Second quarter net

revenues of $59.5 million, within guidance. Company files Form 10-Q

for the second quarter and first six months of fiscal

2015.

Vishay Precision Group, Inc. (NYSE: VPG), a leading producer of

precision sensors and systems, today announced its results for its

second quarter fiscal 2015 and six months ended June 27, 2015.

Ziv Shoshani, VPG’s chief executive officer said, “We have

completed our review and analysis of certain adjustments to our

historical financial statements for a subsidiary located in India

as a result of certain transactions that were recorded for this

subsidiary in the local currency, the Indian rupee, instead of the

functional currency, the U.S. dollar, in prior periods extending

back to 2011. The impact of these prior period adjustments was not

material to any of these prior periods. As a result, we have made

adjustments to our financial statements to correct these and other

immaterial errors. The adjusted financial statements may be found

in Note 12 of our Form 10-Q, which we filed with the Securities and

Exchange Commission today.”

In commenting on second quarter fiscal 2015 financial results,

Mr. Shoshani added, “From a performance perspective, our revenues

continued to be significantly impacted by the negative effect of

foreign currency exchange rates of $5.1 million, compared to the

second quarter of 2014. At the same time, our new advanced sensor

product and on-board weighing systems continue to gain traction in

the marketplace. We remain focused on our strategy of enhancing

shareholder value.”

Net revenues for the second quarter of 2015 were $59.5 million,

representing an 8.7% decrease from $65.2 million of net revenues

for the comparable prior year period. Net revenues for the six

months ended June 27, 2015 were $116.1 million, representing an

8.1% decrease from the $126.4 million of net revenues for

comparable prior year period. Comparing sequential results, net

revenues for the second quarter of 2015 increased by $2.9 million,

or 5.1%, from $56.6 million in the first quarter of 2015.

Net earnings attributable to VPG stockholders for the second

quarter of 2015 were $1.5 million, or $0.11 per diluted share,

compared to net earnings attributable to VPG stockholders for the

second quarter of 2014 of $3.6 million, or $0.26 per diluted share.

Foreign currency exchange rates for the second quarter of 2015 as

compared to the prior year period had a negative impact on net

income of $0.4 million, or $0.03 per diluted share. Net earnings

attributable to VPG stockholders for the six months ended June 27,

2015 were $2.3 million, or $0.17 per diluted share, compared to net

earnings attributable to VPG stockholders of $4.8 million, or $0.34

per diluted share for the comparable prior year period. Foreign

currency exchange rates for the six months of 2015 as compared to

the prior year period had a negative impact on net income of $0.8

million, or $0.06 per diluted share.

Adjusted net earnings attributable to VPG stockholders for the

second quarter of 2015 were $1.8 million, or $0.13 per diluted

share, versus adjusted net earnings attributable to VPG

stockholders of $3.6 million, or $0.26 per diluted share for the

comparable prior year period. Net earnings attributable to VPG

stockholders for the second quarter of 2015 include $0.03 million

of KELK acquisition purchase accounting adjustments (which impacted

costs of products sold), $0.3 million of restructuring costs, and

$0.04 million of associated tax effects.

Adjusted net earnings attributable to VPG stockholders for the

six months ended June 27, 2015 were $2.7 million, or $0.19 per

diluted share, versus adjusted net earnings attributable to VPG

stockholders of $5.0 million, or $0.36 per diluted share for the

comparable prior year period. Net earnings attributable to VPG

stockholders for the six months ended June 27, 2015 include $0.03

million of KELK acquisition purchase accounting adjustments (which

impacted cost of products sold), $0.4 million of restructuring

costs, and $0.06 million of associated tax effects, versus $0.4

million of KELK acquisition purchase accounting adjustments and

restructuring costs, and $0.1 million of associated tax effects for

the comparable prior year period.

Segments

The Foil Technology Products segment revenues were $26.2 million

in the second quarter of 2015, down 6.7% from $28.0 million in the

second quarter last year, and up 4.4% from $25.1 million in the

first quarter of 2015. Net revenues were negatively impacted by the

effects of foreign currency exchange rates by $1.7 million in the

second quarter of 2015 as compared to the second quarter of 2014,

and were negatively impacted by $0.2 million as compared to the

first quarter of 2015. The gross profit margin for the segment

decreased to 39.6% for the second quarter of 2015 compared to 40.5%

in the second quarter last year, and down from 41.4% in the first

quarter of 2015. The gross profit margin decreased from the

comparable prior year period primarily due to the effects of

foreign currency exchange rates and additional headcount for

expansion of our advanced sensor platform. Despite an increase in

revenues, the sequential gross profit margin decrease was due

primarily to the effects of foreign currency exchange rates and

other costs.

The Force Sensors segment revenues of $15.6 million in the

second quarter of 2015 were down 7.9% compared to $17.0 million in

the second quarter last year, and were up 2.7% from $15.2 million

in the first quarter of 2015. Decreased year-over-year revenues are

attributable primarily to the effect of foreign currency exchange

rates of $0.9 million. The increase in sequential revenues is

attributable to higher volume. The gross profit margin for the

segment was 19.0% in the second quarter of 2015 versus 22.7% in the

second quarter of 2014 and 21.8% in the first quarter of 2015. The

gross profit margin for the quarter decreased from the comparable

prior year period primarily due to the effects of foreign currency

exchange rates. The sequential gross profit margin decreased due to

a reduction in inventory.

The Weighing and Control Systems segment revenues were $17.7

million in the second quarter of 2015, down 12.1% from $20.2

million in the second quarter last year, and up 8.6% from $16.3

million in the first quarter of 2015. Net revenues were negatively

impacted by the effects of foreign currency exchange rates of $2.4

million in the second quarter of 2015 as compared to the second

quarter of 2014. The sequential increase is attributable to volume

in our process weighing business. The gross profit margin for the

segment was 43.6% in the second quarter of 2015 versus 48.2% in the

second quarter of 2014 and 44.6% in the first quarter of 2015. The

year-over-year decrease in gross profit margin is primarily due to

the effects of foreign currency exchange rates and unfavorable

product mix. The sequential decrease in gross profit margin is

primarily due to higher freight costs and unfavorable product

mix.

Outlook

Mr. Shoshani concluded, “Assuming a similar exchange rate impact

to our revenues and given the normal seasonality in our business,

we expect net revenues in the range of $55 million to $60 million

for the third quarter of 2015.”

*Editor’s Note: We define adjusted net earnings as net

earnings attributable to VPG stockholders before acquisition

purchase accounting adjustments, restructuring costs, and

associated tax effects. ** For a reconciliation of GAAP to non-GAAP

financial information, refer to the quarterly financial tables.

About VPG

Vishay Precision Group, Inc. (VPG) is an internationally

recognized designer, manufacturer and marketer of: components based

on its resistive foil technology; sensors; and sensor-based systems

specializing in the growing markets of stress, force, weight,

pressure, and current measurements. VPG is a market leader of foil

technology products, providing ongoing technology innovations in

precision foil resistors and foil strain gages, which are the

foundation of the company's force sensors products and its weighing

and control systems. The product portfolio consists of a variety of

well-established brand names recognized for precision and quality

in the marketplace. To learn more, visit VPG at

www.vpgsensors.com.

Forward-Looking Statements

From time to time, information provided by us, including but not

limited to statements in this report, or other statements made by

or on our behalf, may contain "forward-looking" information within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements involve a number of risks, uncertainties, and

contingencies, many of which are beyond our control, which may

cause actual results, performance, or achievements to differ

materially from those anticipated.

Such statements are based on current expectations only, and are

subject to certain risks, uncertainties, and assumptions. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those anticipated, expected, estimated, or

projected. Among the factors that could cause actual results to

materially differ include: general business and economic

conditions, changes in the current pace of economic recovery,

including if such recovery stalls or does not continue as expected;

difficulties or delays in completing acquisitions and integrating

acquired companies; the inability to realize anticipated synergies

and expansion possibilities; difficulties in new product

development; changes in competition and technology in the markets

that we serve and the mix of our products required to address these

changes; changes in foreign currency exchange rates; difficulties

in implementing our ERP system and the associated impact on

manufacturing efficiencies and customer satisfaction; difficulties

in implementing our cost reduction strategies, such as

underutilization of production facilities, labor unrest or legal

challenges to our lay-off or termination plans, operation of

redundant facilities due to difficulties in transferring production

to lower-labor-cost countries; and other factors affecting our

operations, markets, products, services, and prices that are set

forth in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2014. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

VISHAY PRECISION GROUP, INC. Consolidated

Condensed Statements of Operations (Unaudited - In thousands,

except per share amounts)

Fiscal quarter ended

June 27, 2015 June 28, 2014 Net revenues

$ 59,508 $ 65,162 Costs of products sold

38,473 40,253 Gross profit

21,035 24,909 Gross profit margin

35.3 % 38.2

% Selling, general, and administrative expenses

18,396 19,897 Restructuring costs

304

7 Operating income

2,335 5,005 Operating

margin

3.9 % 7.7 % Other income (expense):

Interest expense

(173 ) (240 ) Other

(414 ) (247 ) Other income (expense) - net

(587 ) (487 ) Income before

taxes

1,748 4,518 Income tax expense

288 948 Net earnings

1,460 3,570 Less: net (loss) earnings attributable to

noncontrolling interests

(16 ) (8 ) Net

earnings attributable to VPG stockholders

$ 1,476

$ 3,578 Basic earnings per share attributable

to VPG stockholders

$ 0.11 $ 0.26 Diluted earnings

per share attributable to VPG stockholders

$ 0.11 $

0.26 Weighted average shares outstanding - basic

13,580 13,756 Weighted average shares outstanding - diluted

13,790 13,968

VISHAY PRECISION

GROUP, INC. Consolidated Condensed Statements of Operations

(Unaudited - In thousands, except per share amounts)

Six

fiscal months ended June 27, 2015 June 28, 2014

Net revenues

$ 116,116 $ 126,402 Costs of

products sold

74,102 79,783

Gross profit

42,014 46,619 Gross profit margin

36.2

% 36.9 % Selling, general, and administrative

expenses

37,144 39,060 Restructuring costs

382

331 Operating income

4,488 7,228

Operating margin

3.9 % 5.7 % Other income

(expense): Interest expense

(360 ) (456 ) Other

(1,343 ) (683 ) Other income (expense)

- net

(1,703 ) (1,139 ) Income

before taxes

2,785 6,089 Income tax expense

478 1,277 Net earnings

2,307 4,812 Less: net (loss) earnings attributable to

noncontrolling interests

(29 ) 59

Net earnings attributable to VPG stockholders

$

2,336 $ 4,753 Basic earnings per share

attributable to VPG stockholders

$ 0.17 $ 0.35

Diluted earnings per share attributable to VPG stockholders

$ 0.17 $ 0.34 Weighted average shares

outstanding - basic

13,663 13,754 Weighted average shares

outstanding - diluted

13,875 13,963

VISHAY PRECISION GROUP, INC. Consolidated Condensed Balance

Sheets (In thousands)

June 27, 2015

December 31,2014

(Unaudited)

Assets Current assets: Cash and cash equivalents

$

65,456 $ 79,642 Accounts receivable, net

38,250

37,427 Inventories: Raw materials

13,808 14,223 Work in

process

21,245 19,813 Finished goods

20,716

18,806 Inventories, net

55,769 52,842

Deferred income taxes

5,552 5,636 Prepaid expenses

and other current assets

9,394 10,361

Total current assets

174,421 185,908 Property

and equipment, at cost: Land

1,891 1,893 Buildings and

improvements

50,555 49,909 Machinery and equipment

79,948 78,500 Software

6,997 6,837 Construction in

progress

2,678 2,928 Accumulated depreciation

(91,820 ) (89,374 ) Property and equipment,

net

50,249 50,693 Goodwill

12,046 12,788

Intangible assets, net

15,416 17,381 Other

assets

20,352 20,393 Total

assets

$ 272,484 $ 287,163

Liabilities and equity Current liabilities: Trade accounts

payable

$ 8,780 $ 10,559 Payroll and related expenses

14,046 14,216 Other accrued expenses

14,776 16,902

Income taxes

127 2,133 Current portion of long-term debt

16,366 5,120 Total current

liabilities

54,095 48,930 Long-term debt, less

current portion

4,635 17,713 Deferred income taxes

610 638 Other liabilities

7,431 7,644 Accrued pension

and other postretirement costs

12,014

12,353 Total liabilities

78,785

87,278 Commitments and contingencies Equity:

Common stock

1,276 1,273 Class B convertible common stock

103 103 Treasury stock

(6,169 ) (32 ) Capital

in excess of par value

189,769 189,532 Retained earnings

37,671 35,335 Accumulated other comprehensive loss

(29,111 ) (26,560 ) Total Vishay Precision

Group, Inc. stockholders' equity

193,539 199,651

Noncontrolling interests

160 234

Total equity

193,699 199,885

Total liabilities and equity

$ 272,484 $

287,163

VISHAY PRECISION GROUP,

INC. Consolidated Condensed Statements of Cash Flows (Unaudited

- In thousands)

Six fiscal months ended June 27,

2015 June 28, 2014 Operating activities

Net earnings

$ 2,307 $ 4,812 Adjustments to reconcile

net earnings to net cash (used in) provided by operating

activities: Impairment of goodwill and indefinite-lived intangibles

Depreciation and amortization

5,524 5,783 (Gain) loss on

disposal of property and equipment

(1 ) 9 Share-based

compensation expense

416 485 Inventory write-offs for

obsolescence

916 562 Other

1,121 (54 ) Net changes in

operating assets and liabilities: Accounts receivable, net

(1,671 ) (4,857 ) Inventories, net

(4,345

) 346 Prepaid expenses and other current assets

943

(586 ) Trade accounts payable

(1,670 ) (281 ) Other

current liabilities

(3,589 ) (1,338 )

Net cash (used in) provided by operating activities

(49 ) 4,881

Investing

activities Capital expenditures

(5,037 ) (3,435 )

Proceeds from sale of property and equipment

65

63 Net cash used in investing activities

(4,972 ) (3,372 )

Financing

activities Principal payments on long-term debt and capital

leases

(1,810 ) (2,070 ) Purchase of treasury stock

(6,137 ) — Distributions to noncontrolling interests

(45 ) (43 ) Net cash used in financing

activities

(7,992 ) (2,113 ) Effect of exchange rate

changes on cash and cash equivalents

(1,173 )

250 Decrease in cash and cash equivalents

(14,186 ) (354 ) Cash and cash equivalents at

beginning of period

79,642 72,809

Cash and cash equivalents at end of period

$

65,456 $ 72,455

VISHAY PRECISION GROUP, INC. Reconciliation of

Consolidated Adjusted Gross Profit Margin (Unaudited - In

thousands)

Fiscal quarter ended Six fiscal months

ended June 27, 2015 June 28, 2014 June 27,

2015 June 28, 2014 Gross profit

$ 21,035 $

24,909

$ 42,014 $ 46,619 Gross profit margin

35.3 % 38.2 %

36.2 % 36.9 %

Reconciling items

affecting gross profit margin

Acquisition purchase accounting adjustments

26 2

26

41 Adjusted gross profit

$

21,061 $ 24,911

$ 42,040

$ 46,660 Adjusted gross profit margin

35.4 %

38.2 %

36.2 % 36.9 %

VISHAY

PRECISION GROUP, INC. Reconciliation of Adjusted Earnings Per

Share (Unaudited - In thousands, except per share data)

Fiscal quarter ended Six fiscal months ended June

27, 2015 June 28, 2014 June 27, 2015 June 28,

2014 Net earnings attributable to VPG stockholders

$

1,476 $ 3,578

$ 2,336 $ 4,753

Reconciling items

affecting operating margin

Acquisition purchase accounting adjustments

26 2

26

41 Restructuring costs

304 7

382 331

Reconciling items

affecting income tax expense

Tax effect of adjustments for purchase accounting and restructuring

costs

41 2

57

94 Adjusted net earnings attributable to VPG

stockholders

$ 1,765 $ 3,585

$

2,687 $ 5,031 Weighted average shares

outstanding - diluted

13,790 13,968

13,875 13,963

Adjusted net earnings per diluted share

$ 0.13

$ 0.26

$ 0.19 $ 0.36

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150903005761/en/

VPGWendy WilsonSenior Director Investor Relations and Corporate

Communications919-374-5501wendy.wilson@vpgsensors.com

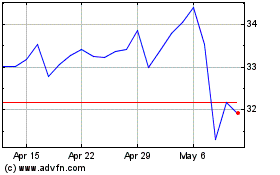

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From May 2024 to Jun 2024

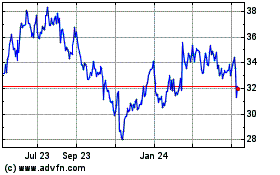

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Jun 2023 to Jun 2024