Acadian Timber Corp. (TSX: ADN) -

Investors, analysts and other interested parties can access

Acadian Timber Income Fund's 2009 Fourth Quarter and Year-end

Results conference call via webcast on Wednesday, February 10, 2010

at 10:00 a.m. ET at www.acadiantimber.com or via teleconference at

1-800-319-4610, toll free in North America. For overseas calls

please dial +1-604-638-5340, at approximately 9:50 a.m. ET. The

teleconference recorded rebroadcast can be accessed at

1-800-319-6413 or +1-604-638-9010 and enter passcode 2826.

Acadian Timber Corp. (the "Corporation") (TSX: ADN), formerly

Acadian Timber Income Fund ("Acadian" or the "Fund"), today

reported financial and operating results(1) for the three and

twelve month periods ended December 31, 2009.

For the three months ended December 31, 2009 (the "fourth

quarter"), Acadian generated net sales of $16.7 million on

consolidated volumes of 343 thousand m3, compared with net sales of

$19.7 million on consolidated volumes of 307 thousand m3 during the

same period last year.

EBITDA for the fourth quarter was $2.0 million or 12% of sales

as compared to EBITDA of $6.9 million or 35% of sales during the

comparable period in 2008. Results in the quarter reflect a lower

contribution from the management of the Crown licensed timberlands

by New Brunswick Timberlands and soft pricing at Maine Timberlands.

As a result of these market conditions, Acadian has continued to

reduce near-term harvest levels of our high margin spruce-fir

sawlogs allowing us to maximize opportunities when markets recover,

thus preserving the long-term value of Acadian's resource.

Additionally, the Fund incurred $0.9 million of non-recurring costs

associated with the previously announced conversion to a

corporation.

For the year ended December 31, 2009, Acadian generated net

sales of $63.4 million as compared to net sales of $67.9 million in

2008. EBITDA was $12.1 million or 19% of sales as compared to

EBITDA of $17.4 million or 26% of sales in the prior year.

"While 2009 was another very challenging year, we are pleased

with what we have achieved this year at both corporate and

operating levels. These accomplishments include successfully

completing the conversion to a corporation and extending the

maturity of our bank term credit facility," commented Reid Carter,

Chief Executive Officer of Acadian. "While 2010 is expected to be

another difficult year, we will focus on identifying and accessing

market opportunities while keeping costs low," added Mr.

Carter.

(1) This news release makes reference to earnings before

interest, taxes, depletion, depreciation and amortization

("EBITDA") and distributable cash from operations. Management

believes that EBITDA and distributable cash from operations are key

performance measures in evaluating Acadian's operations and are

important in enhancing investors' understanding of Acadian's

operating performance. As EBITDA and distributable cash from

operations do not have a standardized meaning prescribed by

Canadian GAAP, they may not be comparable to similar measures

presented by other companies. As a result, we have provided in this

news release reconciliations of net income and cash flow from

operations, as determined in accordance with Canadian GAAP, to

EBITDA and distributable cash from operations.

New Chief Financial Officer Appointed

Brookfield Timberlands Management LP, as Manager of Acadian,

announced that, after almost three years as Acadian's Chief

Financial Officer, Mr. Joseph Cornacchia will be leaving Acadian to

take on new responsibilities within Brookfield Asset Management.

"The entire management team would like to thank Mr. Cornacchia for

his hard work, dedication and very significant contributions to

Acadian and wish him the best in his new endeavours" commented Mr.

Carter. Effective February 10, 2010, Mr. Brian Banfill will replace

Mr. Cornacchia as Acadian's Senior Vice-President and Chief

Financial Officer. Mr. Banfill has been intimately involved with

Acadian since its inception and is a Certified General Accountant

with over 25 years of experience in the forest industry.

Review of Operations

2009 Financial and Operating Highlights

Three Months Ended Year Ended

December 31 December 31

------------------------------------------------

($millions except per unit

information) 2009 2008 2009 2008

----------------------------------------------------------------------------

Net sales $ 16.7 $ 19.7 $ 63.4 $ 67.9

EBITDA 2.0 6.9 12.1 17.4

Distributable cash from

operations 1.3 5.7 8.1 13.3

Distributions declared 1.4 3.4 11.7 13.7

Net income(1) - 15.8 9.3 18.9

Per unit - fully diluted

Net Income (loss)(1) - (0.14) 0.30 0.02

Distributable cash from

operations 0.08 0.34 0.49 0.80

Distributions declared -

Class A unitholders 0.08 0.21 0.70 0.83

Sales volume (000s m3) 343.0 306.6 1,258.3 1,251.0

----------------------------------------------------------------------------

(1) Net income includes the impact of the revaluation of the Class B

Interest Liability of a subsidiary, the future income tax

expense/recovery, and the depreciation and depletion expense, which are

non-cash items recorded in each respective period.

Included in the net income for the three and twelve month

periods ended December 31, 2009 is a non-cash future income tax

recovery of $0.3 million and $3.0 million, respectively (2008 -

$6.1 million expense and $6.2 million expense, respectively). The

future income tax liability of the Fund is based on differences

between the financial reporting and tax basis of assets and

liabilities of its subsidiaries, which have been measured using the

substantially enacted tax rates and laws that are expected to be in

effect at the time the differences are anticipated to reverse. The

reduction in the future income tax liability, and related recovery,

recorded during the year is largely a result of a decline in the

substantially enacted tax rate expected to be in effect.

Also, included in net income for the year ended December 31,

2009 is a non-cash gain related to the Class B Interest Liability

of a subsidiary. The settlement obligation of this interest was

based on the trading value of Acadian's units at the time of

settlement, which required recording the liability at its fair

value at each balance sheet date with the corresponding gain

arising from a decrease in Acadian's unit price or loss arising

from an increase in Acadian's unit price included in the statement

of operations. In addition, as this Canadian dollar liability was

issued by a self-sustaining U.S. dollar subsidiary of the Fund, the

obligation was required to be converted to U.S. dollars at each

reporting period, with the corresponding gain or loss included in

the statement of operations. These items resulted in a $4.7 million

gain for the year ended December 31, 2009 (2008 - $22.2 million

gain) comprised of a $4.1 million mark-to-market gain (2008 - $15.0

million gain) and a $0.6 million foreign exchange gain (2008 - $7.2

million gain).

On February 3, 2009, an affiliate of Brookfield Asset Management

Inc. ("Brookfield") converted all units representing the Class B

Liability of a subsidiary into Class A Units of the Fund on a

one-for-one basis. Accordingly, the Class B Liability of a

subsidiary was not outstanding during the fourth quarter and was

not revalued at the end of the period.

New Brunswick Timberlands

The table below summarizes operating and financial results for

New Brunswick Timberlands.

Three Months Ended Three Months Ended

December 31, 2009 December 31, 2008

--------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (millions) (000s m3) (000s m3) (millions)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 57.4 68.0 $ 3.8 72.5 73.2 $ 4.4

Hardwood 148.7 143.9 7.6 81.7 78.2 4.6

Biomass 58.8 58.8 1.1 57.4 57.4 1.1

----------------------------------------------------------------------------

264.9 270.7 12.5 211.6 208.8 10.1

Other sales 0.8 3.2

----------------------------------------------------------------------------

Net sales $ 13.3 $ 13.3

----------------------------------------------------------------------------

EBITDA $ 2.5 $ 4.5

EBITDA margin 19% 34%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

--------------------------------------------------------------

Year Ended December 31, 2009 Year Ended December 31, 2008

--------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (millions) (000s m3) (000s m3) (millions)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 336.5 328.9 $ 18.9 273.8 280.8 $ 17.0

Hardwood 444.0 432.7 22.1 389.6 413.5 23.8

Biomass 235.4 235.4 4.5 241.6 241.6 4.4

----------------------------------------------------------------------------

1,015.9 997.0 45.5 905.0 935.9 45.2

Other sales 3.3 4.8

----------------------------------------------------------------------------

Net sales $ 48.8 $ 50.0

----------------------------------------------------------------------------

EBITDA $ 10.8 $ 11.5

EBITDA margin 22% 23%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 68 thousand m3,

144 thousand m3 and 59 thousand m3, respectively, during the fourth

quarter, representing a 30% increase in sales volumes as compared

to same period in 2008. This increase reflects improved demand for

hardwood pulpwood as compared to the fourth quarter of 2008.

Approximately 30% of sales volumes were sold as sawlogs, 48% as

pulpwood and 22% as biomass in the fourth quarter. This compares to

34% of sales volumes sold as sawlogs, 39% as pulpwood and 27% as

biomass in the fourth quarter of 2008.

Net sales for the fourth quarter totaled $13.3 million,

consistent with the same period in 2008. The increase in sales

volumes was offset by a lower value species mix and a $2.4 million

decrease in other sales. The decrease in other sales was primarily

attributed to a reduced contribution from our management of Crown

licensed timberlands as a result of lower harvesting activity. The

weighted average selling price was $46.05 in the fourth quarter of

2009, compared to $48.79 in the same period of 2008.

Costs for the fourth quarter were $10.8 million, representing an

increase of 23% compared to the same period of 2008. This was

primarily a result of increased harvest volumes, longer hauling

distances and cable logging.

EBITDA for the fourth quarter was $2.5 million, compared to $4.5

million in the same period in 2008, while EBITDA margin decreased

from 34% to 19%.

NB Timberlands experienced no incidents among employees and

three minor reportable incidents among contractors during the

fourth quarter, from which the individuals have since fully

recovered. We are pleased to report that there were no reportable

environmental incidents during the fourth quarter.

Maine Timberlands

The table below summarizes operating and financial results for

Maine Timberlands.

Three Months Ended Three Months Ended

December 31, 2009 December 31, 2008

--------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (millions) (000s m3) (000s m3) (millions)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 43.7 43.6 $ 2.1 72.4 72.4 $ 4.8

Hardwood 21.2 21.2 1.1 18.1 18.7 1.4

Biomass 7.5 7.5 0.1 6.7 6.7 0.1

----------------------------------------------------------------------------

72.4 72.3 3.3 97.2 97.8 6.3

Other sales 0.1 0.1

----------------------------------------------------------------------------

Net sales $ 3.4 $ 6.4

----------------------------------------------------------------------------

EBITDA $ 0.7 2.5

EBITDA margin 21% 39%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

--------------------------------------------------------------

Year Ended December 31, 2009 Year Ended December 31, 2008

--------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) (millions) (000s m3) (000s m3) (millions)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 196.0 195.6 $ 11.7 234.4 234.2 $ 13.7

Hardwood 45.3 44.6 2.2 62.1 62.5 3.6

Biomass 21.1 21.1 0.3 18.4 18.4 0.2

----------------------------------------------------------------------------

262.4 261.3 14.2 314.9 315.1 17.5

Other sales 0.4 0.4

----------------------------------------------------------------------------

Net sales $ 14.6 $ 17.9

----------------------------------------------------------------------------

EBITDA $ 4.2 $ 6.5

EBITDA margin 29% 36%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Maine Timberlands experienced strong operating conditions during

the fourth quarter, primarily as a result of favourable weather

conditions. However, difficult market conditions resulted in a

significant decline in the operation's financial performance.

Softwood, hardwood and biomass shipments were 44 thousand m3, 21

thousand m3, and 7 thousand m3, respectively, with total sales

volumes decreasing by 26% as compared to the fourth quarter of

2008. The decrease in sales volumes reflects particularly strong

volumes in the fourth quarter of 2008 as the operation's largest

contractor caught up on its contract volume after weather-related

difficulties during the spring and early summer operating season.

Approximately 43% of sales volumes were sold as sawlogs, 47% as

pulpwood and 10% as biomass during the fourth quarter. This

compares to 55% of sales volumes sold as sawlogs, 38% as pulpwood

and 7% as biomass in the fourth quarter of 2008.

Net sales for the fourth quarter totaled $3.4 million, compared

to $6.4 million for the same period last year. The year-over-year

decline in net sales is a result of lower shipment volumes, a lower

value species mix, and softer prices across all products. The

weighted average price across all products was $45.27 in the fourth

quarter, compared to $64.19 in the same period of 2008, reflecting

a 29% decrease in Canadian dollar terms. Weighted average selling

prices decreased 22% in U.S. dollar terms year over year.

Costs for the fourth quarter were $2.7 million, compared to $3.9

million for the same period in 2008. This decrease reflects lower

sales volumes and lower variable costs per m3, partially due to

lower diesel prices.

EBITDA for the fourth quarter was $0.7 million, compared to $2.5

million for the same period in 2008, while EBITDA margin decreased

from 39% to 21%.

Maine Timberlands had no recordable safety incidents among

employees and one minor reportable incident among contractors

during the fourth quarter. The individual has since fully

recovered. We are pleased to report that there were no reportable

environmental incidents during the fourth quarter.

Market and Company Outlook

The following Market Outlook contains forward-looking statements

about Acadian Timber Corp.'s market outlook for fiscal 2010.

Reference should be made to the "Forward-looking Statements"

section of this news release. For a description of material factors

that could cause actual results to differ materially from the

forward-looking statements in the following, please see the Risk

Factors section of our Management's Discussion and Analysis

(MD&A) in our most recent Annual Report and Annual Information

Form available on our website at www.acadiantimber.com or filed

with SEDAR at www.sedar.com.

Consensus forecasts for U.S. housing predict an increase in

housing starts to only 675,000 units in 2010 and 910,000 in 2011 -

a very slow recovery from 2009's post World War II low of 550,000

starts. While smaller, non-industrial timberland owners continue to

withhold timber from the market, an ample supply of Crown and

private timber has placed considerable pressure on timber prices

resulting in price declines of approximately 20% from 2006 - 2007

averages. The fact that Fraser Papers Inc. is currently expected to

operate its Edmundston Pulp mill and Plaster Rock sawmill provides

some encouragement that demand for Acadian's spruce-fir sawlogs

will be stronger in 2010 than in 2009, although prices are expected

to remain low throughout the year. Despite current difficult

softwood sawlog markets, Acadian continues to find markets for its

key products while choosing to preserve value for those products

that don't offer adequate market opportunities by reducing the

near-term harvest levels of our high margin spruce-fir sawlogs.

Weak softwood sawlog markets and relatively large inventories of

softwood pulpwood and chips is also expected to result in

uncertainties in regard to the level of activity on Fraser Papers

Inc.'s Crown licensed timberlands which is managed by Acadian,

reducing the contribution from these management services to

Acadian's net income.

Markets for hardwood sawlogs and specialty products remain

relatively stable, particularly for aspen. These markets are

expected to remain stable into 2010. Markets for hardwood have

improved since the first half of 2009 and Acadian's major hardwood

pulpwood customers continue to operate and take deliveries with

pricing improving modestly from the second and early third quarter.

Acadian has been able to sell all of its biomass, although this

market has also been under pressure due to low demand for electric

power and reduced gas and oil prices. The Biomass Crop Assistance

Program (BCAP) implemented in the U.S. during the fourth quarter of

2009 may provide limited additional opportunities for biomass sales

by our Maine Timberlands although the impact of this two-year

program on biomass sales by our New Brunswick Timberlands remains

uncertain.

"During these challenging market conditions, we remained focused

on preserving long-term value for shareholders and merchandising

all of our products for their highest value, while seeking every

opportunity to reduce costs. We continue to be confident in

Acadian's long-term outlook and the quality of our asset base. We

believe that our new tax effective corporate structure and steadily

improving market conditions will lead to improved financial

performance going forward" concluded Mr. Carter.

Acadian Timber Corp. is a leading supplier of primary forest

products in Eastern Canada and the Northeastern U.S. With a total

of 2.4 million acres of land under management, the Corporation is

the second largest timberland operator in New Brunswick and

Maine.

The Corporation owns and manages approximately 1.1 million acres

of freehold timberlands in New Brunswick and Maine, and provides

management services relating to approximately 1.3 million acres of

Crown licensed timberlands. The Corporation also owns and operates

a forest nursery in Second Falls, New Brunswick. Acadian's products

include softwood and hardwood sawlogs, pulpwood and biomass

by-products, sold to over 110 regional customers.

Acadian Timber Corp.'s shares are listed for trading on the

Toronto Stock Exchange under the symbol ADN.

For further information, please visit our website at

www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information and other

forward-looking statements within the meaning of applicable

Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of the Corporation and its subsidiaries

(collectively, "Acadian"), or industry results, to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. When used

in this News Release, such statements may contain such words as

"may," "will," "intend," "should," "expect," "believe," "outlook,"

"predict," "remain," "anticipate," "estimate," "potential,"

"continue," "plan," "could," "might," "project," "targeting" or the

negative of these terms or other similar terminology.

Forward-looking information in this News Release includes, without

limitation, statements regarding management's beliefs, intentions,

results, performance, goals, achievements, future events, plans and

objectives, business strategy, access to capital, liquidity and

trading volumes, dividends, taxes, capital expenditures, projected

costs, and anticipated benefits of the conversion from an income

trust to a corporation, and similar statements concerning

anticipated future events, results, achievements, circumstances,

performance or expectations that are not historical facts. These

statements reflect management's current expectations regarding

future events and operating performance are based on information

currently available to management and speak only as of the date of

this News Release. All forward-looking statements in this News

Release are qualified by these cautionary statements.

Forward-looking statements involve significant risks and

uncertainties, should not be read as guarantees of future

performance or results, should not be unduly relied upon, and will

not necessarily be accurate indications of whether or not such

results will be achieved. Factors that could cause actual results

to differ materially from the results discussed in the

forward-looking statements include, but are not limited to: general

economic and market conditions; product demand; concentration of

customers; commodity pricing; interest rate and foreign currency

fluctuations; seasonality; weather and natural conditions;

regulatory, trade or environmental policy changes; changes in

Canadian income tax law; economic situation of key customers;

failure to realize the anticipated benefits of the conversion from

an income trust to a corporation; the risks associated with the

availability and the amount of the tax basis in connection with the

conversion from an income fund to a corporation;

and other risks and factors, to the extent they remain

applicable to the Corporation, discussed under the heading "Risk

Factors" in each of the Annual Information Form dated March 27,

2009 and the Management Information Circular dated November 23,

2009 of Acadian Timber Income Fund (the "Fund"), the predecessor

reporting issuer to the Corporation, and other filings of the Fund

and the Corporation with securities regulatory authorities, which

are available on SEDAR at www.sedar.com. Forward-looking

information is based on various material factors or assumptions,

which are based on information currently available to Acadian.

Material factors or assumptions that were applied in drawing a

conclusion or making an estimate set out in the forward-looking

information may include, but are not limited to: anticipated

financial performance; business prospects; strategies; regulatory

developments; exchange rates; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the availability

and cost of labour and services and the ability to obtain financing

on acceptable terms, which are subject to change based on commodity

prices, market conditions for timber and wood products, the

economic situation of key customers, and the utilization of the tax

basis resulting from the conversion from an income trust to a

corporation. Readers are cautioned that the preceding list of

material factors or assumptions is not exhaustive. Although the

forward-looking statements contained in this News Release are based

upon what management believes are reasonable assumptions, the

Corporation cannot assure readers that actual results will be

consistent with these forward-looking statements. Certain

statements in this New Release may also be considered "financial

outlook" for the purposes of applicable Canadian securities laws,

and such financial outlook may not be appropriate for purposes

other than this News Release. The forward-looking statements in

this News Release are made as of the date of this News Release, and

should not be relied upon as representing Acadian's views as of any

date subsequent to the date of this News Release. The Corporation

assumes no obligation to update or revise these forward-looking

statements to reflect new information, events, circumstances or

otherwise, except as required by applicable law.

Acadian Timber Income Fund

Consolidated Balance Sheets

----------------------------------------------------------------------------

As at December 31

(CAD millions) 2009 2008

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 2.1 $ 9.0

Accounts receivable and other assets 6.2 4.7

Note receivable 4.0 -

Inventory 1.8 1.4

----------------------------------------------------------------------------

14.1 15.1

Intangible assets 6.1 6.1

Timberlands, logging roads and fixed assets 190.0 207.8

----------------------------------------------------------------------------

$ 210.2 $ 229.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND UNITHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 4.3 $ 6.2

Distributions payable to unitholders - 0.8

----------------------------------------------------------------------------

4.3 7.0

Future income tax liability 13.9 17.7

Long-term debt 80.7 80.8

Class B Interest Liability of a subsidiary - 31.6

Unitholders' equity 111.3 91.9

----------------------------------------------------------------------------

$ 210.2 $ 229.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Income Fund

Consolidated Statements of Operations and Deficit

----------------------------------------------------------------------------

For the Three Months For the Year Ended

Ended December 31 December 31

----------------------------------------------------------------------------

CAD millions 2009 2008 2009 2008

----------------------------------------------------------------------------

Net sales $ 16.7 $ 19.7 $ 63.4 $ 67.9

Operating costs and expenses

Cost of sales 12.1 11.1 43.3 44.8

Selling, administration and

other 2.6 1.7 8.6 6.4

Depreciation and depletion 1.6 2.2 7.1 7.4

----------------------------------------------------------------------------

16.3 15.0 59.0 58.6

----------------------------------------------------------------------------

Operating earnings 0.4 4.7 4.4 9.3

Gain on sale of timberlands - - (0.6) (0.7)

Gain on Class B Interest

Liability of a subsidiary - (19.1) (4.7) (22.2)

Interest:

Interest income - - - (0.2)

Interest expense 0.7 1.0 3.1 3.6

Class B Interest Liability

of a subsidiary - 0.9 0.3 3.7

----------------------------------------------------------------------------

Earnings (loss) before

income tax expense (0.3) 21.9 6.3 25.1

Future income tax recovery

(expense) 0.3 (6.1) 3.0 (6.2)

----------------------------------------------------------------------------

Net income for the period - 15.8 9.3 18.9

Deficit, beginning of period (21.6) (34.2) (20.9) (29.8)

Unitholders' distributions (1.4) (2.5) (11.4) (10.0)

----------------------------------------------------------------------------

Deficit, end of period $ (23.0) $ (20.9) $ (23.0) $ (20.9)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per unit - basic $ - $ 1.31 $ 0.58 $ 1.57

Net income (loss) per unit

diluted $ - $ (0.14) $ 0.30 $ 0.02

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Income Fund

Consolidated Statement of Comprehensive Income (Loss)

----------------------------------------------------------------------------

For the Three Months For the Year Ended

Ended December 31 December 31

----------------------------------------------------------------------------

CAD millions 2009 2008 2009 2008

----------------------------------------------------------------------------

Net income $ - $ 15.8 $ 9.3 $ 18.9

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Unrealized foreign currency

translation gain (loss) (1.2) 1.7 (6.0) 1.5

----------------------------------------------------------------------------

Comprehensive income (loss) $ (1.2) $ 17.5 $ 3.3 $ 20.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Income Fund

Consolidated Statements of Cash Flows

----------------------------------------------------------------------------

For the Three Months For the Year Ended

Ended December 31 December 31

----------------------------------------------------------------------------

CAD millions 2009 2008 2009 2008

----------------------------------------------------------------------------

Cash provided by (used for):

----------------------------------------------------------------------------

Operating activities

Net income $ - $ 15.8 $ 9.3 $ 18.9

Items not affecting cash:

Future income tax expense

(recovery) (0.3) 6.1 (3.0) 6.2

Depreciation and depletion 1.6 2.2 7.1 7.4

Gain on sale of timberlands - - (0.6) (0.7)

Gain on Class B Interest

Liability of a subsidiary - (19.1) (4.7) (22.2)

----------------------------------------------------------------------------

1.3 5.0 8.1 9.6

Net change in non-cash

working capital balances

and other (0.8) 1.6 (4.0) 4.5

----------------------------------------------------------------------------

0.5 6.6 4.1 14.1

----------------------------------------------------------------------------

Investing activities

Sale of timberlands, logging

roads and fixed assets - - 0.6 0.8

Additions to timberlands,

logging roads and fixed

assets - (0.2) (0.8) (0.5)

Silviculture expenditures - - (0.1) (0.3)

Issuance of note receivable (4.0) - (4.0) -

----------------------------------------------------------------------------

(4.0) (0.2) (4.3) -

----------------------------------------------------------------------------

Financing activities

Distributions paid to

unitholders (2.2) (2.5) (12.2) (10.0)

Borrowing from revolving

credit facility 5.5 - 5.5 -

----------------------------------------------------------------------------

3.3 (2.5) (6.7) (10.0)

----------------------------------------------------------------------------

Increase (decrease) in cash

and cash equivalents during

the period (0.2) 3.9 (6.9) 4.1

Cash and cash equivalents,

beginning of period 2.3 5.1 9.0 4.9

----------------------------------------------------------------------------

Cash and cash equivalents,

end of period $ 2.1 $ 9.0 $ 2.1 $ 9.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliation to EBITDA and Distributable Cash from Operations

----------------------------------------------------------------------------

For the Three Months For the Year Ended

Ended December 31 December 31

----------------------------------------------------------------------------

CAD millions 2009 2008 2009 2008

----------------------------------------------------------------------------

Net income(1) $ - $ 15.8 $ 9.3 $ 18.9

Add (deduct)

Interest income - - - (0.2)

Interest expense 0.7 1.0 3.1 3.6

Distribution on Class B

Interest Liability of a

subsidiary - 0.9 0.3 3.7

Future income tax expense

(recovery) (0.3) 6.1 (3.0) 6.2

Depreciation and depletion 1.6 2.2 7.1 7.4

Non-cash gain on Class B

Interest Liability of a

subsidiary - (19.1) (4.7) (22.2)

----------------------------------------------------------------------------

EBITDA 2.0 6.9 12.1 17.4

Add (deduct)

Interest income - - - 0.2

Interest expense (0.7) (1.0) (3.1) (3.6)

Silviculture and capital

expenditures - (0.2) (0.5) (0.8)

Non-cash gain on sale of

timberlands - - (0.6) (0.7)

Proceeds from sale of

timberlands, logging roads

and fixed assets - - 0.6 0.8

Acquisition of timberlands - - (0.4) -

----------------------------------------------------------------------------

Distributable cash from

operations $ 1.3 $ 5.7 $ 8.1 $ 13.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Distributions declared $ 1.4 $ 3.4 $ 11.7 $ 13.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net income includes the impact of the revaluation of the Class B

Interest Liability of a subsidiary, the future income tax

expense/recovery, and the depreciation and depletion expense, which are

non-cash items recorded in each respective period.

Reconciliation to Distributable Cash from Operations

----------------------------------------------------------------------------

For the Three Months For the Year Ended

Ended December 31 December 31

----------------------------------------------------------------------------

CAD millions 2009 2008 2009 2008

----------------------------------------------------------------------------

Cash flow from operating

activities $ 0.5 $ 6.6 $ 4.1 $ 14.1

Add (deduct):

Capital adjustments

Proceeds from sale of

timberlands, logging roads

and fixed assets - - 0.6 0.8

Acquisition of timberlands - - (0.4) -

Other adjustments

Change in non-cash working

capital balances and other 0.8 (1.6) 4.0 (4.5)

Distribution on Class B

Interest liability of a

subsidiary - 0.9 0.3 3.7

Silviculture and capital

expenditures - (0.2) (0.5) (0.8)

----------------------------------------------------------------------------

Distributable cash from

operations $ 1.3 $ 5.7 $ 8.1 $ 13.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Distributions declared $ 1.4 $ 3.4 $ 11.7 $ 13.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Acadian Timber Corp. Robert Lee Investor Relations and

Communications 604-661-9607 rlee@acadiantimber.com

www.acadiantimber.com

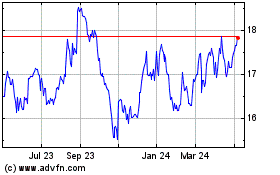

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jun 2024 to Jul 2024

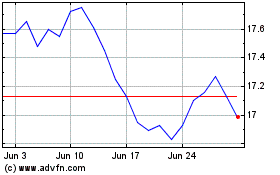

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jul 2023 to Jul 2024