Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

July 26 2023 - 11:48AM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

96

.9

%

Australia

:

4

.4

%

46,553

APA

Group

$

303,889

0.2

319,689

Aurizon

Holdings

Ltd.

739,974

0.4

80,060

BHP

Group

Ltd.

-

Class

DI

2,190,686

1.3

59,120

BlueScope

Steel

Ltd.

712,995

0.4

52,728

Glencore

PLC

269,659

0.2

54,431

IGO

Ltd.

505,510

0.3

16,733

Rio

Tinto

Ltd.

1,166,021

0.7

190,557

South32

Ltd.

487,168

0.3

62,421

Telstra

Group

Ltd.

177,016

0.1

94,789

Transurban

Group

914,333

0.5

7,467,251

4.4

Brazil

:

1

.1

%

104,093

Rumo

SA

426,565

0.2

67,251

TIM

SA/Brazil

183,991

0.1

27,370

Vale

SA

348,619

0.2

23,365

Wheaton

Precious

Metals

Corp.

1,058,869

0.6

2,018,044

1.1

Canada

:

4

.6

%

52,596

AltaGas

Ltd.

891,904

0.5

3,663

Canadian

National

Railway

Co.

413,008

0.2

11,972

Canadian

Pacific

Kansas

City

Ltd.

912,253

0.5

10,869

Franco-Nevada

Corp.

1,579,548

0.9

40,879

(1)

Hydro

One

Ltd.

1,165,089

0.7

47,722

Kinross

Gold

Corp.

224,988

0.1

5,399

Nutrien

Ltd.

284,447

0.2

25,532

Rogers

Communications,

Inc.

-

Class

B

1,125,665

0.7

7,489

Teck

Resources

Ltd.

-

Class

B

292,333

0.2

42,111

TELUS

Corp.

797,860

0.5

2,344

West

Fraser

Timber

Co.

Ltd.

158,183

0.1

7,845,278

4.6

Chile

:

0

.1

%

30,885

Lundin

Mining

Corp.

215,911

0.1

China

:

2

.7

%

970,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

461,314

0.3

148,000

China

Oilfield

Services

Ltd.

-

Class

H

150,689

0.1

283,000

China

Railway

Group

Ltd.

-

Class

H

186,479

0.1

3,792,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

416,482

0.2

5,400

Contemporary

Amperex

Technology

Co.

Ltd.

-

Class

A

168,242

0.1

237,500

Fosun

International

Ltd.

156,640

0.1

74,100

Inner

Mongolia

ERDOS

Resources

Co.

Ltd.

-

Class

A

144,443

0.1

434,000

Kunlun

Energy

Co.

Ltd.

346,178

0.2

60,400

Shenzhen

Senior

Technology

Material

Co.

Ltd.

-

Class

A

137,625

0.1

75,300

(2)

Sichuan

New

Energy

Power

Co.

Ltd.

148,472

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

172,000

SITC

International

Holdings

Co.

Ltd.

$

298,800

0.2

48,256

Suzhou

Dongshan

Precision

Manufacturing

Co.

Ltd.

-

Class

A

172,501

0.1

36,640

Weihai

Guangwei

Composites

Co.

Ltd.

-

Class

A

151,194

0.1

94,100

Western

Mining

Co.

Ltd.

-

Class

A

135,972

0.1

98,700

Xiamen

C

&

D,

Inc.

-

Class

A

161,334

0.1

97,700

Yintai

Gold

Co.

Ltd.

-

Class

A

178,076

0.1

18,460

YongXing

Special

Materials

Technology

Co.

Ltd.

-

Class

A

164,469

0.1

44,800

Zangge

Mining

Co.

Ltd.

-

Class

A

144,891

0.1

224,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

165,898

0.1

35,800

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

150,657

0.1

59,800

ZTE

Corp.

-

Class

H

183,614

0.1

6,042

ZTO

Express

Cayman,

Inc.,

ADR

152,500

0.1

4,376,470

2.7

Colombia

:

0

.1

%

51,487

Interconexion

Electrica

SA

ESP

203,634

0.1

Denmark

:

0

.3

%

278

AP

Moller

-

Maersk

A/S

-

Class

B

467,871

0.3

Finland

:

0

.4

%

3,368

Kone

Oyj

-

Class

B

171,326

0.1

132,506

Nokia

Oyj

536,044

0.3

707,370

0.4

France

:

3

.6

%

1,287

(2)

Aeroports

de

Paris

196,162

0.1

3,067

Air

Liquide

SA

513,885

0.3

6,119

Arkema

SA

534,492

0.3

26,087

Cie

de

Saint-Gobain

1,448,730

0.8

9,461

Eiffage

SA

1,010,368

0.6

43,632

Engie

SA

656,078

0.4

52,437

Getlink

SE

892,205

0.5

8,025

Legrand

SA

760,705

0.4

29,583

Orange

SA

353,319

0.2

6,365,944

3.6

Germany

:

4

.6

%

21,432

BASF

SE

1,019,267

0.6

8,447

Brenntag

SE

664,296

0.4

100,317

E.ON

SE

1,216,175

0.7

8,179

Evonik

Industries

AG

164,281

0.1

14,181

GEA

Group

AG

597,672

0.3

9,172

Heidelberg

Materials

AG

657,963

0.4

17,369

Siemens

AG,

Reg

2,858,297

1.7

1,512

Symrise

AG

161,924

0.1

36,493

United

Internet

AG,

Reg

525,705

0.3

7,865,580

4.6

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Greece

:

0

.3

%

32,730

Hellenic

Telecommunications

Organization

SA

$

501,354

0.3

Hong

Kong

:

0

.7

%

9,800

Jardine

Matheson

Holdings

Ltd.

466,715

0.3

117,000

Power

Assets

Holdings

Ltd.

630,024

0.4

1,096,739

0.7

India

:

1

.8

%

32,782

Adani

Ports

&

Special

Economic

Zone

Ltd.

292,322

0.2

541,023

Bharat

Electronics

Ltd.

732,674

0.4

30,881

Larsen

&

Toubro

Ltd.

821,886

0.5

125,517

NTPC

Ltd.

263,228

0.2

78,663

Power

Grid

Corp.

of

India

Ltd.

222,149

0.1

70,896

UPL

Ltd.

586,297

0.3

50,193

Vedanta

Ltd.

168,595

0.1

3,087,151

1.8

Ireland

:

0

.9

%

20,994

CRH

PLC

993,493

0.6

12,848

Smurfit

Kappa

Group

PLC

457,777

0.3

1,451,270

0.9

Israel

:

0

.1

%

122,209

Bezeq

The

Israeli

Telecommunication

Corp.

Ltd.

152,813

0.1

Italy

:

0

.8

%

189,420

Snam

SpA

992,933

0.6

1,080,810

(2)

Telecom

Italia

SpA/Milano

287,290

0.2

1,280,223

0.8

Japan

:

9

.3

%

11,400

AGC,

Inc.

415,238

0.2

37,500

Asahi

Kasei

Corp.

254,323

0.1

9,500

Azbil

Corp.

299,910

0.2

24,000

Chubu

Electric

Power

Co.,

Inc.

286,692

0.2

13,000

Fuji

Electric

Co.

Ltd.

545,309

0.3

3,300

Hamamatsu

Photonics

KK

167,745

0.1

3,100

Hirose

Electric

Co.

Ltd.

419,657

0.2

3,200

Hitachi

Ltd.

184,168

0.1

5,400

ITOCHU

Corp.

182,293

0.1

37,800

Kajima

Corp.

529,154

0.3

51,000

KDDI

Corp.

1,572,408

0.9

800

Keyence

Corp.

387,822

0.2

34,500

Lixil

Corp.

443,889

0.3

5,200

Mitsubishi

Corp.

207,896

0.1

35,100

NGK

Insulators

Ltd.

422,951

0.2

15,900

Nippon

Sanso

Holdings

Corp.

325,154

0.2

29,900

Nippon

Telegraph

&

Telephone

Corp.

849,481

0.5

10,900

Nissan

Chemical

Corp.

472,845

0.3

17,300

Nitto

Denko

Corp.

1,230,122

0.7

202,900

Oji

Holdings

Corp.

780,812

0.5

33,300

Osaka

Gas

Co.

Ltd.

527,930

0.3

20,000

Shimadzu

Corp.

618,516

0.4

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Japan:

(continued)

6,400

Shin-Etsu

Chemical

Co.

Ltd.

$

197,033

0.1

17,700

SoftBank

Group

Corp.

696,459

0.4

231,500

Sumitomo

Chemical

Co.

Ltd.

689,346

0.4

35,600

Sumitomo

Corp.

671,890

0.4

16,300

Taisei

Corp.

517,940

0.3

21,600

Tokyo

Gas

Co.

Ltd.

460,187

0.3

12,800

Toyota

Industries

Corp.

789,320

0.5

14,000

Toyota

Tsusho

Corp.

614,950

0.4

11,500

Yokogawa

Electric

Corp.

216,546

0.1

15,977,986

9.3

Luxembourg

:

0

.3

%

21,026

ArcelorMittal

SA

524,467

0.3

Malaysia

:

0

.2

%

274,200

Malaysia

Airports

Holdings

Bhd

410,406

0.2

Mexico

:

0

.6

%

5,541

Grupo

Aeroportuario

del

Sureste

SAB

de

CV

-

Class

B

155,470

0.1

303,699

Operadora

De

Sites

Mexicanos

SAB

de

CV

-

Class

1

298,909

0.2

50,053

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

487,231

0.3

941,610

0.6

Netherlands

:

0

.4

%

178,387

Koninklijke

KPN

NV

613,696

0.4

Philippines

:

0

.2

%

46,760

International

Container

Terminal

Services,

Inc.

162,374

0.1

10,580

SM

Investments

Corp.

174,960

0.1

337,334

0.2

Portugal

:

0

.2

%

65,375

EDP

-

Energias

de

Portugal

SA

319,350

0.2

Qatar

:

0

.2

%

132,104

Ooredoo

QPSC

385,061

0.2

Russia

:

0.0

%

267,141

(2)(3)

Alrosa

PJSC

—

0.0

4,101,092

(3)

Inter

RAO

UES

PJSC

—

0.0

124,960

(3)

Mobile

TeleSystems

PJSC

—

0.0

—

0.0

Saudi

Arabia

:

1

.2

%

56,454

Etihad

Etisalat

Co.

647,081

0.4

7,828

SABIC

Agri-Nutrients

Co.

260,510

0.2

32,087

Sahara

International

Petrochemical

Co.

303,944

0.2

79,414

Saudi

Electricity

Co.

456,851

0.3

16,100

Saudi

Telecom

Co.

185,693

0.1

1,854,079

1.2

Singapore

:

1

.5

%

54,300

(1)

BOC

Aviation

Ltd.

398,699

0.2

134,900

Keppel

Corp.

Ltd.

629,061

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Singapore:

(continued)

230,100

Singapore

Airlines

Ltd.

$

1,090,267

0.6

295,900

Singapore

Telecommunications

Ltd.

544,305

0.3

2,662,332

1.5

South

Africa

:

0

.5

%

21,786

Anglo

American

PLC

600,168

0.3

17,375

Impala

Platinum

Holdings

Ltd.

139,504

0.1

100,780

Sibanye

Stillwater

Ltd.

178,066

0.1

917,738

0.5

South

Korea

:

1

.8

%

9,436

CJ

Corp.

629,458

0.4

19,210

GS

Holdings

Corp.

557,337

0.3

9,076

(2)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

658,015

0.4

12,706

Korea

Aerospace

Industries

Ltd.

492,760

0.3

3,640

Samsung

C&T

Corp.

303,200

0.2

723

Samsung

SDI

Co.

Ltd.

390,564

0.2

3,031,334

1.8

Spain

:

1

.7

%

35,552

ACS

Actividades

de

Construccion

y

Servicios

SA

1,186,406

0.7

4,858

(1)

Aena

SME

SA

762,258

0.4

57,690

Red

Electrica

Corp.

SA

978,323

0.6

2,926,987

1.7

Sweden

:

1

.6

%

16,832

Atlas

Copco

AB

-

Class

A

246,227

0.1

16,740

(2)

Boliden

AB

264,573

0.1

9,149

Sandvik

AB

161,290

0.1

10,489

SKF

AB

-

Class

B

166,899

0.1

87,667

Telefonaktiebolaget

LM

Ericsson

-

Class

B

453,313

0.3

220,656

Telia

Co.

AB

514,544

0.3

58,848

Volvo

AB

-

Class

B

1,087,603

0.6

2,894,449

1.6

Switzerland

:

1

.5

%

231

Givaudan

SA,

Reg

761,372

0.4

7,044

Holcim

AG

435,206

0.3

6,808

SIG

Group

AG

186,202

0.1

3,813

Sika

AG,

Reg

1,043,318

0.6

274

Swisscom

AG,

Reg

173,578

0.1

2,599,676

1.5

Taiwan

:

1

.7

%

22,000

Accton

Technology

Corp.

252,247

0.1

83,000

Delta

Electronics,

Inc.

852,324

0.5

34,200

Evergreen

Marine

Corp.

Taiwan

Ltd.

169,728

0.1

328,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,134,808

0.7

132,000

Zhen

Ding

Technology

Holding

Ltd.

496,893

0.3

2,906,000

1.7

Thailand

:

0

.3

%

53,000

Electricity

Generating

PCL

219,979

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Thailand:

(continued)

410,700

PTT

Global

Chemical

PCL

$

415,588

0.2

635,567

0.3

Turkey

:

0

.3

%

85,978

KOC

Holding

AS

326,364

0.2

103,225

Turkcell

Iletisim

Hizmetleri

AS

166,757

0.1

493,121

0.3

United

Kingdom

:

2

.3

%

71,463

BAE

Systems

PLC

825,938

0.5

7,131

Bunzl

PLC

279,166

0.2

51,459

CNH

Industrial

NV

658,652

0.4

11,933

DCC

PLC

683,802

0.4

13,840

Halma

PLC

415,376

0.2

10,472

(2)

Liberty

Global

PLC

-

Class

A

170,694

0.1

14,904

Smiths

Group

PLC

298,209

0.2

1,181

Spirax-Sarco

Engineering

PLC

160,978

0.1

10,542

SSE

PLC

247,262

0.1

15,687

United

Utilities

Group

PLC

197,834

0.1

3,937,911

2.3

United

States

:

44

.5

%

6,576

3M

Co.

613,607

0.4

11,645

AECOM

908,892

0.5

3,826

Air

Products

and

Chemicals,

Inc.

1,029,730

0.6

1,936

Albemarle

Corp.

374,674

0.2

3,749

Alcoa

Corp.

118,918

0.1

5,434

Allegion

PLC

569,157

0.3

15,419

AMERCO

713,746

0.4

10,408

American

Electric

Power

Co.,

Inc.

865,113

0.5

9,446

AMETEK,

Inc.

1,370,331

0.8

2,703

(2)

Arrow

Electronics,

Inc.

342,308

0.2

47,738

AT&T,

Inc.

750,919

0.4

9,080

Atmos

Energy

Corp.

1,046,742

0.6

39,189

Baker

Hughes

Co.

1,067,900

0.6

4,755

(2)

Boeing

Co.

978,104

0.6

24,018

Carrier

Global

Corp.

982,336

0.6

5,719

Caterpillar,

Inc.

1,176,684

0.7

2,656

Celanese

Corp.

276,277

0.2

7,441

Cheniere

Energy,

Inc.

1,040,029

0.6

69,520

Cisco

Systems,

Inc.

3,453,058

2.0

8,176

Consolidated

Edison,

Inc.

762,821

0.4

55,707

CSX

Corp.

1,708,534

1.0

2,271

Deere

&

Co.

785,721

0.5

5,965

Dover

Corp.

795,313

0.5

16,063

Dow,

Inc.

783,553

0.5

9,779

DTE

Energy

Co.

1,052,220

0.6

9,279

Duke

Energy

Corp.

828,522

0.5

6,977

Ecolab,

Inc.

1,151,554

0.7

18,176

Edison

International

1,227,244

0.7

19,532

Emerson

Electric

Co.

1,517,246

0.9

6,442

Essential

Utilities,

Inc.

262,447

0.2

3,431

Evergy,

Inc.

198,483

0.1

7,169

Eversource

Energy

496,310

0.3

1,605

Expeditors

International

of

Washington,

Inc.

177,048

0.1

6,553

(2)

F5,

Inc.

967,092

0.6

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States:

(continued)

2,385

FedEx

Corp.

$

519,882

0.3

3,854

Ferguson

PLC

558,483

0.3

5,418

FMC

Corp.

563,905

0.3

21,179

Fortive

Corp.

1,378,965

0.8

14,057

Freeport-McMoRan,

Inc.

482,717

0.3

17,207

General

Electric

Co.

1,747,027

1.0

29,577

Halliburton

Co.

847,381

0.5

2,540

HEICO

Corp.

392,633

0.2

4,193

Honeywell

International,

Inc.

803,379

0.5

18,575

Ingersoll

Rand,

Inc.

1,052,459

0.6

24,757

Johnson

Controls

International

PLC

1,477,993

0.9

31,151

Juniper

Networks,

Inc.

946,056

0.6

8,221

(2)

Keysight

Technologies,

Inc.

1,330,158

0.8

5,278

Linde

PLC

1,866,617

1.1

867

Lockheed

Martin

Corp.

384,957

0.2

3,671

Newmont

Corp.

148,859

0.1

12,610

NextEra

Energy,

Inc.

926,331

0.5

45,250

NiSource,

Inc.

1,216,772

0.7

3,022

Norfolk

Southern

Corp.

629,120

0.4

4,719

Nucor

Corp.

623,191

0.4

1,664

Old

Dominion

Freight

Line,

Inc.

516,572

0.3

7,426

ONEOK,

Inc.

420,757

0.2

5,522

Owens

Corning

587,154

0.3

4,952

Parker-Hannifin

Corp.

1,586,819

0.9

18,400

Pentair

PLC

1,020,648

0.6

41,220

(2)

PG&E

Corp.

698,267

0.4

7,372

PPG

Industries,

Inc.

967,870

0.6

34,093

PPL

Corp.

893,237

0.5

9,640

Raytheon

Technologies

Corp.

888,230

0.5

1,161

Reliance

Steel

&

Aluminum

Co.

272,463

0.2

4,150

Rockwell

Automation,

Inc.

1,156,190

0.7

11,692

Schlumberger

NV

500,768

0.3

4,482

Schneider

Electric

SE

775,382

0.5

16,411

Sealed

Air

Corp.

621,156

0.4

11,036

Sempra

Energy

1,583,997

0.9

18,544

Sensata

Technologies

Holding

PLC

769,947

0.4

4,623

Sherwin-Williams

Co.

1,053,027

0.6

1,767

Snap-on,

Inc.

439,736

0.3

3,438

Steel

Dynamics,

Inc.

315,952

0.2

14,204

Targa

Resources

Corp.

966,582

0.6

18,901

Textron,

Inc.

1,169,405

0.7

2,279

(2)

T-Mobile

US,

Inc.

312,793

0.2

4,769

Trane

Technologies

PLC

778,444

0.5

277

TransDigm

Group,

Inc.

214,301

0.1

8,212

(2)

Trimble,

Inc.

383,254

0.2

8,675

(2)

Uber

Technologies,

Inc.

329,043

0.2

10,687

UGI

Corp.

298,915

0.2

3,462

Union

Pacific

Corp.

666,504

0.4

6,669

United

Parcel

Service,

Inc.

-

Class

B

1,113,723

0.7

3,310

United

Rentals,

Inc.

1,104,845

0.6

37,890

(2)

Verizon

Communications,

Inc.

1,350,021

0.8

20,489

Vistra

Corp.

491,121

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States:

(continued)

9,349

Westinghouse

Air

Brake

Technologies

Corp.

$

865,998

0.5

24,452

Westrock

Co.

684,901

0.4

1,328

WW

Grainger,

Inc.

861,899

0.5

2,417

Xcel

Energy,

Inc.

157,806

0.1

4,352

Xylem,

Inc.

436,070

0.3

75,543,315

44.5

Zambia

:

0

.1

%

9,473

First

Quantum

Minerals

Ltd.

198,462

0.1

Total

Common

Stock

(Cost

$155,225,945)

165,213,784

96.9

EXCHANGE-TRADED

FUNDS

:

1

.6

%

29,603

iShares

MSCI

ACWI

ETF

2,712,227

1.6

Total

Exchange-Traded

Funds

(Cost

$2,653,893)

2,712,227

1.6

PREFERRED

STOCK

:

0

.5

%

Brazil

:

0

.4

%

268,173

Cia

Energetica

de

Minas

Gerais

615,815

0.4

Chile

:

0

.1

%

3,267

Sociedad

Quimica

y

Minera

de

Chile

SA

210,539

0.1

Total

Preferred

Stock

(Cost

$876,540)

826,354

0.5

Total

Long-Term

Investments

(Cost

$158,756,378)

168,752,365

99.0

SHORT-TERM

INVESTMENTS

:

0

.8

%

Mutual

Funds:

0.8%

1,351,000

(4)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.000%

(Cost

$1,351,000)

1,351,000

0.8

Total

Short-Term

Investments

(Cost

$1,351,000)

1,351,000

0.8

Total

Investments

in

Securities

(Cost

$160,107,378)

$

170,103,365

99.8

Assets

in

Excess

of

Other

Liabilities

277,373

0.2

Net

Assets

$

170,380,738

100.0

ADR

American

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

May

31,

2023.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Industry

Diversification

Percentage

of

Net

Assets

Chemicals

10

.5

%

Machinery

8

.7

Metals

&

Mining

8

.0

Electric

Utilities

6

.7

Industrial

Conglomerates

6

.1

Diversified

Telecommunication

Services

5

.3

Electronic

Equipment,

Instruments

&

Components

4

.5

Electrical

Equipment

4

.1

Ground

Transportation

4

.1

Communications

Equipment

4

.0

Building

Products

3

.9

Multi-Utilities

3

.8

Aerospace

&

Defense

3

.6

Trading

Companies

&

Distributors

3

.4

Construction

&

Engineering

3

.3

Gas

Utilities

2

.9

Wireless

Telecommunication

Services

2

.8

Transportation

Infrastructure

2

.6

Multi-Sector

Holdings

1

.6

Energy

Equipment

&

Services

1

.5

Oil,

Gas

&

Consumable

Fuels

1

.4

Construction

Materials

1

.2

Air

Freight

&

Logistics

1

.2

Containers

&

Packaging

1

.1

Passenger

Airlines

0

.6

Independent

Power

And

Renewable

Electricity

Producers

0

.6

Paper

&

Forest

Products

0

.6

Marine

Transportation

0

.6

Water

Utilities

0

.3

Assets

in

Excess

of

Other

Liabilities*

1

.0

Net

Assets

100

.0

%

* Includes

short-term

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

May

31,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

May

31,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

7,467,251

$

—

$

7,467,251

Brazil

2,018,044

—

—

2,018,044

Canada

7,845,278

—

—

7,845,278

Chile

215,911

—

—

215,911

China

152,500

4,223,970

—

4,376,470

Colombia

203,634

—

—

203,634

Denmark

—

467,871

—

467,871

Finland

—

707,370

—

707,370

France

—

6,365,944

—

6,365,944

Germany

—

7,865,580

—

7,865,580

Greece

—

501,354

—

501,354

Hong

Kong

466,715

630,024

—

1,096,739

India

—

3,087,151

—

3,087,151

Ireland

—

1,451,270

—

1,451,270

Israel

—

152,813

—

152,813

Italy

—

1,280,223

—

1,280,223

Japan

—

15,977,986

—

15,977,986

Luxembourg

—

524,467

—

524,467

Malaysia

—

410,406

—

410,406

Mexico

941,610

—

—

941,610

Netherlands

—

613,696

—

613,696

Philippines

—

337,334

—

337,334

Portugal

—

319,350

—

319,350

Qatar

385,061

—

—

385,061

Russia

—

—

—

—

Saudi

Arabia

—

1,854,079

—

1,854,079

Singapore

—

2,662,332

—

2,662,332

South

Africa

—

917,738

—

917,738

South

Korea

—

3,031,334

—

3,031,334

Spain

—

2,926,987

—

2,926,987

Sweden

8,855

2,885,594

—

2,894,449

Switzerland

—

2,599,676

—

2,599,676

Taiwan

—

2,906,000

—

2,906,000

Thailand

—

635,567

—

635,567

Turkey

166,757

326,364

—

493,121

United

Kingdom

170,694

3,767,217

—

3,937,911

United

States

74,767,933

775,382

—

75,543,315

Zambia

198,462

—

—

198,462

Total

Common

Stock

87,541,454

77,672,330

—

165,213,784

Exchange-Traded

Funds

2,712,227

—

—

2,712,227

Preferred

Stock

826,354

—

—

826,354

Short-Term

Investments

1,351,000

—

—

1,351,000

Total

Investments,

at

fair

value

$

92,431,035

$

77,672,330

$

—

$

170,103,365

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(

79,769

)

$

—

$

(

79,769

)

Total

Liabilities

$

—

$

(

79,769

)

$

—

$

(

79,769

)

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

T

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

At

May

31,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Infrastructure,

Industrials

and

Materials

Fund:

Description

Counterparty

Put/Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Industrial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

06/01/23

USD

98.030

244,823

USD

23,711,108

$

554,157

$

(

22,850

)

iShares

MSCI

EAFE

ETF

UBS

AG

Call

06/15/23

USD

73.230

247,166

USD

17,153,320

139,550

(

1,872

)

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

06/15/23

USD

38.950

243,902

USD

9,241,447

135,000

(

55,047

)

Materials

Select

Sector

SPDR

Fund

Wells

Fargo

Call

06/01/23

USD

78.340

125,096

USD

9,384,702

235,205

—

$

1,063,912

$

(

79,769

)

Currency

Abbreviations:

USD

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

20,833,568

Gross

Unrealized

Depreciation

(

10,837,581

)

Net

Unrealized

Appreciation

$

19,991,974

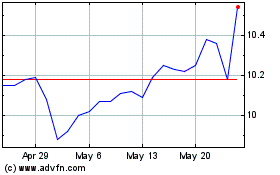

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

From Apr 2024 to May 2024

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

From May 2023 to May 2024