WIA Declares Monthly Dividends for September and October and Modified Dividend for November

September 01 2005 - 9:02AM

Business Wire

Western Asset/Claymore U.S. Treasury Inflation Protected Securities

Fund (NYSE:WIA) today declared its September and October monthly

dividends of $0.065625 per share, and November monthly dividend of

$0.052500 per share. This modified November dividend represents a

reduction of $0.013125 per share from the Fund's most recent

monthly dividend. Lower-than-expected inflation year-to-date

coupled with the increased costs of the Fund's leverage have

continued to put pressure on the Fund's dividend. Given the

current, as well as outlook for short-term interest rates and

inflation, we believe this new dividend rate more accurately

reflects the earnings rate of the Fund's underlying portfolio. The

September dividend will be paid on September 30, 2005, to

shareholders of record as of September 15, 2005 with an ex-dividend

date of September 13, 2005. The October dividend will be paid on

October 31, 2005, to shareholders of record as of October 14, 2005

with an ex-dividend date of October 12, 2005. The November dividend

will be paid on November 30, 2005, to shareholders of record as of

November 15, 2005 with an ex-dividend date of November 10, 2005.

Additionally, the portfolio composition, including asset class,

sector concentration, credit quality and top ten holdings, will be

updated on the Fund's dedicated website at www.westernclaymore.com.

Western Asset Management Company, a subsidiary of Legg Mason, Inc.,

is the Fund's Investment Adviser. Founded in 1971, with offices in

Pasadena, London and Singapore, Western Asset manages $229.1

billion in assets as of June 30, 2005. Claymore Securities, Inc. is

the Fund's Servicing Agent. Claymore is a privately-held financial

services company offering unique investment solutions for financial

advisors and their valued clients. Claymore entities have provided

supervision, management, servicing or distribution on approximately

$11.6 billion in assets through closed-end funds, unit investment

trusts, mutual funds and separately managed accounts. Additional

information on Claymore's closed-end funds is available at

www.claymore.com/products/CEFs.aspx. This information does not

represent an offer to sell securities of the Fund and it is not

soliciting an offer to buy securities of the Fund. There can be no

assurance that the Fund will achieve its investment objectives. The

net asset value of the Fund will fluctuate with the value of the

underlying securities. It is important to note that closed-end

funds trade on their market value, not net asset value, and

closed-end funds often trade at a discount to their net asset

value. Past performance is not indicative of future performance. An

investment in the Fund is subject to certain risks and other

considerations. Such risks and considerations include, but are not

limited to: Investment Risk, Market Discount Risk, Interest Rate

Risk, U.S. TIPS Risk, Credit Risk, Lower-Grade and Unrated

Securities Risk, Leverage Risk, Issuer Risk, Country Risk,

Prepayment Risk, Reinvestment Risk, Derivatives Risk,

Inflation/Deflation Risk, Mortgage-Related Securities Risk,

Management Risk, Turnover Risk, Anti-Takeover Provisions, Smaller

Company Risk, and Market Disruption and Geopolitical Risk.

Investors should consider the investment objectives and policies,

risk considerations, charges and expenses of the Fund carefully

before they invest. For this and more information, please contact a

securities representative or Claymore Securities, Inc., 2455

Corporate West Drive, Lisle, Illinois 60532, 800-345-7999. The

Fund's common shares do not represent a deposit or obligation of,

and are not guaranteed or endorsed by, any bank or other insured

depository institution, and are not federally insured by the

Federal Deposit Insurance Corporation, the Federal Reserve Board or

any other government agency.

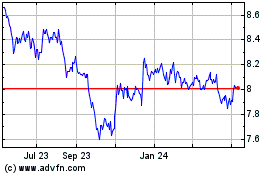

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jun 2024 to Jul 2024

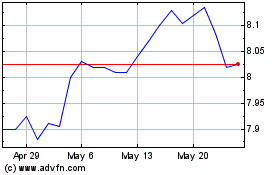

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Jul 2023 to Jul 2024