these documents are

available under Century’s SEDAR profile at www.sedar.com and will

also be posted on Century’s website at www.centuryglobal.ca.

The Company is also pleased to report that it

delivered a total comprehensive income of $1,935,337 for the nine

months ended December 31, 2020 (compared with a loss of $3,561,600

for the same period last year) and $534,992 for the third fiscal

quarter this year (compared to a loss of $1,122,397 for the same

quarter last year). The total comprehensive income year-to-date

comprised operating net income from the Hong Kong food segment as

well as two accretive corporate transactions, which included in the

third quarter, acquisition of a joint venture partner’s interests

(outlined below and discussed in the MD&A). The Company’s

revenue was $6,408,724 year-to-date and $1,820,170 for the

quarter.

As of December 31, 2020, the Company had strong

working capital of $16.8 million, consisting of cash, bank deposits

and marketable securities totaling $15.0 million, together with

accounts receivables and other current assets of $4.0 million, less

accounts payable and other current liabilities of $2.2 million.

The Joyce Lake DSO Iron Ore

Project

In November 2020, the Company acquired a joint

venture partner’s interests in the Joyce Lake Iron Ore Project

(“Joyce Lake”) and other Labrador iron ore projects, so as to

increase the Company’s ownership to 100%. During the quarter

Century also completed an internal reorganization placing the Joyce

Lake project in a corporate structure to facilitate accretive

financings. Century management has placed the Company in a stronger

financial position to now allow rapid advancement of the Joyce Lake

project at the dawn of a potential new iron ore price super-cycle.

As previously announced, the Company intends to spin-out the Joyce

Lake project to facilitate the next phases of development

financing.

The iron ore market has continued to perform

strongly through January 2021, at an average selling price close to

US$170/t (62% CFR China). The Joyce Lake 2015 NI 43-101 Feasibility

Study dated April 14, 2015 (the “Study”) determined a pre-tax net

present value, at an 8% discount rate, of $130.8 million at an

assumed iron ore price of only US$95/t. According to the Study’s

sensitivity analysis, the pre-tax net present value becomes $888.8

million at US$142.5/t (some US$25/t below January’s average selling

price), as discussed below. The Study is available on SEDAR and was

published in April 2015.

To seize the great opportunity presented by a

strong recovery in the global iron ore market, the Company plans to

spin-out Joyce Lake, in a similar manner to the way Century Metals

Inc. (now known as Reyna Silver Corp.) was spun-out in 2019. The

Joyce Lake spin-out will be consistent with accretive raising

additional capital to fund an optimization of the Study and to

advance the Joyce Lake project to a production decision as soon as

possible. The structure and timing of any spin-out of the Joyce

Lake project and any related additional capital raises to further

fund the Joyce Lake project remain under consideration by Century

and are subject to finalization.

Joyce Lake, our most advanced project, is a DSO

(direct shipping ore) project in Newfoundland and Labrador, close

to the town of Schefferville, Quebec which is serviced by a rail

link directly to ocean shipping iron ore ports at Sept-Iles. A new

43km dedicated haul road will be used from the Joyce Lake project

to the rail link. It has completed feasibility and permitting

studies and can be brought to production within approximately 30

months.

Following an expenditure of more than $40

million, the project has reserves of 17.72 million tonnes at 59.71%

Fe based on estimates included in the Study.

The NI 43-101 Study contemplates an open pit

mine of 2.5 million t/a over a 7-year life-of-mine producing both

lump and fines from crushing and screening with no tailings

generated. The Study financial analysis used a base case long term

price of US$95/t, a capital cost of $259.6M and operating costs of

$58.25 FOB the port at Sept- Iles, which generated an NPV8% of

$61.4M after tax and $130.8M before tax.

The Study (page 22-8) also provides a

sensitivity analysis range of iron ore selling prices CFR China. In

the context of higher prices, compared to the US$95/t life-of-mine

price assumed in the Study, the Study table extract below shows the

impact of higher prices on valuations and returns. At US$142.5/t

(which is 50% higher than the US$95/t Study base case but still

some US$25/t below the January 2021 average selling price of

US$167.8/t), Joyce Lake NPV8% is $888.8M before tax. This

information should be viewed in the context of the full information

presented in the Study.

|

Selling Price Variation |

0 |

+10% |

+30% |

+50% |

|

Base Price for 62% Fe, CFR China (US$/DMT) |

$95.00 |

$104.50 |

$123.50 |

$142.50 |

|

IRR before tax |

18.7% |

30.4% |

52.4% |

73.7% |

|

NPV (8%) before tax in C$ |

$130.8M |

$282.4M |

$585.6M |

$888.8M |

|

Payback before tax (year) |

4.4 |

3.2 |

2.0 |

1.5 |

Joyce Lake Mineral Reserves

The following mineral reserves estimate for

Joyce Lake DSO Project was estimated during the Study effective as

of March 2, 2015.

|

|

Tonnage |

Grade |

Grade |

Grade |

Grade |

|

Mineral Reserves |

(t) |

(%Fe) |

(%SiO2) |

(%Al2O3) |

(%Mn) |

|

High Grade Proven (Above 55% Fe) |

11.63 M |

61.35 |

9.16 |

0.54 |

0.84 |

|

Low Grade Proven (52% - 55% Fe) |

2.89 M |

53.31 |

20.70 |

0.60 |

0.70 |

|

High Grade Probable (Above 55% Fe) |

2.45 M |

61.50 |

9.48 |

0.50 |

0.61 |

|

Low Grade Probable (52% - 55% Fe) |

0.75 M |

53.09 |

21.90 |

0.58 |

0.30 |

|

Total Reserve (Above 52% Fe) |

17.72 M |

59.71 |

11.62 |

0.55 |

0.76 |

The strip ratio is 4.09.

Mineral resources and mineral reserves are

reported in accordance with Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) definition standards for Mineral

Resources, Mineral Reserves and their Guidelines, and are compliant

with NI43-101.

Allan (Wenlong) Gan, P. Geo, a Qualified Person

as defined by NI 43-101, has reviewed and approved the technical

information contained in this news release.

ABOUT CENTURY

Century Global Commodities Corporation (TSX:CNT)

is primarily a resource exploration and development company with a

large portfolio of multi-billion tonne iron ore projects in Canada,

mostly discovered by its own exploration team. Century also owns

100% of the Joyce Lake Direct Shipping Ore project, its most

advanced project. It has other non-ferrous metals properties under

exploration as well as a well-established food distribution

business in Hong Kong (Century Food).

Iron Ore Projects

With Baowu and Minmetals, both Global Fortune

500 companies, as Chinese strategic partners and shareholders,

Century owns one of the largest iron ore mineral resource bases in

the world, with 8.4 billion tonnes of measured and indicated

resources and 11 billion tonnes of inferred resources across five

projects in Quebec and Newfoundland and Labrador including Joyce

Lake DSO Iron Ore Project, Full Moon Taconite Project and the

Duncan Lake project.

Century Food

Century Food is a subsidiary operation of the

Company and was started a few years ago. It is a value-adding

marketing and distribution business for quality food products

sourced from such regions as Europe and Australia and sold in the

Hong Kong market.

For further information please contact:

Sandy Chim, President & CEOCentury Global Commodities

Corporation416-977-3188IR@centuryglobal.ca

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, CENTURY’S OWNERSHIP AND PLANS FOR THE SPIN-0UT,

FINANCING AND DEVELOPMENT OF THE JOYCE LAKE IRON ORE PROJECT,

INCLUDING PROJECTIONS AS TO THE TIME FRAME FOR DEVELOPMENT, CAPITAL

COSTS, OPERATING COSTS AND THE RELATED INTERNAL RATES OF RETURN,

PAYBACK PERIODS AND PROJECT NET PRESENT VALUES. FORWARD-LOOKING

INFORMATION IS BASED ON, AMONG OTHER THINGS, OPINIONS, ASSUMPTIONS,

ESTIMATES AND ANALYSES THAT, WHILE CONSIDERED REASONABLE BY CENTURY

AT THE DATE THE FORWARD-LOOKING INFORMATION IS PROVIDED, ARE

INHERENTLY SUBJECT TO SIGNIFICANT RISKS, UNCERTAINTIES,

CONTINGENCIES AND OTHER FACTORS THAT MAY CAUSE ACTUAL RESULTS AND

EVENTS TO BE MATERIALLY DIFFERENT FROM THOSE EXPRESSED OR IMPLIED

BY THE FORWARD-LOOKING INFORMATION. THE RISKS, UNCERTAINTIES,

CONTINGENCIES AND OTHER FACTORS THAT MAY CAUSE ACTUAL RESULTS TO

DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY THE

FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT LIMITED TO,

RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS DESCRIBED IN

CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED MARCH 31,

2020. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARDLOOKING

INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY

OTHER DATE. WHILE CENTURY MAY ELECT TO, IT DOES NOT UNDERTAKE TO

UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED

IN ACCORDANCE WITH APPLICABLE LAWS.

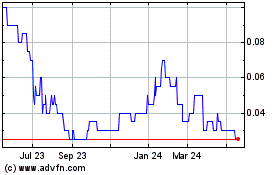

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

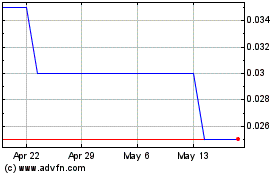

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Jan 2024 to Jan 2025