Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 24 2024 - 2:27PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

98.8%

Australia

:

3.7%

319,689

Aurizon

Holdings

Ltd.

$

745,724

0.4

36,940

BHP

Group

Ltd.

-

Class

DI

1,124,545

0.7

22,066

BlueScope

Steel

Ltd.

302,688

0.2

15,723

Fortescue

Metals

Group

Ltd.

258,186

0.1

42,983

Reece

Ltd.

548,320

0.3

15,647

Rio

Tinto

Ltd.

1,284,705

0.7

151,329

South32

Ltd.

-

Class

DI

304,165

0.2

376,671

Telstra

Group

Ltd.

951,793

0.6

94,789

Transurban

Group

809,877

0.5

6,330,003

3.7

Belgium

:

0.1%

1,885

Solvay

SA

218,357

0.1

Brazil

:

1.4%

112,900

Cia

Siderurgica

Nacional

SA

378,241

0.2

27,700

Telefonica

Brasil

SA

297,257

0.2

146,351

TIM

SA/Brazil

513,502

0.3

11,200

Vale

SA

-

Foreign

168,499

0.1

17,848

Wheaton

Precious

Metals

Corp.

872,703

0.5

5,758

Yara

International

ASA

195,342

0.1

2,425,544

1.4

Canada

:

4.7%

3,854

Agnico

Eagle

Mines

Ltd.

206,908

0.1

17,882

AltaGas

Ltd.

363,715

0.2

23,660

Barrick

Gold

Corp.

415,678

0.3

2,946

Canadian

National

Railway

Co.

341,853

0.2

7,647

Canadian

Pacific

Kansas

City

Ltd.

550,525

0.3

29,827

Canadian

Utilities

Ltd.

-

Class

A

668,220

0.4

21,122

Enbridge,

Inc.

737,507

0.4

10,368

Franco-Nevada

Corp.

1,161,228

0.7

26,536

(1)

Hydro

One

Ltd.

737,638

0.4

33,554

Kinross

Gold

Corp.

197,820

0.1

16,511

Quebecor,

Inc.

-

Class

B

366,370

0.2

15,152

Rogers

Communications,

Inc.

-

Class

B

652,442

0.4

7,892

TC

Energy

Corp.

295,976

0.2

7,088

Teck

Resources

Ltd.

-

Class

B

267,024

0.2

13,316

TELUS

Corp.

238,264

0.2

10,129

West

Fraser

Timber

Co.

Ltd.

734,660

0.4

7,935,828

4.7

Chile

:

0.1%

25,954

Lundin

Mining

Corp.

179,791

0.1

China

:

3.3%

835,000

AviChina

Industry

&

Technology

Co.

Ltd.

-

Class

H

378,388

0.2

192,400

Baoshan

Iron

&

Steel

Co.

Ltd.

-

Class

A

167,796

0.1

711,400

BOE

Technology

Group

Co.

Ltd.

-

Class

A

385,927

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

296,100

CECEP

Solar

Energy

Co.

Ltd.

-

Class

A

$

231,231

0.1

874,400

CECEP

Wind-Power

Corp.

-

Class

A

377,711

0.2

1,090,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

464,419

0.3

156,000

China

Oilfield

Services

Ltd.

-

Class

H

167,633

0.1

590,000

China

Railway

Group

Ltd.

-

Class

H

258,957

0.2

3,792,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

393,103

0.2

289,000

Fosun

International

Ltd.

164,502

0.1

95,400

Hengdian

Group

DMEGC

Magnetics

Co.

Ltd.

-

Class

A

181,094

0.1

1,198,600

Shanghai

Construction

Group

Co.

Ltd.

-

Class

A

419,909

0.3

116,800

(2)

Sichuan

New

Energy

Power

Co.

Ltd.

-

Class

A

190,944

0.1

156,400

Sichuan

Road

and

Bridge

Group

Co.

Ltd.

-

Class

A

169,131

0.1

109,500

Sinotruk

Hong

Kong

Ltd.

227,151

0.1

25,700

Sunresin

New

Materials

Co.

Ltd.

-

Class

A

181,342

0.1

237,800

Western

Mining

Co.

Ltd.

-

Class

A

428,074

0.3

214,600

Yutong

Bus

Co.

Ltd.

-

Class

A

405,118

0.2

552,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

349,544

0.2

50,500

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

159,465

0.1

5,701,439

3.3

Denmark

:

0.3%

351

AP

Moller

-

Maersk

A/S

-

Class

B

554,231

0.3

Finland

:

0.1%

24,275

Metso

Oyj

239,127

0.1

France

:

3.3%

1,370

Aeroports

de

Paris

168,924

0.1

1,726

Air

Liquide

SA

327,214

0.2

1,332

Airbus

SE

197,951

0.1

6,968

Arkema

SA

709,042

0.4

26,087

Cie

de

Saint-Gobain

1,700,758

1.0

65,035

Getlink

SE

1,188,388

0.7

11,595

Legrand

SA

1,118,320

0.7

17,828

Orange

SA

219,656

0.1

5,630,253

3.3

Germany

:

4.2%

24,288

BASF

SE

1,129,809

0.7

6,365

Brenntag

SE

550,653

0.3

5,791

Daimler

Truck

Holding

AG

188,067

0.1

41,575

Deutsche

Telekom

AG,

Reg

996,476

0.6

28,752

Evonik

Industries

AG

537,676

0.3

12,014

GEA

Group

AG

442,040

0.3

9,639

Heidelberg

Materials

AG

786,824

0.5

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Germany

(continued)

13,251

Siemens

AG,

Reg

$

2,225,926

1.3

1,940

Wacker

Chemie

AG

237,420

0.1

7,094,891

4.2

Hong

Kong

:

0.6%

11,200

Jardine

Matheson

Holdings

Ltd.

437,248

0.3

114,000

Power

Assets

Holdings

Ltd.

594,707

0.3

1,031,955

0.6

India

:

1.6%

17,947

Adani

Ports

&

Special

Economic

Zone

Ltd.

177,912

0.1

34,869

CG

Power

&

Industrial

Solutions

Ltd.

188,027

0.1

29,607

JSW

Steel

Ltd.

284,968

0.2

30,881

Larsen

&

Toubro

Ltd.

1,152,807

0.7

10,460

PI

Industries

Ltd.

472,980

0.3

104,884

Power

Grid

Corp.

of

India

Ltd.

263,054

0.1

173,357

Tata

Steel

Ltd.

266,408

0.1

2,806,156

1.6

Ireland

:

0.6%

8,681

(2)

AerCap

Holdings

NV

592,218

0.3

11,132

Smurfit

Kappa

Group

PLC

422,926

0.3

1,015,144

0.6

Italy

:

0.3%

4,666

Prysmian

SpA

179,984

0.1

45,768

Terna

-

Rete

Elettrica

Nazionale

368,756

0.2

548,740

0.3

Japan

:

8.4%

25,000

AGC,

Inc.

908,275

0.5

85,100

Asahi

Kasei

Corp.

590,849

0.4

55,800

Central

Japan

Railway

Co.

1,338,651

0.8

63,500

Chubu

Electric

Power

Co.,

Inc.

784,507

0.5

3,900

Hirose

Electric

Co.

Ltd.

436,841

0.3

4,500

Hitachi

Ltd.

312,891

0.2

44,800

Japan

Airlines

Co.

Ltd.

847,957

0.5

16,200

JFE

Holdings,

Inc.

239,293

0.1

3,100

Keyence

Corp.

1,327,469

0.8

14,600

Lixil

Corp.

178,519

0.1

10,100

MISUMI

Group,

Inc.

163,985

0.1

19,500

Murata

Manufacturing

Co.

Ltd.

378,928

0.2

16,400

NGK

Insulators

Ltd.

200,232

0.1

23,800

Nippon

Paint

Holdings

Co.

Ltd.

177,417

0.1

17,300

Nitto

Denko

Corp.

1,229,435

0.7

38,200

Osaka

Gas

Co.

Ltd.

744,455

0.4

21,600

Shimadzu

Corp.

560,328

0.3

1,700

SMC

Corp.

856,297

0.5

16,800

SoftBank

Group

Corp.

680,763

0.4

50,700

Sumitomo

Corp.

1,062,994

0.6

13,000

Tokyo

Gas

Co.

Ltd.

301,407

0.2

18,300

Toyota

Tsusho

Corp.

1,014,099

0.6

14,335,592

8.4

Luxembourg

:

0.5%

31,462

ArcelorMittal

SA

790,984

0.5

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Mexico

:

0.6%

37,300

Grupo

Mexico

SAB

de

CV

$

171,354

0.1

320,899

Operadora

De

Sites

Mexicanos

SAB

de

CV

-

Class

1

402,960

0.2

50,053

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

493,023

0.3

1,067,337

0.6

Netherlands

:

0.2%

4,619

Akzo

Nobel

NV

355,557

0.2

Qatar

:

0.3%

893,052

Mesaieed

Petrochemical

Holding

Co.

412,520

0.2

61,010

Ooredoo

QPSC

172,423

0.1

584,943

0.3

Russia

:

—%

267,141

(3)

Alrosa

PJSC

—

—

4,101,092

(3)

Inter

RAO

UES

PJSC

—

—

124,960

(3)

Mobile

TeleSystems

PJSC

—

—

—

—

Saudi

Arabia

:

0.9%

56,454

Etihad

Etisalat

Co.

695,235

0.4

26,719

Sahara

International

Petrochemical

Co.

230,887

0.1

79,414

Saudi

Electricity

Co.

382,476

0.2

30,346

Saudi

Telecom

Co.

311,449

0.2

1,620,047

0.9

Singapore

:

1.1%

61,600

(1)

BOC

Aviation

Ltd.

443,209

0.3

134,900

Keppel

Corp.

Ltd.

672,956

0.4

152,700

Sembcorp

Industries

Ltd.

586,915

0.3

56,400

Singapore

Technologies

Engineering

Ltd.

156,437

0.1

1,859,517

1.1

South

Africa

:

0.4%

16,767

Anglo

American

PLC

453,765

0.3

36,063

Impala

Platinum

Holdings

Ltd.

146,640

0.1

600,405

0.4

South

Korea

:

1.8%

17,291

GS

Holdings

Corp.

551,307

0.3

2,221

Hanwha

Aerospace

Co.

Ltd.

217,216

0.1

7,264

(2)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

626,948

0.4

575

LG

Chem

Ltd.

222,447

0.1

966

LG

Innotek

Co.

Ltd.

177,755

0.1

798

POSCO

Holdings,

Inc.

298,010

0.2

8,422

Samsung

C&T

Corp.

776,557

0.5

5,556

(2)

SK

Square

Co.

Ltd.

218,621

0.1

3,088,861

1.8

Spain

:

2.7%

5,790

Acciona

SA

817,238

0.5

7,048

(1)

Aena

SME

SA

1,212,085

0.7

15,705

(1)

Cellnex

Telecom

SA

599,591

0.3

57,690

Red

Electrica

Corp.

SA

967,004

0.6

223,873

Telefonica

SA

965,391

0.6

4,561,309

2.7

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Sweden

:

2.0%

4,157

Holmen

AB

-

Class

B

$

174,225

0.1

24,547

Husqvarna

AB

-

Class

B

187,437

0.1

47,515

Sandvik

AB

939,018

0.6

29,050

SKF

AB

-

Class

B

546,746

0.3

65,151

Volvo

AB

-

Class

B

1,510,956

0.9

3,358,382

2.0

Switzerland

:

2.1%

20,469

ABB

Ltd.,

Reg

814,023

0.5

214

Givaudan

SA,

Reg

800,876

0.4

16,059

Holcim

AG

1,181,296

0.7

3,193

Sika

AG,

Reg

867,695

0.5

3,663,890

2.1

Taiwan

:

1.6%

580,000

AUO

Corp.

304,378

0.2

209,000

China

Steel

Corp.

175,042

0.1

79,000

Delta

Electronics,

Inc.

799,031

0.5

176,000

Eva

Airways

Corp.

176,348

0.1

328,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,065,370

0.6

600,000

Innolux

Corp.

242,433

0.1

2,762,602

1.6

Thailand

:

0.3%

291,200

Indorama

Ventures

PCL

202,844

0.1

208,600

PTT

Global

Chemical

PCL

228,782

0.2

431,626

0.3

Turkey

:

0.3%

40,138

KOC

Holding

AS

196,428

0.1

123,106

(2)

Turkcell

Iletisim

Hizmetleri

AS

246,636

0.2

443,064

0.3

United

Kingdom

:

3.6%

98,906

BAE

Systems

PLC

1,312,219

0.8

16,040

Bunzl

PLC

608,905

0.4

290,382

Centrica

PLC

547,234

0.3

61,985

CNH

Industrial

NV

658,893

0.4

11,933

DCC

PLC

806,719

0.5

18,548

Halma

PLC

500,567

0.3

25,735

Smiths

Group

PLC

536,955

0.3

14,333

United

Utilities

Group

PLC

197,507

0.1

1,027,030

Vodafone

Group

PLC

923,474

0.5

6,092,473

3.6

United

States

:

47.6%

6,576

3M

Co.

651,484

0.4

15,087

AECOM

1,340,631

0.8

29,452

AES

Corp.

506,869

0.3

675

Air

Products

and

Chemicals,

Inc.

182,621

0.1

2,657

Allegion

PLC

281,881

0.2

15,419

AMERCO

834,939

0.5

15,402

American

Electric

Power

Co.,

Inc.

1,225,229

0.7

10,179

AMETEK,

Inc.

1,580,086

0.9

3,409

(2)

Arista

Networks,

Inc.

748,991

0.4

94,924

AT&T,

Inc.

1,572,891

0.9

5,867

Atmos

Energy

Corp.

667,723

0.4

44,241

Baker

Hughes

Co.

1,493,134

0.9

6,818

(2)

Boeing

Co.

1,579,253

0.9

2,374

(2)

Builders

FirstSource,

Inc.

318,377

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

16,565

Carrier

Global

Corp.

$

860,717

0.5

4,312

Caterpillar,

Inc.

1,081,105

0.6

9,411

CenterPoint

Energy,

Inc.

266,049

0.2

1,341

Cheniere

Energy,

Inc.

244,263

0.1

73,491

Cisco

Systems,

Inc.

3,555,495

2.1

9,421

(2)

Cleveland-Cliffs,

Inc.

161,664

0.1

4,259

CRH

PLC

267,252

0.2

16,260

CSX

Corp.

525,198

0.3

2,271

Deere

&

Co.

827,575

0.5

9,046

Delta

Air

Lines,

Inc.

334,069

0.2

5,965

Dover

Corp.

842,019

0.5

23,522

Dow,

Inc.

1,217,264

0.7

13,331

DTE

Energy

Co.

1,387,890

0.8

2,735

Duke

Energy

Corp.

252,386

0.1

10,296

Eastman

Chemical

Co.

863,114

0.5

2,652

Eaton

Corp.

PLC

603,834

0.4

3,091

Ecolab,

Inc.

592,637

0.3

21,514

Edison

International

1,441,223

0.8

18,302

Emerson

Electric

Co.

1,627,048

1.0

6,039

Entergy

Corp.

612,415

0.4

22,822

Evergy,

Inc.

1,164,835

0.7

7,169

Eversource

Energy

425,910

0.3

3,372

Expeditors

International

of

Washington,

Inc.

405,787

0.2

6,858

(2)

F5,

Inc.

1,174,021

0.7

4,062

Fastenal

Co.

243,598

0.1

2,385

FedEx

Corp.

617,310

0.4

3,854

Ferguson

PLC

660,344

0.4

20,761

Fortive

Corp.

1,432,094

0.8

15,433

Fortune

Brands

Innovations,

Inc.

1,056,080

0.6

22,784

Freeport-McMoRan,

Inc.

850,299

0.5

13,402

General

Electric

Co.

1,632,364

1.0

10,569

Graco,

Inc.

853,764

0.5

31,983

Halliburton

Co.

1,184,331

0.7

1,567

HEICO

Corp.

268,004

0.2

3,282

Honeywell

International,

Inc.

643,009

0.4

7,361

Ingersoll

Rand,

Inc.

525,796

0.3

14,700

Johnson

Controls

International

PLC

776,160

0.5

9,048

(2)

Keysight

Technologies,

Inc.

1,229,533

0.7

6,306

Linde

PLC

2,609,234

1.5

688

Lockheed

Martin

Corp.

308,066

0.2

4,604

Newmont

Corp.

185,035

0.1

12,335

NextEra

Energy,

Inc.

721,721

0.4

45,250

NiSource,

Inc.

1,160,210

0.7

894

Nordson

Corp.

210,394

0.1

4,955

Nucor

Corp.

842,201

0.5

2,577

Old

Dominion

Freight

Line,

Inc.

1,002,608

0.6

5,305

ONEOK,

Inc.

365,249

0.2

11,755

Otis

Worldwide

Corp.

1,008,461

0.6

5,522

Owens

Corning

748,673

0.4

4,024

Parker-Hannifin

Corp.

1,743,116

1.0

18,400

Pentair

PLC

1,187,536

0.7

53,838

(2)

PG&E

Corp.

924,399

0.5

11,288

PPG

Industries,

Inc.

1,602,783

0.9

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

6,652

Raytheon

Technologies

Corp.

$

542,005

0.3

2,496

Reliance

Steel

&

Aluminum

Co.

687,049

0.4

4,303

Rockwell

Automation,

Inc.

1,185,218

0.7

10,842

RPM

International,

Inc.

1,115,967

0.7

10,333

Schlumberger

NV

537,729

0.3

4,143

Schneider

Electric

SE

762,527

0.4

11,658

Sealed

Air

Corp.

389,144

0.2

21,822

Sempra

Energy

1,590,169

0.9

18,544

Sensata

Technologies

Holding

PLC

602,865

0.4

6,634

Sherwin-Williams

Co.

1,849,559

1.1

2,082

Snap-on,

Inc.

571,905

0.3

2,532

Steel

Dynamics,

Inc.

301,637

0.2

44,467

Tenaris

SA

767,176

0.4

5,093

Textron,

Inc.

390,429

0.2

2,279

T-Mobile

US,

Inc.

342,876

0.2

381

TransDigm

Group,

Inc.

366,854

0.2

14,626

(2)

Trimble,

Inc.

678,646

0.4

16,658

(2)

Uber

Technologies,

Inc.

939,178

0.6

3,462

Union

Pacific

Corp.

779,885

0.5

8,833

United

Parcel

Service,

Inc.

-

Class

B

1,339,171

0.8

1,315

United

Rentals,

Inc.

625,966

0.4

37,890

Verizon

Communications,

Inc.

1,452,324

0.9

456

Watsco,

Inc.

174,297

0.1

8,424

Westinghouse

Air

Brake

Technologies

Corp.

981,901

0.6

1,095

WW

Grainger,

Inc.

860,878

0.5

17,013

Xcel

Energy,

Inc.

1,035,071

0.6

81,180,677

47.6

Zambia

:

0.1%

15,586

First

Quantum

Minerals

Ltd.

127,610

0.1

Total

Common

Stock

(Cost

$154,105,170)

168,636,335

98.8

EXCHANGE-TRADED

FUNDS

:

1.6%

27,112

iShares

MSCI

ACWI

ETF

2,657,518

1.6

Total

Exchange-Traded

Funds

(Cost

$2,459,172)

2,657,518

1.6

PREFERRED

STOCK

:

0.3%

Brazil

:

0.3%

268,173

Cia

Energetica

de

Minas

Gerais

602,049

0.3

Total

Preferred

Stock

(Cost

$579,050)

602,049

0.3

Total

Long-Term

Investments

(Cost

$157,143,392)

171,895,902

100.7

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

0.4%

Mutual

Funds

:

0.4%

611,000

(4)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.260%

(Cost

$611,000)

$

611,000

0.4

Total

Short-Term

Investments

(Cost

$611,000)

$

611,000

0.4

Total

Investments

in

Securities

(Cost

$157,754,392)

$

172,506,902

101.1

Liabilities

in

Excess

of

Other

Assets

(1,820,980)

(1.1)

Net

Assets

$

170,685,922

100.0

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2023.

Industry

Diversification

Percentage

of

Net

Assets

Electric

Utilities

7.8

%

Industrial

Machinery

&

Supplies

&

Components

6.7

Specialty

Chemicals

6.4

Industrial

Conglomerates

5.8

Electrical

Components

&

Equipment

5.1

Integrated

Telecommunication

Services

4.7

Trading

Companies

&

Distributors

4.4

Building

Products

4.0

Multi-Utilities

3.6

Aerospace

&

Defense

3.3

Communications

Equipment

3.2

Construction

Machinery

&

Heavy

Transportation

Equipment

3.2

Steel

3.1

Electronic

Equipment

&

Instruments

2.5

Rail

Transportation

2.5

Wireless

Telecommunication

Services

2.4

Diversified

Metals

&

Mining

2.4

Oil

&

Gas

Equipment

&

Services

2.3

Construction

&

Engineering

2.2

Commodity

Chemicals

1.9

Industrial

Gases

1.8

Gold

1.8

Electronic

Components

1.7

Highways

&

Railtracks

1.7

Multi-Sector

Holdings

1.6

Air

Freight

&

Logistics

1.4

Construction

Materials

1.3

Gas

Utilities

1.2

Cargo

Ground

Transportation

1.1

Agricultural

&

Farm

Machinery

1.0

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Oil

&

Gas

Storage

&

Transportation

1.0

%

Airport

Services

0.8

Passenger

Airlines

0.8

Diversified

Chemicals

0.8

Copper

0.7

Electronic

Manufacturing

Services

0.6

Integrated

Telecommunication

S

0.6

Passenger

Ground

Transportation

0.5

Paper

&

Plastic

Packaging

Products

&

Materials

0.5

Forest

Products

0.4

Fertilizers

&

Agricultural

Chemicals

0.4

Renewable

Electricity

0.4

Marine

Transportation

0.3

Independent

Power

Producers

&

Energy

Traders

0.3

Water

Utilities

0.1

Marine

Ports

&

Services

0.1

Paper

Products

0.1

Oil

&

Gas

Drilling

0.1

Precious

Metals

&

Minerals

0.1

Liabilities

in

Excess

of

Other

Assets*

(0.7)

Net

Assets

100.0%

* Includes

short-term

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

6,330,003

$

—

$

6,330,003

Belgium

—

218,357

—

218,357

Brazil

2,230,202

195,342

—

2,425,544

Canada

7,935,828

—

—

7,935,828

Chile

179,791

—

—

179,791

China

—

5,701,439

—

5,701,439

Denmark

—

554,231

—

554,231

Finland

—

239,127

—

239,127

France

—

5,630,253

—

5,630,253

Germany

—

7,094,891

—

7,094,891

Hong

Kong

437,248

594,707

—

1,031,955

India

472,980

2,333,176

—

2,806,156

Ireland

592,218

422,926

—

1,015,144

Italy

—

548,740

—

548,740

Japan

—

14,335,592

—

14,335,592

Luxembourg

—

790,984

—

790,984

Mexico

1,067,337

—

—

1,067,337

Netherlands

—

355,557

—

355,557

Qatar

172,423

412,520

—

584,943

Russia

—

—

—

—

Saudi

Arabia

695,235

924,812

—

1,620,047

Singapore

—

1,859,517

—

1,859,517

South

Africa

—

600,405

—

600,405

South

Korea

—

3,088,861

—

3,088,861

Spain

—

4,561,309

—

4,561,309

Sweden

—

3,358,382

—

3,358,382

Switzerland

—

3,663,890

—

3,663,890

Taiwan

—

2,762,602

—

2,762,602

Thailand

—

431,626

—

431,626

Turkey

246,636

196,428

—

443,064

United

Kingdom

—

6,092,473

—

6,092,473

United

States

79,650,974

1,529,703

—

81,180,677

Zambia

127,610

—

—

127,610

Total

Common

Stock

93,808,482

74,827,853

—

168,636,335

Exchange-Traded

Funds

2,657,518

—

—

2,657,518

Preferred

Stock

602,049

—

—

602,049

Short-Term

Investments

611,000

—

—

611,000

Total

Investments,

at

fair

value

$

97,679,049

$

74,827,853

$

—

$

172,506,902

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(914,928)

$

—

$

(914,928)

Total

Liabilities

$

—

$

(914,928)

$

—

$

(914,928)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

At

November

30,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Infrastructure,

Industrials

and

Materials

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Industrial

Select

Sector

SPDR

Fund

UBS

AG

Call

12/28/23

USD

107.050

224,194

USD

23,999,968

$

288,964

$

(288,964)

iShares

MSCI

EAFE

ETF

UBS

AG

Call

12/14/23

USD

71.560

322,798

USD

23,377,031

344,425

(441,432)

iShares

MSCI

Emerging

Markets

ETF

Citibank

N.A.

Call

12/14/23

USD

39.270

178,236

USD

7,051,016

128,793

(121,321)

Materials

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

12/28/23

USD

82.410

59,459

USD

4,900,016

63,211

(63,211)

$

825,393

$

(914,928)

Currency

Abbreviations:

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

23,126,832

Gross

Unrealized

Depreciation

(8,374,322)

Net

Unrealized

Appreciation

$

14,752,510

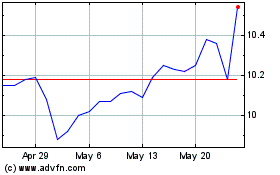

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

From Apr 2024 to May 2024

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

From May 2023 to May 2024