China Gold International Announces Loan Agreement and Deposit Services Agreement with Related Party

December 19 2017 - 9:30AM

China Gold International Resources Corp. Ltd. (TSX:CGG) (HKEx:2099)

(the “

Company” or “

China Gold

International Resources”) wishes to announce that on

December 18, 2017, the Company and China National

Gold Group Finance Co., Ltd. (“

China Gold

Finance”) entered into a deposit services agreement (the

“

Deposit Services Agreement”) pursuant to which

the Company and its subsidiaries (the “

Group”)

may, from time to time, make withdrawals and deposits with China

Gold Finance up to a daily maximum deposit balance (including

interest) not exceeding RMB 100,000,000. Loan interest

payable to China Gold Finance will be based on the RMB benchmark

rate for a one year loan published by The People’s Bank of China

(4.35%) with a 5% discount. In addition, on December 18, 2017, the

Company and China Gold Finance entered into a loan agreement (the

“

Loan Agreement”) pursuant to which China Gold

Finance agreed to provide an unsecured loan in the aggregate amount

of RMB 350,000,000 to satisfy the financial needs of the Group

within the PRC. Deposit interest rates payable by China Gold

Finance for any deposits shall be, at a minimum, 20% higher than

the benchmark interest rate published by The People's Bank of China

for the same period and for the same type of deposit.

China Gold Finance is licensed by the China

Banking Regulatory Commission.

China National Gold Group Co.,

Ltd. (formerly: China National Gold Group Corporation), the

controlling shareholder of the Company, holds a 51% interest in

China Gold Finance and therefore, both the Deposit Services

Agreement and the Loan Agreement (together, the

“Transactions”) constitute a “related party

transaction” as defined in Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). For the purposes of MI

61-101, the Transactions are exempt from (i) minority approval

requirements in accordance with section 5.7(a) by virtue of the

fact that the value of the loan and the deposit, in each case, is

less than 25% of the Company's market capitalization and (ii) the

formal valuation requirement because each of the loan and the

deposit is a credit facility.

About China Gold International

Resources

China Gold International Resources Corp. Ltd. is

based in Vancouver, BC, Canada and operates both profitable and

growing mines, the CSH Gold Mine in Inner Mongolia, and the Jiama

Copper-Polymetallic Mine in Tibet Autonomous Region of the People’s

Republic of China. The Company’s objective is to continue to build

shareholder value by growing production at its current mining

operations, expanding its resource base, and aggressively acquiring

and developing new projects internationally. The Company is listed

on the Toronto Stock Exchange (TSX: CGG) and the Main Board of The

Stock Exchange of Hong Kong Limited (HKEx: 2099).

For further information on China Gold

International Resources Corp. Ltd., please refer to its SEDAR

profile at www.sedar.com or contact Tel:604-609-0598,

Email:info@chinagoldintl.com, Website:www.chinagoldintl.com.

Cautionary Note About Forward-Looking

Statements

Certain information regarding China Gold

International Resources contained herein may constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Although China

Gold International Resources believes that the expectations

reflected in such forward-looking statements are reasonable, it can

give no assurance that such expectations will prove to have been

correct. China Gold International Resources cautions that actual

performance will be affected by a number of factors, most of which

are beyond its control, and that future events and results may vary

substantially from what China Gold International Resources

currently foresees. Factors that could cause actual results to

differ materially from those in forward-looking statements include

market prices, exploitation and exploration results, continued

availability of capital and financing and general economic, market

or business conditions. The forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

The information contained herein is stated as of the current date

and subject to change after that date.

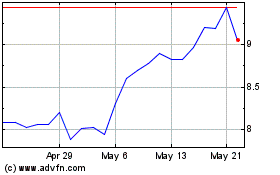

China Gold International... (TSX:CGG)

Historical Stock Chart

From Nov 2024 to Dec 2024

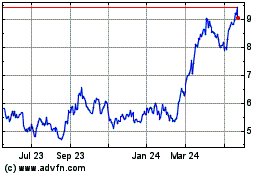

China Gold International... (TSX:CGG)

Historical Stock Chart

From Dec 2023 to Dec 2024