Additional Proxy Soliciting Materials (definitive) (defa14a)

June 19 2020 - 10:11AM

Edgar (US Regulatory)

SCHEDULE 14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

WESTERN ASSET INFLATION-LINKED

INCOME FUND

(Name of

Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by the registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Your Vote Is Important No Matter How Many or How Few Shares You Own June 19, 2020 Vote Today for the Fund that is Delivering Monthly

Distributions to You Ahead of the Western Asset Inflation-Linked Income Fund (the “Fund”) Special Meeting of Shareholders on July 14, 2020, you are being asked to vote to approve new agreements1 between the Fund and its investment manager

and subadvisers that will enable the Fund to continue to operate and deliver the returns you rely on. Why Should I Vote to Approve the Agreements with the Funds Investment Manager and Subadvisers? Approving these agreements will enable the Fund to

continue to operate uninterrupted and deliver the strong total returns and distribution payouts you have come to expect The investment manager and subadvisers have developed and implemented the Fund’s strategy that has enhanced shareholder

value Importantly, the new management and subadvisory agreements will be identical to the current agreements, except for the dates of execution, effectiveness and termination Protect the Value of Your Investment — Vote Your Proxy Card Today The

Fund’s Board of Trustees unanimously recommends that you vote “FOR” the approval of the new management agreement for the Fund’s manager and the new subadvisory agreements for the Fund’s subadvisers to ensure shareholders

receive uninterrupted value.

Your Vote is Important, No Matter How Many or How Few Shares You Own You can vote by internet, telephone or by signing and dating the

proxy card and mailing it in the envelope provided. If you have any questions about how to vote your shares or need additional assistance, please contact: Shareholders Call Toll Free: (877) 800-5185 Banks and Brokers Call: (212) 750-5833 Innisfree

M&A Incorporated Notes 1 The “change of control” resulting from the pending combination of Legg Mason Inc. (“Legg Mason”), the parent company of the Fund’s investment manager and subadvisers, and Franklin Resources,

Inc., a global investment management organization operating as Franklin Templeton, will cause your Fund’s management and subadvisory agreements to terminate. Forward Looking Statement Past performance is no guarantee of future results. The

information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. All investments are subject to risk including the possible loss of principal. All benchmark performance reflects no deduction

for fees, expenses or taxes. Please note that an investor cannot invest directly in a benchmark.

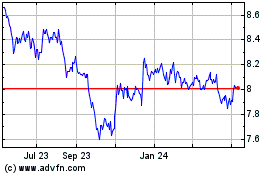

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

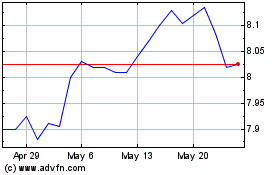

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jul 2023 to Jul 2024