0001528129false00015281292024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 9, 2024

VITAL ENERGY, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Delaware | 001-35380 | 45-3007926 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | |

| 521 E. Second Street | Suite 1000 | | |

| Tulsa | Oklahoma | | 74120 |

| (Address of principal executive offices) | | (Zip code) |

Registrant's telephone number, including area code: (918) 513-4570

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | VTLE | New York Stock Exchange |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | |

| | Emerging Growth Company | ☐ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02. Results of Operations and Financial Condition.

On January 9, 2024, Vital Energy, Inc. (the "Company") issued a press release (i) providing selected preliminary financial and operating results for the quarter ended December 31, 2023 and (ii) announcing plans to host a conference call on Thursday, February 22, 2024 at 7:30 am Central Time to discuss its financial and operating results for the quarter and year ended December 31, 2023. A copy of the Company's press release has been furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information furnished under this Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto are deemed to be "furnished" and shall not be deemed "filed" for the purpose of Section 18 of the Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On January 9, 2024, the Company furnished the press release described above in the Item 2.02 of this Current Report on Form 8-K. The press release is attached as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

All statements in the press release, other than historical financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. See the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and the Company's other filings with the SEC for a discussion of other risks and uncertainties. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In accordance with General Instruction B.2 of Form 8-K, the information furnished under this Item 7.01 of this Current Report on Form 8-K and the exhibit attached hereto are deemed to be "furnished" and shall not be deemed "filed" for the purpose of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | VITAL ENERGY, INC. |

| | | |

| | | |

Date: January 10, 2024 | By: | /s/ Bryan J. Lemmerman |

| | | Bryan J. Lemmerman |

| | | Executive Vice President and Chief Financial Officer |

Vital Energy Provides Select Preliminary Fourth-Quarter 2023 Results

Total and oil production exceed outlook with capital investments in-line

Company provides fourth-quarter and full-year 2023 earnings and conference call details

TULSA, OK - January 9, 2024 - Vital Energy, Inc. (NYSE: VTLE) ("Vital Energy" or the "Company") today provided select preliminary results for fourth-quarter 2023, including average daily total and oil production and incurred capital investments. Details for the Company’s fourth-quarter and full-year 2023 earnings release and conference call are provided within this release.

Fourth-Quarter 2023 Preliminary Production and Capital Expenditures

Production. The Company’s fourth-quarter 2023 total production averaged approximately 113.4 thousand barrels of oil equivalent per day ("MBOE/d"), above guidance of 101.8 - 105.8 MBOE/d. Oil production for the quarter averaged approximately 52.8 thousand barrels of oil per day ("MBO/d"), above guidance of 47.9 - 50.9 MBO/d. Production results were primarily driven by outperformance of recently turned-in-line wells in Howard and Upton counties. Earlier-than-expected closing dates for previously announced transactions and the acquisition of additional working interests during the quarter contributed approximately 1,250 BOE/d (60% oil) to quarterly production.

Capital Investments. Total incurred capital expenditures during fourth-quarter 2023 were approximately $190 million, excluding non-budgeted acquisitions and leasehold expenditures, in-line with guidance of $175 - $190 million.

Fourth-Quarter 2023 Average Shares Outstanding

For the three months ended December 31, 2023, diluted weighted-average shares outstanding was approximately 29.8 million. The outstanding 2.0% Cumulative Mandatorily Convertible Series A Preferred Stock (the "Series A Preferred Stock") is included in diluted weighted-average shares outstanding.

As of December 31, 2023, total shares of common stock outstanding was approximately 35.4 million and total shares of Series A Preferred Stock outstanding was 595,104. Share count includes common shares held in escrow related to the Maple and Tall City acquisitions.

Fourth-Quarter 2023 Earnings Release and Conference Call Details

Vital Energy plans to report complete fourth-quarter and full-year 2023 financial and operating results after market close on Wednesday, February 21, 2024, and host a conference call and webcast at 7:30 a.m. CT on Thursday, February 22, 2024.

To participate in the call, dial 800.715.9871, using conference code 6099172 or listen to the call via the Company's website at www.vitalenergy.com, "Investor Relations | News & Presentations | Upcoming Events." A replay will be available following the call via the Company’s website.

About Vital Energy

Vital Energy, Inc. is an independent energy company with headquarters in Tulsa, Oklahoma. Vital's business strategy is focused on the acquisition, exploration and development of oil and natural gas properties in the Permian Basin of West Texas.

Additional information about Vital may be found on its website at www.vitalenergy.com.

Forward-Looking Statements

This press release and any oral statements made regarding the subject of this release contain forward-looking statements as defined under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, that address activities that Vital Energy assumes, plans, expects, believes, intends, projects, indicates, enables, transforms, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. The forward-looking statements involve risks and uncertainties, including, among others, that our business plans may change as circumstances warrant.

General risks relating to Vital Energy include, but are not limited to, moderating but continuing inflationary pressures and associated changes in monetary policy that may cause costs to rise; changes in domestic and global production, supply and demand for commodities, actions by the Organization of Petroleum Exporting Countries and other producing countries and the Russian-Ukrainian military conflict, Israeli-Hamas military conflict, or other military conflicts, the decline in prices of oil, natural gas liquids and natural gas and the related impact to financial statements as a result of asset impairments and revisions to reserve estimates, the volatility of oil, natural gas liquids and natural gas prices, including our area of operation in the Permian Basin, reduced demand due to shifting market perception towards the oil and gas industry; competition in the oil and gas industry; the ability of the Company to execute its strategies, including its ability to successfully identify and consummate strategic acquisitions at purchase prices that are accretive to its financial results and to successfully integrate acquired businesses, assets and properties, pipeline transportation and storage constraints in the Permian Basin, the effects and duration of the outbreak of disease, and any related government policies and actions, long-term performance of wells, drilling and operating risks, the possibility of production curtailment, the impact of new laws and regulations, including those regarding the use of hydraulic fracturing, including under the Inflation Reduction Act (the “IRA”) including those related to climate change, the impact of legislation or regulatory initiatives intended to address induced seismicity on the Company’s ability to conduct its operations; hedging activities, tariffs on steel, the impacts of severe weather, including the freezing of wells and pipelines in the Permian Basin due to cold weather, possible impacts of litigation and regulations, the impact of the Company’s transactions, if any, with its securities from time to time, the impact of new environmental, health and safety requirements applicable to the Company’s business activities, the possibility of the elimination of federal income tax deductions for oil and gas exploration and development, imposition of any additional taxes under the IRA or otherwise, and other factors, including those and other risks described in its Annual Report on Form 10-K for the year ended December 31, 2022,

and those set forth from time to time in other filings with the Securities and Exchange Commission ("SEC"). These documents are available through Vital Energy’s website at www.vitalenergy.com under the tab “Investor Relations” or through the SEC’s Electronic Data Gathering and Analysis Retrieval System at www.sec.gov. Any of these factors could cause Vital Energy’s actual results and plans to differ materially from those in the forward-looking statements. Therefore, Vital Energy can give no assurance that its future results will be as estimated. Any forward-looking statement speaks only as of the date on which such statement is made. Vital Energy does not intend to, and disclaims any obligation to, correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

All amounts, dollars and percentages presented in this press release are rounded and therefore approximate.

Investor Contact:

Ron Hagood

918.858.5504

ir@vitalenergy.com

v3.23.4

Document and Entity Information

|

Jan. 09, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001528129

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 09, 2024

|

| Entity Registrant Name |

VITAL ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35380

|

| Entity Tax Identification Number |

45-3007926

|

| Entity Address, Address Line One |

521 E. Second Street

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Tulsa

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

74120

|

| City Area Code |

918

|

| Local Phone Number |

513-4570

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

VTLE

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

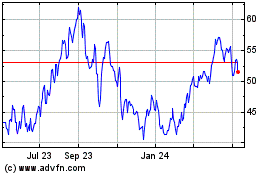

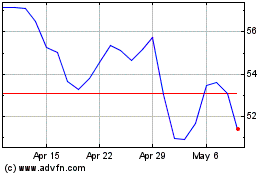

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From Apr 2024 to May 2024

Vital Energy (NYSE:VTLE)

Historical Stock Chart

From May 2023 to May 2024