African Swine Fever Hurts U.S. Animal Health Business

May 07 2019 - 2:40PM

Dow Jones News

By Kirk Maltais

Livestock health companies have seen a virulent hog disease take

sizable bites of their business -- and the worst may be yet to

come.

African swine fever, a virus not harmful to humans but which

means near-certain death for pigs, continues to ravage China's hog

supply. There is no vaccine for the virus, and companies that

provide medicines, vaccines and diagnostic products to livestock

producers are seeing sales slip as Chinese pig farmers opt to wait

until the epidemic dissipates before restocking their

operations.

Last month, Chinese officials warned that domestic pork prices

could surge more than 70% this year after about a quarter of the

nation's hog population was culled or died from the disease.

However, some U.S. animal health companies think the numbers

could continue to climb.

"People I see in China are talking about 50%," said Jack

Clifford Bendheim, chairman, president and CEO of Phibro Animal

Health Corp. (PAHC), during an earnings call Tuesday. He said he

believes China may lose as much as 350 million pigs this year,

which is nearly as much as the total 2018 pigs of the European

Union and the U.S. combined, according to USDA data.

In its earnings, Philbro reported an 8% drop in the adjusted

Ebitda of its animal health division this quarter, partially

attributed to how fast African swine fever kills infected pigs.

"The virus is so violent that often pigs don't live past 10

days," Mr. Bendheim told investors.

Zoetis Inc. (ZTS) felt a similar sting in its quarterly

earnings, reporting last week a 10% drop in net income for the

quarter due to African swine fever curbing the need for vaccines

for other pig diseases in China. According to Zoetis CEO Juan Ramon

Alaix, the company expects the virus to spread more quickly in the

summer due to the warmer weather.

Elanco Animal Health Inc. (ELAN) is scheduled to report its

first-quarter earnings on Thursday. In an earnings call in

February, Elanco CEO Jeffrey Simmons said African swine fever had

no impact on the company's earnings in 2018, but officials were

still keeping a close eye on the progress of the disease in

China.

Executives expect the global pork market to react strongly to

fill the gap left by China -- with U.S. and E.U. producers

expanding their operations.

"African swine fever has the potential to impact the global

protein industry on a level that we have never experienced, and it

is an event that will underscore the power of the Tyson business

model," said Tyson Foods Inc. (TSN) CEO Noel White during the

company's earnings call Monday.

Mr. White told investors that Tyson would race to supply the

deteriorating Chinese market. The company reported profits to all

of its meat production but expects that disease-related profits

won't impact the company's bottom line until the end of

September.

Write to Kirk Maltais at kirk.maltais@wsj.com

(END) Dow Jones Newswires

May 07, 2019 14:25 ET (18:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

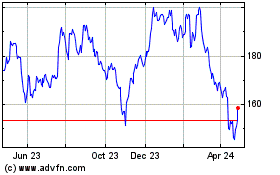

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

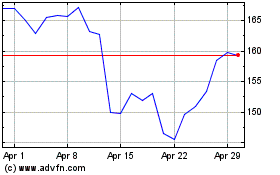

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024