Calian Group Ltd. (“

Calian” or the

“

Company”) (TSX: CGY) is pleased to announce that

the Toronto Stock Exchange (the “

Exchange” or

“

TSX”) has accepted a notice (the

“

Notice”) filed by the Company of its intention to

make a normal course issuer bid (the “

NCIB”). In

connection with the NCIB, the Company has entered into an automatic

share purchase plan (an “

ASPP”) with its

designated broker to allow for purchases of its common shares (the

“

Shares”).

“We are continuing with a share buyback program

as we continue to believe that the market price of the Shares does

not reflect its underlying value and therefore undervalues the

Company’s future growth prospects,” said Kevin Ford, CEO of Calian.

“After three quarters, we are firmly on track with our three-year

strategic plan. We have also completed three acquisitions,

investing nearly $90 million in capital, all while maintaining a

strong balance sheet. We are confident in the long-term prospects

of Calian and believe that buying back Shares is a good use of

capital.”

The Notice provides that the Company may, during

the 12-month period commencing September 1, 2024 and ending August

31, 2025, or on such earlier date as Calian completes its purchases

or provides notice of termination, purchase up to 995,904 Shares in

total, representing approximately 10% of Calian’s public float of

Shares as at August 16, 2024. As of the close of business on August

16, 2024 the Company had 11,846,546 Shares issued and outstanding.

Except for block purchases permitted under the rules of the TSX,

the number of Shares to be purchased per day will not exceed 1,974,

which represents 25% of the average daily trading volume of the

Shares on the TSX for the most recently completed six calendar

months (being 7,899 Shares) prior to the TSX’s acceptance of the

Notice. The actual number of Shares which may be purchased under

the NCIB and the timing of any such purchases will be determined by

management of the Company, subject to applicable law and the rules

of the TSX.

Subject to any required regulatory approvals,

all purchases of Shares under the NCIB will be conducted through

the facilities of the TSX and/or alternative Canadian trading

systems at prevailing market prices, or by such other means as may

be permitted by the applicable securities regulator. All Shares

purchased under the NCIB will be cancelled.

Calian has entered into an ASPP with Desjardins

Securities Inc. (“Desjardins”) to allow for the

purchase of Shares under the NCIB at times when the Company would

ordinarily not be permitted to purchase Shares due to regulatory

restrictions or self-imposed blackout periods.

Pursuant to the ASPP, prior to entering into a

blackout period, Calian may, but is not required to, instruct

Desjardins to make purchases under the NCIB in accordance with the

terms of the ASPP. Such purchases will be determined by Desjardins

in its sole discretion based on parameters established by Calian

prior to the blackout period in accordance with the rules of the

TSX, applicable securities laws and the terms of the ASPP. The ASPP

has been pre-cleared by the TSX concurrently with the initiation of

the NCIB.

As noted above, the board of directors of the

Company (the “Board”) believes that the recent

market prices of the Shares do not properly reflect the underlying

value of such shares. As a result, depending upon future price

movements and other factors, the Board believes that the purchase

of the Shares would be a desirable use of corporate funds in the

best interests of the Company. Furthermore, the purchases are

expected to benefit all persons who continue to hold Shares by

increasing their equity interest in the Company when such

repurchased Shares are cancelled.

To the knowledge of the Company, no director,

senior officer or other insider of the Company or any of their

associates currently intends to sell any Shares under the NCIB,

however sales by such persons through the facilities of the

Exchange or any other available market or alternative trading

system may occur if the personal circumstances of any such persons

change or if any such persons make a decision unrelated to these

normal course purchases. The benefits to any such person whose

Shares are purchased would be the same as the benefits available to

all other holders whose Shares are purchased.

Under Calian’s normal course issuer bid expiring

on August 31, 2024 (the “Expiring NCIB”), the

Company received approval from the TSX to purchase for cancellation

up to a maximum of 1,044,012 Shares, representing approximately 10%

of Calian’s public float of Shares as at the close of business on

August 22, 2023. As of the date hereof, the Company has repurchased

and cancelled 110,720 Shares under the Expiring NCIB, at a weighted

average purchase price of approximately $50.96 per Share.

About Calian

We keep the world moving forward. Calian® helps

people communicate, innovate, learn and lead safe and healthy

lives. Every day, our employees live our values of customer

commitment, integrity, innovation, respect and teamwork to engineer

reliable solutions that solve complex challenges. That’s

Confidence. Engineered. A stable and growing 40-year company, we

are headquartered in Ottawa with offices and projects spanning

North American, European and international markets. Visit

calian.com to learn about innovative healthcare, communications,

learning and cybersecurity solutions.

Product or service names mentioned herein may be

the trademarks of their respective owners.

Media inquiries: media@calian.com

Investor Relations inquiries: ir@calian.com

Cautionary Note and Forward-Looking

Information

This press release contains forward-looking

information within the meaning of Canadian securities legislation.

Forward-looking information relates to future events or the

anticipated performance of Calian and reflects management’s

expectations or beliefs regarding such future events. In certain

cases, statements that contain forward-looking information can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, “believes” or variations of such words

and phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might”, or “will be taken”, “occur” or

“be achieved” or the negative of these words or comparable

terminology. Forward-looking information in this press release

includes statements with respect to the anticipated benefits of the

NCIB and the number of Shares that may be purchased under the NCIB.

By its very nature forward-looking information involves known and

unknown risks, uncertainties and other factors that may cause

actual performance of Calian to be materially different from any

anticipated performance expressed or implied by such

forward-looking information.

Forward-looking information is subject to a

variety of risks and uncertainties, which could cause actual events

or results to differ from those reflected in the forward-looking

information, including, without limitation, the risks described

under the heading “Risk Factors” in the Company’s annual

information form dated December 18, 2023 for its fiscal year ended

September 30, 2023 and other risks identified in the Company’s

filings with Canadian securities regulators, which filings are

available on SEDAR+ at www.sedarplus.ca.

The risk factors referred to above are not an

exhaustive list of the factors that may affect any of the Company’s

forward-looking information. Forward-looking information includes

statements about the future and is inherently uncertain, and the

Company’s actual achievements or other future events or conditions

may differ materially from those reflected in the forward-looking

information due to a variety of risks, uncertainties and other

factors. The Company's statements containing forward-looking

information are based on the beliefs, expectations, and opinions of

management on the date the statements are made, and the Company

does not assume any obligation to update such forward-looking

information if circumstances or management's beliefs, expectations

or opinions should change, other than as required by applicable

law. For the reasons set forth above, one should not place undue

reliance on forward-looking information.

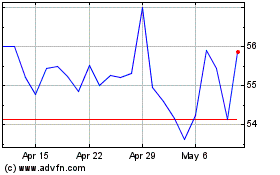

Calian (TSX:CGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

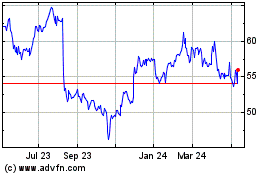

Calian (TSX:CGY)

Historical Stock Chart

From Nov 2023 to Nov 2024