Notice of Exempt Solicitation. Definitive Material. (px14a6g)

May 04 2017 - 5:27PM

Edgar (US Regulatory)

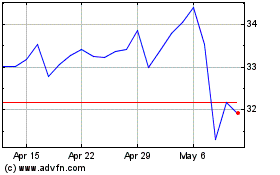

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From May 2024 to Jun 2024

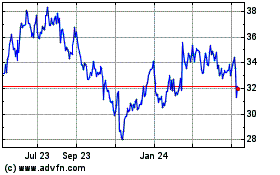

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Jun 2023 to Jun 2024